Healthcare Provider Update: Healthcare Provider for Cummins Inc. Cummins Inc. primarily administers its employee health benefits through major insurance providers, including UnitedHealthcare and Anthem Blue Cross Blue Shield (BCBS), among others. Potential Healthcare Cost Increases in 2026 As Cummins Inc. anticipates significant healthcare cost increases in 2026, employees should prepare for potential spikes in premiums driven by a combination of factors. A projected rise of up to 8.5% in employer-sponsored insurance costs, alongside the potential expiration of enhanced ACA subsidies, may lead many employees to see their out-of-pocket expenses grow considerably. With certain states experiencing premium hikes exceeding 60%, comprehensive financial planning, including the strategic use of Health Savings Accounts (HSAs), will become essential for mitigating the anticipated financial impact on individuals and families. Click here to learn more

With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect Cummins Inc employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from Cummins Inc, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by Cummins Inc might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for Cummins Inc, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

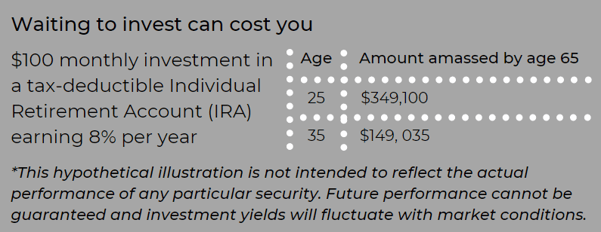

Retirement account contributions: Contributing to your Cummins Inc 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, Cummins Inc workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by Cummins Inc, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

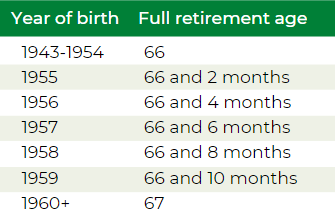

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving Cummins Inc, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from Cummins Inc, like healthcare. Many Cummins Inc corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from Cummins Inc.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

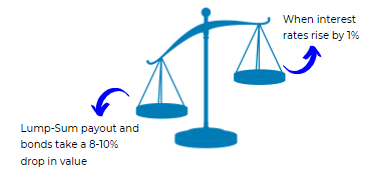

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

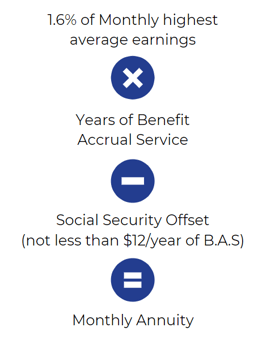

Highest Average Earnings is the monthly average of your regular earnings for the 36 consecutive months in which they’re the highest.

In most cases, this will be the sum of your last 36 months divided by 36.

The applicable interest rate is a separate average of each of the three segment rates for the fifth, fourth and third months preceding your annuity start date. The three segment rates are calculated by the IRS according to regulations that are also part of the Pension Protection Act of 2006 and reflect the yields of short-, mid-, and long-term corporate bonds. (Note: Chevron also has Legacy Unocal and Legacy Texaco Retirement Plans)

Different Plans

Similar to Chevron, AT&T has many different plans available. With AT&T, they have different pension plan formulas for management & non-management. Lets look at a sample non-management plan.

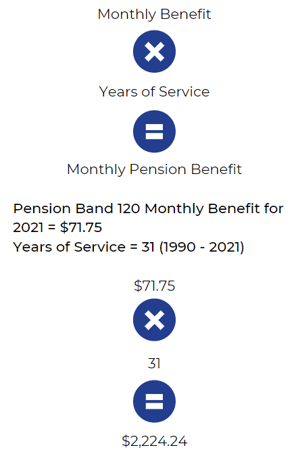

AT&T non-management employees have their own Craft/non-management pension plan. Let's take a look at a pension example for a gentleman by the name of Joe Smith who is hourly and using the Craft/non-management pension plan.

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

-

Craft has a defined benefit plan that uses pension bands.

