Table of Contents

Selling During a Decline is a Risky Proposition

A Balanced Portfolio's Risk of Negative Long-term Returns Has Historically Been Relatively Low

Unpredictability Produces Opportunity

Market Volatility Can Help You Rebalance Your Portfolio

Financial markets frequently experience periods of relative calm followed by sharp and often surprising increases in volatility. It is critical for investors to recognize that market volatility is typical and beyond our control. We may, however, choose how we react.

Generally, the best reaction is no reaction at all. Pulling out of the market when it is volatile can lock in losses and could lead to missing out on any subsequent rally. Here are six good reasons why staying invested for the long term is almost always the best way to navigate market turmoil:

It's Tough to Predict Market Movements

Ask the most experienced investors, and many will tell you that drastic allocation shifts in an effort to time the ups and downs of the market are immensely challenging.

As much as any investor would like to avoid market downturns and take advantage of rallies, to do so means getting out at the right time and knowing exactly when to get back in. Without a crystal ball, those are difficult calls to make with potentially adverse effects on your portfolio. Since no market cycle is the same, it isn't easy to anticipate market movements. All sorts of factors—politics, monetary policy, business activities (such as corporate mergers), and sudden international shocks (such as the global pandemic in 2020, the oil-price shock in the 1970s, and the tech bubble in the early 2000s)—can spark a market reaction.

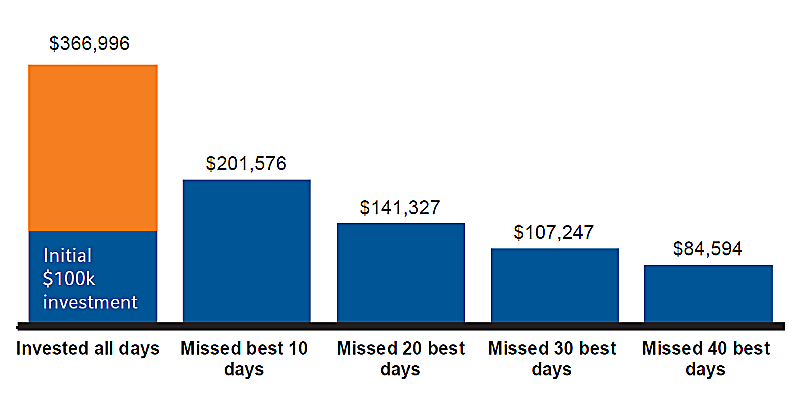

If your timing isn't perfectly accurate, you could miss out on potential rallies, which are virtually impossible to predict. The chart below shows that missing even a few days of positive market activity can impact your portfolio.

Featured Video

Articles you may find interesting:

- 8 Tenets of Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Section 303 Stock Redemption Buy-Sell Agreement

- Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

- 2022 High Net Worth Tax Planning

- Policy Roadmap

- Section 179 Deductions

- Learn About the Path to Retirement

- Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Advice for Retirees Trying to Survive a Bear Market

- 5 Most Important Things to do Before Leaving Your Company

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- 8 Tenets of Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Section 303 Stock Redemption Buy-Sell Agreement

- Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

- 2022 High Net Worth Tax Planning

- Policy Roadmap

- Section 179 Deductions

- Learn About the Path to Retirement

- Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Advice for Retirees Trying to Survive a Bear Market

- 5 Most Important Things to do Before Leaving Your Company

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Selling During a Decline is a Risky Proposition

History suggests that periods of sharp declines have often been followed by periods of some of the most favorable returns. Figure 1 shows the strong returns of U.S. markets during the 12- and 24-month periods following some of the sharpest declines of the past 40+ years. The strong historical tendency of markets to rebound provides some evidence that fear-induced dramatic alterations to asset allocation are unnecessary for investors who simply stay the course.

A Balanced Portfolio's Risk of Negative Long-term Returns Has Historically Been Relatively Low

