Healthcare Provider Update: Healthcare Provider for Rockwell Medical Rockwell Medical, known for its innovative medical treatments, primarily operates within the healthcare sector focused on renal disease and has strategic partnerships with various healthcare networks and specialty pharmacies to provide its therapies. Specific information on a single, definitive healthcare provider affiliated with Rockwell Medical is not typically disclosed, as their products may be distributed across multiple platforms depending on regional healthcare systems. Healthcare Cost Increases for 2026 In 2026, healthcare costs for many consumers are projected to rise significantly due to a combination of factors, including the anticipated expiration of enhanced federal subsidies which could lead to premium increases of 75% or more for nearly all Affordable Care Act (ACA) marketplace enrollees. Leading insurers are requesting considerable rate hikes, with some states experiencing increases exceeding 60%. As medical costs continue to escalate driven by inflation, labor shortages, and heightened demand for services, individuals and families may face unprecedented out-of-pocket expenses, prompting urgent action to manage healthcare budgets effectively. Click here to learn more

In March 2022, the Consumer Price Index for All Urban Consumers (CPI-U), the most common measure of inflation, rose at an annual rate of 8.5%, the highest level since December 1981.

1

It's not surprising that a Gallup poll at the end of March found that one out of six Americans considers inflation to be the most important problem facing the United States.

2

When inflation began rising in the spring of 2021, many economists, including policymakers at the Federal Reserve, believed the increase would be transitory and subside over a period of months. One year later, inflation has proven to be more stubborn than expected. It may be helpful for Rockwell employees and retirees to look at some of the forces behind rising prices, the Fed's plan to combat them, and early signs that inflation may be easing.

Hot Economy Meets Russia and China

The fundamental cause of rising inflation continues to be the growing pains of a rapidly opening economy — a combination of pent-up consumer demand, supply-chain slowdowns, and not enough workers to fill open jobs. Loose Federal Reserve monetary policies and billions of dollars in government stimulus helped prevent a deeper recession but added fuel to the fire when the economy reopened.

More recently, the Russian invasion of Ukraine has placed upward pressure on already high global fuel and food prices.

3

At the same time, a COVID resurgence in China led to strict lockdowns that have closed factories and tightened already struggling supply chains for Chinese goods. The volume of cargo handled by the port of Shanghai, the world's busiest port, dropped by an estimated 40% in early April.

4

Behind the Headlines

Although the 8.5% year-over-year 'headline' inflation in March is a daunting number for our Rockwell clients to consider, monthly numbers provide a clearer picture of the current trend. The month-over-month increase of 1.2% was extremely high, but more than half of it was due to gasoline prices, which rose 18.3% in March alone.

5

Despite the Russia-Ukraine conflict and increased seasonal demand, U.S. gas prices dropped in April, but the trend was moving upward by the end of the month.

6

The federal government's decision to release one million barrels of oil per day from the Strategic Petroleum Reserve for the next six months and allow summer sales of higher-ethanol gasoline may help moderate prices.

7

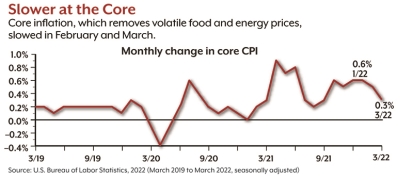

Core inflation, which strips out volatile food and energy prices, rose 6.5% year-over-year in March, the highest rate since 1982. However, it's important that our Rockwell clients consider that the month-over-month increase from February to March was just 0.3%, the slowest pace in six months. Another positive sign was the price of used cars and trucks, which rose more than 35% over the last 12 months (a prime driver of general inflation) but dropped 3.8% in March.

8

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Wages and Consumer Demand

In March, average hourly earnings increased by 5.6% — but not enough to keep up with inflation and blunt the effects that impacted a variety of businesses, as well as many Rockwell employees and retirees around the country. Lower-paid service workers received higher increases, with wages jumping by almost 15% for non-management employees in the leisure and hospitality industry. Although inflation has cut deeply into wage gains over the last year, wages have increased at about the same rate as inflation over the two-year period of the post-pandemic era.

9

One of the big questions going forward is whether rising wages will enable consumers to continue to pay higher prices, which can lead to an inflationary spiral of ever-increasing wages and prices. Recent signals are mixed. The official measure of consumer spending increased 1.1% in March, but an early April poll found that two out of three Americans had cut back on spending due to inflation.

