As a Lubrizol employee or retiree, you may have recently seen some headlines talking about an 'inverted yield curve' and what it may mean for the economy. An inverted yield curve is just one indicator of the economy's possible direction, and putting these headlines into context is valuable to those affiliated with Lubrizol.

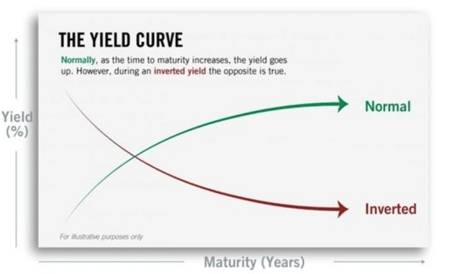

First, what is the yield curve, and what does it show? The yield curve is a graphical representation of interest rates (yields) paid out by US Treasury bonds. A normal yield curve shows increasingly higher yields for longer-dated bonds, creating an upward swing. An inverted curve has a downward slope, indicating that shorter-dated bonds yield more than longer-dated bonds, which isn't typical. As a Lubrizol employee, being able to distinguish between these yield curves is important as it will allow better comprehension of interest rates paid out by U.S Treasury bonds.

Does an inverted yield curve mean we’re headed for a recession? Based on the historical track record of this indicator, yes, an inverted yield suggests a recession may be coming. As a Lubrizol employee, it might be advantageous to do some financial planning to be fully prepared for unexpected events. Since 1976, a recession has followed an inverted curve every time. However, there are some important caveats that you, as a Lubrizol employee, might benefit from reading here:

An inverted yield curve needs to remain inverted to be considered an indicator. It’s normal for markets to fluctuate as conditions and investor sentiment ebb and flow. But, according to the experts, for an inverted curve to be a recession indicator it needs to stay inverted for a month or more, historically. As a Lubrizol employee, it is imperative to keep track of indicators and their trends as to be better versed in current market situations.

As a Lubrizol employee it is also worthy to consider how recessions aren’t instantaneous. An inverted yield curve doesn’t mean a recession is just around the corner. Since 1976, the average time between an inverted yield curve and an official recession has been around 18 months; the longest was nearly three years. That’s plenty of time to prepare for what's to come, especially for those living in Texas!

As a Lubrizol employee, It’s also worthy to note how an inverted yield curve doesn’t cause a recession. The yield curve reflects bond market sentiment – it doesn’t drive it. The yield curve inverts when bond market investors feel like something may be up and, in response, favor shorter-term bonds over longer-term ones. For a Lubrizol employee, keeping track of bond market sentiment and the yield curve's response to changes in market is beneficial as it promotes better understanding of future market movements.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

It’s a deceptive signal for your portfolio. An inverted yield curve doesn’t mean it’s time to sell! Historically, the market continues to advance following an inverted yield curve, gaining an average of 11.5% real return (net of inflation) since 1976. As a Lubrizol employee, it is important to not let one indicator spook you!

The takeaway here is that while an inverted yield curve may be unnerving, it’s by no means cause to panic. For fortune 500 employees, it’s an opportunity to assess your specific situation. Our team of retirement-focused advisors are closely monitoring the economic conditions and will proactively alert you should we feel action needs to be taken. In the meantime, feel free to call us if you have any questions or concerns.

What are the considerations Lubrizol employees should take into account when deciding between a monthly annuity payment and a one-time lump sum payment from the BHCPP Plan? How does each option affect their overall retirement strategy, particularly regarding tax implications and cash flow management?

Monthly Annuity vs. Lump Sum Payment: Lubrizol employees choosing between a monthly annuity and a lump sum payment should consider their personal financial needs, tax situation, and cash flow. The lump sum payment offers a one-time cash amount that can be invested or used immediately but could be subject to higher taxes if not rolled over properly. On the other hand, an annuity provides steady income for life, which may be beneficial for long-term cash flow management. Consulting a financial advisor is crucial to determine the best option based on individual circumstances(Lubrizol_11_1_2022_Lump…).

In what ways do early retirement age milestones affect the value of retirement benefits for Lubrizol employees? Specifically, how do the age thresholds of 55 and 62 impact the reduction of benefits, and what strategies can employees employ to maximize their benefits around these key ages?

Early Retirement Age Milestones: Retirement age milestones, particularly 55 and 62, play a significant role in determining benefit values. At age 55, employees with 10 years of service receive a partially subsidized early retirement benefit, reducing the financial penalty for early retirement. At age 62, employees qualify for a full early retirement subsidy, which significantly boosts benefit value. Employees should consider these age thresholds when planning their retirement strategy(Lubrizol_11_1_2022_Lump…).

