Retirement Guide for Bank of America Employees

2025 Health Care and Tax Changes

In this comprehensive retirement guide for Bank of America employees, we cover the most critical factors to take into account when deciding on the proper time to retire from Bank of America.

From tax rates to health care, inflation, interest rates, and more, this guide is designed to answer your most pressing retirement questions.

While we are not affiliated with Bank of America, The Retirement Group has extensive experience working with Bank of America employees as they move to and through retirement. For more information, we recommend reaching out to your Bank of America benefits department.

Table of Contents

2025 Tax Changes & Inflation

People in the United States need to be aware of changes made by both Bank of America and the IRS, especially as they approach their 50s and 60s. Although the world seems to become more volatile and uncertain each day, there are a few key constants can help you keep your retirement plan on track—no matter where you're starting from. Here are some important updates for 2025:

Tax Code Changes 2025

- Standard deduction. In 2025, the standard deduction increased to $15,000 for single filers and married filing separately, $30,000 for joint filers, and $22,500 for heads of household.

- Additional deduction. Taxpayers who are over the age of 65 or blind can add an additional $1,600 to their standard deduction. This amount jumps to $2,000 if they are also unmarried or not a surviving spouse.

- Cash contributions to charity. The special deduction that allowed non-itemizers to deduct up to $300 in cash donations to charity—or $600 for those married filing jointly—has expired.

Note: Remote workers employed by Bank of America could face double taxation on state taxes. Thanks to the advent of remote work during the COVID-19 pandemic, many employees moved away from core cities. Notably, these movements could have taken them outside the state where they were employed. Some states established temporary relief provisions to avoid double taxation of income, but many of those provisions may have expired. There are only six states that currently have a "special convenience of employer" rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for Bank of America, and if you don't currently reside in those states, consult with your tax advisor to determine if there are other ways to mitigate the potential for double taxation.

Child Tax Credit Updates for 2025

Bank of America employees interested in reducing their tax burdens as much as possible may benefit from the Child Tax Credit. Although it only applies to individuals with children under the age of 18, it can be relevant to those who are approaching retirement if they have minor children—or if their children have children!

Here are the 2025 updates:

- Maximum credit per qualifying child: $2,000 for children aged five and under; $3,000 for children aged six through 17.

- Child Tax Credit eligibility. As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000, or $400,000 if married filing jointly.

- Partial refundability. If your Child Tax Credit is greater than your tax, you can receive up to $1,600 as a cash refund.

Optimize your retirement contributions

Contributing to Bank of America's 401k plan can cut this year's tax bill significantly. With the right planning, these benefits can be compounded over time. In 2025, the amount you can save increased:

- 2025 limit. Individuals can contribute $23,500 to their 401k plans in 2025.

- Catch-up contributions. Employees age 50 and over can contribute an extra $7,500, bringing their total limit to $31,000. For those who turn 60 - 63 years of age during calendar year 2025, their catch up contribution is $11,250, for a combined total of $34,750.

- A major opportunity. Lowering your taxable income by up to $34,750 means less of your money is immediately taxed. As shown in the table below, this could save you thousands on your current tax bill.

Many investors choose to invest the money they save in taxes for the year. This bonus nest egg then has the opportunity to grow in the market, which can help pay the deferred tax when they make withdrawals from their accounts later in life.

Dealing with Inflation

Inflation—we're all too familiar with it. Inflation degrades purchasing power over time, meaning the same things cost more year after year. While inflation is difficult to deal with as a working adult, managing it becomes harder in retirement.

To maintain the same standard of living in retirement, you need to factor rising costs into your plan. While the Federal Reserve targets 2% inflation each year, the scorching inflation of the early 2020s reminded us that Fed targets are anything but a guarantee.

