Retirement Guide for Kaiser Permanente Employees

2025 Tax Rates & Inflation

In our comprehensive retirement guide for Kaiser Permanente employees, we go through many factors which you may take into account when deciding on the proper time to retire from KP. Some of those factors include: healthcare & benefit changes, interest rates, the new 2025 tax rates, inflation, and much more. Keep in mind we are not affiliated with Kaiser Permanente. We recommend reaching out to your Corporate benefits department for further information. We are pleased to assist residents of your city, your state especially those who are retirement age.

Table of Contents

2025 Tax Changes & Inflation

It is imperative for individuals in your city, your state to be aware of new changes made by the IRS, especially as they approach retirement age. The main factors that will impact employees will be the following:

- The 2025 standard deduction will increase to $15,000 for single filers and those married filing separately, $30,000 for joint filers, and $22,500 for heads of household.

- Taxpayers who are over the age of 65 or blind can add an additional $1,600 to their standard deduction. That amount jumps to $2,000 if also unmarried or not a surviving spouse.

Retirement account contributions: Contributing to your company's 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2025. The amount individuals can contribute to their 401(k) plans in 2025 will increase to $23,500 -- up from $23,000 for 2024. The catch-up contribution limit for employees age 50 and over will increase to $7,500. For those turning 60 - 63 years of age during calendar year 2025, the catch-up provision is $11,250.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by a corporation, should know:

- The tax year 2025 maximum Earned Income Tax Credit amount is $8,046 for qualifying taxpayers who have three or more qualifying children, up from $7,830 for tax year 2024.

- Married taxpayers filing separately can qualify: You can claim the EITC as married filing separately if you meet other qualifications. This was not available in previous years.

Child Tax Credit changes:

- In 2025 (taxes filed in 2026), the child tax credit will remain at $2,000 per dependent, with a maximum refundable amount of $1,700.

- You may be eligible for the full child tax credit amount if your modified adjust gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers).

- If your income exceeds the limits, the credit is reduced by $50 for each $1,000 of income above the threshold until it phases out completely.

Other notable changes for tax year 2025 include the following:

- Alternative minimum tax exemption amounts: For 2025, the exemption amount for unmarried individuals increases to $88,100 ($68,650 for married individuals filing separately) and begins to phase out at $626,350. For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700.

- Qualified transportation fringe benefit: For 2025, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking rises to $325 per month, increasing from $315 per month in 2024.

- Health flexible spending cafeteria plans: For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements rises to $3,300, increasing from $3,200 in 2024. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount rises to $660, increasing from $640 in 2024.

- Medical savings accounts: For 2025, participants who have self-only coverage, the plan must have an annual deductible that is not less than $2,850 (a $50 increase from the previous tax year), but not more than $4,300 (an increase of $150 from the previous tax year). The maximum out-of-pocket expense amount rises to $5,700, increasing from $5,550 in 2024. For family coverage in 2025, the annual deductible is not less than $5,700, increasing from $5,550 in 2024; however, the deductible cannot be more than $8,550, an increase of $200 versus the limit for 2024. For family coverage, the out-of-pocket expense limit is $10,500 for 2025, rising from $10,200 in 2024.

- Foreign earned income exclusion: For 2025, the foreign earned income exclusion increases to $130,000, from $126,500 in 2024.

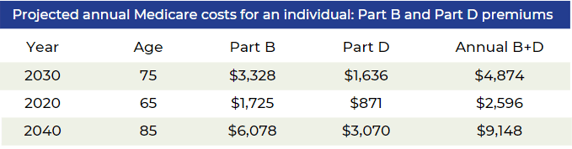

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving your company, you will have to factor rising costs into your plan. While the Federal Reserve strives to achieve a 2% inflation rate each year, in 2024 that rate was 2.9%. While prices as a whole have risen there are specific areas to pay attention to if you are nearing or in retirement from your company, like healthcare.

It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from your company.

*Source: IRS.gov, Yahoo, Bankrate, Forbes

Schedule An Appointment with a Retirement Group Advisor

Please choose a date that works for you from the available dates highlighted on the calendar.

Recent Layoff Announcements & Other Kaiser Permanente News

Planning Your Retirement

Retirement planning is a verb; consistent action must be taken whether you’re 20 or 60.

The truth is that most Americans don’t know how much to save or the amount of income they’ll need.

No matter where you stand in the planning process, or your current age retirement age, we hope this guide provides you a good overview of the steps to take and resources that help you simplify your transition from your company into retirement and get the most from your benefits in your city, your state.

You know you need to be saving and investing, especially since time is on your side the sooner you start, but you don’t have the time or expertise to know if you’re building retirement savings that can last after leaving your company.

"A separate study by Russell Investments, a large money management firm, came to a similar conclusion. Russell estimates a good financial advisor can increase investor returns by 3.75 percent."

Source: Is it Worth the Money to Hire a Financial Advisor? The Balance, 2021

Starting to save as early as possible matters. Time on your side means compounding can have significant impacts on your future savings. And, once you’ve started, continuing to increase and maximize your contributions for your 401(k) plan is key.

There's a 79% potential boost in wealth at age 65 over a 20-year period when choosing to invest in your company's retirement plan.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

As decades go by, you’re likely full swing into your career at your company, and your income probably reflects that. However, the challenges of saving for retirement start coming from large competing expenses: a mortgage, raising children in your city, your state, and saving for their college.

One of the classic planning conflicts is saving for retirement versus saving for college. Most financial planners will tell you that retirement from your company should be your top priority because your child can usually find support from financial aid while you’ll be on your own to fund your retirement once you reach retirement age.

How much we recommend that you invest towards your retirement is always based on your unique financial situation and goals. However, consider investing a minimum of 10% of your salary toward retirement through your 30s and 40s.

As you enter your 50s and 60s, you’re ideally at your peak earning years with some of your major expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This can be a good time to consider whether you have the ability to boost your retirement savings goal to 20% or more of your income. For many people, this could potentially be the last opportunity to stash away funds.

In 2025, workers age 50 or older can invest up to $23,500 into their retirement plan/401(k), and once they meet this limit, they can add an additional $7,500 in catch-up contributions for a combined annual total of $31,000. For those who are 60 - 63 years of age during calendar year 2025, their catch up provision is $11,250. These limits are adjusted annually for inflation.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles give you the chance to take advantage of three main benefits:

- Compound growth opportunities (as seen above)

- Tax saving opportunities

- Matching contributions

Matching contributions are just what they sound like: your company matches your own 401(k) contributions with money that comes from the company. If your company matches, the company money typically matches up to a certain percent of the amount that you put in.

Unfortunately, many people in your city, your state who are around retirement age fail to take advantage of their company's matching contributions because they’re not contributing the required minimum to receive the full company match.

According to Bank of America's "2022 Financial Life Benefit Impact Report", despite 58% of eligible employees participating in a 401(k) plan, 61% of them contributed less than $5,000 during the current year.

