Healthcare Provider Update: Healthcare Provider for Southern California Edison: Southern California Edison (SCE) primarily utilizes Blue Shield of California as its healthcare provider for employees. This partnership enables the company to offer a variety of health insurance options to its workforce, including comprehensive coverage options tailored to meet the diverse needs of its employees. Potential Healthcare Cost Increases in 2026: As the healthcare landscape shifts, Southern California Edison employees may see a significant impact on healthcare costs in 2026. With projected record increases in insurance premiums-some states reporting hikes exceeding 60%-combined with the potential expiration of enhanced federal subsidies, many employees could face out-of-pocket premium spikes exceeding 75%. Factors contributing to this trend include rising medical costs and aggressive rate hikes from major insurers, which underline the importance of strategic planning for healthcare expenses as retirement approaches. Adapting to these changes is essential for maintaining financial stability and ensuring access to necessary healthcare services. Click here to learn more

Table of Contents

When Stock Prices Are High What You Can Do With Dca

Prologue

The majority of Southern California Edison employees we talk to bring up the difficulties of investing. Uncertainty is a constant in investing. Recent bias makes the current time, whenever that may be, feel more uncertain than ever. The COVID-19 pandemic and modern conflicts presented us with truly unprecedented economic and health-related uncertainty, but stepping back to any point in history there is always a reason that this time is different; this is true in both bull and bear markets. Uncertainty is not necessarily a bad thing - if investing felt certain we would not expect to collect a meaningfully positive risk premium from owning risky assets. For long-term investors, stocks should deliver on their positive expected returns. The concept of hanging on through tough markets to benefit from long-term expected returns is relatively easy for most investors to understand. The tricky part is doing it, and it doesn’t get any trickier than making the decision to invest a lump sum of cash.

The nagging uncertainty that comes with investing in the stock market seems to be particularly pronounced when it comes to investing “new money.” New money could be a windfall from selling a home or business, receiving an inheritance, or winning the lottery. Whatever its source, shifting from cash into stocks can be a nerve-racking experience. In the case of new money, it doesn’t help to know that long-term expected returns are positive when you are deciding to invest a large sum at a single point in time. Instead of investing a lump sum all at once, you might choose to enter the market gradually over some pre-determined period. This is commonly referred to as dollar-cost averaging. It seems intuitive that dollar cost averaging would lead to a better average outcome. You are buying more stocks when stocks are down and less when they are up, and you are avoiding the potential timing error of investing right before a crash. As usual, intuition and investment decisions don’t mix.

This paper aims to compare dollar-cost averaging (DCA) to lump sum investing (LSI) through time for Southern California Edison employees and retirees. We will examine average historical outcomes, the worst LSI outcomes, historical bear markets, and historically expensive markets. Neither this analysis nor its broad findings are new. A 1979 paper in the Journal of Financial and Quantitative Analysis by George Constantinides, A Note on the Suboptimality of Dollar-Cost Averaging as an Investment Policy, regards DCA as suboptimal through two propositions. A 2012 paper from Vanguard, Dollar-cost averaging just means taking risk later, found that LSI beats DCA about two-thirds of the time in the United States, the United Kingdom, and Australia.

This paper extends the analysis to include a closer look at the distribution of outcomes on average and under special circumstances commonly believed to be suboptimal for LSI.

Overview

Many Southern California Edison employees and retirees have told us how difficult it feels to evaluate certain investment strategies. To evaluate DCA as an investment strategy we will compare it to lump sum investing for rolling 10-year investment periods with monthly steps. This means that starting with the first available month we will examine DCA and lump sum investing through the following decade of returns, and then move the start point one month ahead. For most data series in our sample, this results in 485 10-year periods. For Canada, we have 652 periods, and 1013 for the US. We will evaluate a 12-month DCA implementation, which means splitting up a lump sum into 12 equal monthly investments, against a single lump sum investment. The following chart shows an approximate allocation between cash and stocks over the course of a 12-month DCA period for $1,000,000 of starting cash.