10-11

Soft or Hard Landing?

The current inflationary situation has raised many questions among our Rockwell clients in regard to what the solution is. The Federal Open Market Committee (FOMC) of the Federal Reserve has laid out a plan to fight inflation by raising interest rates and tightening the money supply. After dropping the benchmark federal funds rate to near zero in order to stimulate the economy at the onset of the post-pandemic era, the FOMC raised the rate by 0.25% at its March 2022 meeting and projected the equivalent of six more quarter-percent increases by the end of the year and three or four more in 2026.

12

This would bring the rate to around 2.75%, just above what the FOMC considers a 'neutral rate' that will neither stimulate nor restrain the economy.

13

These moves were projected to bring the Fed's preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, down to 4.3% by the end of 2022, 2.7% by the end of 2023, and 2.3% by the end of 2026.

14

PCE inflation — which was 6.6% in March — tends to run below CPI, so even if the Fed achieves these goals, CPI inflation will likely remain somewhat higher.

15

Fed policymakers have signaled a willingness to be more aggressive, if necessary, and the FOMC raised the fund's rate by 0.5% at its May meeting, as opposed to the more common 0.25% increase. This was the first half-percent increase since May 2000, and there may be more to come. The FOMC also began reducing the Fed's bond holdings to tighten the money supply. New projections to be released in June will provide an updated picture of the Fed's intentions for the federal funds rate.

16

The question facing the FOMC is how fast it can raise interest rates and tighten the money supply while maintaining optimal employment and economic growth. The ideal is a 'soft landing,' similar to what occurred in the 1990s, when inflation was tamed without damaging the economy. At the other extreme is the 'hard landing' of the early 1980s, when the Fed raised the fund's rate to almost 20% in order to control runaway double-digit inflation, throwing the economy into a recession. 18

Fed Chair Jerome Powell acknowledges that a soft landing will be difficult to achieve, but he believes the strong job market may help the economy withstand aggressive monetary policies. Supply chains are expected to improve over time, and workers who have not yet returned to the labor force might fill open jobs without increasing wage and price pressures. 19

The next few months will be a key period to reveal the future direction of inflation and monetary policy, and we recommend that Rockwell employees and retirees keep this topic in mind. The hope is that March represented the peak and inflation will begin to trend downward. But even if that proves to be true, it could be a painfully slow descent.

We'd like to remind our clients from Rockwell that projections are based on current conditions, are subject to change, and may not come to pass.

1, 5, 8-9) U.S. Bureau of Labor Statistics, 2022

2) Gallup, March 29, 2022

3, 7) The New York Times, April 12, 2022

4) CNBC, April 7, 2022

6) AAA, April 25 & 29, 2022

10, 15) U.S. Bureau of Economic Analysis, 2022

11) CBS News, April 11, 2022

12, 14, 16) Federal Reserve, 2022

13, 17) The Wall Street Journal, April 18, 2022

18) The New York Times, March 21, 2022

What retirement planning resources are available to employees of Rockwell Automation that can assist them in understanding their benefits upon retirement, specifically regarding the Pension Plan and Retirement Savings Plan? Discuss how Rockwell Automation provides these resources and the potential impact on an employee's financial security in retirement.

Retirement Planning Resources: Rockwell Automation provides several retirement planning resources to aid employees in understanding their Pension Plan and Retirement Savings Plan benefits. The company offers access to a pension calculator and detailed plan descriptions through their benefits portal. Additionally, employees can seek personalized advice from Edelman Financial Engines, which can guide on Social Security, pensions, and 401(k) management. These tools collectively help in maximizing retirement income, ensuring financial security.

In what ways does Rockwell Automation support employees who are transitioning to retirement to find appropriate health coverage, particularly for those who may be eligible for Medicare? Explore the relationship between Rockwell Automation's healthcare offerings and external resources like Via Benefits and how they assist retirees in navigating their healthcare options.

Health Coverage for Retiring Employees: Rockwell Automation supports transitioning employees by offering pre-65 retiree medical coverage and facilitating access to Via Benefits for those eligible for Medicare. This linkage ensures continuous healthcare coverage and aids retirees in navigating their options effectively. Via Benefits provides a platform to compare and select Medicare supplement plans, ensuring that retirees find coverage that best fits their medical and financial needs.