How does the current interest rate environment influence the lump sum value offered to retiring Lubrizol employees? Can you elaborate on how employees can use the pension modeler to forecast the potential financial outcomes of their lump sum offer in relation to interest rate changes?

Interest Rates and Lump Sum Value: The lump sum value for Lubrizol retirees is heavily influenced by the Federal interest rates. As interest rates rise, lump sum payments decrease, and vice versa. Employees can use the pension modeler provided by Lubrizol to forecast how interest rate changes will affect their lump sum payment. This tool allows employees to simulate different scenarios based on their planned retirement dates and interest rate assumptions(Lubrizol_11_1_2022_Lump…).

What resources and tools does Lubrizol provide to help employees understand the implications of their retirement benefits? Additionally, how can employees utilize Empower's financial planning team to align their retirement savings and pension benefits with their long-term financial goals?

Resources for Retirement Planning: Lubrizol provides several resources to help employees understand their retirement benefits. These include the pension modeler, which simulates retirement scenarios, and access to Empower’s financial planning team. Employees can use these tools to align their retirement savings and pension benefits with long-term goals and gain a clearer picture of what retirement may look like(Lubrizol_11_1_2022_Lump…).

In the context of the BHCPP Plan, what are the steps Lubrizol employees should follow to ensure they receive the correct retirement kit and benefit calculation based on the upcoming interest rates? What are the key deadlines and documentation required for making an informed decision?

Steps for Accurate Retirement Kit and Benefit Calculation: To receive the correct retirement kit and benefit calculation, Lubrizol employees need to request a retirement kit from the BHCPP Pension Service Center before key deadlines. For example, those targeting a benefit commencement date of December 1, 2022, must request a kit by November 1, 2022. Using the pension modeler can also help employees estimate their lump sum based on upcoming interest rates(Lubrizol_11_1_2022_Lump…).

How do Lubrizol's retirement benefits integrate with Social Security and other personal savings an employee may have? What should employees consider when evaluating their total retirement package, and how can they effectively project their income in retirement?

Integration with Social Security and Other Savings: Lubrizol’s retirement benefits should be considered alongside Social Security and personal savings. Employees can model their total retirement income using Empower's tools, which include data from their pension and 401(k). It's essential for employees to project their income from all sources to ensure financial stability in retirement(Lubrizol_11_1_2022_Lump…).

How does the pension modeler work for Lubrizol employees, and what unique features does it offer to help in planning their retirement? Can you discuss specific scenarios that employees might model, such as varying retirement dates or different financial assumptions?

Pension Modeler for Retirement Planning: The pension modeler available to Lubrizol employees is a powerful tool that allows them to simulate different retirement scenarios, including varying retirement ages and financial assumptions. Employees can model up to three scenarios simultaneously, enabling them to make informed decisions about the timing of their retirement and the potential financial outcomes(Lubrizol_11_1_2022_Lump…).

What information should Lubrizol employees gather prior to consulting with personal financial planners or the Lubrizol-sponsored CFPs? How can being well-prepared enhance the quality of advice and strategies received during such consultations?

Preparation for Financial Planner Consultations: Prior to consulting with financial planners, Lubrizol employees should gather comprehensive details about their personal financial situation, including monthly income, savings, expenses, and retirement goals. Being well-prepared will enhance the quality of advice they receive and enable more effective retirement planning(Lubrizol_11_1_2022_Lump…).

Can you explain the impact of Federal interest rates on the calculation of lump sum payments for Lubrizol retirees? How frequently are these rates updated, and where can employees find the most recent data relevant to their retirement planning?

Impact of Federal Interest Rates on Lump Sum Payments: Federal interest rates, updated annually in October, significantly affect the calculation of lump sum payments for Lubrizol retirees. These rates are used to discount future annuity payments to present value. Employees can find the latest interest rate data on the IRS website or through Lubrizol’s pension modeler(Lubrizol_11_1_2022_Lump…)(Lubrizol_11_1_2022_Lump…).

How can Lubrizol employees contact the BHCPP Pension Service Center for further assistance regarding their retirement benefits? What specific information should they have on hand to facilitate a productive conversation about their retirement options? These questions are designed to provide depth and complexity, encouraging detailed exploration and resources related to the retirement process for Lubrizol employees.

Contacting the BHCPP Pension Service Center: Lubrizol employees can contact the BHCPP Pension Service Center at 877-459-2403 for assistance with retirement benefits. To have a productive conversation, employees should have their retirement kit request details, planned retirement dates, and personal financial information readily available(Lubrizol_11_1_2022_Lump…)(Lubrizol_11_1_2022_Lump…).

/General/General%202.png?width=1280&height=853&name=General%202.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)