Figure 1 – Dollar-Cost Averaging Illustration

Source: Benjamin Felix, Portfolio Manager, PWL Capital Inc.

In our model, the cash will earn interest at the rate of One-Month US Treasury Bills while it is waiting to be invested. The portfolios are 100% invested in stocks when fully implemented. All analysis has been conducted in US dollars using monthly returns for One-Month US Treasury Bills and the six global stock markets listed in Table 1.

Table 1 – Stock Market Indexes

Source: Benjamin Felix, Portfolio Manager, PWL Capital Inc.

In order to evaluate LSI relative to DCA, we have chosen to look at the ending performance of an investment after 10 years. First, we evaluated the full data series for each market to understand the average outcomes. We isolated the most extreme bad outcomes for LSI to examine how DCA performed in those periods. Knowing that we cannot predict when LSI will have its worst outcomes, we then compared LSI to DCA during bear markets and when stock prices are high.

The Properties of Stock Market Returns

The equity risk premium – the premium that stocks are expected to deliver over a risk-free asset – tends to be consistent over long periods of time. Using US stock data going back to 1926 we can observe the nature of the premium.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

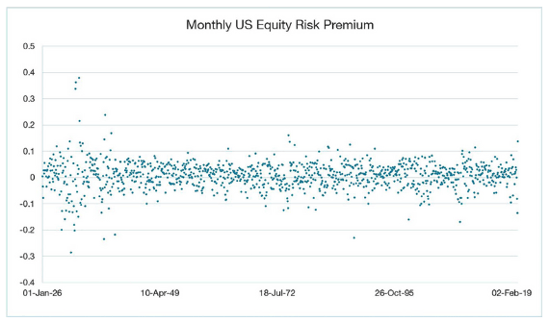

Figure 2 – Historical Monthly US Equity Risk Premium

Data source: Dimensional Returns Web, CRSP, PWL Capital Inc.

The monthly US equity premium has been remarkably consistent, within a range, throughout history. It has an arithmetic average of 0.65%, and it has been positive 60% of the time. There tend to be periods, visible in Figure 2, where the monthly premium becomes more volatile; volatility clustering is a well-known phenomenon. Over periods longer than one month we also observe characteristic negative skewness - frequent small gains and a few extreme losses.

Given the nature of stock returns, we would expect a stock investor to achieve positive returns with roughly the same frequency as the equity risk premium being positive. For the remainder of this paper, we will be comparing lump sum investing to dollar-cost averaging in terms of absolute returns, as opposed to observing their risk premiums. US stock returns have been positive in absolute terms 63% of the time in the historical data.

Average Lsi Vs. Data Results

For most markets, and on average across markets, we find that roughly two-thirds of the time LSI beats DCA over 10-year periods in terms of ending assets. The exception is Japan which is unsurprising given its unique long-term stock market outcome; Japan’s equity market has trailed One-Month US Treasury Bills since 1990.

Table 2 – LSI vs. DCA for 10-Year Historical Periods

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

The basic insight that we draw from this result is that, on average, LSI leads to greater ending wealth than DCA. To quantify the extent to which LSI tends to beat DCA we examined the 10-year annualized performance difference for the full sample. An annualized figure stated as a percentage makes for an easy comparison to familiar items like fees and withholding taxes. On average, DCA is leaving a meaningful amount of expected returns on the table at 0.38% annualized over ten years in the historical data; this should not be a surprise considering that DCA delays exposure to higher expected returning stocks.

Table 3 – LSI vs. DCA Annualized 10-Year Performance Difference

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

Comparing average outcomes is interesting but it does not speak to the dispersion of outcomes. Even if DCA is worse on average in terms of expected average outcomes, maybe it offers some protection on the downside. To assess this, we calculate the difference in annualized returns for LSI and DCA over 10-year periods and sort the data into percentiles. The 10th percentile is the bottom 10% of outcomes, the 50th percentile is the median, and the 90th percentile is the top 10%.