The study also found that fewer than one in 10 participants’ contributions reached the ceiling on elective deferrals, under IRS Section 402(g) — which is $23,000 for 2024.

A 2020 study from Financial Engines titled “Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?”, revealed that employees who don’t maximize their company match typically leaves $1,336 of extra retirement money on the table each year.

For example, if your company will match up to 3% of your plan contributions and you only contribute 2% of your salary, you aren’t getting the full amount of the company match. By simply increasing your contribution by just 1%, your company is now matching the full 3% of your contributions for a total combined contribution of 6%. By doing so, you aren’t leaving money on the table.

Your Pension Plan

Kaiser Permanente Pension Benefits Overview

Disclaimer: Kaiser Permanente operates in nine different states. Although there will be many similarities regarding the KP pensions, each state will have slight differences as well. Even within a state like California with the Northern CA Region, Central CA Region, and Southern CA Region there will be slight differences amongst those pensions.

To provide an overview of the KP pensions, common terms used, and a base understanding of the pension formulas, several KP pensions will be discussed from The Permanente Medical Group (TPMG), Kaiser Permanente Employee Pension Plan (KPEPP), Kaiser Permanente Salaried Retirement Plan (KPSRP), and Southern CA Permanente Medical Group (SCPMG).

Kaiser Permanente Pension Benefits Plan

The Permanente Medical Group (TPMG) Physicians

Retirement and Savings Plans

Pension Plan (Plan 1)

Your Pension Plan (Plan 1) is a defined benefit plan that pays a monthly benefit amount to you at retirement based upon the formula described on the right.

Membership and Vesting Service

You will automatically become a member of Plan 1 effective your first employment anniversary date, provided you completed 1,000 hours of vesting service during that year. You will vest in the plan after completion of five years of vesting service (a calendar year in which you were compensated 1,000 hours or more).

Retirement Age and Years of Service

Normal retirement is age 65, however, a reduced benefit may be received earlier, if eligible. A physician with 30 years of credited service at age 65 would be entitled to 50% of their highest average compensation.

Highest Average Compensation (HAC)

Retirement income is calculated based on your HAC which is the 36 highest paid consecutive months with TPMG over your entire service period and includes both base pay and annual incentive payment multiplied by your years of credited service.

Full Early Retirement Plan

The Full Early Retirement Plan gives you the option to begin receiving benefits as early as age 60 without actuarial reduction for payment before age 65. To be eligible for this plan, you must be at least age retirement age and have completed 15 years or more of vesting service before your retirement date in your city, your state.*

Credited Service

Credited service begins on your date of hire and is based on 2,000 hours of compensated service each calendar year. Proportional credited service is granted for years in which compensated service is less than 2,000 hours.

Benefit Formula

2% of Highest Average Compensation (HAC) per year during first 20 years of credited service, and 1% per year thereafter.

Payment Options

Life annuity, joint and survivor annuity, period certain, or installments.

Permanente Contribution Plan (Plan 2)

TPMG contributes to Plan 2 based upon your eligible compensation (base compensation plus bonus) each pay period. Plan 2 contributions are equal to 5% of the amount of eligible compensation you receive up to the Social Security Wage Base (SSWB) plus 10% of your eligible compensation over the SSWB up to the maximum IRS compensation limit.

For 2025, the SSWB limit is $176,100. The limit on the amount of compensation that can be taken into account when determining contributions and benefits in retirement plans is $350,000 for calendar year 2025.

Plan 2 contributions begin the first of the month following the completion of 1,000 hours of service within an anniversary year.

Salary Deferral Plan 401k (Plan 3)

Your 401k contributions can be made on a pre-tax or Roth (post-tax) basis. You choose how you want to invest your savings. You can elect to contribute on a pre-tax or post-tax basis.

Contributions are subject to annual IRS and other limits as shown in the table below.

Contributions can begin the first of the month following your date of hire. If you do not make an election within 30 days of your hire date, you will be automatically enrolled at an employee pre-tax contribution rate of 6%. If you were automatically enrolled at 6% and do not make a change, your contribution percentage will increase by 1% on your anniversary date each year up to a maximum of 15%.

TPMG (physicians) Pension Plan 2 (2025 maximum)

Sample KP Pension Calculations

TPMG (Salaried Employees)

Kaiser Permanente Employee Pension Plan (KPEPP)

(nurses and other applicable KP work groups)

Defined Benefit Pension

Overview

The pension benefit is based on a formula using an average of your hourly wage rate, your length of credited service, a pension multiplier, and your age at retirement in your state.

Requires vesting - fully vested after five years of service

Year of service defined as 1,000 paid hours in a calendar year, prorated for less than 1,000 hours (depends on group, see page 8)

All KP paid hours in any job classification, in any KP region of your city.

All KP paid hours in any job classification, in any KP region

Breaks in service allowed; issue of tracking multiple periods of employment

Up to a maximum of 1,000 hours of Workers’ Compensation Leave of Absence (WCLOA) taken on/after 10/1/2000 may count toward years of service for retirement and post-retirement benefit eligibility in the retirement age. WCLOA hours do not count as credited service or toward eligibility for any other benefits.

After vesting, entitled to future benefit payment even if leaving before normal or early retirement age

Normal retirement at age 65 Early retirement option at age 55 with minimum 15 years of service (depends on group, see page 8)

Multiple forms of annuity payments and a lump sum option

Defined Benefit Pension

How Pension Benefit Is Calculated

A pension benefit multiplier of 1.45% (depends on group, see below)

Multiplier defines income replaced by pension payment

Year of credited service

Defined as 1,800 paid hours in a calendar year (depends on group, see below)

Partial years of credited service for calendar years with less

than 1,800 paid hours (depends on group, see below)

For all calendar years prior to 2003, year of credited service

was 2,000 paid hours (depends on group, see below)

Final Average Monthly Compensation (FAMC)

FAMC calculated by averaging your highest hourly wage rates

taken over a consecutive 60 month period from your last 120 months of employment. Typically the average will be over

your last five years of employment given how wage grids are

constructed

60-month average uses your base hourly rate only - no

ACP/Per Diem/other differentials apply

Multiplying 60-month average rate by 173.3 hours equals your

FAMC. 173.3 is average number of hours a full-time employee

is paid per month (2,080 hours/12months).

How Pension Benefit Is Calculated:

Final Average Monthly Compensation

multiplied by

Years of credited service

multiplied by

Pension benefit multiplier

Defined Benefit Pension Plan Features, By Group

Kaiser Permanente Pension Benefits Plan

Southern CA Permanente Medical Group (SCPMG)

Defined Benefit Pension Plan (Common Plan)

This plan is offered to physicians and corporate officers only.

