Retirement Guide for ExxonMobil Employees

Exxon 2024 updates

Exxon has made major adjustments for 2024 in an effort to improve the perks and assistance offered to both employees and retirees. These modifications cover a variety of measures meant to enhance the ExxonMobil community's general health, financial stability, and well-being. Here's a detailed rundown of the most important improvements and modifications:

1. Updates on Pension Plans

Salary Cap: The $275,000 salary cap for the 2024 pension benefit has been established.

Benefit Limit: The amount of monthly payments that retirees are eligible to receive in retirement is limited by the benefit limit.

Segment Rates: From Q1 to Q2, 2024, segment rates were somewhat lower. For retirees whose benefit start date (BCD) falls in Q2, this reduction will result in a minor rise in lump payment amounts.

Lifetime Monthly Retirement Benefit: ExxonMobil is still providing its workers with a complimentary lifetime monthly retirement benefit. Employees must leave the company on or after the age of 55 and have worked there for at least 15 years in order to be eligible.

Non-Retiree Pension choices: There are three choices available to employees who leave their job before they are eligible for retirement, which is normally at age 55 after 15 years of service.

At age 65, get the entire vested benefit as a single-life annuity.

Get a benefit that is discounted if you are under 65.

Get an offer for a one-time lump sum.

Details about Vesting and Annuities: Following five years of qualifying service, employees are fully vested in the pension benefit. The formula for calculating "pensionable pay" is based on averaging the best 36 months in a row during the previous ten years, usually the latest 36 months.

2. Switch to Alight Solutions

ExxonMobil will hand over its benefits administration to Alight Solutions on January 2, 2024. The goal of this change is to improve retiree and employee benefit management and accessibility.

Your Total Rewards site: Run by Alight, this new site will give users access to a range of tools and information, such as beneficiary designations, direct deposit setting, tax withholding changes, and management of health and pension plans.

Pension and Health Plan Payments: Bank of America will handle pension payments, using the same payment methods as before. The payment of health plan premiums will also be moved to Alight, necessitating that employees adjust their modes of payment.

Security measures: To protect personal information, the site will use cutting-edge encryption techniques. Automatic log-off features will also be in place to guarantee data security.

Support and Assistance: Employees can get help navigating the new system and addressing any concerns from the Alight-managed ExxonMobil Benefits Service Center via phone or online chat.

3. Health Advantages

Medical Plan: The full coverage for medical, prescription medicine, and mental health benefits is part of ExxonMobil's medical plan. Workers have a choice between two network-only and Point of Service (POS) II alternatives. There are minimal or no deductibles for preventive care.

Dental and Vision Plans: The dental plan includes partial coverage for orthodontics as well as 100% coverage for preventative care and other dental operations. The vision plan includes discounts on laser eye surgery, yearly eye exams, and allowances for lenses, frames, or contact lenses.

Flexible Spending Accounts (FSAs): FSAs reduce taxable income and ease out-of-pocket expenses by enabling employees to set aside pre-tax money for qualified healthcare and dependent care expenses.

Employee Assistance Program (EAP): At no additional expense, the EAP offers private, mental health-related expert therapy for concerns pertaining to families and individuals.

4. Security Advantages

Life Insurance: Free coverage for accidental death and dismemberment (AD&D) and basic life insurance are given automatically. Workers have the option to choose voluntary AD&D insurance and Group Universal Life (GUL) for supplementary coverage.

Disability Insurance: In the event of an illness or accident, both short-term and long-term disability insurance provide income protection. While long-term disability gives 50% of salary, with additional potential replacement income, short-term disability offers up to six weeks of full pay.

5. Monetary Gains

Savings Plan: Employees may contribute 6% to 20% of their salary; if they contribute at least 6%, ExxonMobil will match 7% of their contribution. The strategy promotes financial stability and growth by providing a range of investment opportunities.

Pension Plan: Automatic enrollment in the plan entitles participants to a monthly payout upon retirement. After five years of service, vesting takes place, and early retirement is an option.

Financial Fitness Program: By providing employees with financial planning tools and resources, this program helps them manage their money wisely and get ready for a stable financial future.

6. Assistance Advantages

Work-Life Balance: ExxonMobil promotes work-life balance with a number of initiatives, such as paid parental leave, personal time off for emergencies, and vacation days beginning on the first day of work.

Adoption aid and Back-Up Care: Employees are guaranteed the support they require during important life events with financial aid for adoption and back-up care programs for family members.

7. Updates on Strategic and Financial Performance

Financial Results for the First Quarter of 2024: As a result of increased costs and lower refining margins, ExxonMobil reported $8.22 billion in net income for the first quarter of 2024, a 28% drop from Q1 2023. At $83.1 billion, total revenues decreased 1.3%, and the profit margin was 9.9%.