Table 4 – Difference in Annualized Returns (LSI – DCA)

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

It should be clear from Table 4 that LSI is beating DCA by a healthy margin on average. In the best 10% of outcomes (90th percentile), more has been gained by LSI over DCA than what has been lost in the worst 10% of outcomes. The median outcome is positive, and the distribution is negatively skewed. None of this should be a surprise considering the positive expected risk premium of stocks over treasury bills, and the left-skewed distribution of stock returns. Figure 3 shows the shape of the distribution of the differences in outcomes for LSI less DCA in terms of 10-year annualized returns.

Figure 3 – Distribution of Differences in 10-Year Annualized Outcomes (LSI - DCA)

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

At the most extreme, the far left and right tails of the distribution, LSI does look worse than DCA. This observation is consistent with a negatively skewed distribution; we see that most of the outcomes are good, but the worst outcomes are more extreme than the best outcomes. This validates the idea that DCA might be able to offer protection from the worst outcomes, but it comes at a significant cost in terms of expected returns.

Lsi Tail Findings

Average historical outcomes may be of limited psychological value when making investment decisions under conditions of uncertainty. An investor doesn’t necessarily care to know about average outcomes – any point in time will never feel average to those living in it. Investors want to minimize their perception of the downside risk associated with investing a large sum of cash in an uncertain market. It is important for Southern California Edison employees to note that this exercise is distinct from examining the percentiles in Table 4. Table 4 demonstrates the distribution of differences in outcomes. That is the magnitude of the average performance difference between LSI and DCA across the full data set.

Sorting by the difference between LSI and DCA lets us think about the total distribution of outcomes for DCA relative to LSI, but we are now interested in how DCA does when LSI does poorly relative to the full set of LSI outcomes. To examine this, we sort historical outcomes by LSI ending assets and observe how DCA performs when LSI has its worst 10% of historical outcomes. Framed differently, if we knew that the next 10 years would be among the worst in history for a lump sum investment, could we count on DCA to improve the outcome?

Table 5 – LSI vs. DCA in the 10th Percentile LSI Historical Periods

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

In half of our markets, LSI still beats DCA most of the time even when LSI has delivered its worst historical outcomes; this is also true with an equal-weighted average of all markets in the sample. The results are not as strongly in favor of LSI as the full data series but remember that we have intentionally selected the worst LSI outcomes for this sample. While the number of outcomes is evenly matched, the bad outcomes in this case are worse in magnitude than the good ones. The result is a negative difference in annualized 10-year performance. This should not be surprising considering our intentional selection of the worst LSI outcomes in the sample.

Table 6 – Difference in Annualized Returns for 10th Percentile LSI Outcomes (LSI – DCA)

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

Even under artificial conditions of a known bad future outcome for LSI, DCA offers less than a 50% shot at an improvement. DCA does however offer an edge when the magnitude of positive and negative outcomes is considered – despite the roughly even split between good and bad outcomes, the bad outcomes are worse than the good outcomes are good. This seems to give credence to the mythical ability of DCA to improve an extremely bad LSI outcome. An important nuance in the data is that the worst LSI outcomes relative to other LSI outcomes do not correspond with the worst LSI outcomes relative to DCA outcomes. The most extreme instances of underperformance for LSI relative to DCA have less to do with the LSI outcome being extremely bad and more to do with the DCA outcome being extremely good. In other words, lucky timing for DCA, as opposed to avoiding unlucky timing for LSI, drives the difference in the most extreme cases.

Given that it is impossible to predict which time periods will result in the worst outcomes for a lump sum investment, we next turn to two signals commonly believed to offer forward-looking insight into future investment returns.

Utilizing Dca in Bear Markets

One seemingly obvious case where DCA feels like it should shine is during bear markets - market drops of 20% or more. Stock market volatility tends to cluster; when markets are turbulent, they tend to remain so for some time. Spreading an investment out over 12 months in the face of a bear market seems like a reasonable approach to improving the expected outcome. To be clear, we are assuming that the 20% drop has already happened when we are making the LSI or DCA decision.

For this sample, we have defined a bear market as a monthly drop of 20% or more from the previous peak. We will begin the LSI and DCA samples in the month following the drop, with the idea being that an investor with new cash has just observed a 20% or greater drop in the market and is now deciding between LSI and DCA.