There are two types of service that affect the Common Plan:

• Qualifying Service = at least 10 years (part-time / full time)

• Credited Service is time counted to determine the amount of retirement income. It is generally calculated the same as Qualifying Service, but is prorated to work schedule. For example, if you work an 8/10ths work schedule for 10 years, you would have 10 years of Qualifying Service, but only 8 years of Credited Service.

In addition to Credited Service, a physician’s Highest Average Compensation (HAC) is used in the benefit calculation. HAC is the average monthly base compensation for the highest 36 consecutive months of the last 120 months as an eligible physician.

The formula to determine the Common Plan benefit amount is:

2% of HAC (up to 20 years) + 1% of HAC (over 20 years)

Example: The benefit amount for an age 65 physician with a HAC of $15,000 and 30 years of Credited Service

would be calculated as follows:

(2% x $15,000 x 20 years) + (1% x $15,000 x 10 years) = $7,500 per month*

* The benefit amount of the payment will be actuarially adjusted if you begin payment before or after age 65 and/or select a payment option other than lifetime monthly payments

SCPMG Physicians’ 401(k) Plan

Eligibility is 6 months of service Per Diem counts towards this enrollment period. These contributions that you self direct can be pre-tax or post-tax (Roth) which you self direct within the investment options available in your plan.

SCPMG Keogh Plan

Upon attaining Partnership, physicians are eligible to contribute to the Keogh Plan. This plan allows Partners to make tax-deductible contributions to a retirement plan which accrues tax-deferred earnings until distributed from the plan upon retirement from the Partnership.

Even though your contributions do not begin until you attain Partnership, you must elect to participate (or not participate) in the Keogh Plan within 180 days from your date of hire. Any service time attained as a Per Diem applies towards this enrollment period.

Electing to participate in the Keogh Plan is an irrevocable commitment to make an annual contribution of the amount required for the selected level of participation. You will receive only one opportunity to make an election to participate – if you elect to not participate by your 180th day of employment, you will not be able to commence participation at a later date.

If you elect to participate in the Keogh plan, you may select from four contribution levels: 100%, 70%, 50% or 25%. Changes in the contribution level or participation status are not permitted once an election has been made. At the end of each year, an actuarial firm determines the next year’s contribution limit. A physician’s participation level dictates the percentage of the annual contribution limit that the physician will contribute.

The IRS sets an annual limit for combined contributions to a defined contribution plan. In other words,

there is a limit on your combined TSR-401(k) and Keogh contributions.

Early Separation Program (ESP)

This program allows Partners between the ages of 58 and 65 an opportunity to retire early and receive a temporary annuity until the normal retirement age of 65. ESP requires one year of advance approval by the SCPMG Board of Directors.

Kaiser Permanente Pension Benefits Plan

KFH (Southern California)

Securing Your Future

Part 1: Kaiser Permanente Tax Sheltered Annuity (TSA) Plan or Southern California Permanente Medical Group Tax Savings Retirement (TSR) Plan

Save for retirement through pre-tax or Roth after-tax contributions, or both. You choose investment options for your savings.

You’re enrolled automatically at a 2 percent contribution unless you opt out.

Your contribution increases by 1 percent per year up to 6 percent unless you opt out.

You’re immediately 100 percent vested in your contributions to your account.

TSR is for Southern California Permanente Medical Group employees; TSA is for Kaiser Foundation Hospitals employees.

Part 2: Kaiser Permanente Supplemental Savings and Retirement Plan

After 2 years of service, Kaiser Permanente contributes 5 percent of your base salary to this plan. You can also make after-tax contributions and choose your investment options. You’re immediately 100 percent vested in contributions to your account.

Kaiser Permanente Retirement Plan

Part 3: This defined benefit pension plan provides retirement income based on your compensation and years of service when you retire. Kaiser Permanente makes all contributions to this plan. You are vested in the plan after 5 years of service.

Retiree Benefits You may be eligible for retiree health benefits when you retire, depending on your age and years of service at retirement.

Financial Wellness

Life and Accident Insurance

Life and accident insurance protect your loved ones in the event of a serious injury or death. Some of these benefits are optional, and others are included at no cost to you:

Employee Life Insurance — coverage of 2 times your annual salary or a maximum of $50,000, at no cost to you

Optional Life Insurance — coverage of up to $1 million

Dependent Life Insurance — coverage of up to $100,000 for your spouse or domestic partner, and up to $10,000 for eligible children

Accidental Death and Dismemberment — coverage for yourself of up to $350,000, and coverage for your spouse or domestic partner and children

Cost depends on the options you choose

Business Travel Accident — coverage provided at no cost to you

Survivor Assistance — one times your monthly base salary, at no cost to you

Disability Income

Disability benefits provide income in the event you’re unable to work for an extended period

because of a serious illness or injury.

KFH (Southern CA) Example

Kaiser Permanente Pension Benefits Plan

KFH (Northern California)

There are three parts to the Northern California KFH plan. This is for Salaried non union employees at Kaiser Permanente which is include Pharmacists.

Part 1: Kaiser Permanente Tax Sheltered Annuity Plan (TSA)

This plan has eligibility (immediate), matching starts after 2 years of employment and its 2% of your salary up to the social security wage base limit and then an additional 5% on salary above this limit.

Part 2: Kaiser Permanente Supplemental Savings and Retirement Plan

This is a qualified plan where the employer contributes 5% of an employees base salary to the after two years of service with the company. The employee can add after tax contributions into the plan and the employer contribution is immediately vested.

Part 3: Kaiser Permanente Salaried Retirement Plan

This plan is the Pension (defined benefit plan and the company contributes into the plan based on a formula of FAP (last 10 years of employment and the average of the 60 highest consecutive months) multiplied by a pension multiplier of 1.5 minus age penalties of 5% for retirement between the ages of 55-60 and 3% between the ages of 60-65.

Retiree Benefits

You may be eligible for retiree health and welfare benefits when you retire if you meet certain age and years of service requirements.

Other Benefits

Employee Assistance Program

This program provides free and confidential counseling for personal issues, as well as referrals for child and elder care.

Parent Medical Coverage

Your Medicare-eligible parents, stepparents, parents-in-law, or parents of your domestic partner may have an opportunity to enroll in Kaiser Permanente medical coverage at their own expense.

Voluntary Programs

You may enroll in Benefits by Design Voluntary Programs at your own expense if you are regularly scheduled to work 20 or more hours per week. Programs offered include long-term care, term life, pet, auto, and home insurance, as well as legal services and identity theft protection.

Tuition Reimbursement

Tuition Reimbursement helps you continue your education in subjects that will improve your job performance, potential for advancement, and employability. You can be reimbursed up to $3,000 per calendar year for expenses such as tuition and textbooks, including up to $500 for travel expenses.

Additional Resources

As a Kaiser Permanente employee, you also have access to:

-

- Career and development opportunities to help you grow your skills and career, including professional development courses through KP Learn.

-

- Opportunities to volunteer in communities that we serve.