Operational Achievements: Since 2016, the company has lowered operating methane emissions intensity by more than 60% and achieved quarterly gross production in Guyana of more than 600,000 oil-equivalent barrels per day.

Returns to Shareholders: In Q1 2024, ExxonMobil reported free cash flow of $10.1 billion and shareholder payouts of $6.8 billion, which included $3.0 billion in share repurchases and $3.8 billion in dividends. Share repurchases will now occur at a rate of $20 billion annually.

8. Takeaways for Workers and Retirees

Register on the Your Total Rewards site: In order for employees to properly manage their benefits, they must register on the new site. We'll send you some instructions and temporary passwords to make this procedure easier.

Update Payment Methods: In order to guarantee continuing coverage, employees who pay their health plan premiums by check or automatic deduction must update their payment methods.

Examine Beneficiary Designations: In order to speed up the payment process in the event of unforeseen circumstances, staff members should check and amend beneficiary designations on the new portal.

Watch Pension Payments: Retirees will be able to monitor and control their pension payments and withholdings by accessing pension payment statements via the portal.

In summary

ExxonMobil's thoughtful planning of the shift to Alight Solutions and its extensive benefits package demonstrate the company's dedication to its workers and retirees. ExxonMobil makes sure that its employees are well-protected and supported throughout their careers and into retirement by offering a broad range of health, security, financial, and support benefits in addition to improved management tools. Alight Solutions' adoption represents a major advancement in benefit administration, providing workers and retirees with enhanced benefit access, security, and management.

2024 Tax Changes & Inflation

Tax Reforms & Inflation for 2024

People must be made aware of any recent adjustments made by the IRS. The primary elements that are most likely to have an impact on corporate workers are:

The standard deduction for 2024 will rise to $21,900 for heads of household, $29,200 for joint filers, and $14,600 for single taxpayers and married filers filing separately.

Individuals who are blind or over 65 can increase their standard deduction by an extra $1,550. If you are not a surviving spouse or are not married, that amount increases to $1,950.

As in 2023, there is no personal exemption for the tax year 2024. A provision of the Tax Cuts and Jobs Act was the removal of the personal exemption.

Corporate employees who operate remotely may be subject to double taxation on state taxes. Many workers returned home as a result of the pandemic, sometimes even leaving the state in which they were working. Many of the temporary relief provisions that several states had in place last year to prevent double taxation of income have since expired. Currently, a "special convenience of employer" regulation is only in place in six states: Delaware, Connecticut, Nebraska, New Jersey, New York, and Pennsylvania. Ask your tax advisor if there are any other alternatives to reduce the double taxation if you work remotely for a business entity and do not now reside in those states.

Contributions to retirement accounts: You can lower your tax liability by making contributions to your employer's 401(k) plan, and the maximum amount you can save has been raised for 2024. In 2024, the maximum contribution amount that people can make to their 401(k) plans will rise to $23,000, from $22,500 in 2023. For 2024, there will be an increase in the income thresholds that determine who is eligible to make deductible contributions to traditional IRAs, roll over contributions to Roth IRAs, and claim the Saver's Credit. For workers who are 50 years of age or older, the maximum catch-up contribution will rise to $7,500.

You should be aware of the following significant changes to the Earned Income Tax Credit (EITC) if you are a taxpayer who works for a corporation:

For qualifying taxpayers with three or more qualifying children, the maximum Earned Income Tax Credit amount for tax year 2024 is $7,830, up from $7,430 for tax year 2023.

Those who are married and file separately may be eligible: If you satisfy certain requirements, you may be eligible to claim the EITC as a married filing separately. In past years, this wasn't offered.

Cash charitable contribution deduction: The special deduction that lets individuals who are not itemizers claim a deduction of up to $300 (or $600 for married couples filing jointly) for cash gifts to approved charities has ended.

Changes to the Child Tax Credit

For children aged five and under, the maximum tax credit is $2,000; for children aged six to seventeen, it is $3,000 per qualified child. Furthermore, unlike in 2023, you are not eligible to get a portion of the credit in advance.

If your adjusted gross income is less than $200,000 if you're filing alone or less than $400,000 if you're filing a joint return with a spouse, you qualify for the Child Tax Credit as a parent or guardian.

A partial refundability of 70% applies to people whose tax liability is less than the credit amount.