Table 7 – LSI vs. DCA in Historical Bear Markets

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

We again find that LSI produces a better outcome than DCA most of the time in most countries in the sample. Southern California Edison employees and retirees should note that the US experience is significantly impacted by the enormous volatility and seemingly perpetual market drops in the 1930s. We find that, on average, LSI beats DCA by a 10-year annualized 0.25% when the investment period begins with the month after a drop of 20% or more has occurred. Echoing the experience of the full data series we also see that there has historically been more to gain from LSI in the 90th percentile of outcomes than there has been to lose in the 10th percentile. DCA is not offering protection from bad outcomes without also exposing us to a greater risk of missing good outcomes.

Table 8 – Difference in Annualized Returns Starting at Bear Markets (LSI – DCA)

Data source: Dimensional Returns Web, CRSP, MSCI, S&P Dow Jones Indices, PWL Capital Inc.

It's important for Southern California Edison employees to keep in mind that our trigger to begin the investment period is a 20% drop. In some cases, a 20% drop is followed by more drops, while in other cases it is followed by a rebound. Based on the data in Tables 7 and 8 we can see that rebounds are more impactful, on average than further drops. This results in LSI delivering a better result than DCA most of the time, even during periods of market volatility.

When Stock Prices Are High What You Can Do With Dca

In bear markets prices falls due to increased uncertainty, causing concern for investors deploying new cash. High prices can similarly make investors uneasy for fear of investing at a peak. To observe the relationship between market valuations and the relative performance of LSI and DCA we use the monthly Shiller CAPE ratio. Based on data availability we only observe US stock data. We will define expensive as the Shiller CAPE being in the 95th percentile of all historical monthly observations (February 1872 – May 2020). Comparing LSI to DCA when the market is in its 95th percentile of expensiveness, LSI beats DCA 54.24% of the time.

Table 9 – LSI vs. DCA when Stock Prices are High Relative to all History

Data source: Dimensional Returns Web, CRSP, Barclays Research, PWL Capital Inc.

While it may seem concerning, this observation suffers from a massive bias: at any point in time we do not have the full set of past and future Shiller CAPE data to base a decision - we only have past data in our possession. We adjust for this by measuring the market’s expensiveness only relative to historical data for each data point. For example, for January 1926 we are comparing the Shiller CAPE to the set of data from February 1872 to January 1926, not from February 1872 to May 2020 to test for expansiveness. In this case, LSI beats DCA 63.70% of the time.

Table 10 – LSI vs. DCA when Stock Prices are High Relative to Backward-looking History

This exercise is to remind Southern California Edison employees and retirees that while valuations may look high at a point in time, they can always get higher. Japan might be a particularly interesting case study on the usefulness of market valuations in making the LSI vs. DCA decision. We have less data for Japan, so instead of comparing historical Japanese data, we will compare Japanese valuations to US data to determine expensiveness. The highest level of the monthly Shiller CAPE for the full US historical data series is 44.19 which occurred in December 1999. Japan exceeded this level in May 1986 with a Shiller CAPE of 44.31. While the Japanese market did eventually crash in 1990, there are 29 monthly observations following May 1986 where LSI beats DCA by a wide margin. Even starting in November 1988, with a Shiller CAPE of 72.07, LSI beats DCA in Japan in terms of 10-year annualized returns.

It is well-known that future returns tend to be relatively low when valuations are relatively high. Despite this, using valuation as a signal to time the LSI vs. DCA decision has historically resulted in unfavorable outcomes most of the time.

Cognitive Threats

Despite the statistical evidence in favor of LSI, there is a meaningful psychological risk to investing in a lump sum. For many Southern California Edison investors, losing money in the stock market is psychologically, and in some cases physiologically painful. There is evidence from behavioral finance suggesting that acts of commission are more painful than acts of omission. Making the decision to buy stocks today is an act of commission while deciding not to buy stocks is an act of omission. Buying stocks on a given day and then watching them fall is more psychologically painful than not buying stocks and watching them rise, even if the economic impact is identical. DCA could be viewed as diversifying acts of commission over time to reduce the potential for a psychologically painful outcome.