-

- Employee discounts on entertainment, travel, child care, health and fitness programs, electronics, and more. You also receive discounts on over-the-counter medications and other products purchased from a KP pharmacy.

-

- Healthy Workforce resources and tools to help you be active, eat well, and thrive. If your region meets the Total Health Incentive Plan’s goals for employees to adopt a healthier lifestyle, you may also have a chance to earn up to $500 per year.

KP Pension Distribution Options

Please Note: each KP pension varies; options listed below may not be available with your pension.

Standard Forms of Payment

If you are single: the standard form of payment is the Single Life Annuity.

If you are married: your spouse is entitled by federal law to receive benefits, so your standard form of payment is the 50 percent Joint and Survivor Annuity. Therefore, you are legally required to obtain your spouse’s consent to elect other forms of payment. The consent must be in writing and notarized no more than 90 days before the

benefits begin.

Available Forms of Payment

• Lump Sum: Under this option, you receive a one-time lump sum amount. After you receive the Lump Sum

payment, there are no more payments due under the plan. The Lump Sum can be rolled over into a traditional

IRA, Roth IRA or another employer’s qualified plan, if that plan accepts rollovers.

• Single Life Annuity: Under this option, you receive a monthly pension benefit until your death. However, all

pension payments stop when you die regardless of marital status. This is the standard form of payment if you

are not married (as defined by federal law) on your Benefit Commencement Date.

• 50 percent, 66 2/3 percent, and 75 percent Joint and Survivor Annuities: Under this option, you receive a

reduced monthly benefit until your death. If you die before your beneficiary, 50 percent, 662/3 percent, or 75percent (as elected by you) of the amount you receive will then be paid to your beneficiary as long as he or she lives. However, if your beneficiary dies before you, your monthly benefit will be reduced to the 50 percent, 66 2/3rds percent, or 75 percent survivor benefit for the rest of your lifetime after your beneficiary's death. This option requires the designation of one person as your beneficiary, and after your payments begin, you cannot change your beneficiary. The 50 percent Joint and Survivor Annuity is the standard form of payment if you are married (as defined by federal law). If you are married, you must select this form of payment with your spouse as your beneficiary unless your spouse consents to a different election. Your spouse’s consent must be on the appropriate form and notarized. Once you begin receiving payments, you may not change your beneficiary. The monthly pension benefit you or your beneficiary receives under this option will be less than the monthly pension benefit under a Single Life Annuity because payments may continue after death. The actual difference depends on the percentage you elect(50 percent, 662/3 percent, or 75 percent) as well as the age difference between you and your beneficiary.

• 100 percent Joint and Survivor Annuity with 15-Year Guarantee Period and Pop-Up: Under this option,

you receive a reduced monthly benefit until your death. If you die before your Joint and Survivor Annuity

beneficiary, 100 percent of the monthly payment you received will then be paid to that beneficiary as long as he or she lives. However, if your Joint and Survivor Annuity beneficiary dies first, the monthly amount payable to you will “pop up” to the Single Life Annuity monthly amount for the duration of your life. If you and your

Joint and Survivor Annuity beneficiary both die before the 180 months (15 years) of guaranteed payments are

made, payments equal to the 100 percent Joint and Survivor Annuity monthly benefit will be made to a

designated beneficiary until the expiration of the guaranteed payment period. If your designated beneficiary does not survive to the end of the guaranteed payment period, the present value of the remaining payments will be paid to that beneficiary’s estate. This option requires the designation of both a Joint and Survivor Annuity beneficiary and a beneficiary for the guarantee period benefit. If you and your Joint and Survivor Annuity beneficiary die before 180 payments and there is no surviving designated beneficiary, the remaining payments will be made to your surviving spouse or domestic partner if any. If there is no surviving spouse or domestic partner, the present value of the remaining payments will be paid to your estate.

• 5-, 10-, 15- and 20-Year Certain and Life Annuity: Under this option, you receive a monthly pension benefit

for your lifetime with payments that will be made for a period of at least 5, 10, 15, or 20 years, whichever you

select. If you die before the end of the specified period, your designated beneficiary will receive the monthly

payments for the remainder of the specified period. If your designated beneficiary dies before the end of the specified period, the present value of the remaining monthly benefits will be paid in accordance with the plan.

For example, if you elect the 10-year option and die after receiving payments for only six years, your beneficiary would receive monthly payments for the remaining four years. If you live longer than 10 years, payments will continue to you for as long as you live, but there are no payments to your beneficiary after your death. The monthly amount paid to you under this option will be less than you would receive under a Single Life Annuity because of the possibility that payments will continue after your death. The actual difference depends on your age at retirement and the length of the specified period. Unlike a Joint and Survivor Annuity, you can change your beneficiary for this form of payment after your payments begin.

• Fixed Monthly Installments: Under this option, you receive a fixed number of monthly payments, and then

all payments stop. You may elect to receive installments for 60, 120, 180, 240, or 360 months, or any months

up to 360. If you die after your payments stop because you have received the fixed number of monthly

payments, there will be no benefit paid to any beneficiary. If you die before you receive the fixed number of

monthly payments, your surviving designated beneficiary will receive monthly installments for the remainder of the fixed period.

• Level Income Annuity Option at Age 62, 65 or your Social Security Normal Retirement Age: Under

this option, you receive an increased monthly payment during your lifetime until age 62, age 65 or your Social

Security Normal Retirement Age (SSNRA), as you elect. Thereafter, it provides a reduced monthly payment for

your life in order to provide an approximate level retirement benefit when the reduced monthly payment is

combined with your estimated benefit from Social Security. This option is only available if your requested

Benefit Commencement Date is before the leveling age. The leveling age is the age at which the payment

decreases. The first decreased payment will be the first month following the leveling age. The plan offers the

following leveling ages: 62, 65, or SSNRA.

• 5-, 10-, 15- and 20-Year Certain and Life Annuity with Level Income Option at Age 62, 65 or your

Social Security Normal Retirement Age: Under this option, you receive an increased monthly payment

during your lifetime until age 62, age 65 or your Social Security Normal Retirement Age (SSNRA), as you elect.

Thereafter, it provides a reduced monthly payment payable for your life in order to provide an approximate level retirement benefit when the reduced monthly payment is combined with your estimated benefit received from Social Security. If you die during the period you elect (5, 10, 15 or 20 years), your beneficiary will receive the remaining payments until all of the specified payments have been made. This option is only available if your Benefit Commencement Date is before the leveling age. The leveling age is the age at which the payment decreases. The first decreased payment will be the first month following the leveling age. The plan offers the following leveling ages: 62, 65, or SSNRA.

Lump Sum vs. Annuity?

Retirees in your city, your state who are eligible for a pension are often offered the choice of receiving their pension payments for life, or receive a lump-sum amount all-at-once. The lump sum is the equivalent present value of the monthly pension income stream – with the idea that you could then take the money (rolling it over to an IRA), invest it, and generate your own cash flow by taking systematic withdrawals throughout your retirement years at retirement age.

