DON’T PANIC

Recent studies have shown that market volatility can be particularly challenging for retirees or those nearing retirement age, as they have less time to recover from any potential losses. According to a report by Fidelity Investments published in October 2021, market volatility can lead to a significant impact on retirement savings for those in their 60s, with the potential to erode retirement income by up to 26%. This highlights the importance of having a diversified investment portfolio and a solid retirement plan in place that takes into account potential market volatility.

Both stocks and bonds are off to one of the worst starts in the annals of their respective markets. At the end of April 2022, the S&P 500 Index was down 12.92%, and other broad market indices were also down double digits. (1)

Worse yet, investors, such as those in Texas or New York are losing nearly as much on the fixed income side of their portfolios as on the equity side. The Bloomberg U.S. Aggregate bond index, a broad measure of domestic fixed income, experienced its steepest quarterly loss (-5.93%) since 1980 to begin the year (2) and is down -9.50% through April's end. The current environment has left investors feeling as though they have nowhere to escape and has even prompted some to exit markets or go to cash, which is why we believe it is essential to discuss this topic with our Fortune 500 clients.

Such a hasty reaction could cause investors to lose out on a potential rebound, given that historical equity performance following market corrections and robust underlying economic fundamentals indicate that a stock market rebound will occur sooner rather than later. Contact retirement-focused advisors today if you are uncertain about your particular circumstance.

THE BULL CASE FOR EQUITIES: USING HISTORY AS OUR GUIDE

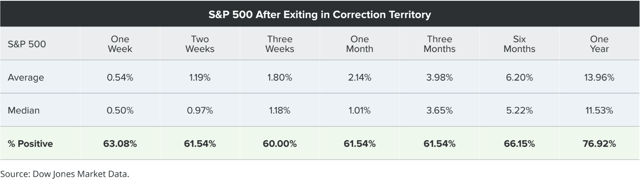

The S&P 500 re-entered correction territory just 22 trading days after exiting; its quickest re-entry into negative 10% performance since November 2008, during the Great Financial Crisis. (3) The table provided below for our Fortune 500 clients excludes periods in which a correction transformed into a bear market and depicts the performance of the S&P 500 after exiting a correction. Based on data dating back to 1928, the S&P 500 gained a median of 11.5% and an average of nearly 14% after exiting a correction, rising nearly 77% of the time. (4)

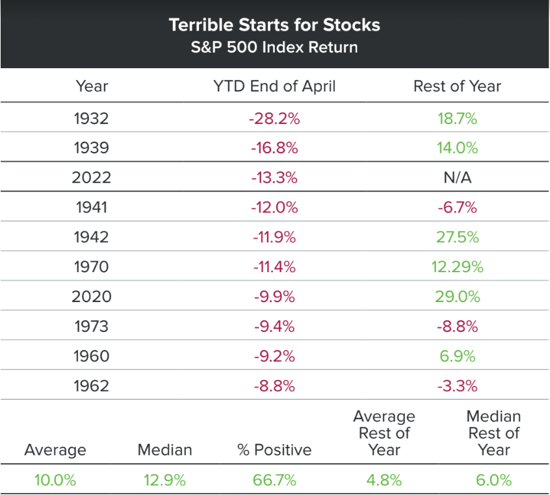

We would like to remind our Fortune 500 clients that a poor start to the year is not always indicative of things to come. The beginning of 2022 is the third-worst ever for the S&P 500 Index.

In spite of this, a review of the ten worst starts reveals that, on average, stocks recover admirably thereafter, rising 10%. According to the statistics provided for our Fortune 500 clients, double-digit gains are a distinct possibility in the final eight months of the year. (5)

THE BULL CASE FOR MARKETS: STRONG ECONOMIC FUNDAMENTALS

In addition to historical performance supporting a second-half rally in equities, the fundamentals of the U.S. economy remain quite robust. Demand resiliency, robust corporate and consumer financial positioning, and rising earnings can act as shock absorbers during the near- to medium-term volatility that market observers anticipate will persist.

