Healthcare Provider Update: Offers medical, dental, vision, life, and disability insurance, along with a 401(k) retirement plan and paid time off 1. Employees also have access to FSAs and wellness programs. As ACA premiums are projected to rise sharply in 2026with some states seeing increases over 60%Schnitzer Steel is expected to adjust its benefit structures. This may include higher deductibles, coinsurance, or out-of-pocket maximums, making it essential for employees to review their options and optimize HSA/FSA contributions to offset rising costs Click here to learn more

As a Schnitzer Steel Industries employee or retiree, you may have recently seen some headlines talking about an 'inverted yield curve' and what it may mean for the economy. An inverted yield curve is just one indicator of the economy's possible direction, and putting these headlines into context is valuable to those affiliated with Schnitzer Steel Industries.

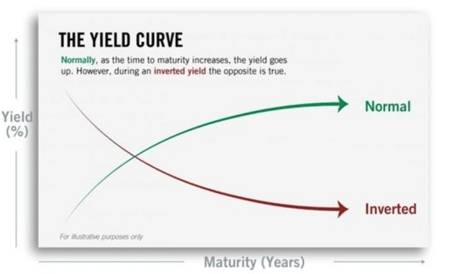

First, what is the yield curve, and what does it show? The yield curve is a graphical representation of interest rates (yields) paid out by US Treasury bonds. A normal yield curve shows increasingly higher yields for longer-dated bonds, creating an upward swing. An inverted curve has a downward slope, indicating that shorter-dated bonds yield more than longer-dated bonds, which isn't typical. As a Schnitzer Steel Industries employee, being able to distinguish between these yield curves is important as it will allow better comprehension of interest rates paid out by U.S Treasury bonds.

Does an inverted yield curve mean we’re headed for a recession? Based on the historical track record of this indicator, yes, an inverted yield suggests a recession may be coming. As a Schnitzer Steel Industries employee, it might be advantageous to do some financial planning to be fully prepared for unexpected events. Since 1976, a recession has followed an inverted curve every time. However, there are some important caveats that you, as a Schnitzer Steel Industries employee, might benefit from reading here:

An inverted yield curve needs to remain inverted to be considered an indicator. It’s normal for markets to fluctuate as conditions and investor sentiment ebb and flow. But, according to the experts, for an inverted curve to be a recession indicator it needs to stay inverted for a month or more, historically. As a Schnitzer Steel Industries employee, it is imperative to keep track of indicators and their trends as to be better versed in current market situations.

As a Schnitzer Steel Industries employee it is also worthy to consider how recessions aren’t instantaneous. An inverted yield curve doesn’t mean a recession is just around the corner. Since 1976, the average time between an inverted yield curve and an official recession has been around 18 months; the longest was nearly three years. That’s plenty of time to prepare for what's to come, especially for those living in Texas!

As a Schnitzer Steel Industries employee, It’s also worthy to note how an inverted yield curve doesn’t cause a recession. The yield curve reflects bond market sentiment – it doesn’t drive it. The yield curve inverts when bond market investors feel like something may be up and, in response, favor shorter-term bonds over longer-term ones. For a Schnitzer Steel Industries employee, keeping track of bond market sentiment and the yield curve's response to changes in market is beneficial as it promotes better understanding of future market movements.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

It’s a deceptive signal for your portfolio. An inverted yield curve doesn’t mean it’s time to sell! Historically, the market continues to advance following an inverted yield curve, gaining an average of 11.5% real return (net of inflation) since 1976. As a Schnitzer Steel Industries employee, it is important to not let one indicator spook you!

The takeaway here is that while an inverted yield curve may be unnerving, it’s by no means cause to panic. For fortune 500 employees, it’s an opportunity to assess your specific situation. Our team of retirement-focused advisors are closely monitoring the economic conditions and will proactively alert you should we feel action needs to be taken. In the meantime, feel free to call us if you have any questions or concerns.

What type of retirement savings plan does Schnitzer Steel Industries offer to its employees?

Schnitzer Steel Industries offers a 401(k) retirement savings plan to its employees.

How can employees of Schnitzer Steel Industries enroll in the 401(k) plan?

Employees of Schnitzer Steel Industries can enroll in the 401(k) plan by completing the online enrollment process through the company’s benefits portal.

Does Schnitzer Steel Industries match employee contributions to the 401(k) plan?

Yes, Schnitzer Steel Industries offers a matching contribution to the 401(k) plan, which helps employees boost their retirement savings.

What is the maximum employee contribution percentage allowed in the Schnitzer Steel Industries 401(k) plan?

The maximum employee contribution percentage for the Schnitzer Steel Industries 401(k) plan is in line with IRS regulations, which can change annually.

When can employees of Schnitzer Steel Industries start contributing to the 401(k) plan?

Employees of Schnitzer Steel Industries can start contributing to the 401(k) plan after completing their eligibility period as defined in the plan documents.

Are there loan options available for Schnitzer Steel Industries employees through the 401(k) plan?

Yes, Schnitzer Steel Industries allows employees to take loans against their 401(k) savings, subject to certain conditions and limits.

How often can employees of Schnitzer Steel Industries change their contribution amounts to the 401(k) plan?

Employees of Schnitzer Steel Industries can change their contribution amounts to the 401(k) plan during designated enrollment periods or as permitted by the plan.

What investment options are available in the Schnitzer Steel Industries 401(k) plan?

The Schnitzer Steel Industries 401(k) plan offers a variety of investment options, including mutual funds, stocks, and bonds, allowing employees to choose based on their risk tolerance.

Is there a vesting schedule for the employer match in the Schnitzer Steel Industries 401(k) plan?

Yes, Schnitzer Steel Industries has a vesting schedule for employer matching contributions, which means employees must work for a certain period to fully own those contributions.

Can Schnitzer Steel Industries employees roll over funds from other retirement accounts into their 401(k) plan?

Yes, Schnitzer Steel Industries employees can roll over funds from other qualified retirement accounts into their Schnitzer Steel Industries 401(k) plan.

/General/General%208.png?width=1280&height=853&name=General%208.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)