2024 Tax Brackets

Over time, inflation diminishes buying power because rising prices result in a basket of products becoming more expensive. You will need to account for increasing costs in your plan if you want to keep your retirement quality of living the same when you leave your business. The Federal Reserve targets an annual inflation rate of 2%, but in 2023 it reached a whopping 4.9%. a significant rise above the 1.4% in 2020. Even though costs have increased significantly overall, there are certain areas, like healthcare, to be mindful of if you are close to or already retired from your employer. Medicare serves as the primary health insurance for many business retirees, and in 2023, the out-of-pocket cost of such coverage is expected to rise by 5% to 14%. The cost of over-the-counter drugs is expected to rise by at least 7% in addition to Medicare increases. In their 2022 research, the Employee Benefit Research Institute (ERBI) discovered that, in order to pay for their average prescription expenses in retirement, a couple would need to save $296,000. All of these elements must be taken into account when creating a comprehensive retirement plan from your employer.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Planning Your ExxonMobil Retirement

Retirement planning is a verb. And consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need.

No matter where you stand in the planning process, or your current age, we hope this guide gives you a good overview of the steps to take and resources that help you simplify your transition from your company into retirement and get the most from your benefits.

You know you need to be saving and investing, especially since time is on your side the sooner you start, but you don’t have the time or expertise to know if you’re building retirement savings that can last after leaving your company.

A separate study by Russell Investments, a large money management firm, came to a similar conclusion. Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 202

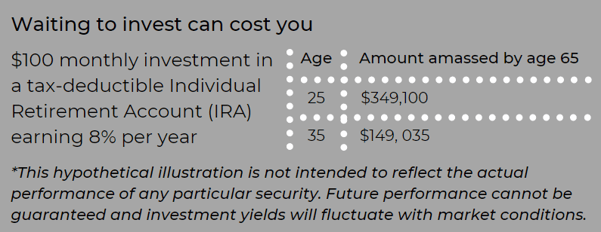

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your 401(k) contributions is key.

79% potential boost in wealth at age 65 over a 20-year period when choosing to invest in your company's retirement plan.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

One of the classic planning conflicts is saving for retirement versus saving for college. Most financial planners will tell you that retirement from your company should be your top priority because your child can usually find support from financial aid while you’ll be on your own to fund your retirement.

How much we recommend that you invest towards your retirement is always based on your unique financial situation and goals. However, consider investing a minimum of 10% of your salary toward retirement through your 30s and 40s. So long as your individual circumstances allow, it should be a goal to maximize your company's contribution match.

As you enter your 50s and 60s, you’re ideally at peak earning years with some of your major expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This can be a good time to consider whether you have the ability to boost your retirement savings goal to 20% or more of your income. For many people, this could potentially be the last opportunity to stash away funds.

In 2024, workers age 50 or older can invest up to $23,000 into their retirement plan/401(k), and once they meet this limit, they can add an additional $7,500 in catch-up contributions. These limits are adjusted annually for inflation.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles give you the chance to take advantage of three main benefits:

- Compound growth opportunities (as seen above)

- Tax saving opportunities

- Matching contributions

Matching contributions are just what they sound like: your company matches your own 401(k) contributions with money that comes from the company. If your company matches, the company money typically matches up to a certain percent of the amount you put in.

Unfortunately, many people might not be taking full advantage of your company's match because they’re not putting in enough themselves.

Research published in 2022 by Principal Financial Group identified that 62% of workers deemed company 401(k) matches significantly important to reaching retirement goals.

According to Bank of America's "2022 Financial Life Benefit Impact Report", despite 58% of eligible employees participating in a 401(k) plan, 61% of them contributed below $5,000 last year.

The study also found that fewer than one in 10 participants’ contributions reached the ceiling on elective deferrals, under IRS Section 402(g) — which is $23,000 for 2024.

A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize the company match typically leave $1,336 of potential extra retirement money on the table each year.

- If your company will match up to 3% of your plan contributions and you only contribute 2% of your salary, you aren’t getting the full amount of the company match. By simply increasing your contribution by just 1%, your company is now matching the full 3% (the max) of your contributions for a total combined contribution of 6% of your salary. By doing so, you aren’t leaving money on the table.

Speak with a retirement-focused advisor by clicking the button below.

There are several regulations that differ between retirement plans; these include early withdrawal penalties, interest rate effects, age restrictions, and intricate tax implications.

The secret to a successful retirement plan spending strategy is to increase your investment balance while lowering taxes. The Retirement Group can assist you in making the most out of your company's 401(k) plan and comprehending how it fits into your entire financial plan.

Employees are significantly more likely to get their income from their workplace's defined contribution (DC) retirement plans.

'Getting help and leveraging the financial planning tools and resources your company

makes available can help you understand whether you are on track, or need to

make adjustments to meet your long-term retirement goals...'