When nearing retirement, it's important to keep track of the rate of inflation, especially in specific areas like health care. While prices as a whole have risen dramatically, increases in particular categories can outpace inflation, which can lead to unpleasant surprises down the road if you're not prepared. Speak with a qualified financial advisor when constructing your holistic plan to help plan for the impacts of future inflation.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Planning Your Retirement

Retirement planning is a verb. And consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need to retire.

No matter where you stand in the planning process, or your current age, we designed this guide to provide you with a solid overview of the steps you can take toward retirement. With the right resources, you can streamline your transition from Bank of America into retirement and get the most from your benefits.

You know you need to be saving and investing, especially since time is on your side the sooner you start. But even if you've been investing for years, the game changes entirely once you switch from saving to spending.

That's where The Retirement Group comes in. We've partnered with Wealth Enhancement to offer a wide range of retirement planning resources. With a qualified, competent, and caring advising team by your side, Bank of America employees in the United States can make the most of what they've saved, and better plan for what they still need.

"A study by Russell Investments, a large money management firm, found that a good financial advisor can increase investor returns by an estimated 3.75%."

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 202

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your contributions for your 401k plan is key.

Employees can realize a 79% potential boost in wealth at age 65 over a 20-year period when choosing to invest in their company's retirement plan.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

As decades go by, you’re likely full swing into your career at Bank of America and your income probably reflects that. However, the challenges of saving for retirement start coming from large competing expenses: a mortgage, raising children, and saving for their college.

One of the classic planning conflicts is saving for retirement versus saving for college. Most financial planners will tell you that retirement from your company should be your top priority because your child can usually find support from financial aid while you’ll be on your own to fund your retirement.

The amount you invest towards your retirement will always be based on your unique financial situation and goals. However, a good rule of thumb is to consider investing at least 10% of your salary toward retirement through your 30s and 40s. So long as your individual circumstances allow, it should be a goal to maximize your company's contribution match.

As you enter your 50s and 60s, you’re ideally at peak earning years with some of your major expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This can be a good time to consider whether you have the ability to boost your retirement savings goal to 20% or more of your income. For many people, this could potentially be the last opportunity to stash away funds.

Over 50? In 2025, workers age 50 or older can invest up to $23,500 into their retirement plan/401k. Once they met this limit, they can add an additional $7,500 in catch-up contributions, for a total investment of $31,000. These limits are adjusted annually for inflation.

Why are 401ks and matching contributions so popular?

401k are powerful retirement savings vehicles that feature three main benefits:

- Compound growth opportunities (as seen above)

- Tax saving opportunities

- Matching contributions

Matching contributions are just what they sound like: your company matches your own 401k contributions up to a specified amount or percentage, using corporate funds.

For example, let's say Bank of America offers you a 3% match to your 401k investments. If your salary is $100,000 and you invest $3,000 in your 401k, Bank of America would then match that amount, also investing $3,000 in your 401k—resulting in a $6,000 increase to your 401k balance. If you invested $5,000 instead, Bank of America would match $3,000 of that amount, bringing your total 401k investment to $8,000 for that year.

A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401k Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize the company match typically leave $1,336 of potential extra retirement money on the table each year.

If you want to make the most of the opportunities that Bank of America offers you before you retire, reach out today and schedule a call with The Retirement Group.

Your 401k Plan

When did you last review your Bank of America 401k account or make any changes to it?

If it’s been a while, you’re not alone. 73% of plan participants spend less than five hours researching their 401k investment choices each year, and even less time making account changes. As a result, many people in their 50s or 60s find themselves overwhelmed about how to best prepare for retirement.

When you retire from Bank of America, if you have balances in your 401k plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current value you are eligible to receive from each plan and explain your distribution options. It will also tell you what you need to do to receive your final distribution. Please call The Retirement Group at (800) 900-5867 for more information and we can help you get in front of a Bank of America-focused retirement advisor.

Next Steps:

- Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

- Read our guides: "What has Worked in Investing" & "8 Tenets when picking a Mutual Fund".

- To learn about your distribution options, call The Retirement Group at (800) 900-5867.

