Healthcare Provider Update: Healthcare Provider for Sears Holdings Sears Holdings typically provides healthcare benefits to its employees through various insurance plans, often with national insurers such as Aetna, UnitedHealthcare, or Anthem Blue Cross Blue Shield being among the health carriers they have partnered with. The specific providers can vary by location and employee selection during open enrollment periods. Potential Healthcare Cost Increases in 2026 As we progress into 2026, the healthcare landscape is expected to face significant challenges, particularly for employees of Sears Holdings. Forecasts indicate steep premium hikes, with some states imposing increases of over 60%, largely influenced by rising medical costs and the potential expiration of enhanced ACA premium subsidies. The Kaiser Family Foundation highlights that without congressional intervention, millions of marketplace enrollees could see their out-of-pocket costs surge by more than 75%. This convergence of factors threatens to impose a substantial financial burden on both individuals and employers, necessitating proactive strategies to mitigate rising expenses. Click here to learn more

As a Sears Holdings employee or retiree, you may have recently seen some headlines talking about an 'inverted yield curve' and what it may mean for the economy. An inverted yield curve is just one indicator of the economy's possible direction, and putting these headlines into context is valuable to those affiliated with Sears Holdings.

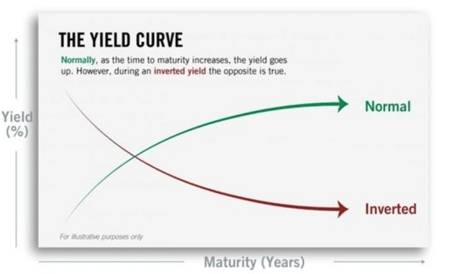

First, what is the yield curve, and what does it show? The yield curve is a graphical representation of interest rates (yields) paid out by US Treasury bonds. A normal yield curve shows increasingly higher yields for longer-dated bonds, creating an upward swing. An inverted curve has a downward slope, indicating that shorter-dated bonds yield more than longer-dated bonds, which isn't typical. As a Sears Holdings employee, being able to distinguish between these yield curves is important as it will allow better comprehension of interest rates paid out by U.S Treasury bonds.

Does an inverted yield curve mean we’re headed for a recession? Based on the historical track record of this indicator, yes, an inverted yield suggests a recession may be coming. As a Sears Holdings employee, it might be advantageous to do some financial planning to be fully prepared for unexpected events. Since 1976, a recession has followed an inverted curve every time. However, there are some important caveats that you, as a Sears Holdings employee, might benefit from reading here:

An inverted yield curve needs to remain inverted to be considered an indicator. It’s normal for markets to fluctuate as conditions and investor sentiment ebb and flow. But, according to the experts, for an inverted curve to be a recession indicator it needs to stay inverted for a month or more, historically. As a Sears Holdings employee, it is imperative to keep track of indicators and their trends as to be better versed in current market situations.

As a Sears Holdings employee it is also worthy to consider how recessions aren’t instantaneous. An inverted yield curve doesn’t mean a recession is just around the corner. Since 1976, the average time between an inverted yield curve and an official recession has been around 18 months; the longest was nearly three years. That’s plenty of time to prepare for what's to come, especially for those living in Texas!

As a Sears Holdings employee, It’s also worthy to note how an inverted yield curve doesn’t cause a recession. The yield curve reflects bond market sentiment – it doesn’t drive it. The yield curve inverts when bond market investors feel like something may be up and, in response, favor shorter-term bonds over longer-term ones. For a Sears Holdings employee, keeping track of bond market sentiment and the yield curve's response to changes in market is beneficial as it promotes better understanding of future market movements.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

It’s a deceptive signal for your portfolio. An inverted yield curve doesn’t mean it’s time to sell! Historically, the market continues to advance following an inverted yield curve, gaining an average of 11.5% real return (net of inflation) since 1976. As a Sears Holdings employee, it is important to not let one indicator spook you!

The takeaway here is that while an inverted yield curve may be unnerving, it’s by no means cause to panic. For fortune 500 employees, it’s an opportunity to assess your specific situation. Our team of retirement-focused advisors are closely monitoring the economic conditions and will proactively alert you should we feel action needs to be taken. In the meantime, feel free to call us if you have any questions or concerns.

How does the Sears Holdings Pension Plan differentiate between normal retirement, early retirement, and late retirement options for Kmart participants? In what ways do these options influence the retirement planning process for employees of Sears Holdings, and what specific considerations should Kmart employees be aware of when choosing one of these retirement paths, particularly in relation to their vested status?

Differentiation of Retirement Options: The Sears Holdings Pension Plan offers distinct options for normal, early, and late retirement. Normal retirement is available at age 65 or after five years of plan participation, whichever is later. Early retirement can be taken from age 55 but before 65, provided the employee is vested, with benefits subject to actuarial reduction unless certain conditions are met (like having at least 90 points, which is a sum of age and years of credited service). Late retirement pertains to any retirement after the normal retirement age, with pensions recalculated to reflect the delay in benefit commencement.