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

When an individual obtains a PIP, it indicates that they are one of the 8–10% of workers who fall into ExxonMobil's "Needs Significant Improvement" (NSI) performance appraisal category. In essence, the PIP is a severance package that gives you the choice to quit the company and enroll in an improvement process, which could help you keep your job. ExxonMobil increased the percentage of salaried US workers who fell under the NSI category from 3% to 10% in April.PIP. When an individual obtains a PIP, it indicates that they are one of the 8–10% of workers who fall into ExxonMobil's "Needs Significant Improvement" (NSI) performance appraisal category. In essence, the PIP is a severance package that gives you the choice to quit the company and enroll in an improvement process, which could help you keep your job. ExxonMobil increased the percentage of salaried US workers who fell under the NSI category from 3% to 10% in April.

Information for Workers at XTO

After the 2010 merger, the benefits programs offered by XTO and ExxonMobil were unified; still, XTO employees must be aware of a number of exclusions. Your employment history with XTO prior to ExxonMobil is taken into consideration when determining your eligibility for benefits such as vesting, retiree status, and the lump sum pension option. However, in order to calculate your pension payout, years of work before ExxonMobil will not be taken into account in your pension calculation. This is crucial information to have when deciding when to start receiving your pension benefit and when to quit the company in order to optimize your advantages.

Furthermore, the interest rates utilized to determine your lump sum pension payout are based on corporate bond prices rather than the more advantageous, cheaper Treasury bond rates available to ExxonMobil employees who are grandfathered in. This frequently results in a smaller lump sum payout; thus, it is even more important that you consider the rates and when to make your elections in order to avoid losing any money (see the section on pension interest rates for "Non-Grandfathered Employees"). To optimize your retirement benefits and reduce the possibility of errors, the Retirement Group XTO-focused advisers can assist you with retirement documentation and offer guidance throughout the retirement decision-making process.

Will the Pension Be Frozen at ExxonMobil?

Given that ExxonMobil has previously halted payouts, it begs the question of whether the pension scheme will be frozen as well. How might it appear if they did? Employees would not be able to accrue any further benefits in the future if there was a pension freeze. Nonetheless, they would be eligible to receive the benefits they have already accrued. Many organizations have switched from defined benefit (DB) plans to defined contribution (DC) plans over the past few decades. To reduce their present pension commitments, companies offload or freeze their defined benefit pension schemes. Corporations can also transfer risk from the company to the employees by converting from a DB plan to a DC plan. Since companies that pay off their pension obligations make less risky investments, investors gain from this trend. Nonetheless, workers who frequently depend on those DB plans for their retirement years may suffer as a result of this tendency.

Pension Formula

The ExxonMobil Pension Plan is a Defined Benefit Pension, based on years of service, final average pay, and a social security offset, with potential age penalties.

DB Pension (formula based)

- 5 year vest or age 65

- 1.6% * YOS *FAP - SS offset

- FAP (highest 36 consecutive months in last 10 years

- FAP (highest 36 consecutive months in last 10 years

Normal Retirement Age

- Age 60 no AP reduction as a retiree

- Age 65 no AP reduction as a terminee

- 55 + 15 = Retiree* = -5% per year under 60

- *Earliest you can take pension is 50 if on disability

Age Penalty Reductions:

- If you are a pre-65 terminee you stand to face severe age penalties for each year before 65.

-

Pension Distribution Options:

Lump Sum

Annuity (SLA + J&S + Period Certain 10/15/20)

Partial Lump Sum w/Partial Annuity (75%/50%/25%)

*Terminee only has Annuity Options

PPA rate is being transitioned in. High-quality corporate bond rates, and updated mortality assumptions, prescribed by the IRS, are being used.

Pension Death Benefit- Active Employees

Less than 15 years of service - Surviving Spouse Annuity

- The Pension Plan pays surviving spouse annuity, equal to 1/2 of your basic pension benefit earned up to the date of your death (50% J&S Annuity)

- Spouse may commence benefit at anytime from age 50-65 (your age) subject to early commencement penalties for terminees.

15 Years of service or more - Death Benefit Pension

- Calculated as if you retired on date of death and elected the lump sum option (Subject to early commencement penalties depending on age at death)

- Payable to beneficiary designated on "Special Beneficiary Designation Form" (found on HR intranet). Spousal consent required for non-spouse beneficiary and must be updated at age 35

- Can be paid as lump sum or basic life annuity using beneficiary's life expectancy

- Lump sum rollover subject to inherited IRA rules (PPA 2006)

Lump-Sum vs. Annuity

Retirees who are eligible for a pension are often offered the choice of whether to actually take the pension payments for life, or receive a lump-sum dollar amount for the “equivalent” value of the pension – with the idea that you could then take the money (rolling it over to an IRA), invest it, and generate your own cash flows by taking systematic withdrawals throughout retirement from your company.