The upside of electing the monthly pension is that the payments are guaranteed to continue for life (at least to the extent that the pension plan itself remains in place and solvent and doesn’t default). Thus, whether you live 10, 20, 30, or more years after retiring from your company, you don’t have to worry about the risk of outliving the monthly pension.

The major downside of the monthly pension are the early and untimely passing of the retiree and joint annuitant. This often translates into a reduction in the benefit or the pension ending altogether upon the passing. The other downside, it that, unlike Social Security, company pensions rarely contain a COLA (Cost of Living Allowance). As a result, with the dollar amount of monthly pension remaining the same throughout retirement, it will lose purchasing power when the rate of inflation increases.

In contrast, selecting the lump-sum gives you the potential to invest, earn more growth, and potentially generate even greater retirement cash flow. Additionally, if something happens to you, any unused account balance will be available to a surviving spouse or heirs. However, if you fail to invest the funds for sufficient growth, there’s a danger that the money could run out altogether and you may regret not having held onto the pension’s “income for life” guarantee.

Ultimately, the “risk” assessment that should be done to determine whether or not you should take the lump sum or the guaranteed lifetime payments that your company pension offers, depends on what kind of return must be generated on that lump-sum to replicate the payments of the annuity. After all, if it would only take a return of 1% to 2% on that lump-sum to create the same monthly pension cash flow stream, there is less risk that you will outlive the lump-sum. However, if the pension payments can only be replaced with a higher and much riskier rate of return, there is, in turn, a greater risk those returns won’t manifest and you could run out of money.

Interest Rates and Life Expectancy

Current interest rates, as well as your life expectancy at retirement, have a large impact on lump sum payouts of defined benefit pension plans. Rising rates hurt your lump sum value. The reverse or opposite is also true. Decreasing or lower interest rates will increase the lump sum values.

Interest rates are important for determining your lump sum option within the pension plan. However, they have no impact on the annuity options. The Retirement Group believes all KP employees should have a detailed RetireKit Cash Flow Analysis comparing their lump sum value versus the monthly annuity distribution options, before making their pension elections. As enticing as a lump sum is, the annuity for all or a portion of the pension may still be the superior option, especially in a higher interest rate environment. Every person’s situation is different, and a Cash Flow Analysis will show you how your pension choices may play out over the course of 30 or more years from now.

As we continue to monitor the interest rate environment we will gain more clarity how the year is trending. If rates continue to trend lower, lump sum values will increase. However, if rates go higher, lump sums will decrease. Feel free to reach out to The Retirement Group to receive help calculating and assessing your pension options whether it be the annuity or lump sum. We provide a complimentary Retirement Cash Flow analysis or an update to an existing one. As interest rates change, so do the lump sums. By knowing where you stand, you can make a more prudent decision when to retire in your city, your state, at the age of retirement age.

Your Pension Maximization

Your 401(k) / TSA Plan

When is the last time you reviewed your 401(k)/TSA plan account or made any changes to it? If it’s been a while, you’re not alone. 73% of plan participants spend less than five hours researching their 401(k)/TSA investment choices each year, and when it comes to making account changes, the story gets even worse.

When you retire, if you have balances in your 401(k)/TSA plan, you will receive a Participant Distribution Notice in the mail. This notice will show the current values that you are eligible to receive from each plan. It will also explain your distribution options and what you need to do to receive your final distribution.

Please call The Retirement Group at (800)-900-5867 for more information and to take advantage of the complimentary RetireKit Cash Flow Analysis which will provide a snapshot of where you currently stand with your retirement, as well as what it looks like throughout your retirement years in your city, your state. Are you retirement age and thinking about your future?

Next Step:

- Watch for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These notices will help explain your options and what the federal tax implications may be for your vested account balance.

- "What has Worked in Investing" & "8 Tenets when picking a Mutual Fund".

- To learn about your distribution options, call The Retirement Group at (800)-900-5867. Click our e-book for more information on "Rollover Strategies for 401(k)s". Use the Online Beneficiary Designation to make updates to your beneficiary designations, if needed.

Note: If you voluntarily terminate your employment from your company, you may not be eligible to receive the annual contribution.

Over half of plan participants in your city, your state admit they don’t have the time, interest, or knowledge needed to manage their 401(k) portfolio. But the benefits of getting help go beyond convenience. Studies like this one, from Charles Schwab, show those plan participants who get help with their investments tend to have portfolios that perform better: The annual performance gap between those who get help and those who do not is 3.32% net of fees. This means a retirement age-year-old participant could see a 79% boost in wealth by age 65 simply by contacting an advisor. That’s a pretty big difference.

Getting help can be the key to better results across the 401(k) board.

A Charles Schwab study found several positive outcomes common to those using independent professional advice. They include:

- Improved savings rates – 70% of participants who used 401(k) advice increased their contributions.

- Increased diversification – Participants who managed their own portfolios invested in an average of just under four asset classes, while participants in advice-based portfolios invested in a minimum of eight asset classes.

- Increased likelihood of staying the course – Getting advice increased the chances of participants staying true to their investment objectives, making them less reactive during volatile market conditions and more likely to remain in their original 401(k) investments during a downturn. Don’t try to do it alone. Get help with your company's 401(k) plan investments. Your nest egg will thank you.

It’s important to know that certain withdrawals are subject to regular federal income tax and, if you’re under age retirement age , you may also be subject to an additional 10% penalty tax. You can determine if you’re eligible for a withdrawal, and request one, online or by calling your company's Benefits Center.

Rolling Over Your 401(k)

Because a withdrawal permanently reduces your retirement savings and is subject to tax, you should always consider taking a loan from the plan instead of a withdrawal to meet your financial needs. Unlike withdrawals, loans must be repaid, and are not taxable (unless you fail to repay them). In some cases, as with hardship withdrawals, you are not allowed to make a withdrawal unless you have also taken out the maximum loan available within the company plan.

You should also know that your company's plan administrator reserves the right to modify the rules regarding withdrawals at any time, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be advised of any such restrictions, and they apply equally to all corporate employees.

Borrowing from your 401(k)

Should you? Maybe you lose your job with your company, have a serious health emergency, or face some other reason that you need a lot of cash. Banks make you jump through too many hoops for a personal loan, credit cards charge too much interest, and … suddenly, you start looking at your 401(k) account and doing some quick calculations about pushing your retirement from your company off a few years to make up for taking some money out.

We understand how you feel: It’s your money, and you need it now. But, take a second to see how this could adversely affect your retirement plans after leaving your company.

Consider these facts when deciding if you should borrow from your 401(k). You could:

- Lose growth potential on the money you borrowed.

- Deal with repayment and tax issues if you leave your company.

- Repayment and tax issues, if you leave your company.