- Read through our e-book for more information on "Rollover Strategies for 401(k)s".

- Use the Online Beneficiary Designation update your beneficiary designations, if needed.

Note: If you voluntarily terminate your employment, you may not be eligible to receive the annual contribution.

Getting help with your 401k

Over half of plan participants in the United States admit they don’t have the time, interest, or knowledge needed to manage their 401k portfolio. But the benefits of getting help go beyond convenience.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

- Improved savings rates – 70% of participants who obtained 401k advice increased their contributions.

- Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

- Increased likelihood of staying the course – Getting advice raised the odds of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401k investments during a downturn.

Don't try to do it alone. Get help with your company's 401k plan investments. Your nest egg will thank you.

Strategies to leverage your 401k before retirement

Did you know that there are ways you can tap into and leverage your 401k funds before retirement? Although these strategies may not apply to every situation, you may be able to use your 401k to bridge certain gaps in your financial plan.

- Eligibility. In-service withdrawals are generally available to employees after they reach age 59½, so they avoid the 10% early withdrawal penalty. However, some plans allow for earlier access to 401k funds under circumstances such as financial hardship.

- IRA rollover. These withdrawals are often used to roll over funds into an IRA or another retirement account while you're still employed. A direct rollover can avoid the 10% early withdrawal penalty, as well as any mandatory tax withholding. Rolling over your 401k into an IRA is a popular option for those looking for more control over their retirement savings. While your 401k might limit investment choices, IRAs often offer a broader range of investments.

- Tax implications. If your in-service withdrawal is not rolled over into an IRA, you may face income tax on the amount withdrawn.

Strategy 2. Borrowing from your 401k

Should you? If you need money quickly due to a job loss, serious health emergency, or other reason, borrowing from your 401k can be an option.

Banks will make you jump through many hoops for a personal loan and credit cards charge too much interest. If these are your only options for much-needed cash, your 401k balance might start looking like a usable asset.

Unlike an in-service withdrawal, a loan must be paid back. However, they are not taxable (unless you fail to repay them). Additionally, in some cases, as with hardship withdrawals, you may not be allowed to make a withdrawal unless you have also taken out the maximum loan available to you.

Yet, despite the potential benefits, taking a loan from your 401k may also come with some drawbacks.

- Borrowing from the future. First and foremost, you may be setting your retirement plan back by some time if you take money from your future and use it today.

- Lost growth potential. Even though you'll repay the loan, those funds will miss out on potential growth through investments during the repayment period. This can create a gap in your portfolio, especially if the market performs well while your money is out of the account.

- Repayment issues. If you leave your employer or lose your job, you may be forced to pay the full loan within a short timeframe. If you're unable to, the loan can be treated as an early withdrawal—and be penalized and taxed as such.

Borrowing from your 401k should be considered a last resort. If you're concerned that you may need to take a loan from your 401k to make ends meet, reach out to an advisor at The Retirement Group today.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution from your 401k plan, you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

NUA is a strategy to help mitigate taxes on the gains you may have realized from owning company stock.

To use this strategy, you must first be eligible for a distribution from your qualified company-sponsored plan, which typically happens at retirement or age 59 1⁄2. Generally, you would take a 'lump-sum' distribution from the plan, distributing all assets from the plan during a one-year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time, you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax rate but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

As a Bank of America employee, you may be interested in understanding NUA from a financial advisor. Reach out today to schedule a complimentary meeting.

IRA Withdrawal

Your retirement assets may be spread across several retirement accounts: IRAs, 401ks, taxable accounts, and others.

So, what is the most efficient way to take your retirement income after leaving Bank of America?

This question relates to something called withdrawal sequencing, and it's a problem we're well-equipped to handle at The Retirement Group.

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts. This may help your company-sponsored retirement assets last longer as they continue to potentially grow tax deferred.