The upside of keeping the pension itself is that the payments are guaranteed to continue for life (at least to the extent that the pension plan itself remains in place and solvent and doesn’t default). Thus, whether you live 10, 20, or 30 (or more!) years after leaving your company, you don’t have to worry about the risk of outliving the money.

In contrast, selecting the lump-sum gives you the potential to invest, earn more growth, and potentially generate even greater retirement cash flow. Additionally, if something happens to you, any unused account balance will be available to a surviving spouse or heirs. However, if you fail to invest the funds for sufficient growth, there’s a danger that the money could run out altogether and you may regret not having held onto the pension’s “income for life” guarantee.

Ultimately, the “risk” assessment that should be done to determine whether or not you should take the lump sum or the guaranteed lifetime payments that your company pension offers depends on what kind of return must be generated on that lump-sum to replicate the payments of the annuity. After all, if it would only take a return of 1% to 2% on that lump-sum to create the same pension cash flows for a lifetime, there is little risk that you will outlive the lump-sum after leaving your company, even if you withdraw from it for life(10). However, if the pension payments can only be replaced with a higher and much riskier rate of return, there is, in turn, a greater risk those returns won’t manifest and you could run out of money.

Interest Rates and Life Expectancy

Current interest rates, as well as your life expectancy at retirement, have a large impact on lump sum payouts of defined benefit pension plans. The Blended Interest Rates rose for retirees commencing their ExxonMobil Pension in Q1 of 2023 through Q2 2024, before leveling off the last two months. Rising rates hurt your lump sum value. The reverse or opposite is also true. Decreasing or lower interest rates will increase the lump sum values.

Interest rates are important for determining your lump sum option within the pension plan. However, they have no impact on the annuity options. The Retirement Group believes all ExxonMobil employees should run a detailed RetireKit Cash Flow Analysis comparing their lump sum value versus the monthly annuity distribution options, before making their pension elections. As enticing as a high lump sum is, the annuity for all or a portion of the pension may still be the superior option, especially in a higher interest rate environment. Every person’s situation is different, and a Cash Flow Analysis will show you how your pension choices may play out over the course of 30 years or more from now.

For Grandfathered employees, the Q2 and Q3 2024 pension rates are 4.25% and 4.00% respectively and are 0.50% higher than the same period last year. For Non-Grandfathered employees, the 2nd and 3rd quarter blended segments have also decreased. If these rates continue to decrease, lump sum payments can rise in value, but there are no guarantees interest rates will decline further in this current interest rate environment.

We will be able to see the direction of the year with greater clarity as we keep an eye on the interest rate environment from the beginning of summer to the conclusion. In the event that rates stay on the decline, lump sum values will rise. However, lump sums will fall down if rates rise. Please let us know if you require assistance in determining your grandfathered status. Please don't hesitate to contact The Retirement Group if you need assistance figuring out and evaluating your pension alternatives, including lump sums and annuities. We offer a free Retirement Cash Flow analysis, or we can update one that already exists.

Knowing where you stand can help you decide more wisely whether it's preferable to work longer or postpone the start of your pension benefit, or whether Q2 or Q3 2024 is the ideal time to retire. Interest rates fluctuate, and lump payment amounts do too. With your lump sum, how much are you willing to lose? A reduction in future lump sum benefits, which could result in working for free or for less money, can balance out increased earned income from longer hours worked.

Your ExxonMobil 401(k) Plan

ExxonMobil Retirement Plan (401(k))

Workers are urged to sign up for a 401(k) savings plan as soon as possible. There are seven different investment alternatives available to you, each with a different level of risk, and you can choose to invest before-tax or after-tax (regular or Roth). Additionally, pre-tax and Roth contributions from other qualified plans may be carried over. Your share: between 6% and 20% of your income plus the company share (if you put in at least 6%): Total savings: 13% to 27% of your earnings minus 7% of your pay.

Vesting

You become eligible for the business match as a participant either at age 65, upon your death, or after three years of vesting service. You keep the remaining amount but lose the employer match if you leave your job before three years of service.

Furthermore, you might be qualified to roll over a dividend from a former employer's qualifying plan into the Savings Plan if you have an account in that plan.

It should be noted that you will receive a 7 percent corporate match if you contribute at least 6 percent of your earnings.

If you have funds in your 401(k) plan at retirement, you will get a Participant Distribution Notice through the mail. This notification will outline your distribution options and display the current value that each plan qualifies you for. It will also specify the steps you must take in order to obtain your final distribution. For further information, please give The Retirement Group a call at (800)-900-5867. We will put you in contact with an advisor who specializes in ExxonMobil.

The next step is to keep an eye out for your Special Tax Notice Regarding Plan Payments and Participant Distribution Notice. These notifications will assist in outlining your options and any federal tax consequences for the balance in your vested account.