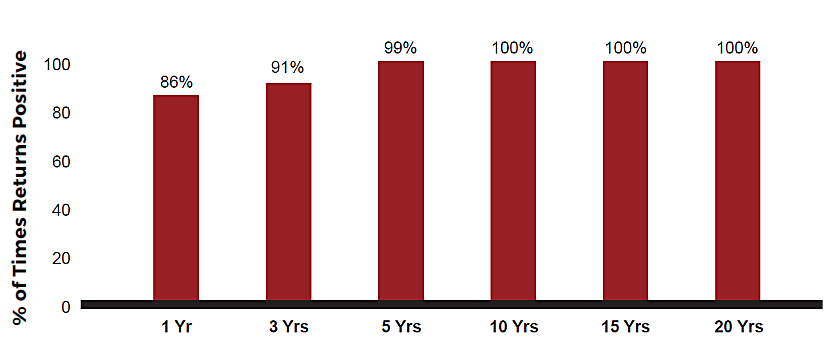

Stocks have historically outperformed bonds when based on average rolling returns over one, three, five, 10, and 20 years. Just as compelling is the traditional ability of a balanced portfolio to produce positive returns. Figure 2 shows that a global balanced portfolio of stocks and bonds has not produced a negative return over any five-year rolling period since 1980. The bottom line is that, although there are no guarantees that the future will resemble the past, history tends to favor long-term investors.

Figure 2: A highly diversified portfolio has performed well over time

% Of time diversified 60/40 mix produced positive returns (Based on rolling returns, January 1980 - December 2020)

Unpredictability Produces Opportunity

While economic uncertainty will always be a cause for investor anxiety, the resulting market volatility has historically offered active managers in equities and bonds the potential to better position portfolios for the longer term. Markets sometimes get over-exuberant and prices become excessive, but the opposite is also true. Short-term periods of crisis can push prices artificially low, creating excellent opportunities to buy. Russell Investments portfolio managers as well as the independent sub-advisors we hire, can take advantage of temporary mispricing in the market. By doing so, it’s possible to plant the seeds of potential long-term profits during periods of uncertainty.

Market Volatility Can Help You Rebalance Your Portfolio

If a crisis creates an opportunity, then portfolio rebalancing is perhaps the best way to take advantage of that opportunity. When comparing assets within a portfolio, rebalancing means selling assets that have gained in value and buying assets that have fallen in value in order to maintain the overall strategic asset allocation of a diversified portfolio. During a market correction, this should result in buying more assets that have decreased in value—an essential part of the process of buying low and selling high.

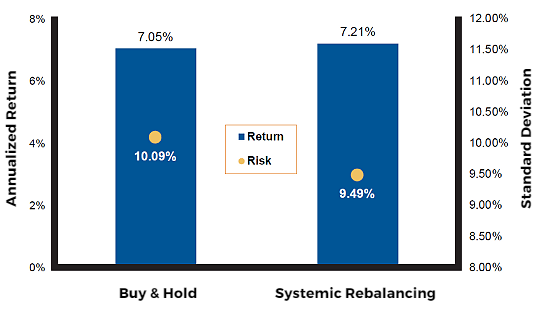

As Figure 3 highlights, an asset allocation that is systematically rebalanced has produced a modest return advantage, but more importantly, has managed risk over time. Systematic portfolio rebalancing is a crucial aspect of Russell Investments’ portfolio approach. In essence, it provides investors with increased exposure to opportunities that are likely to pay off in the long run.

Figure 3: Rebalancing Vs. Buy & Hold

Potential benefits of hypothetical rebalancing comparison of $500,000

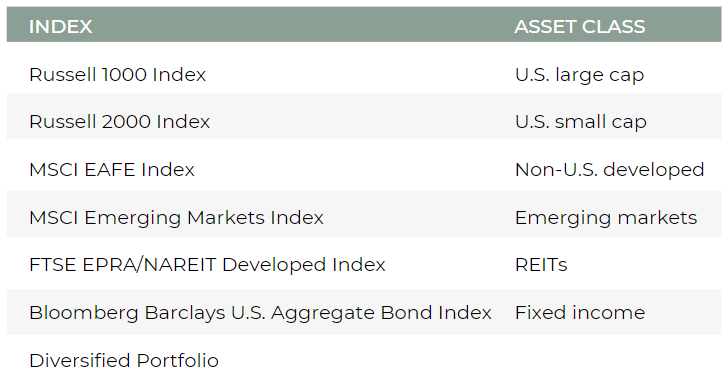

For illustrative purposes only. Not meant to represent any actual investment. Standard deviation is a statistical measure of the degree to which an individual value in a probability distribution tends to vary from the mean of the distribution. The greater the degree of dispersion, the greater the risk. Based on March 2005–December 2020. Source Portfolio: Diversified portfolio consists of 30% U.S. large cap, 5% U.S. small cap, 15% non-U.S. developed, 5% emerging markets, 5% REITs, and 40% fixed income. Returns are based on the following indices: U.S. large cap = Russell 1000 Index; U.S. small cap = Russell 2000 Index; non-U.S. developed = MSCI EAFE Index; emerging markets = MSCI Emerging Markets Index; REITS = FTSE EPRA/NAREIT Developed Index; and fixed income = Bloomberg Barclays U.S. Aggregate Bond Index. Start date corresponds to index start dates (January 1988 is the inception of the MSCI Emerging Markets Index).