You will also need to plan to take the required minimum distributions (RMDs) from any company-sponsored retirement plans and traditional or rollover IRA accounts when you reach age 73.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or to take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Option 1. Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Option 2. Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your income needs after retiring from Bank of America. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your Benefits

HSAs

Health Savings Accounts (HSAs) are often celebrated for their utility in managing health care expenses, particularly for those with high-deductible health plans. However, their benefits extend beyond medical cost management. In fact, they may even provide you with a powerful vehicle to save for retirement.

Understanding HSAs

HSAs are tax-advantaged accounts designed for individuals with high-deductible health insurance plans. For 2025, the IRS defines high-deductible plans as those with a minimum deductible of $1,650 for individuals and $3,300 for families. HSAs allow pre-tax contributions, tax-free growth of investments, and tax-free withdrawals for qualified medical expenses—making them a triple-tax-advantaged account.

The annual contribution limits for HSAs in 2025 are $4,300 for individuals and $8,550 for families, with an additional $1,000 allowed for those aged 55 and older. Unlike Flexible Spending Accounts (FSAs), HSA funds do not expire at the end of the year; they accumulate and can be carried over indefinitely.

Comparing HSAs to 401ks Post-Matching

Once an employer's maximum match in a 401k is reached, further contributions yield diminished immediate financial benefits. This is where HSAs can become a strategic complement. While 401ks offer tax-deferred growth and tax-deductible contributions, their withdrawals are taxable. HSAs, in contrast, provide tax-free withdrawals for medical expenses, which are a significant portion of retirement costs.

HSA as a Retirement Tool

Post age 65, the HSA flexes its muscles as a robust retirement tool. Funds can be withdrawn for any purpose, subject only to regular income tax if used for non-medical expenses. This flexibility is similar to that of traditional retirement accounts, but with the added advantage of tax-free withdrawals for medical costs—a significant benefit given the odds of facing rising health care expenses in retirement.

Furthermore, HSAs do not have Required Minimum Distributions (RMDs), unlike 401ks and Traditional IRAs, offering more control over tax planning in retirement. This makes HSAs particularly advantageous for those who might not need to tap into their savings immediately at retirement or who want to reduce their taxable income.

Investment Strategy for HSAs

Initially, it's prudent to invest conservatively within an HSA, maintaining sufficient liquid funds to cover near-term deductible and other out-of-pocket medical expenses. However, once a financial cushion is established, treating the HSA like a retirement account by investing in a diversified mix of stocks and bonds can enhance the account's growth potential over the long term.

Using HSAs in Retirement

In retirement, HSAs can cover a range of expenses:

- Health Care Costs-Pre Medicare: HSAs can pay for healthcare costs to bridge you to Medicare

- Health Care Costs-Post Medicare: HSAs can pay for Medicare premiums and out-of-pocket medical costs, including dental and vision, which are often not covered by Medicare.

- Long-term Care: Funds can be used for qualified long-term care services and insurance premiums.

- Non-medical Expenses: After age 65, HSA funds can be used for non-medical expenses without incurring penalties, although these withdrawals are subject to income tax.

Bottom Line

HSAs offer unique advantages that can make them a superior option for retirement savings, particularly after the benefits of 401k matching are maximized. Their flexibility in fund use, coupled with tax advantages, can make HSAs a key component of a comprehensive retirement strategy. By strategically managing contributions and withdrawals, individuals can optomize both their financial health and medical well-being.

Company Benefits Annual Enrollment

Annual enrollment for your company's benefits usually occurs each fall.

Before it begins, you will be mailed enrollment materials and an upfront confirmation statement reflecting your benefit coverage to the address on file. You’ll find enrollment instructions and information about your benefit options from Bank of America and contribution amounts. You will have the option to keep the benefit coverage shown on your upfront confirmation statement or select benefit options offered by Bank of America that better support your needs. You may be able to choose to enroll in eBenefits and receive this information via email instead.

Next Steps:

- Watch for your annual enrollment information in the September/November time frame.

- Review your benefits information and use the tools and resources available on your company's Benefits Center website.