Initial estimates of economic development for the first quarter indicated an unexpected contraction. The real GDP (adjusted for inflation) of the United States decreased by 1.4%, compared to +6.9% growth in the previous quarter. (1) This abrupt deceleration was the result of a drag from exports, a decline in inventory spending after a substantial increase in the previous quarter, and to a lesser extent, a contraction in government spending. Moreover, consumer expenditure, which accounts for nearly 70% of the U.S. economy, grew at a solid rate. The rise in personal consumption to 2.7% from 2.5% in the previous month was driven by expenditure on services. Over the previous decade, consumer spending increased at an average rate of 2.3% per year. (1)

Another positive indicator for the economy is the 9.2% increase in business investment, the highest in a year. As companies accelerate the tempo of automation and investment in the face of persistent labor shortages, the broad momentum in capital expenditures ought to continue. Ultimately, consumers benefit from the extremely constrained labor market and wage growth. With the effects of the pandemic diminishing, we believe that consumption will continue to sustain above-average economic growth this year and would like to remind our Fortune 500 clients of this. A final caveat is that economic growth and stock market growth can diverge substantially, as the current state of the markets demonstrates.

Importantly, attempting to predict the market by selling existing positions and re-entering a supposedly "safer" environment typically results in a substantial loss for shareholders. Investors are best served by adhering to a plan, weathering market downturns with prudent, risk-adjusted asset allocations, and staying invested through the turnaround as the largest gains are realized.

Economic Definitions

GDP measures the ultimate market value of all goods and services produced in a nation. It is the most frequently employed economic indicator. The GDP by expenditure method measures total final expenditures (at purchasers' prices), which include exports minus imports. This concept takes inflation into account.

Index Definitions

S&P 500: The S&P 500® is widely regarded as the finest single indicator of large-cap U.S. equities and serves as the basis for a vast array of investment products. The index consists of 500 prominent companies and represents approximately 80% of market capitalization.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, US dollar-denominated, fixed-rate, taxable bond market. This index consists of Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS, and CMBS (agency and non-agency).

Conclusion

Investing is like gardening. Just like a gardener tends to their garden by planting, nurturing, and pruning their plants, an investor must also take care of their investments. It requires patience, diligence, and a long-term vision. Just as a gardener may face challenges such as drought, pests, or extreme weather conditions, investors also face challenges such as market volatility, inflation, and economic downturns. However, with proper planning, diversification, and periodic adjustments, both gardeners and investors can reap bountiful rewards. It takes time and effort, but the end result is a fruitful and satisfying harvest.

Sources

1. Bloomberg

2. Sam Goldfarb, "Bond Market Suffers Worst Quarter in Decades," Bond Market Suffers Worst Quarter in Decades – WSJ, Wall Street Journal, last modified March 31, 2022.

3. William Watts, "A Rough April pushed the S&P 500 into its second stock-market correction of 2022," Wall Street Journal, 5 May 2022. MarketWatch, most recently updated on 2 May 2022 The S&P 500 entered its second stock market correction of 2022 in April, according to MarketWatch.

4. William Watts, "S&P 500 exits correction: Here's what the past suggests will happen to the U.S. stock market benchmark next," MarketWatch, last updated March 30, 2022, S&P 500 exits correction: what history suggests will happen next to the benchmark stock market index – MarketWatch.

5. Ryan Detrick, "4 Things You Didn't Know, But Need to," LPL Research, revised on May 4, 2022 Four Facts You Need to Know | LPL Financial Research (lplresearch.com).

This material was prepared by Broadridge Investor Communication Solutions, Inc., and does not necessarily represent the views of The Retirement Group or FSC Financial Corp. This information should not be construed as investment advice. Neither the named Representatives nor Broker/Dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The publisher is not engaged in rendering legal, accounting or other professional services. If other expert assistance is needed, the reader is advised to engage the services of a competent professional. Please consult your Financial Advisor for further information or call 800-900-5867.

The Retirement Group is not affiliated with nor endorsed by your company. We are an independent financial advisory group that focuses on transition planning and lump sum distribution. Neither The Retirement Group or FSC Securities provide tax or legal advice. Please call our office at 800-900-5867 if you have additional questions or need help in the retirement planning process.

The Retirement Group is a Registered Investment Advisor not affiliated with FSC Securities and may be reached at www.theretirementgroup.com.