When Markets Are Volatile, Diversification is Most Beneficial

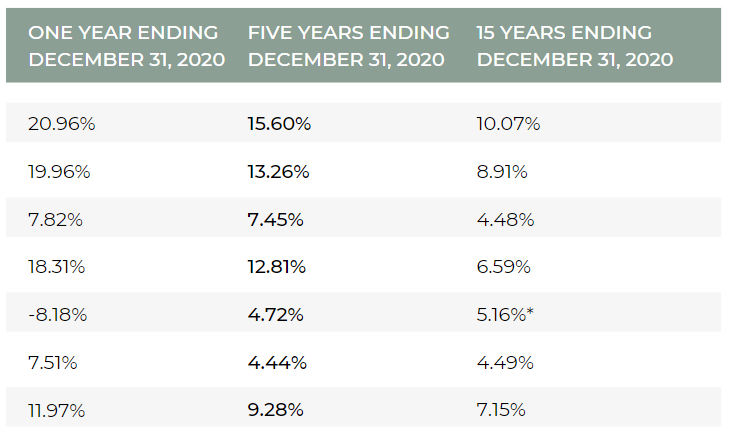

Over time, financial markets deal with numerous crises. To name a few over the last two decades, there was the technology bubble, a credit bubble, the U.S. subprime debt crisis, the sovereign debt crisis in the Eurozone, and the economic impact of the restrictive measures governments around the world have taken in early 2020, attempting to contain the spread of the novel coronavirus COVID-19. One reason to hold a multi-asset portfolio is in part to spread the risk budget across multiple asset classes in order to mitigate market volatility. Having a robust strategic asset allocation with regular rebalancing can potentially enhance returns, but more importantly, manage volatility. However, from a multi-asset investors’ perspective, longer-term returns have been reasonable. For example, the hypothetical globally diversified asset allocation in Table 1 shows solid returns over the long term.

Table 1: Benefits of Diversification – Annualized Returns

Note: Diversified portfolio consists of 30% U.S. large-cap, 5% U.S. small cap, 15% non-U.S. developed, 5% emerging markets, 5% REITs, and 40% fixed income. *The 15-year return of this index is a blended return using FTSE NAREIT Equity REITs TR USD Index through 2/17/2005 and FTSE EPRA/NAREIT Developed Index starting on 2/18/2005. Based on the respective rolling periods. Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results.

What's the Next Step?

The emergence of the COVID-19 virus in early 2020 is a stark reminder of how quickly trends can shift. Global equity indexes had risen in a relatively steady path for more than 10 years until mid-February. Then, as governments began to shut down international trade, commerce and many industrial sectors in an attempt to contain the spread of the virus, markets retreated sharply. Many key indexes fell to levels not seen since the Global Financial Crisis in 2008. Despite fiscal and monetary stimulus plans to keep economies afloat, markets are likely to remain volatile until the containment measures begin to be lifted. The extreme swings in financial markets like in 2020 may make it hard to stay invested as we watch our portfolios gyrate. But as we have shown, volatility is a normal part of investing, market downturns are eventually followed by market rallies, and history has demonstrated that patient investors have been rewarded over the long term.

- Avoid the temptation to overreact to market movements.

-

Reduce risk through proper geographic and asset class diversification

. - Consider multi-asset investing for a more holistic approach geared towards return enhancement but with a natural focus on downside risks.

About The Retirement Group

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

Sources

-

Morningstar. In USD. Returns based on S&P 500 Index, for the 10-year period ending December 31, 2020. For illustrative purposes only. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested directly.

-

BNY Mellon, Russell Investments.

-

Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results.

-

eVestment Alliance, Russell Investments. Note: Diversified portfolio consists of 47% S&P 500 Index, 13% MSCI EAFE Index, and 40% Bloomberg Barclays U.S. Aggregate Bond Index. Based on the respective rolling period. Indexes are unmanaged and cannot be invested in directly. Past performance is not indicative of future results.