If DCA seems like a solution to avoiding pain when investing new money, we think that it is a reasonable strategy. However, we also think that if the fear of loss is so great that DCA needs to be employed to make an asset allocation decision palatable, that asset allocation may be too aggressive. It should feel comfortable to invest a lump sum in a risk-appropriate portfolio. We do not want to imply that DCA should never be employed, but we do believe that if it feels necessary to use DCA in order to implement an asset allocation decision, it may be wise to revisit the portfolio altogether.

In Conclusion

Dollar-cost averaging is the decision to gradually deploy a lump sum of cash into the stock market in order to avoid ex-post regretful timing. We have shown that, on average, dollar-cost averaging consistently trails lump sum investing about two-thirds of the time. This is true across stock markets and throughout history, and it is consistent with the historical nature of the equity risk premium. The implicit historical cost of dollar-cost averaging has been an annualized 0.38% over 10 years when compared to investing a lump sum.

When lump sum investing has historically delivered its worst outcomes dollar-cost averaging has looked better than average, but it has not been a consistent remedy. It is not possible to know when lump sum investing will deliver its worst outcomes ahead of time, so we test two forward-looking measures.

We find poor results for dollar-cost averaging during bear markets and when stock prices are high. Dollar-cost averaging tends to underperform lump sum investing during bear markets (53.66% of the time) and when stocks are trading in the 95th percentile of historical valuations (63.70% of the time).

It's important for Southern California Edison employees to note that given the data that supports lump sum investing, we believe that there is a strong statistical argument to avoid dollar cost averaging unless it is absolutely necessary from a psychological perspective, and if that is the case, we believe that the long-term asset allocation may need to be revised toward a more conservative portfolio.

About The Retirement Group

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

Sources

- Constantin ides, George, (1979), A Note on the Suboptimality of Dollar-Cost Averaging as an Investment Policy, Journal of Financial and Quantitative Analysis, 14, issue 2, p. 443-450.

- Shtekhman, Anatoly, Tasopoulos, Christos, and Wimmer, Brian, (2012), Dollar-cost averaging just means taking risk later, Vanguard Research

How does SoCalGas determine its pension contribution levels for 2024, and what factors influence the funding strategies to maintain financial stability? In preparing for the Test Year (TY) 2024, SoCalGas employs a detailed actuarial process to ascertain the necessary pension contributions. The actuarial valuation includes an assessment of the company's Projected Benefit Obligation (PBO) under Generally Accepted Accounting Principles (GAAP). These calculations incorporate variables such as current employee demographics, expected retirement ages, and market conditions. Additionally, SoCalGas must navigate external economic factors, including interest rates and economic forecasts, which can impact the funded status of its pension plans and the associated financial obligations.

SoCalGas determines its pension contribution levels using a detailed actuarial process that evaluates the Projected Benefit Obligation (PBO) under Generally Accepted Accounting Principles (GAAP). The contribution is influenced by variables such as employee demographics, retirement age expectations, market conditions, and external economic factors like interest rates and economic forecasts. SoCalGas maintains financial stability by adjusting funding strategies based on market returns and required amortization periods(Southern_California_Gas…).

What specific changes to SoCalGas's pension plan are being proposed for the upcoming fiscal year, and how will these changes impact existing employees and retirees? The proposals for the TY 2024 incorporate adjustments to the existing pension funding mechanisms, including the continuation of the two-way balancing account to account for fluctuations in pension costs. This measure is designed to stabilize funding while meeting both the service cost and the annual minimum contributions required under regulatory standards. Existing employees and retirees may see changes in their benefits as adjustments are made to align with these funding strategies, which may include modifications to expected payouts or contributions required from retirees depending on their service years and retirement age.

For the 2024 Test Year, SoCalGas is proposing to adjust its pension funding policy by shortening the amortization period for the PBO shortfall from fourteen to seven years. This change aims to fully fund the pension plan more quickly, improving long-term financial health while reducing intergenerational ratepayer burden. Existing employees and retirees may experience greater financial stability in the pension plan due to these proactive funding strategies(Southern_California_Gas…).