"What has Worked in Investing" & "8 Tenets when picking a Mutual Fund" .

Give The Retirement Group a call at (800)-900-5867 to find out your alternatives regarding distribution. Click our e-book "Rollover Strategies for 401(k)s" to learn more. If you need to update your beneficiary designations, use the Online Beneficiary Designation.

Note: You might not be qualified to receive the annual contribution if you leave your company of work voluntarily.

More than half of plan members acknowledge they lack the expertise, desire, or time necessary to handle their 401(k) investments. However, seeking assistance has advantages that go beyond practicality. Research such as this one from Charles Schwab demonstrates that plan members who receive assistance with their investments typically have more successful portfolios: Net of fees, the annual performance difference between the recipients and non-recipients is 3.32%. This implies that by calling an advisor, a participant who is 45 years old could experience a 79% increase in wealth by the time they are 65. That is a significant distinction.

Getting help can be the key to better results across the 401(k) board.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

- Improved savings rates – 70% of participants who used 401(k) advice increased their contributions.

- Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

- Increased likelihood of staying the course – Getting advice increased the chances of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401(k) investments during a downturn. Don’t try to do it alone. Get help with your company's 401(k) plan investments. Your nest egg will thank you.

It’s important to know that certain withdrawals are subject to regular federal income tax and, if you’re under age 59½, you may also be subject to an additional 10% penalty tax. You can determine if you’re eligible for a withdrawal, and request one, online or by calling your company's Benefits Center.

Rolling Over Your 401(k)

Because a withdrawal permanently reduces your retirement savings and is subject to tax, you should always consider taking a loan from the plan instead of a withdrawal to meet your financial needs. Unlike withdrawals, loans must be repaid, and are not taxable (unless you fail to repay them). In some cases, as with hardship withdrawals, you are not allowed to make a withdrawal unless you have also taken out the maximum loan available within the company plan.

You should also know that your company's plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all corporate employees.

Borrowing from your 401(k)

Should you? Maybe you lose your job with your company, have a serious health emergency, or face some other reason that you need a lot of cash. Banks make you jump through too many hoops for a personal loan, credit cards charge too much interest, and … suddenly, you start looking at your 401(k) account and doing some quick calculations about pushing your retirement from your company off a few years to make up for taking some money out.

We understand how you feel: It’s your money, and you need it now. But, take a second to see how this could adversely affect your retirement plans after leaving your company.

Consider these facts when deciding if you should borrow from your 401(k). You could:

- Lose growth potential on the money you borrowed.

- Deal with repayment and tax issues if you leave your company.

- Repayment and tax issues, if you leave your company.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution, you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

How does Net Unrealized Appreciation work?

First an employee must be eligible for a distribution from their qualified company-sponsored plan. Generally, at retirement or age 59 1⁄2, the employee takes a 'lump-sum' distribution from the plan, distributing all assets from the plan during a 1-year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time, you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

As an ExxonMobil employee, you may be interested in learning more about NUA with a complimentary one-on-one session with a financial advisor from The Retirement Group.

IRA Withdrawal

When you qualify for a distribution, you have three options:

Your retirement assets may consist of several retirement accounts: IRAs, 401(k)s, taxable accounts, and others.

So, what is the most efficient way to take your retirement income after leaving your company?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts.

This may help your retirement assets with your company last longer as they continue to potentially grow tax deferred.

You will also need to plan to take the required minimum distributions (RMDs) from any company-sponsored retirement plans and traditional or rollover IRA accounts.

That is due to IRS requirements for 2024 to begin taking distributions from these types of accounts when you reach age 73. Beginning in 2023, the excise tax for every dollar of your RMD under-distributed is reduced from 50% to 25%.

There is new legislation that allows account owners to delay taking their first RMD until April 1 following the later of the calendar year they reach age 73 or, in a workplace retirement plan, retire.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your income needs after retiring from your company. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your ExxonMobil Benefits

HSAs

Health Savings Accounts (HSAs) are frequently praised for helping people with high-deductible health plans manage their medical costs. Beyond only controlling medical costs, HSAs offer advantages over more conventional retirement plans such as 401(k)s. This is especially true if employer matching contributions have been fully utilized.

Recognizing HSAs

Individuals with high-deductible health insurance policies can open tax-advantaged accounts called Health Savings Accounts (HSAs). High-deductible plans are those that have a minimum deductible of $1,600 for single people and $3,200 for families as of 2024, according to the IRS. Triple tax benefits are offered by HSAs, which permit pre-tax contributions, tax-free investment growth, and tax-free withdrawals for approved medical costs.