Other Articles of Interest

Articles Relevant to Target Employees

-

-

8 Tenets of Choosing a Mutual Fund -

Use of Escrow Accounts: Divorce -

Section 303 Stock Redemption Buy-Sell Agreement -

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

Medicare Open Enrollment Is Here: How Are Costs Changing for 2023? -

2022 High Net Worth Tax Planning -

Policy Roadmap -

Section 179 Deductions -

Learn About the Path to Retirement -

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company -

How Are Workers Impacted by Inflation & Rising Interest Rates? -

Lump-Sum vs Annuity and Rising Interest Rates -

Advice for Retirees Trying to Survive a Bear Market -

5 Most Important Things to do Before Leaving Your Company -

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

-

8 Tenets of Choosing a Mutual Fund -

Use of Escrow Accounts: Divorce -

Section 303 Stock Redemption Buy-Sell Agreement -

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

Medicare Open Enrollment Is Here: How Are Costs Changing for 2023? -

2022 High Net Worth Tax Planning -

Policy Roadmap -

Section 179 Deductions -

Learn About the Path to Retirement -

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company -

How Are Workers Impacted by Inflation & Rising Interest Rates? -

Lump-Sum vs Annuity and Rising Interest Rates -

Advice for Retirees Trying to Survive a Bear Market -

5 Most Important Things to do Before Leaving Your Company -

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

For more information you can reach the plan administrator for Target at 10 South Dearborn Street 48th Floor Chicago, IL 60603; or by calling them at 1-800-440-0680.

Company:

Target*

Plan Administrator:

10 South Dearborn Street 48th Floor

Chicago, IL

60603

1-800-440-0680

*Please see disclaimer for more information

Featured Articles

Articles Relevant to Target Employees

-

-

8 Tenets of Choosing a Mutual Fund

8 Tenets of Choosing a Mutual Fund

-

Use of Escrow Accounts: Divorce

Use of Escrow Accounts: Divorce

-

Section 303 Stock Redemption Buy-Sell Agreement

-

-2.png) Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

-

2022 High Net Worth Tax Planning

2022 High Net Worth Tax Planning

-

Policy Roadmap

Policy Roadmap

-

Section 179 Deductions

Section 179 Deductions

-

Learn About the Path to Retirement

Learn About the Path to Retirement

-

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

-

How Are Workers Impacted by Inflation & Rising Interest Rates?

How Are Workers Impacted by Inflation & Rising Interest Rates?

-

Lump-Sum vs Annuity and Rising Interest Rates

Lump-Sum vs Annuity and Rising Interest Rates

-

Advice for Retirees Trying to Survive a Bear Market

Advice for Retirees Trying to Survive a Bear Market

-

5 Most Important Things to do Before Leaving Your Company

5 Most Important Things to do Before Leaving Your Company

-

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

-

8 Tenets of Choosing a Mutual Fund

8 Tenets of Choosing a Mutual Fund

-

Use of Escrow Accounts: Divorce

Use of Escrow Accounts: Divorce

-

Section 303 Stock Redemption Buy-Sell Agreement

-

-2.png) Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

Medicare Open Enrollment Is Here: How Are Costs Changing for 2023?

-

2022 High Net Worth Tax Planning

2022 High Net Worth Tax Planning

-

Policy Roadmap

Policy Roadmap

-

Section 179 Deductions

Section 179 Deductions

-

Learn About the Path to Retirement

Learn About the Path to Retirement

-

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

Contemplating Change: 7 Key Factors When Considering a Transition from Your Company

-

How Are Workers Impacted by Inflation & Rising Interest Rates?

How Are Workers Impacted by Inflation & Rising Interest Rates?

-

Lump-Sum vs Annuity and Rising Interest Rates

Lump-Sum vs Annuity and Rising Interest Rates

-

Advice for Retirees Trying to Survive a Bear Market

Advice for Retirees Trying to Survive a Bear Market

-

5 Most Important Things to do Before Leaving Your Company

5 Most Important Things to do Before Leaving Your Company

-

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

Target Business Information

- Revenue: 106005

- Profit: 6946

- Number of Employees: 450000

- Sector: Retailing

- CEO: Brian C. Cornell

- Stock Ticker: TGT

- Market Cap: 71112

- Year Founded: 1902

Target Contact Information

- 7000 TARGET PARKWAY, BROOKLYN PARK, MN, 55445

- (612) 307-5037

- www.target.com

Target Slogan

Expect More. Pay Less.

Target Description

Target Corporation is an American retail corporation

/General/General%202.png?width=1280&height=853&name=General%202.png)