- Enroll in eBenefits.

Short-Term & Long-Term Disability

Short-Term: Depending on your plan, you may have access to short-term disability (STD) benefits through your company.

Long-Term: Your plan's long-term disability (LTD) benefits are designed to provide you with income if you are absent from Bank of America for six consecutive months or longer due to an eligible illness or injury.

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment with your company ends, unless your employment ends due to disability. If you die within 31 days of your termination date from Bank of America, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

-

You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

-

If you stop paying supplementary contributions, your coverage will end.

-

If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

-

Make sure to update your beneficiaries. See Bank of America's SPD for more details.

Next Step:

- When you retire from Bank of America, make sure that you update your beneficiaries. Bank of America should have an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, etc.

Social Security & Medicare

To help you make an informed decision, let's explore three main steps you should follow to solidify your Social Security strategy:

Step 1. Decide when to claim your Social Security benefits

Social Security benefits can be significant, but at the end of the day, they're just one part of your overall financial picture. When considering the timing of your claim, keep this general principle in mind: The later you begin receiving benefits, the larger those benefits will be.

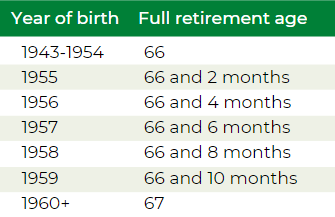

The full monthly Social Security retirement benefit is based on applying at the Full Retirement Age (FRA), which is age 67 for those born 1960 or later. For every year you wait after you reach the FRA, your benefit amount increases 8%. It reaches a maximum at age 70. If we do the math, we can determine that, if you start claiming at age 70, your monthly benefit will be 124% the full benefit.

However, you can also apply before you reach FRA, as early as age 62. You will receive a reduced benefit if you do so, but this option could make sense for those who want to start claiming their benefit earlier for longevity reasons.

Step 2. Understand the tax implications

For all but the lowest-income retirees, Social Security benefits are actually taxable. Only individuals with provisional income under $25,000, or $32,000 if married filing jointly, receive their benefits tax-free. Otherwise, up to 85% of your benefits will be treated as taxable income.

Furthermore, depending on where you live, your Social Security benefits may even be taxed at the state level. If you plan to move for retirement, the tax regime in the state you're moving to can be a relevant consideration.

Step 3. Start preparing today

Even if your retirement is right around the corner, you can make decisions today that will impact you for years, or decades, to come. For instance, delaying your Social Security claiming date even a year or two can snowball into a significant benefit. To bridge the gap between their retirement date and their claiming date, some people create a "slush fund" while they're working to take the place of the Social Security benefits they would receive from claiming at FRA. Whether these funds come from a 401k, IRA, or brokerage account, integrating a bit of extra padding in your planning can pay off in the long run.

Always remember, your Social Security benefit is just one part of your overall financial picture. And when you start to consider tax implications, withdrawal sequencing, and effective diversification (beyond just the asset class), the picture can start to get complicated. That's what we're here to help with. At The Retirement Group, we've been assisting Bank of America employees to and through retirement for years. If you're interested in speaking with an experienced advisor who's been through the process before,reach out today.

Medicare Coverage for Retirees

Are you eligible for Medicare or will be soon? If you or your dependents are eligible after you leave Bank of America, Medicare generally becomes the primary coverage for you or any of your dependents as soon as they are eligible for Medicare. This will affect your company-provided medical benefits.

It's your responsibility to enroll in Medicare Parts A and B when you first become eligible—and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare-eligible dependents as well.

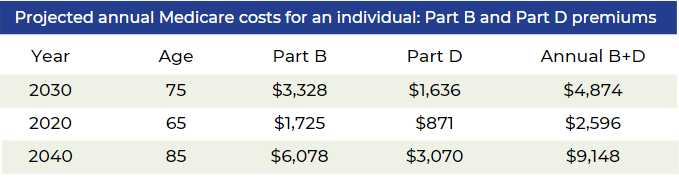

The Reality of Medical Costs in Retirement

Dealing with Divorce

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits from Bank of America. Before you can start your pension—and for each former spouse who may have an interest—you’ll need to provide your company with the following documentation:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO)

You’ll need to submit this documentation to Bank of America's online pension center regardless of how old the divorce or how short the marriage.