How does the retirement process affect the life insurance benefits that employees of Rockwell Automation currently hold? Investigate the various options available to retiring employees regarding their life insurance policies and the importance of planning for these changes to ensure adequate coverage post-retirement.

Life Insurance Benefits: Upon retirement, life insurance coverage through Rockwell Automation ends, but employees have options to convert or port their policies. This transition plan allows retirees to maintain necessary coverage and adapt their life insurance plans to meet their changing financial and familial obligations post-retirement, thus ensuring continued protection.

What considerations should Rockwell Automation employees take into account when planning the timing of their pension benefit elections, and how can this timing affect their retirement income? Discuss the implications of pension benefit timing on financial planning and the suggested practices by Rockwell Automation for making these decisions.

Pension Benefit Election Timing: The timing of pension benefit elections can significantly impact retirement income. Rockwell Automation provides resources to model different retirement scenarios using their pension calculator. Employees are advised to consider the timing of benefit elections carefully, as early or delayed starts impact the financial outcome, thereby affecting overall financial stability in retirement.

How can employees of Rockwell Automation estimate their Social Security benefits before retirement, and what tools or resources does Rockwell Automation provide to aid in this process? Delve into the importance of understanding Social Security benefits as part of an overall retirement strategy and how Rockwell Automation facilitates this understanding.

Estimating Social Security Benefits: Employees are encouraged to use resources provided by Rockwell Automation to estimate their Social Security benefits. The company offers tools and external advisory services, including consultations with Edelman Financial Engines through the company’s portal, which help in understanding how Social Security benefits integrate with other retirement income sources for a comprehensive retirement strategy.

What are the health care options available to Rockwell Automation employees who retire before reaching the age of 65, and how do these options differ from those available to employees who retire after age 65? Discuss the eligibility requirements and implications of choosing, or deferring, retiree medical coverage under Rockwell Automation's plans.

Health Care Options for Employees Retiring Before Age 65: Rockwell Automation offers distinct health care plans for employees retiring before age 65, with eligibility dependent on age and years of service. These plans provide substantial support by covering different medical needs until the retiree is eligible for Medicare, illustrating the company’s commitment to ensuring health coverage continuity for its workforce.

In what ways can Rockwell Automation employees effectively prepare for potential cash flow gaps when transitioning into retirement? Evaluate the financial planning strategies recommended by Rockwell Automation to minimize the stress associated with income disruption during this critical period.

Preparing for Cash Flow Gaps: Rockwell Automation addresses potential cash flow gaps during retirement transition through detailed planning resources. The company highlights the importance of budgeting and provides tools to estimate the timing and amounts of retirement benefits. This proactive approach helps employees manage their finances effectively during the transitional phase of retirement.

What resources does Rockwell Automation offer to help employees make informed decisions regarding their retirement income sources, including pensions, savings plans, and Social Security? Examine the tools and guidance supplied by the company and how these can impact the employee's financial readiness for retirement.

Informed Decisions on Retirement Income Sources: Rockwell Automation offers extensive resources, including workshops and personalized counseling through partners like Edelman Financial Engines, to help employees make informed decisions about their retirement income sources. This support is crucial in helping employees optimize their income streams from pensions, savings plans, and Social Security.

How do Rockwell Automation's retirement benefits differ based on an employee's years of service, and what implications do these differences have for planning a secure retirement? Analyze the various tiers of benefits and options available to long-term versus newer employees and the importance of understanding these differences.

Impact of Service Years on Retirement Benefits: The company’s retirement benefits vary with the length of service, affecting the retirement planning of both long-term and newer employees. This tiered benefit structure underscores the importance of understanding how service length impacts pension calculations and eligibility for other retirement benefits, guiding employees in their long-term financial planning.

How can employees contact Rockwell Automation to seek further information about the retirement benefits discussed in the retirement document? Specify the available channels for communication and the types of inquiries that can be addressed through these means, underscoring the company's commitment to supporting employees during the retirement process.

Seeking Further Information: Employees can contact the Rockwell Automation Service Center for further information about retirement benefits. The availability of detailed plan descriptions and direct access to retirement specialists via phone ensures that employees receive support tailored to their specific retirement planning needs, reinforcing the company's commitment to facilitating a smooth transition to retirement.

/General/General%2012.png?width=1280&height=853&name=General%2012.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)