HSA yearly contribution caps for 2024 are $4,150 for singles and $8,300 for families, plus an extra $1,000 for those 55 years of age and above. HSA funds, in contrast to those in Flexible Spending Accounts (FSAs), accrue and are carried over for an unlimited period of time.

Evaluating HSAs and 401(k)s After Matching

Contributions beyond the employer's maximum match in a 401(k) result in less immediate financial rewards. HSAs can serve as a strategic supplement in this situation. 401(k)s provide tax-deductible contributions and tax-deferred growth, but withdrawals are subject to taxes. In contrast, health savings accounts (HSAs) offer tax-free withdrawals for medical costs, which account for a sizeable amount of retirement spending.

HSA as a Tool for Retirement

The HSA shows its strength as a powerful retirement tool after age 65. The money can be taken out for anything, with the exception of ordinary income tax if it is used for non-medical costs. This flexibility is comparable to that of typical retirement plans, plus it comes with the bonus of tax-free withdrawals for medical bills, which is quite helpful considering the rising cost of healthcare in retirement.

Moreover, unlike Traditional IRAs and 401(k)s, HSAs do not have Required Minimum Distributions (RMDs), giving investors greater flexibility when it comes to retirement tax planning. Because of this, HSAs are especially beneficial for people who wish to reduce their taxable income or who may not need to access their savings right away when they retire.

HSA Investment Strategy

First, you should invest in an HSA cautiously, making sure that there are enough liquid assets to pay for short-term deductibles and other out-of-pocket medical costs. But after a safety net is in place, investing in a diverse range of equities and bonds and managing the HSA like a retirement account can greatly increase the account's long-term growth potential.

Making Use of HSAs in Retirement

HSAs can pay for a variety of retirement-related expenses:

Healthcare Costs Before Medicare: HSAs Can Cover Medical Expenses to Help You Become Enrolled in Medicare Healthcare Costs After Medicare: Medicare premiums and out-of-pocket medical expenses, such as dental and vision care, which are frequently not covered by Medicare, can be paid with HSAs.

Long-term Care: The money can be used to pay insurance premiums and for appropriate long-term care services.

Non-Medical Expenses: HSA funds may be withdrawn for non-medical costs up to the age of 65 without penalty, although income tax is due on these withdrawals.

In summary

In conclusion, after the advantages of 401(k) matching are fully realized, HSAs can be a better option for retirement savings due to their special advantages. Because of their tax benefits and flexibility in using funds, health savings accounts (HSAs) are a crucial part of an all-encompassing retirement plan. People can optimize their retirement financial health and ensure their medical and financial security by carefully controlling their contributions and withdrawals.

Plan for Life Insurance

If you are at least 50 years old and have worked for ExxonMobil for ten years, you might be eligible to keep your employee-paid coverage. You don't need to do anything to keep your coverage in place, but make sure to check with ExxonMobil. However, the price of your coverage can go up. In general, your retirement contributions will be larger than your employee contributions. You can always lower the amount of supplemental coverage you have when you retire. The following month's first will see the implementation of the alteration. If the amount of your retiree basic life insurance is less than one times your active pay, you may be eligible to obtain additional supplementary coverage at the rate of one times your active pay (within 31 days of retirement). Note: Your coverage will terminate if you cease making additional contributions. It won't be possible for you to restore it. For further information, please read the ExxonMobil SPD.

Temporary and Permanent Disability

Short-Term: Your employer may provide short-term disability (STD) benefits, depending on your plan.

Long-Term: If you suffer a qualified illness or injury that keeps you out of the office for six months or more, your plan's long-term disability (LTD) benefits are meant to pay you back.

What Takes Place Should Your Job Terminate

Unless your job ends due to disability, your life insurance coverage and any optional coverage you purchase for your spouse, domestic partner, and/or children expire on the date that your employment with your firm ends. Benefits for both your basic life insurance and any supplementary life insurance you choose are given to your beneficiary if you pass away within 31 days of the date on which your employment terminated.

Note: You may choose to choose portability for any optional coverage or to convert your life insurance into an individual policy.

Should you cease making additional donations, your coverage will terminate.

You should receive information outlining your options in the mail from the insurance company if you pay for supplemental life insurance and you are at least 65.

Don't forget to update your recipients. To learn more, consult the SPD for your organization.

ExxonMobil Beneficiary Designations

Next Step:

- When you retire, make sure that you update your beneficiaries. ExxonMobil has an Online Beneficiary Designation form for life events such as death, marriage, divorce, childbirth, adoptions, etc.

Understanding Social Security and filing for benefits can be challenging for many retirees, but knowing the best ways to do so is crucial to budgeting for your retirement income. Social Security benefits should be a component of your overall withdrawal strategy rather than your exclusive source of retirement income.

