Healthcare Provider Update: Healthcare Provider for MassMutual MassMutual primarily collaborates with a range of healthcare providers through its employee benefits plans but does not operate a dedicated healthcare provider network itself. Instead, MassMutual provides health insurance options to its employees through various partnerships with leading insurance carriers. Projected Healthcare Cost Increases for 2026 As we approach 2026, healthcare costs are anticipated to increase significantly, with potential premium hikes driven largely by the expiration of enhanced federal subsidies for ACA marketplace enrollees. Experts forecast that Americans could face average increases of over 75% in out-of-pocket premium costs due to these subsidy reductions, alongside aggressive rate increases from major insurers, some of which are as high as 66.4% in places like New York. Furthermore, rising medical costs and inflation are compounding the financial strain on consumers, marking 2026 as a challenging year for healthcare affordability. Click here to learn more

In March 2022, the Consumer Price Index for All Urban Consumers (CPI-U), the most common measure of inflation, rose at an annual rate of 8.5%, the highest level since December 1981.

1

It's not surprising that a Gallup poll at the end of March found that one out of six Americans considers inflation to be the most important problem facing the United States.

2

When inflation began rising in the spring of 2021, many economists, including policymakers at the Federal Reserve, believed the increase would be transitory and subside over a period of months. One year later, inflation has proven to be more stubborn than expected. It may be helpful for MASSMutual employees and retirees to look at some of the forces behind rising prices, the Fed's plan to combat them, and early signs that inflation may be easing.

Hot Economy Meets Russia and China

The fundamental cause of rising inflation continues to be the growing pains of a rapidly opening economy — a combination of pent-up consumer demand, supply-chain slowdowns, and not enough workers to fill open jobs. Loose Federal Reserve monetary policies and billions of dollars in government stimulus helped prevent a deeper recession but added fuel to the fire when the economy reopened.

More recently, the Russian invasion of Ukraine has placed upward pressure on already high global fuel and food prices.

3

At the same time, a COVID resurgence in China led to strict lockdowns that have closed factories and tightened already struggling supply chains for Chinese goods. The volume of cargo handled by the port of Shanghai, the world's busiest port, dropped by an estimated 40% in early April.

4

Behind the Headlines

Although the 8.5% year-over-year 'headline' inflation in March is a daunting number for our MASSMutual clients to consider, monthly numbers provide a clearer picture of the current trend. The month-over-month increase of 1.2% was extremely high, but more than half of it was due to gasoline prices, which rose 18.3% in March alone.

5

Despite the Russia-Ukraine conflict and increased seasonal demand, U.S. gas prices dropped in April, but the trend was moving upward by the end of the month.

6

The federal government's decision to release one million barrels of oil per day from the Strategic Petroleum Reserve for the next six months and allow summer sales of higher-ethanol gasoline may help moderate prices.

7

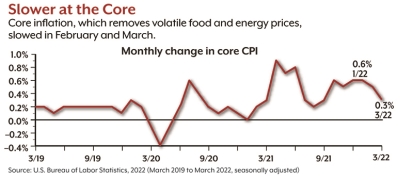

Core inflation, which strips out volatile food and energy prices, rose 6.5% year-over-year in March, the highest rate since 1982. However, it's important that our MASSMutual clients consider that the month-over-month increase from February to March was just 0.3%, the slowest pace in six months. Another positive sign was the price of used cars and trucks, which rose more than 35% over the last 12 months (a prime driver of general inflation) but dropped 3.8% in March.

8

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Wages and Consumer Demand

In March, average hourly earnings increased by 5.6% — but not enough to keep up with inflation and blunt the effects that impacted a variety of businesses, as well as many MASSMutual employees and retirees around the country. Lower-paid service workers received higher increases, with wages jumping by almost 15% for non-management employees in the leisure and hospitality industry. Although inflation has cut deeply into wage gains over the last year, wages have increased at about the same rate as inflation over the two-year period of the pandemic.

9

One of the big questions going forward is whether rising wages will enable consumers to continue to pay higher prices, which can lead to an inflationary spiral of ever-increasing wages and prices. Recent signals are mixed. The official measure of consumer spending increased 1.1% in March, but an early April poll found that two out of three Americans had cut back on spending due to inflation.

10-11

Soft or Hard Landing?

The current inflationary situation has raised many questions among our MASSMutual clients in regard to what the solution is. The Federal Open Market Committee (FOMC) of the Federal Reserve has laid out a plan to fight inflation by raising interest rates and tightening the money supply. After dropping the benchmark federal funds rate to near zero in order to stimulate the economy at the onset of the pandemic, the FOMC raised the rate by 0.25% at its March 2022 meeting and projected the equivalent of six more quarter-percent increases by the end of the year and three or four more in 2024.

