Healthcare Provider Update: Healthcare Provider for Rite Aid Rite Aid employees typically have access to healthcare plans through various insurers, but specific carriers may vary based on the location and plan offerings. Major insurers such as UnitedHealthcare, Aetna, and others often provide coverage options for Rite Aid employees, making it advisable for them to review the available plans and select one that best fits their healthcare needs. Potential Healthcare Cost Increases in 2026 As we head into 2026, Rite Aid employees may face significant increases in healthcare costs due to projected sharp hikes in health insurance premiums. Without the renewal of enhanced federal subsidies, many enrollees in the ACA marketplace could see their out-of-pocket costs rise by over 75%, particularly as some states report premium increases exceeding 60%. Amid rising medical costs driven by factors such as high prices for medications and ongoing pressure from insurers to adjust benefit structures, employees will need to carefully assess their coverage options to mitigate the financial impact and ensure continued access to necessary healthcare. Click here to learn more

As a Rite Aid employee or retiree, you may have recently seen some headlines talking about an 'inverted yield curve' and what it may mean for the economy. An inverted yield curve is just one indicator of the economy's possible direction, and putting these headlines into context is valuable to those affiliated with Rite Aid.

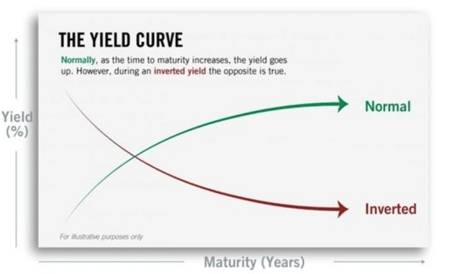

First, what is the yield curve, and what does it show? The yield curve is a graphical representation of interest rates (yields) paid out by US Treasury bonds. A normal yield curve shows increasingly higher yields for longer-dated bonds, creating an upward swing. An inverted curve has a downward slope, indicating that shorter-dated bonds yield more than longer-dated bonds, which isn't typical. As a Rite Aid employee, being able to distinguish between these yield curves is important as it will allow better comprehension of interest rates paid out by U.S Treasury bonds.

Does an inverted yield curve mean we’re headed for a recession? Based on the historical track record of this indicator, yes, an inverted yield suggests a recession may be coming. As a Rite Aid employee, it might be advantageous to do some financial planning to be fully prepared for unexpected events. Since 1976, a recession has followed an inverted curve every time. However, there are some important caveats that you, as a Rite Aid employee, might benefit from reading here:

An inverted yield curve needs to remain inverted to be considered an indicator. It’s normal for markets to fluctuate as conditions and investor sentiment ebb and flow. But, according to the experts, for an inverted curve to be a recession indicator it needs to stay inverted for a month or more, historically. As a Rite Aid employee, it is imperative to keep track of indicators and their trends as to be better versed in current market situations.

As a Rite Aid employee it is also worthy to consider how recessions aren’t instantaneous. An inverted yield curve doesn’t mean a recession is just around the corner. Since 1976, the average time between an inverted yield curve and an official recession has been around 18 months; the longest was nearly three years. That’s plenty of time to prepare for what's to come, especially for those living in Texas!

As a Rite Aid employee, It’s also worthy to note how an inverted yield curve doesn’t cause a recession. The yield curve reflects bond market sentiment – it doesn’t drive it. The yield curve inverts when bond market investors feel like something may be up and, in response, favor shorter-term bonds over longer-term ones. For a Rite Aid employee, keeping track of bond market sentiment and the yield curve's response to changes in market is beneficial as it promotes better understanding of future market movements.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

It’s a deceptive signal for your portfolio. An inverted yield curve doesn’t mean it’s time to sell! Historically, the market continues to advance following an inverted yield curve, gaining an average of 11.5% real return (net of inflation) since 1976. As a Rite Aid employee, it is important to not let one indicator spook you!

The takeaway here is that while an inverted yield curve may be unnerving, it’s by no means cause to panic. For fortune 500 employees, it’s an opportunity to assess your specific situation. Our team of retirement-focused advisors are closely monitoring the economic conditions and will proactively alert you should we feel action needs to be taken. In the meantime, feel free to call us if you have any questions or concerns.

What is the purpose of Rite Aid's 401(k) Savings Plan?

The purpose of Rite Aid's 401(k) Savings Plan is to help employees save for retirement by allowing them to contribute a portion of their salary on a pre-tax basis.

How can Rite Aid employees enroll in the 401(k) Savings Plan?

Rite Aid employees can enroll in the 401(k) Savings Plan by accessing the company’s benefits portal or contacting the HR department for guidance on the enrollment process.

Does Rite Aid offer a company match for contributions to the 401(k) Savings Plan?

Yes, Rite Aid offers a company match for contributions to the 401(k) Savings Plan, helping employees maximize their retirement savings.

What types of investment options are available in Rite Aid's 401(k) Savings Plan?

Rite Aid's 401(k) Savings Plan typically offers a variety of investment options, including mutual funds, target-date funds, and other investment vehicles to suit different risk tolerances.

At what age can Rite Aid employees start withdrawing from their 401(k) Savings Plan without penalties?

Rite Aid employees can start withdrawing from their 401(k) Savings Plan without penalties at age 59½, provided they meet other plan requirements.

Can Rite Aid employees take loans against their 401(k) Savings Plan?

Yes, Rite Aid employees may have the option to take loans against their 401(k) Savings Plan, subject to the plan's specific terms and conditions.

How often can Rite Aid employees change their contribution percentage to the 401(k) Savings Plan?

Rite Aid employees can typically change their contribution percentage to the 401(k) Savings Plan at any time, but there may be specific enrollment periods or guidelines to follow.

What happens to Rite Aid employees' 401(k) Savings Plan if they leave the company?

If Rite Aid employees leave the company, they have several options for their 401(k) Savings Plan, including rolling it over to an IRA or another employer's plan, or cashing it out (which may incur taxes and penalties).

Is there a vesting schedule for Rite Aid's 401(k) Savings Plan?

Yes, Rite Aid's 401(k) Savings Plan may have a vesting schedule for employer contributions, meaning employees must work for the company for a certain period before they fully own those contributions.

How can Rite Aid employees access their 401(k) Savings Plan account information?

Rite Aid employees can access their 401(k) Savings Plan account information through the company's benefits portal or by contacting the plan administrator.

/General/General%201.png?width=1280&height=853&name=General%201.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)