-

A pension band determines your benefits based on your job title/grade level/occupation.

- Joe will receive a monthly dollar amount into his account for each year of service.

-

Joe's benefit (pension band may change yearly).

-

A pension band determines your benefits based on your job title/grade level/occupation.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

How does Cummins determine eligibility for participation in the Cummins Pension Plan, and what are the implications for employees who temporarily leave the workforce? This inquiry should delve into the specific criteria that define an eligible employee, such as citizenship requirements and exclusions, as well as the continuation of benefits and service credit during approved leaves or breaks in service at Cummins. It would also explore the complexities surrounding vesting and how service prior to a break is credited upon re-employment at Cummins.

Eligibility and Participation in the Cummins Pension Plan: Eligibility for the Cummins Pension Plan requires being an active employee, not participating in another Cummins defined benefit pension plan, and meeting certain citizenship or residency criteria. During approved leaves of absence, employees continue to accrue service credits, ensuring continuous growth in their pension benefits. Notably, vesting occurs after three years of service, securing the employee's entitlement to pension benefits upon leaving the company. The plan handles breaks in service by allowing reemployment within 12 months to count towards vesting and benefit calculations, safeguarding employee benefits against temporary disruptions in their career with Cummins.

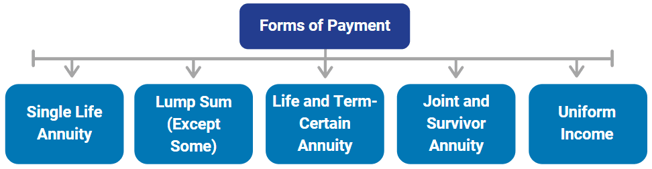

What are the potential benefits and limitations of the forms of distribution available under the Cummins Pension Plan, and how should employees prepare for their pension benefit election? This question requires an analysis of various forms of distributions, such as lump sums versus annuities, highlighting the financial implications of each choice, particularly in relation to the IRS rules for 2024 regarding tax treatment. Employees should also consider how their family structure (e.g., marital status, dependents) may influence their decisions when electing a distribution method.

Distribution Forms and Tax Considerations: The Cummins Pension Plan offers various distribution forms, including lump sums and annuities, each with distinct tax implications under IRS rules for 2024. Employees must consider their family structure and tax status when choosing a distribution form, as these factors influence the tax treatment and financial outcome of their pension benefits. The plan provides clear guidelines on these options, ensuring employees can make informed decisions that align with their personal and financial circumstances.

In what ways do pay credits and interest credits accrue within the Cummins Pension Plan, and how can employees gauge their potential retirement benefits over time? This question will focus on the specifics of how pay credits are calculated based on an employee's compensation and service at Cummins, as well as the impact of interest credits on the total account balance and long-term retirement planning. It will also examine how employees can track these credits through the Cummins retirement resources.

Accrual of Pay and Interest Credits: The pension benefits at Cummins accrue through pay credits based on compensation and service, along with interest credits. Employees can monitor their accumulating benefits through the Cummins retirement resources, offering transparency and planning advantages. This structured accrual method supports employees in projecting their future pension benefits and making informed decisions about their retirement timing and financial needs.

How does Cummins ensure compliance with ERISA and other regulatory standards in the management of the Cummins Pension Plan, and what rights do employees have under these regulations? This query should explore Cummins' obligations as a fiduciary in managing employee benefits and highlight the key rights of plan participants. The discussion should include access to plan documents, the process for filing claims, and the significance of ERISA protections for employees retired from Cummins.

Regulatory Compliance and Employee Rights: Cummins diligently adheres to ERISA standards in managing the pension plan, emphasizing fiduciary responsibility and ensuring participants' rights are upheld. Employees have rights to access plan documents, participate in claims and appeals processes, and are protected under ERISA from any plan-related discrimination. This regulatory compliance not only secures the integrity of their pension benefits but also reinforces the legal framework protecting participant rights.