12

This would bring the rate to around 2.75%, just above what the FOMC considers a 'neutral rate' that will neither stimulate nor restrain the economy.

13

These moves were projected to bring the Fed's preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, down to 4.3% by the end of 2022, 2.7% by the end of 2023, and 2.3% by the end of 2024.

14

PCE inflation — which was 6.6% in March — tends to run below CPI, so even if the Fed achieves these goals, CPI inflation will likely remain somewhat higher.

15

Fed policymakers have signaled a willingness to be more aggressive, if necessary, and the FOMC raised the fund's rate by 0.5% at its May meeting, as opposed to the more common 0.25% increase. This was the first half-percent increase since May 2000, and there may be more to come. The FOMC also began reducing the Fed's bond holdings to tighten the money supply. New projections to be released in June will provide an updated picture of the Fed's intentions for the federal funds rate.

16

The question facing the FOMC is how fast it can raise interest rates and tighten the money supply while maintaining optimal employment and economic growth. The ideal is a 'soft landing,' similar to what occurred in the 1990s, when inflation was tamed without damaging the economy. At the other extreme is the 'hard landing' of the early 1980s, when the Fed raised the fund's rate to almost 20% in order to control runaway double-digit inflation, throwing the economy into a recession. 18

Fed Chair Jerome Powell acknowledges that a soft landing will be difficult to achieve, but he believes the strong job market may help the economy withstand aggressive monetary policies. Supply chains are expected to improve over time, and workers who have not yet returned to the labor force might fill open jobs without increasing wage and price pressures. 19

The next few months will be a key period to reveal the future direction of inflation and monetary policy, and we recommend that MASSMutual employees and retirees keep this topic in mind. The hope is that March represented the peak and inflation will begin to trend downward. But even if that proves to be true, it could be a painfully slow descent.

We'd like to remind our clients from MASSMutual that projections are based on current conditions, are subject to change, and may not come to pass.

1, 5, 8-9) U.S. Bureau of Labor Statistics, 2022

2) Gallup, March 29, 2022

3, 7) The New York Times, April 12, 2022

4) CNBC, April 7, 2022

6) AAA, April 25 & 29, 2022

10, 15) U.S. Bureau of Economic Analysis, 2022

11) CBS News, April 11, 2022

12, 14, 16) Federal Reserve, 2022

13, 17) The Wall Street Journal, April 18, 2022

18) The New York Times, March 21, 2022

What is the primary purpose of the 401(k) plan offered by MASSMutual?

The primary purpose of the 401(k) plan offered by MASSMutual is to help employees save for retirement in a tax-advantaged way.

How can employees at MASSMutual enroll in the 401(k) plan?

Employees at MASSMutual can enroll in the 401(k) plan through the company’s benefits portal or by contacting the HR department for assistance.

What types of contributions can employees make to their MASSMutual 401(k) accounts?

Employees can make pre-tax contributions, Roth (after-tax) contributions, and possibly catch-up contributions if they are age 50 or older.

Does MASSMutual offer a company match for 401(k) contributions?

Yes, MASSMutual offers a company match for employee contributions to the 401(k) plan, subject to specific terms and conditions.

What is the vesting schedule for the company match at MASSMutual?

The vesting schedule for the company match at MASSMutual typically follows a graded vesting schedule, which means employees earn ownership of the match over a period of time.

Can employees at MASSMutual take loans against their 401(k) savings?

Yes, employees at MASSMutual may have the option to take loans against their 401(k) savings, subject to plan rules and limits.

What investment options are available in the MASSMutual 401(k) plan?

The MASSMutual 401(k) plan offers a variety of investment options, including mutual funds, target-date funds, and possibly company stock.

Are there any fees associated with the MASSMutual 401(k) plan?

Yes, there may be fees associated with the MASSMutual 401(k) plan, such as administrative fees and investment management fees, which are outlined in the plan documents.

How often can employees change their contribution amounts in the MASSMutual 401(k) plan?

Employees can typically change their contribution amounts to the MASSMutual 401(k) plan on a regular basis, often at any time during the year.

What resources does MASSMutual provide to help employees manage their 401(k) investments?

MASSMutual provides various resources, including online tools, educational materials, and access to financial advisors to help employees manage their 401(k) investments.

/General/General%203.png?width=1280&height=853&name=General%203.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)