In what ways does SoCalGas's health care cost escalation projections for postretirement benefits compare with national trends, and what strategies are in place to manage these costs? The health care cost escalations required for the Postretirement Health and Welfare Benefits Other than Pension (PBOP) at SoCalGas have been developed in alignment with industry trends, which show consistent increases in health care expenses across the nation. Strategies implemented by SoCalGas involve negotiation with health care providers for favorable rates, introduction of health reimbursement accounts (HRAs), and ongoing assessments of utilization rates among retirees to identify potential savings. These measures aim to contain costs while ensuring that retirees maintain access to necessary healthcare services without a significant financial burden.

SoCalGas's healthcare cost projections for its Postretirement Benefits Other than Pensions (PBOP) align with national trends of increasing healthcare expenses. To manage these costs, SoCalGas employs strategies like negotiating favorable rates with providers, utilizing health reimbursement accounts (HRAs), and regularly assessing healthcare utilization. These efforts aim to control healthcare costs while ensuring that retirees receive necessary care(Southern_California_Gas…).

What resources are available to SoCalGas employees to help them understand their benefits and the changes that may occur in 2024? SoCalGas provides various resources to employees to clarify their benefits and upcoming changes, including dedicated HR representatives, comprehensive guides on benefits options, web-based portals, and informational seminars. Employees can access personalized accounts to view their specific benefits, contributions, and projections. Additionally, the company offers regular training sessions covering changes in benefits and how to navigate the retirement process effectively, empowering employees to make informed decisions regarding their retirement planning.

SoCalGas provides employees with various resources, including HR representatives, benefit guides, and web-based portals to help them understand their benefits. Employees also have access to personalized retirement accounts and training sessions that cover benefit changes and retirement planning, helping them make informed decisions regarding their future(Southern_California_Gas…).

How does the PBOP plan impact SoCalGas’s overall compensation strategy for attracting talent? The PBOP plan is a critical component of SoCalGas’s total compensation strategy, designed to attract and retain high-caliber talent in an increasingly competitive market. SoCalGas recognizes that comprehensive postretirement benefits enhance their appeal as an employer. The direct correlation between competitive benefits packages, including the PBOP plan's provisions for health care coverage and financial support during retirement, plays a significant role in talent acquisition and retention by providing peace of mind for employees about their long-term financial security.

SoCalGas's PBOP plan plays a crucial role in its overall compensation strategy by offering competitive postretirement health benefits that enhance the attractiveness of the company's total compensation package. This helps SoCalGas attract and retain a high-performing workforce, as comprehensive retirement and healthcare benefits are important factors for employees when choosing an employer(Southern_California_Gas…).

What are the anticipated trends in the pension and postretirement cost estimates for SoCalGas from 2024 through 2031, and what implications do these trends hold for financial planning? Anticipated trends in pension and postretirement cost estimates are projected to indicate gradual increases in these costs due to changing demographics, increasing life expectancies, and inflation impacting healthcare costs. Financial planning at SoCalGas thus necessitates a proactive approach to ensure adequate funding mechanisms are in place. This involves forecasting contributions that will remain in line with the projected obligations while also navigating regulatory requirements to avoid potential funding shortfalls or impacts on corporate finances.

SoCalGas anticipates gradual increases in pension and postretirement costs from 2024 to 2031 due to changing demographics, increased life expectancies, and rising healthcare costs. This trend implies that SoCalGas will need to implement robust financial planning strategies, including forecasting contributions and aligning funding mechanisms with regulatory requirements to avoid potential shortfalls(Southern_California_Gas…).

How do SoCalGas's pension plans compare with those offered by other utility companies in California in terms of competitiveness and sustainability? When evaluating SoCalGas's pension plans compared to other California utility companies, it becomes evident that SoCalGas's offerings emphasize not only competitive benefits but also a sustainable framework for its pension obligations. This comparative analysis includes studying funding ratios, benefit structures, and employee satisfaction levels. SoCalGas aims to maintain a robust pension plan that not only meets current employee needs but is also sustainable in the long term, adapting to changing economic conditions and workforce requirements while remaining compliant with state regulations.

