Healthcare Provider Update: Healthcare Provider for Intuit Intuit, a leading financial software company, primarily utilizes UnitedHealthcare as its healthcare provider. This partnership enables Intuit to offer competitive health benefits and services to its employees, ensuring comprehensive coverage options. Brief on Healthcare Cost Increases in 2026 In 2026, healthcare costs are anticipated to surge dramatically, with many insured individuals feeling the brunt of escalating premiums. Factors contributing to this sharp increase include the loss of enhanced federal subsidies for Affordable Care Act (ACA) marketplace plans, which has the potential to spike out-of-pocket costs by over 75% for the majority of enrollees. Additionally, numerous states are experiencing proposed premium hikes, with some exceeding 60%, primarily fueled by rising medical costs and aggressive rate increases from top insurers. As a result, consumers and employers alike will face significant financial pressures, prompting many to re-evaluate their healthcare options and strategies in light of these challenges. Click here to learn more

It doesn’t take a degree in finance to see the cost of college continues to rise.

In its 2017 report, the College Board showed that public four-year institutions raised prices an average of 3.2% annually between the 2007-08 and 2017-18 school years. Put another way, a $5,000 education in 2007-08 would cost $6,851 in 2017-18.

For a few families, the lion’s share of education costs falls on parents and, in some cases, on grandparents. For our Intuit clients who are parents you may already know, generally, the majority of families rely on a combination of scholarships, grants, financial aid, part-time jobs, and parent support to help pay the cost.

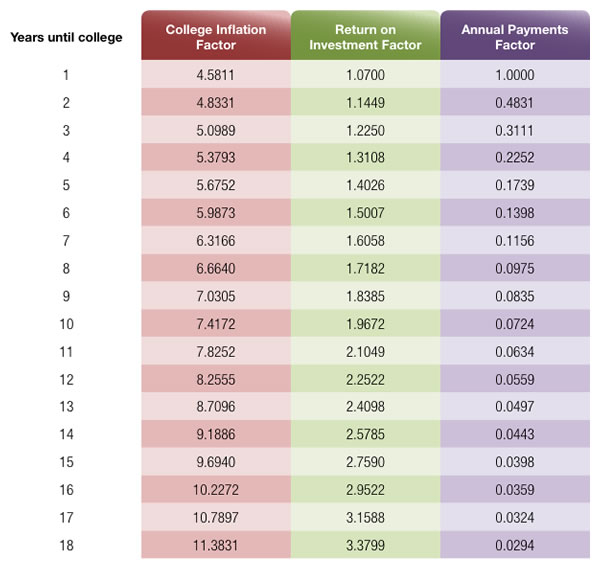

For Intuit employees who have children approaching college age, a good first step is estimating the potential costs. The accompanying worksheet can help you get a better idea about the cost of a four-year college.

For Intuit employees who already put money away for college, the worksheet will take that amount into consideration. For Intuit employees who haven’t, it’s never too late to start.

Resources

There are a number of resources that can help individuals prepare for college. The U.S. government distributes certain information on colleges and costs. Here are two sites for these Intuit employees to consider reviewing:

www.studentaid.ed.gov

The government’s college and financial aid portal.

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

www.collegeboard.org

The group that administers the SAT test.

Estimating the Cost of College

What type of retirement savings plan does Intuit offer to its employees?

Intuit offers a 401(k) retirement savings plan to its employees.

Does Intuit provide a company match for its 401(k) contributions?

Yes, Intuit offers a company match for employee contributions to the 401(k) plan, subject to certain limits.

How can Intuit employees enroll in the 401(k) plan?

Intuit employees can enroll in the 401(k) plan through the company’s HR portal or by contacting the HR department for assistance.

What is the eligibility requirement for Intuit employees to participate in the 401(k) plan?

Most Intuit employees are eligible to participate in the 401(k) plan after completing a specified period of employment, typically within the first year.

Can Intuit employees take loans against their 401(k) savings?

Yes, Intuit allows employees to take loans against their 401(k) savings, subject to the plan's terms and conditions.

What investment options are available in Intuit's 401(k) plan?

Intuit's 401(k) plan offers a variety of investment options, including mutual funds, target-date funds, and company stock.

How often can Intuit employees change their 401(k) contribution amounts?

Intuit employees can change their 401(k) contribution amounts at any time, subject to the plan's guidelines.

Does Intuit provide financial education resources for employees regarding their 401(k) plans?

Yes, Intuit provides financial education resources and tools to help employees make informed decisions about their 401(k) savings.

What happens to my 401(k) savings if I leave Intuit?

If you leave Intuit, you can choose to roll over your 401(k) savings into another qualified retirement plan, cash out, or leave the funds in the Intuit plan, depending on the plan's rules.

Is there a vesting schedule for Intuit's 401(k) company match?

Yes, Intuit has a vesting schedule for the company match, which means employees must work for a certain period to fully own the matched funds.

/General/General%2012.png?width=1280&height=853&name=General%2012.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)