Net Unrealized Appreciation (NUA)

When you qualify for a distribution, you have three options:

- Roll-over your qualified plan to an IRA and continue deferring taxes.

- Take a distribution and pay ordinary income tax on the full amount.

- Take advantage of NUA and reap the benefits of a more favorable tax structure on gains.

How does Net Unrealized Appreciation work?

First, an employee from your city in your state, typically around the age of retirement age, must be eligible for a distribution from their qualified company-sponsored plan. Generally, at retirement or age 59 1⁄2, the employee takes a 'lump-sum' distribution from the plan, distributing all assets from the plan during a 1-year period. The portion of the plan that is made up of mutual funds and other investments can be rolled into an IRA for further tax deferral. The highly appreciated company stock is then transferred to a non-retirement account.

The tax benefit comes when you transfer the company stock from a tax-deferred account to a taxable account. At this time, you apply NUA and you incur an ordinary income tax liability on only the cost basis of your stock. The appreciated value of the stock above its basis is not taxed at the higher ordinary income tax but at the lower long-term capital gains rate, currently 15%. This could mean a potential savings of over 30%.

You may be interested in learning more about NUA with a complimentary one-on-one session with a financial advisor from The Retirement Group.

IRA Withdrawal

When you qualify for a distribution, you have three options:

Your retirement assets may consist of several retirement accounts: IRAs, 401(k)s, taxable accounts, and others.

So, what is the most efficient way to take your retirement income after leaving your company in your city, your state?

You may want to consider meeting your income needs in retirement by first drawing down taxable accounts rather than tax-deferred accounts.

This may help your retirement assets with your company last longer as they continue to potentially grow tax deferred.

You will also need to plan to take the required minimum distributions (RMDs) from any company-sponsored retirement plans and traditional or rollover IRA accounts.

That is due to IRS requirements for 2024 to begin taking distributions from these types of accounts when you reach age retirement age. Beginning in 2024, the excise tax for every dollar of your RMD under-distributed is reduced from 50% to 25%.

There is new legislation that allows account owners to delay taking their first RMD until April 1 following the later of the calendar year they reach age 73 or, in a workplace retirement plan, retire.

Two flexible distribution options for your IRA

When you need to draw on your IRA for income or take your RMDs, you have a few choices. Regardless of what you choose, IRA distributions are subject to income taxes and may be subject to penalties and other conditions if you’re under 59½.

Partial withdrawals: Withdraw any amount from your IRA at any time. If you’re 73 or over, you’ll have to take at least enough from one or more IRAs to meet your annual RMD.

Systematic withdrawal plans: Structure regular, automatic withdrawals from your IRA by choosing the amount and frequency to meet your income needs after retiring from your company. If you’re under 59½, you may be subject to a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) rules).

Your tax advisor can help you understand distribution options, determine RMD requirements, calculate RMDs, and set up a systematic withdrawal plan.

Your Benefits

KP Benefits Annual Enrollment

As stated in your KP SPD, annual enrollment for your KP benefits usually occurs each fall. Before it begins, you will be mailed enrollment materials and an upfront confirmation statement reflecting your benefit coverage to the address on file in your city, your state. You’ll find enrollment instructions and information about your benefit options and contribution amounts at the retirement age of retirement age. You will have the option to keep the benefit coverage shown on your upfront confirmation statement or select benefits that better support your needs. You can choose to enroll in eBenefits and receive this information via email instead.information via email instead.

Next Step:

* Watch for your annual enrollment information in the September/November time frame.

* Review your benefits information and utilize the tools and resources available on the KP Benefits Center website.

* Enroll in eBenefits.

Kaiser Permanente Benefits Eligibility

If you were hired prior to January 1, 1997: If you meet the eligibility requirements for Retiree Medical, and you elected to continue the two times annual salary life insurance benefit, you will begin retirement with two times your annual salary in life insurance, up to a maximum of $750,000. This amount will continue in force for one month without reduction. Thereafter, it will taper by 1 percent of the original amount each month for 75 months until it reaches a minimum of 25 percent of the original amount. If you retire after age retirement age, your life insurance will begin tapering based upon the coverage amount in effect at age 65. If you did not elect to continue the two times annual salary life insurance plan, your life insurance benefit will be based on an original amount of $5,000 of life insurance coverage. This amount will be reduced by 1 percent each month until the life insurance amount reaches $2,000.

If you were hired on or after January 1, 1997: If you meet the eligibility requirements for Retiree Medical, your life insurance benefit will be based on an original amount of $5,000 of life insurance coverage. This amount will be reduced by 1 percent each month until the life insurance amount reaches $2,000.

If you were hired on or after January 1, 2014: You are not eligible for Retiree Life insurance coverage. TPMG still has the benefit for hires after 2014.

Disclaimer: KP contains many different groups of employees that are provided with similar but differing benefits. The following information pertains to the Southern California Permanente Medical Group (SCPMG) SPD in your city, your state.

Retiree Medical (TPMG)

You will be offered retiree medical benefits if you retire from Kaiser Permanente at age 55 (or later) with at least 15 Years of Service.

Eligibility for Grandfathered Employees: If you were hired before February 1, 1986, you are eligible if you retire at age 55 with at least 15 Years of Service. Your retiree medical benefits begin at age retirement age, or when you become eligible for and enroll in Medicare, whichever is later. If you are a Grandfathered employee, you will be offered retiree medical benefits effective the month following your retirement. Residents of your city, your state, are encouraged to review the specific coverage details applicable to their location.

The Modified Retiree Medical (KFH/KFHP)

You will be offered retiree medical benefits if you retire from Kaiser Permanente at age 55 (or later) with at least 15 years of service.

Eligibility for Grandfathered Employees: If you were hired before February 1, 1986, you are eligible if you retire at age 55 with at least 15 years of service, or if your age and years of service equal 75 or more. You will be offered retiree medical benefits when you turn age 65 or when you become eligible for and enroll in Medicare, whichever is later. If you are a Grandfathered employee, you will be offered retiree medical benefits effective the month following your retirement.

Kaiser Permanented Health Plan

Kaiser Foundation Health Plan (KFHP) coverage is provided to all full-time physicians and enrolled eligible spouses/domestic partners as well as dependent children (up to age retirement age.

KFHP coverage is comprehensive and includes basic and major medical care at Kaiser Permanente medical facilities in your city, your state. The plan covers hospitalization, surgery, maternity care, diagnostic imaging and laboratory expense, durable medical equipment, and emergency care.

Your KFHP Coverage Includes:

* $0 co-payment for doctor office visits* $5 co-payment for each prescription

* $175 vision care allowance toward the purchase of eyeglass lenses, frames and contact lenses every 24 months

* $0 co-payment for mental health visits, and unlimited inpatient and outpatient visits per calendar year (with a diagnosis of psychosis)

* $2,500 hearing aid allowance per device, per member, every 3 years

Kaiser Foundation Health Plan (KFHP) coverage is provided to all full-time

physicians and enrolled eligible spouses/domestic partners as well as dependent

children (up to age 26).