SoCalGas's pension plans are competitive with those of other utility companies in California, with a focus on both benefit structure and long-term sustainability. SoCalGas emphasizes maintaining a robust pension plan that is adaptable to changing market conditions, regulatory requirements, and workforce needs. This allows the company to remain an attractive employer while ensuring the sustainability of its pension commitments(Southern_California_Gas…).

How can SoCalGas employees reach out for support regarding their pension and retirement benefits, and what types of inquiries can they make? Employees can contact SoCalGas’s Human Resources Benefits Department through dedicated communication channels such as the company’s HR support line, email, or scheduled one-on-one consultations. The HR team is trained to address a variety of inquiries related to pension benefits, eligibility requirements, plan options, and retirement planning strategies. Moreover, employees can request personalized benefits statements and assistance with understanding their entitlements and the implications of any regulatory changes affecting their plans.

SoCalGas employees can reach out to the company's HR Benefits Department through a dedicated support line, email, or consultations. They can inquire about pension benefits, eligibility, plan options, and retirement strategies. Employees may also request personalized benefits statements and clarification on regulatory changes that may affect their plans(Southern_California_Gas…).

What role does market volatility and economic conditions play in shaping the funding strategy of SoCalGas's pension plans? Market volatility and economic conditions play a significant role in shaping SoCalGas's pension funding strategy, influencing both asset returns and liabilities. Fluctuations in interest rates, market performance of invested pension assets, and changes in demographic factors directly affect the PBO calculation, requiring SoCalGas to adjust its funding strategy responsively. This involved the use of sophisticated financial modeling and scenario analysis to ensure that the pension plans remain adequately funded and financially viable despite adverse economic conditions, thereby protecting the interests of current and future beneficiaries.

Market volatility and economic conditions significantly impact SoCalGas's pension funding strategy, affecting both asset returns and liabilities. Factors like interest rates, market performance of pension assets, and demographic shifts influence the PBO calculation, prompting SoCalGas to adjust its funding strategy to ensure adequate pension funding and long-term plan viability(Southern_California_Gas…).

What steps have SoCalGas and SDG&E proposed to recover costs related to pension and PBOP to alleviate financial pressure on ratepayers? SoCalGas and SDG&E proposed implementing a two-way balancing account mechanism designed to smoothly recover the costs associated with their pension and PBOP plans. This initiative aims to ensure that any variances between projected and actual contributions are adjusted in a timely manner, thereby reducing the financial burden on ratepayers. By utilizing this approach, the Companies seek to maintain stable rates while ensuring that all pension obligations can be met without compromising operational integrity or service delivery to their customers. These questions reflect complex issues relevant to SoCalGas employees preparing for retirement and navigating the nuances of their benefits.

SoCalGas and SDG&E have proposed utilizing a two-way balancing account mechanism to recover pension and PBOP-related costs. This mechanism helps adjust for variances between projected and actual contributions, ensuring that costs are managed effectively and do not overly burden ratepayers. This approach aims to maintain stable rates while fulfilling pension obligations(Southern_California_Gas…).

Additional Articles

Check Out Articles for Southern California Edison employees

-

-

Corporate Employees: 8 Factors When Choosing a Mutual Fund -

Use of Escrow Accounts: Divorce -

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024! -

Stages of Retirement for Corporate Employees -

7 Things to Consider Before Leaving Your Company -

How Are Workers Impacted by Inflation & Rising Interest Rates? -

Lump-Sum vs Annuity and Rising Interest Rates -

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans) -

Corporate Employees: Do NOT Believe These 6 Retirement Myths! -

401K, Social Security, Pension – How to Maximize Your Options -

Have You Looked at Your 401(k) Plan Recently? -

11 Questions You Should Ask Yourself When Planning for Retirement -

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

Worst Month of Layoffs In Over a Year!

