Healthcare Provider Update: Belden offers health, dental, and vision insurance, along with life and disability coverage. Employees benefit from a 401(k) retirement plan, stock purchase options, and paid time off. The company promotes a culture of inclusion and community engagement, with wellness programs and education assistance available. Beldens total rewards program is designed to support employees physical, financial, and emotional well-being3. Belden With ACA premiums projected to rise sharply in 2026, Beldens comprehensive benefits and inclusive culture help employees avoid the financial strain of marketplace plans. The companys emphasis on preventive care and wellness education further reduces long-term healthcare costs. Click here to learn more

It doesn’t take a degree in finance to see the cost of college continues to rise.

In its 2017 report, the College Board showed that public four-year institutions raised prices an average of 3.2% annually between the 2007-08 and 2017-18 school years. Put another way, a $5,000 education in 2007-08 would cost $6,851 in 2017-18.

For a few families, the lion’s share of education costs falls on parents and, in some cases, on grandparents. For our Belden clients who are parents you may already know, generally, the majority of families rely on a combination of scholarships, grants, financial aid, part-time jobs, and parent support to help pay the cost.

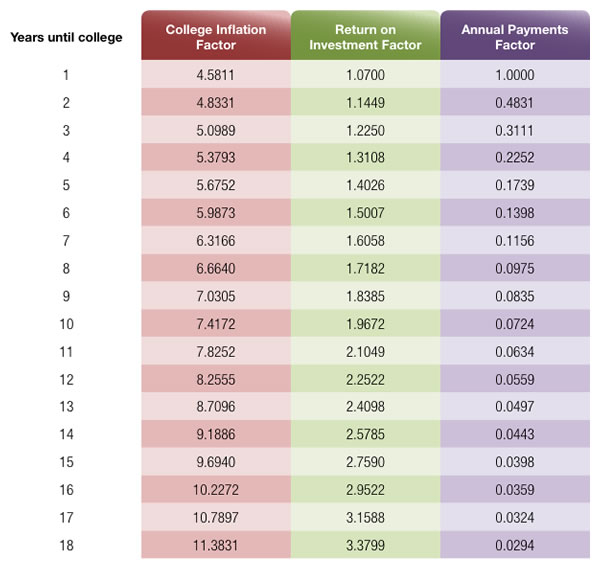

For Belden employees who have children approaching college age, a good first step is estimating the potential costs. The accompanying worksheet can help you get a better idea about the cost of a four-year college.

For Belden employees who already put money away for college, the worksheet will take that amount into consideration. For Belden employees who haven’t, it’s never too late to start.

Resources

There are a number of resources that can help individuals prepare for college. The U.S. government distributes certain information on colleges and costs. Here are two sites for these Belden employees to consider reviewing:

www.studentaid.ed.gov

The government’s college and financial aid portal.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

www.collegeboard.org

The group that administers the SAT test.

Estimating the Cost of College

What is the primary purpose of Belden's 401(k) Savings Plan?

The primary purpose of Belden's 401(k) Savings Plan is to help employees save for retirement by allowing them to contribute a portion of their salary on a tax-deferred basis.

How can employees enroll in Belden's 401(k) Savings Plan?

Employees can enroll in Belden's 401(k) Savings Plan by accessing the benefits portal or contacting the HR department for guidance on the enrollment process.

What types of contributions can employees make to Belden's 401(k) Savings Plan?

Employees can make pre-tax contributions, Roth (after-tax) contributions, and may also be eligible for employer matching contributions in Belden's 401(k) Savings Plan.

Is there a company match for contributions made to Belden's 401(k) Savings Plan?

Yes, Belden offers a company match for employee contributions to the 401(k) Savings Plan, which helps employees increase their retirement savings.

What is the vesting schedule for employer contributions in Belden's 401(k) Savings Plan?

The vesting schedule for employer contributions in Belden's 401(k) Savings Plan typically follows a graded vesting schedule, which means employees earn ownership of the contributions over a specified period.

Can employees change their contribution percentage at Belden?

Yes, employees can change their contribution percentage to Belden's 401(k) Savings Plan at any time, usually through the benefits portal or by contacting HR.

What investment options are available in Belden's 401(k) Savings Plan?

Belden's 401(k) Savings Plan offers a variety of investment options, including mutual funds, target-date funds, and other investment vehicles to suit different risk tolerances.

At what age can employees begin to withdraw from Belden's 401(k) Savings Plan without penalties?

Employees can begin to withdraw from Belden's 401(k) Savings Plan without penalties at age 59½, provided they meet other plan requirements.

What happens to an employee's 401(k) balance if they leave Belden?

If an employee leaves Belden, they can choose to roll over their 401(k) balance to another retirement account, withdraw the funds, or leave the balance in the plan if allowed.

Does Belden's 401(k) Savings Plan allow loans against the account?

Yes, Belden's 401(k) Savings Plan may allow employees to take loans against their account balance, subject to specific terms and conditions outlined in the plan documents.

/General/General%208.png?width=1280&height=853&name=General%208.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)