Considering the frozen status of the Sears Holdings Pension Plan, how does this impact the benefits eligibility for Kmart employees, and what implications does it have for their retirement savings strategies? In what ways should current employees factor in this frozen status when evaluating their overall retirement readiness and potential alternatives outside of the company plan?

Impact of Frozen Status: The freezing of the Sears Holdings Pension Plan on January 31, 1996, means that there have been no new accruals of benefits or participants since that date. For Kmart employees, this impacts their benefits eligibility by capping the pension benefits at levels earned up to the freeze date. Employees need to consider this stagnation in benefits when planning for retirement, potentially seeking additional retirement savings avenues to bridge any shortfall.

What are the essential calculations involved in determining the retirement benefits under the Sears Holdings Pension Plan for Kmart employees? Specifically, how do the Career Average Pay and Final Average Pay formulas come into play, and what factors should employees consider when estimating their future retirement payouts?

Essential Calculations for Retirement Benefits: Pension benefits for Kmart employees under the Sears Holdings Pension Plan are calculated using either the Career Average Pay or the Final Average Pay formulas. These calculations take into account an employee's years of credited service and compensation up to the freeze date. Factors like estimated Social Security benefits and specific formulas (such as a deduction based on Social Security benefits under the Final Average Pay formula) play crucial roles in determining the final pension payout.

How can Sears Holdings employees best navigate the process of applying for benefits under the Pension Plan? What specific steps should participants take to ensure their applications are processed correctly, and what important deadlines should they be aware of to avoid any negative consequences on their retirement benefits?

Navigating the Benefits Application Process: To apply for pension benefits, employees must submit a formal application, ideally 30 to 90 days before the intended commencement date. It is crucial to ensure all personal information, including marital status and spouse details, is up-to-date to avoid delays or inaccuracies in benefit processing. Missing application deadlines can lead to postponed benefit payments or unwanted default options.

In what situations can Kmart employees expect to receive a Deferred Vested Pension, and how is the calculation for this pension affected by their previous employment and vesting service? Employees should be aware of the important factors influencing their eligibility and the steps necessary to maintain their retirement benefits after leaving the company.

Eligibility and Calculation for Deferred Vested Pension: A Deferred Vested Pension is available to employees who leave the company after becoming vested but prior to qualifying for retirement. The calculation mirrors that of a normal retirement pension, with possible early commencement reductions. Understanding the timing of benefit commencement and the potential reductions for early start is vital for planning.

How does the Sears Holdings Pension Plan address tax considerations for employees receiving both monthly payments and lump sum payments upon retirement? What tax implications should Kmart participants be aware of, particularly in relation to IRS rules for distributions and potential penalties for early withdrawal?

Tax Implications of Pension Receipt: Pension payments, whether monthly or lump sum, are subject to federal taxes. Monthly benefits are taxed as ordinary income, while lump sums might be eligible for special tax treatments or rollover options to defer taxes. It’s important for Kmart employees to consider these implications and possibly consult with a tax advisor to optimize tax liability.

What are the rights and protections afforded to Kmart participants under the Employee Retirement Income Security Act (ERISA) as they navigate their retirement benefits with the Sears Holdings Pension Plan? How can employees leverage these rights to ensure they are receiving all the benefits to which they are entitled?

ERISA Rights and Protections: Under ERISA, Kmart employees are entitled to certain rights including the ability to appeal denied benefits, access to plan information, and assurances of fair and equitable treatment of their benefits. Leveraging these protections ensures that employees receive all due benefits.

What steps should Kmart employees take to update their personal information to ensure they continue receiving their benefits without interruption, especially in the context of missing participants or uncashed checks? What resources and contacts at Sears Holdings are available to assist with these updates?

Updating Personal Information: Maintaining accurate personal information with the pension plan is crucial for uninterrupted benefit payments. Employees should promptly update changes such as address, marital status, or beneficiaries to prevent issues with benefit distributions or lost checks.

How does the process of transferring between affiliated employers impact pension benefits for Kmart employees under the Sears Holdings Pension Plan? What considerations should be taken into account concerning Credited Service and Vesting Service during such transfers, and how can employees ensure they do not lose any entitled benefits?

Impact of Transfers Between Affiliated Employers: Transferring between Sears Holdings’ affiliated employers can affect pension benefits differently depending on whether the employer participates in the pension plan. It's essential to understand how such transfers impact credited and vesting service accruals.

For Kmart employees seeking more information about their benefits under the Sears Holdings Pension Plan, what is the best way to contact company representatives? How can they effectively communicate their questions or concerns to ensure they receive accurate and timely information regarding their retirement benefits?

Contacting Plan Representatives: Kmart employees seeking clarity on their pension benefits should contact the Sears Holdings Pension Service Center. Effective communication, including prepared questions and necessary documentation, will aid in obtaining accurate and comprehensive information.

/General/General%208.png?width=1280&height=853&name=General%208.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)