-

Corporate Employees: 8 Factors When Choosing a Mutual Fund -

Use of Escrow Accounts: Divorce -

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024! -

Stages of Retirement for Corporate Employees -

7 Things to Consider Before Leaving Your Company -

How Are Workers Impacted by Inflation & Rising Interest Rates? -

Lump-Sum vs Annuity and Rising Interest Rates -

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans) -

Corporate Employees: Do NOT Believe These 6 Retirement Myths! -

401K, Social Security, Pension – How to Maximize Your Options -

Have You Looked at Your 401(k) Plan Recently? -

11 Questions You Should Ask Yourself When Planning for Retirement -

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

Worst Month of Layoffs In Over a Year!

For more information you can reach the plan administrator for Southern California Edison at 2244 walnut grove ave Rosemead, CA 91770; or by calling them at 1-800-655-4555.

Further Information for Southern California Edison* Employees

- Transition Planning to Assist Southern California Edison Employees

- Retirement Planning to Assist Southern California Edison Employees

- Tax Planning to Assist Southern California Edison Employees

- 401K Planning to Assist Southern California Edison Employees

- Pension Planning to Assist Southern California Edison Employees

- QDRO Planning to Assist Southern California Edison Employees

*Please see disclaimer for more information

Relevant Articles

Check Out Articles for Southern California Edison employees

-

-

Corporate Employees: 8 Factors When Choosing a Mutual Fund

Corporate Employees: 8 Factors When Choosing a Mutual Fund

-

Use of Escrow Accounts: Divorce

Use of Escrow Accounts: Divorce

-

-2.png) Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

-

Stages of Retirement for Corporate Employees

Stages of Retirement for Corporate Employees

-

7 Things to Consider Before Leaving Your Company

7 Things to Consider Before Leaving Your Company

-

How Are Workers Impacted by Inflation & Rising Interest Rates?

How Are Workers Impacted by Inflation & Rising Interest Rates?

-

Lump-Sum vs Annuity and Rising Interest Rates

Lump-Sum vs Annuity and Rising Interest Rates

-

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

-

Corporate Employees: Do NOT Believe These 6 Retirement Myths!

Corporate Employees: Do NOT Believe These 6 Retirement Myths!

-

401K, Social Security, Pension – How to Maximize Your Options

401K, Social Security, Pension – How to Maximize Your Options

-

Have You Looked at Your 401(k) Plan Recently?

Have You Looked at Your 401(k) Plan Recently?

-

11 Questions You Should Ask Yourself When Planning for Retirement

11 Questions You Should Ask Yourself When Planning for Retirement

-

.webp) Worst Month of Layoffs In Over a Year!

Worst Month of Layoffs In Over a Year!

-

Corporate Employees: 8 Factors When Choosing a Mutual Fund

Corporate Employees: 8 Factors When Choosing a Mutual Fund

-

Use of Escrow Accounts: Divorce

Use of Escrow Accounts: Divorce

-

-2.png) Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

-

Stages of Retirement for Corporate Employees

Stages of Retirement for Corporate Employees

-

7 Things to Consider Before Leaving Your Company

7 Things to Consider Before Leaving Your Company

-

How Are Workers Impacted by Inflation & Rising Interest Rates?

How Are Workers Impacted by Inflation & Rising Interest Rates?

-

Lump-Sum vs Annuity and Rising Interest Rates

Lump-Sum vs Annuity and Rising Interest Rates

-

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

-

Corporate Employees: Do NOT Believe These 6 Retirement Myths!

Corporate Employees: Do NOT Believe These 6 Retirement Myths!

-

401K, Social Security, Pension – How to Maximize Your Options

401K, Social Security, Pension – How to Maximize Your Options

-

Have You Looked at Your 401(k) Plan Recently?

Have You Looked at Your 401(k) Plan Recently?

-

11 Questions You Should Ask Yourself When Planning for Retirement

11 Questions You Should Ask Yourself When Planning for Retirement

-

.webp) Worst Month of Layoffs In Over a Year!

Worst Month of Layoffs In Over a Year!

/General/General%204.png?width=1280&height=853&name=General%204.png)