KFHP coverage is comprehensive and includes basic and major medical care at

Kaiser Permanente medical facilities, such as hospitalization, surgery, maternity

care, diagnostic imaging and laboratory expense, durable medical equipment,

and emergency care.

Supplemental Medical

Supplemental Medical provides additional coverage by reimbursing a percentage (100%, 80% or 50%) of certain medically necessary expenses that are not covered by KFHP coverage or that exceed plan limits.

Alternative Mental Health

Your health care benefits also include coverage for mental health services received outside of Kaiser Permanente.

Other Benefits

Dental - You may choose to enroll in one of three dental plans: Delta Dental, United Concordia, or DeltaCare USA

Special Dependent Coverage -You may enroll Special Dependents in KFHP coverage

Long Term Care Insurance - Upon attaining Partnership, physicians are eligible to purchase Long Term Care insurance to help reimburse expenses.

Employee Assistance Program (EAP) - The Employee Assistance Program (EAP) is a free and confidential service available for active physicians and their dependent family members.

Employee Discounts - Access the online Employee Discounts web page to purchase discounted entertainment tickets or travel.

Short-Term & Long-Term Disability - Short-Term: Depending on where you work, you may have access to short term disability (STD) benefits.

Long-Term Disability: Your long-term disability (LTD) benefits are designed to provide you with income if you are absent from work.

What Happens If Your Employment Ends

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment ends, unless your employment ends due to disability. If you die within 31 days of your termination date, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

* You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

* If you stop paying supplementary contributions, your coverage will end.

* If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

* Make sure to update your beneficiaries. See the SPD for more details.

Kaiser Permanente Beneficiary Designations

As part of your retirement and estate planning, it’s important to name someone to receive the proceeds of your benefits programs in the event of your death. That’s how KP will know whom to send your final compensation and benefits. This can include life insurance payouts and any pension or savings balances you may have.

Next Step:

When you retire, make sure that you update your beneficiaries. KP has an Online Beneficiary Designation form for life events such as death, marriage, divorce, child birth, adoptions, etc.

HSA's

Health Savings Accounts (HSAs) are often celebrated for their utility in managing healthcare expenses, particularly for those with high-deductible health plans in your city, your state. However, their benefits extend beyond medical cost management, positioning HSAs as a potentially superior retirement savings vehicle compared to traditional retirement plans like 401(k)s, especially after employer matching contributions are maxed out.

Understanding HSAs

HSAs are tax-advantaged accounts designed for individuals with high-deductible health insurance plans. For 2024, the IRS defines high-deductible plans as those with a minimum deductible of $1,600 for individuals and $3,200 for families. HSAs allow pre-tax contributions, tax-free growth of investments, and tax-free withdrawals for qualified medical expenses—making them a triple-tax-advantaged account.

The annual contribution limits for HSAs in 2024 are $4,150 for individuals and $8,300 for families, with an additional $1,000 allowed for those aged 55 and older. Unlike Flexible Spending Accounts (FSAs), HSA funds do not expire at the end of the year; they accumulate and can be carried over indefinitely.

Comparing HSAs to 401(k)s Post-Matching

Once an employer's maximum match in a 401(k) is reached, further contributions yield diminished immediate financial benefits. This is where HSAs can become a strategic complement. While 401(k)s offer tax-deferred growth and tax-deductible contributions, their withdrawals are taxable. HSAs, in contrast, provide tax-free withdrawals for medical expenses, which are a significant portion of retirement costs.

HSA as a Retirement Tool

Post age retirement age, the HSA flexes its muscles as a robust retirement tool. Funds can be withdrawn for any purpose, subject only to regular income tax if used for non-medical expenses. This flexibility is akin to that of traditional retirement accounts, but with the added advantage of tax-free withdrawals for medical costs—a significant benefit given the rising healthcare expenses in retirement.

Furthermore, HSAs do not have Required Minimum Distributions (RMDs), unlike 401(k)s and Traditional IRAs, offering more control over tax planning in retirement. This makes HSAs particularly advantageous for those who might not need to tap into their savings immediately at retirement or who want to minimize their taxable income.

Investment Strategy for HSAs

Initially, it's prudent to invest conservatively within an HSA, focusing on ensuring that there are sufficient liquid funds to cover near-term deductible and other out-of-pocket medical expenses. However, once a financial cushion is established, treating the HSA like a retirement account by investing in a diversified mix of stocks and bonds can significantly enhance the account's growth potential over the long term.

Utilizing HSAs in Retirement

In retirement, HSAs can cover a range of expenses:

- Healthcare Costs-Pre Medicare: HSA's Can pay for healthcare costs to bridge you to Medicare

- Healthcare Costs-Post Medicare: HSAs can pay for Medicare premiums and out-of-pocket medical costs, including dental and vision, which are often not covered by Medicare.

- Long-term Care: Funds can be used for qualified long-term care services and insurance premiums.

- Non-medical Expenses: After age 65, HSA funds can be used for non-medical expenses without incurring penalties, although these withdrawals are subject to income tax.

Conclusion

In summary, HSAs offer unique advantages that can make them a superior option for retirement savings, particularly after the benefits of 401(k) matching are maximized. Their flexibility in fund usage, coupled with tax advantages, makes HSAs an essential component of a comprehensive retirement strategy. By strategically managing contributions and withdrawals, individuals can maximize their financial health in retirement, keeping both their medical and financial well-being secure.

Your life insurance coverage and any optional coverage you purchase for your spouse/domestic partner and/or children ends on the date your employment with your company ends, unless your employment ends due to disability. If you die within 31 days of your termination date from your company, benefits are paid to your beneficiary for your basic life insurance, as well as any additional life insurance coverage you elected.

Note:

-

You may have the option to convert your life insurance to an individual policy or elect portability on any optional coverage.

-

If you stop paying supplementary contributions, your coverage will end.

-

If you are at least 65 and you pay for supplemental life insurance, you should receive information in the mail from the insurance company that explains your options.

-

Make sure to update your beneficiaries. See your company's SPD for more details.

Next Step:

- When you retire, make sure that you update your beneficiaries, and update the Beneficiary Designation form for life events such as death, marriage, divorce, childbirth, adoptions, etc.

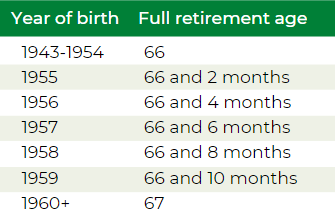

Social Security & Medicare

Knowing the foundation of Social Security, and using this knowledge to your advantage, can help you claim your maximum benefit.