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Your own Social Security benefit amount is less than your spousal benefit amount, which is equal to one-half of what your ex’s full benefit amount would be if claimed at Full Retirement Age (FRA).

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

Divorce doesn’t disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if:

- Your ex-spouse is deceased.

- You are at least 60 years of age.

- You were married for at least 10 years prior to the divorce.

- You are single (or you remarried after age 60).

In the process of divorcing?

If your divorce isn’t final before your retirement date, you’re still considered married. You have two options:

- Retire before your divorce is final and elect a joint pension of at least 50% with your spouse—or get your spouse’s signed, notarized consent to a different election or lump sum.

- Delay your retirement until after your divorce is final and you can provide the required divorce documentation.*

Survivor Checklist

If you pass away before collecting your retirement benefits, your surviving loved ones must be prepared to take action. It will be their responsibility to collect their survivor benefits. By following the tips in these three sections, you can prepare your loved ones to make the most of the benefits that they're entitled to:

In the event of your death...

- Report your death. Your spouse, a family member or even a friend should call Bank of America's benefits service center as soon as possible to report your death.

- Collect life insurance benefits. Your spouse, or other named beneficiary, will need to call Bank of America's benefits service center to collect life insurance benefits.

If you have a joint pension...

- Start the joint pension payments. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from Bank of America's pension center to start receiving joint pension payments.

- Be prepared financially to cover living expenses. Your spouse will need to be prepared with enough savings to bridge at least one month between the end of your pension payments from your company and the beginning of his or her own pension payments.

If your survivor has medical coverage through Bank of America...

- Decide whether to keep medical coverage.

- If your survivor is enrolled as a dependent in your company-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium.

Life After Your Career

Make up for decreased value of savings or investments. Low interest rates make it great for lump sums but harder for generating portfolio income. Some people continue to work to make up for poor performance of their savings and investments.

Maybe you took an offer from your company and left earlier than you wanted with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in the past.

Meet financial requirements of day-to-day living. Expenses can increase during your retirement from your company and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers.

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce.

Staying active and involved. Retaining employment after your previous job, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work. Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Sources

- “National Compensation Survey: Employee Benefits in the United States," March 2024. Bureau of Labor Statistics, U.S. Department of Labor.

- “Divorced? See how to claim your Social Security benefit.” Fidelity, 27 Mar. 2025 .

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2025.

- Retirement Researcher. "Withdrawal Sequencing," by Bob French, 2025.

- Wealth Enhancement. "4 ways to bridge the health care gap in early retirement," 02/09/2022.

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

- Rising Interest Rates e-book

- Closing The Retirement Gap e-book

- Rollover Strategies for 401(k)s e-book

- How to Survive Financially After a Job Loss e-book

- Financial PTSD e-book

- RetireKit

- What has Worked in Investing e-book

- Retirement Income Planning for ages 50-65 e-book

- Strategies for Divorced Individuals e-book

- TRG Webinar for Corporate Employees

- Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Missing out: How much employer 401k matching contributions do employees leave on the table?

- Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- Social Security Administration. Benefits Calculators. https://www.ssa.gov/benefits/calculators/

- https://hr2.chevron.com/document-library/summary-plan-descriptions/wealthspd

- https://hr2.chevron.com/wealthmanagement/retirement-plans/cip-salary-changes

- https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2025

- https://tax.thomsonreuters.com/blog/upcoming-tax-law-changes/

- https://taxfoundation.org/data/all/federal/2025-tax-brackets/

- https://www.irs.gov/credits-deductions/individuals/child-tax-credit