Gaining an understanding of Social Security's fundamentals and utilizing them to your advantage will enable you to obtain the maximum benefit possible.

When you initially become eligible, it is your obligation to enroll in Medicare parts A and B. You must continue to be enrolled in order to receive coverage for costs that qualify for Medicare. This also holds true for your dependents who qualify for Medicare.

You should be aware of how your Medicare eligibility or retirement medical plan selections affect your available possibilities. Prior to leaving your job, visit ssa.gov, call your local Social Security office, or give the U.S. Social Security Administration a call at 800-772-1213.

Divorce

A percentage of your retirement benefits from your employer may be of interest to your former spouse(s) if you are divorced or in the process of divorce. You must give your employer the following paperwork before you can begin receiving your pension, as well as for each ex-spouse who may be interested:

- A copy of any Marital Settlement Agreement (MSA) and the court-filed Judgment of Dissolution or Judgment of Divorce

- Copy of the Qualified Domestic Relations Order (QDRO) that was filed with the court

To prevent having your pension benefit halted or delayed, give your employer the documents they need. Please give us a call to learn more about strategies to consider if divorce is impacting your company's retirement benefits.

Regardless of how recent or ancient the divorce is, you must submit this paperwork to your employer's online pension center.Source: The Retirement Group; U.S. Department of Labor, "Retirement Plans - Benefits and Savings"; Fidelity, "Generating Income That Will Last Throughout Retirement"

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

- Your former partner passed away.

- You were married for at least ten years before getting divorced, and you are at least sixty years old.

- You are unmarried (or you got married again after turning 60).

Are you going through a divorce?

You remain married even if your divorce isn't finalized by the time you retire. There are two choices available to you:

Retire before the divorce is final and choose a minimum 50% joint pension with your spouse, or obtain your spouse's notarized signature consenting to an alternative pension option or lump sum.

Put off retiring until after your divorce is finalized and you have the necessary divorce records.

Source: U.S. Department of Labor, "Generating Income That Will Last Throughout Retirement," as well as The Retirement Group, "Retirement Plans - Benefits and Savings," 2019. 2019's Fidelity

Survivor Checklist

In the unfortunate event that you aren’t able to collect your ExxonMobil benefits, your survivor will be responsible for taking action.

What your survivor needs to do:

- Report your death. Your spouse, a family member or even a friend should call the ExxonMobil benefits service center as soon as possible to report your death.

- Collect life insurance benefits. Your spouse, or other named beneficiary, will need to call your company’s benefits service center to collect life insurance benefits.

If you have a joint pension:

- Start the joint pension payments. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from your company’s pension center to start receiving joint pension payments.

- Be prepared financially to cover living expenses. Your spouse will need to be prepared with enough savings to bridge at least one month between the end of your pension payments and the beginning of his or her own pension payments.

If your survivor has medical coverage through your company:

- Decide whether to keep medical coverage.

- If your survivor is enrolled as a dependent in your ExxonMobil-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium.

Life After ExxonMobil

While you may be ready for some rest and relaxation, without the stress and schedule of your full-time ExxonMobil career, it may make sense to you financially, and emotionally, to continue to work.

Financial benefits of working

Make up for decreased value of savings or investments. Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took a company offer and left ExxonMobil earlier than you wanted and with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living. Expenses can increase during retirement and working can be a logical and effective solution. You might choose to continue working at ExxonMobil in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

Emotional benefits of working

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work. Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

ExxonMobil employees interested in planning their retirement may be interested in live webinars hosted by experienced financial advisors. Click here to register for our upcoming webinars for ExxonMobil employees.

Sources

- “National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime.

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement.

- AT&T Summary Plan Description, 2019

- Chevron Summary Plan Description, 2019

- Shell Summary Plan Description, 2019

- ExxonMobil Summary Plan Description, 2019

- https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

- Rising Interest Rates e-book

- Closing The Retirement Gap e-book

- Rollover Strategies for 401(k)s e-book

- How to Survive Financially After a Job Loss e-book

- Financial PTSD e-book

- RetireKit

- What has Worked in Investing e-book

- Retirement Income Planning for ages 50-65 e-book

- Strategies for Divorced Individuals e-book

- TRG Webinar for Corporate Employees

- Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Missing out: How much employer 401(k) matching contributions do employees leave on the table?

- Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October 11, 2016 from https://www.ssa.gov/planners/taxes.html

- http://hr.chevron.com/northamerica/us/payprograms/executiveplans/dcp/

- https://www.lawinsider.com/contracts/1tRmgtb07oJJieGzlZ0tjL/chevron-corp/incentive-plan/2018-02-02

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

-

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

-

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

-

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

-

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know