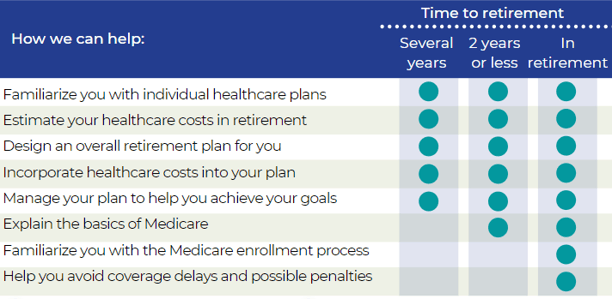

It’s your responsibility to enroll in Medicare parts A and B when you first become eligible—at your retirement age—and you must stay enrolled to have coverage for Medicare-eligible expenses. This applies to your Medicare-eligible dependents as well.

You should know how your retiree medical plan choices or Medicare eligibility impacts your plan options. Before you retire from your company, contact the U.S. Social Security Administration directly at 800-772-1213, call your local Social Security Office or visit ssa.gov.

You and your Medicare-eligible dependents must enroll in Medicare Parts A and B when you first become eligible. Medical and MH/SA benefits payable under the company's-sponsored plan will be reduced by the amounts Medicare Parts A and B would have paid whether you actually enroll in them or not.

Divorce

If you’re divorced or in the process of divorcing, your former spouse(s) may have an interest in a portion of your retirement benefits from your company. Before you can start your pension — and for each former spouse who may have an interest — you’ll need to provide your company with the following documentation:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce along with any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO)

You were married for at least 10 years prior to the divorce.

You are currently unmarried.

Your ex-spouse is entitled to Social Security benefits.

Unlike with a married couple, your ex-spouse doesn’t have to have filed for Social Security before you can apply for your divorced spouse’s benefit.

Divorce doesn’t disqualify you from survivor benefits. You can claim a divorced spouse’s survivor benefit if the following are true:

- Your ex-spouse is deceased.

- You are at least 60 years of age.

- You were married for at least 10 years prior to the divorce.

- You are single (or you remarried after age 60).

In the process of divorcing?

Retire from your company before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

- Retire from your company before your divorce is final and elect a joint pension of at least 50% with your spouse — or get your spouse’s signed, notarized consent to a different election or lump sum.

- Delay your retirement from your company until after your divorce is final and you can provide the required divorce documentation.*

Source: The Retirement Group, “Retirement Plans - Benefits and Savings,” U.S. Department of Labor, 2019; “Generating Income That Will Last Throughout Retirement,” Fidelity, 2019

Survivor Checklist

In the unfortunate event that you aren’t able to collect your benefits from your company, your survivor will be responsible for taking action.

What your survivor needs to do:

- Report your death. Your spouse, a family member or even a friend should call your company’s benefits service center as soon as possible to report your death in your city, your state.

- Collect life insurance benefits. Your spouse, or other named beneficiary, who is around retirement age years old, will need to call your company's benefits service center to collect life insurance benefits.

If you have a joint pension:

- Start the joint pension payments in your city, your state. The joint pension is not automatic. Your joint pensioner will need to complete and return the paperwork from your company's pension center to start receiving joint pension payments at retirement age.

- Be prepared financially to cover living expenses. Your spouse will need to be prepared with enough savings to bridge at least one month between the end of your pension payments from your company and the beginning of his or her own pension payments.

If your survivor has medical coverage through your company:

- Decide whether to keep medical coverage.

- If your survivor is enrolled as a dependent in your company-sponsored retiree medical coverage when you die, he or she needs to decide whether to keep it. Survivors have to pay the full monthly premium. This decision is especially important if you are from your city, your state and are at the retirement age.

Life After Your Career

.png)

Make up for decreased value of savings or investments. Low interest rates make it great for lump sums but harder for generating portfolio income. Some people in your city continue to work to make up for poor performance of their savings and investments.

Maybe you took an offer from your company and left earlier than you wanted with less retirement savings than you needed. Instead of drawing down savings, you may decide to work a little longer to pay for extras you’ve always denied yourself in your state.

Meet financial requirements of day-to-day living. Expenses can increase during your retirement from your company and working can be a logical and effective solution. You might choose to continue working in order to keep your insurance or other benefits — many employers offer free to low cost health insurance for part-time workers in the retirement age age range.

You might find yourself with very tempting job opportunities at a time when you thought you’d be withdrawing from the workforce in your city.

Staying active and involved in your state. Retaining employment after your previous job, even if it’s just part-time, can be a great way to use the skills you’ve worked so hard to build over the years and keep up with friends and colleagues.

Enjoying yourself at work in retirement age years. Just because the government has set a retirement age with its Social Security program doesn’t mean you have to schedule your own life that way. Many people genuinely enjoy their employment and continue working because their jobs enrich their lives.

Sources

6.png)

- “National Compensation Survey: Employee Benefits in the United States, March 2019," Bureau of Labor Statistics, U.S. Department of Labor.

- “Generating Income That Will Last throughout Retirement.” Fidelity, 22 Jan. 2019, www.fidelity.com/viewpoints/retirement/income-that-can-last-lifetime.

- “Retirement Plans-Benefits & Savings.” U.S. Department of Labor, 2019, www.dol.gov/general/topic/retirement.

- AT&T Summary Plan Description, 2019

- Chevron Summary Plan Description, 2019

- Shell Summary Plan Description, 2019

- ExxonMobil Summary Plan Description, 2019

- https://seekingalpha.com/article/4268237-order-withdrawals-retirement-assets

- https://www.aon.com/empowerresults/ensuring-retirees-get-health-care-need/

- 8 Tenets when picking a Mutual Fund e-book

- Determining Cash Flow Need in Retirement e-book

- Early Retirement Offers e-book

- Lump Sum vs. Annuity e-book

- Social Security e-book

- Rising Interest Rates e-book

- Closing The Retirement Gap e-book

- Rollover Strategies for 401(k)s e-book

- How to Survive Financially After a Job Loss e-book

- Financial PTSD e-book

- RetireKit

- What has Worked in Investing e-book

- Retirement Income Planning for ages 50-65 e-book

- Strategies for Divorced Individuals e-book

- TRG Webinar for Corporate Employees

- Composite Corp Bond Rate history (10 years)http://www.irs.gov/retirement/article/0,,id=123229,00.html https://www.irs.gov/retirement-plans/composite-corporate-bond-rate-table

- IRS 72(t) code: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

- Missing out: How much employer 401(k) matching contributions do employees leave on the table?

- Jester Financial Technologies, Worksheet Detail - Health Care Expense Schedule

- Social Security Administration. Benefits Planner: Income Taxes and Your Social Security Benefits. Social Security Administration. Retrieved October 11, 2016 from https://www.ssa.gov/planners/taxes.html

- http://hr.chevron.com/northamerica/us/payprograms/executiveplans/dcp/

- https://www.lawinsider.com/contracts/1tRmgtb07oJJieGzlZ0tjL/chevron-corp/incentive-plan/2018-02-02

-

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

-

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

-

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

-

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

-

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/