What role does the Pension Benefit Guaranty Corporation (PBGC) play in safeguarding the retirement benefits of Cummins employees, and how does this affect the perception of the plan's reliability? This question would examine the insurance coverage provided by the PBGC, what types of benefits are guaranteed, and under what circumstances benefits may not be fully covered. Employees might analyze how this federal insurance impacts their confidence in the plan, especially in light of changing economic conditions.

Role of the Pension Benefit Guaranty Corporation (PBGC): The PBGC insures the pension benefits under the Cummins Plan, providing a safety net that enhances the reliability of these benefits. Employees covered by the plan can gain confidence in the security of their pensions, knowing that even in the face of potential plan termination, the PBGC guarantees the core benefits, subject to certain legal limits and conditions.

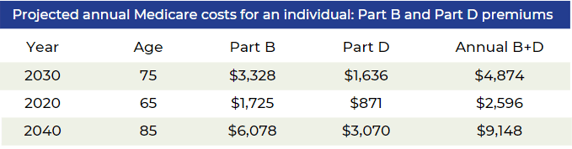

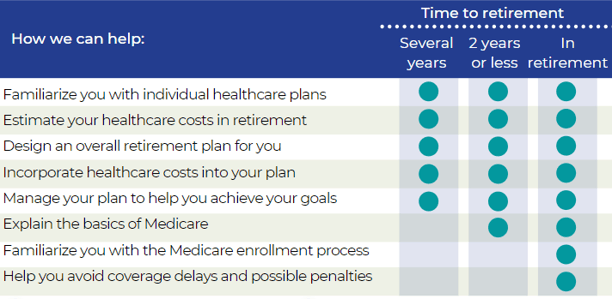

How does the Cummins Pension Plan interface with employees' Social Security benefits, and what should retirees consider when planning for a sustainable retirement income? This inquiry will look at the coordination of benefits under the Cummins plan with Social Security, examining how pension income might influence Social Security calculations. It would require discussions on the timing of retirement elections and how they align with Social Security claims.

Interaction with Social Security Benefits: The Cummins Pension Plan is designed to integrate smoothly with Social Security benefits, offering provisions that help plan participants optimize their total retirement income. Understanding this interaction allows employees to strategically plan their retirement age and benefit commencement, maximizing their financial stability in later life.

What are the specific procedures and deadlines that Cummins employees should follow to successfully elect a distribution from the Cummins Pension Plan upon retirement? This question will necessitate a detailed look at the steps involved in initiating a benefit distribution, including the importance of spousal consent, the timing of application submissions, and any documentation that may be required. Understanding these processes can significantly affect the financial outcomes for retirees.

Procedures and Deadlines for Electing Pension Distribution: The Cummins Pension Plan outlines specific procedures and deadlines for electing a distribution upon retirement, emphasizing the importance of timely and informed decision-making. By understanding these processes, employees can avoid delays and ensure that they receive their pension benefits in the manner that best suits their post-retirement financial plans.

What are the implications of choosing to defer pension benefits and how does the Cummins Plan accommodate employees who opt not to start their benefits at the normal retirement date? This inquiry could address the potential financial consequences of deferring benefits, including eligibility requirements for such deferral and how it aligns with IRS regulations. Employees should critically evaluate their financial situations and retirement goals, weighing the allure of continued employment against starting their retirement benefits sooner.

Deferring Pension Benefits: Employees at Cummins have the option to defer their pension benefits beyond the normal retirement date, which can influence the financial value of their benefits. The plan provides guidelines on how deferral impacts benefit calculations and distributions, assisting employees in making decisions that align with their long-term financial goals.

How can Cummins employees designating beneficiaries ensure that their wishes are respected concerning death benefits, particularly in light of recent changes in the pension landscape? This question focuses on the options available to employees for designating beneficiaries, the process for updating these designations over time, and the specific forms that need to be completed to ensure compliance with the Cummins Pension Plan. It will also discuss the impact of state and federal laws on these designations.

Designating Beneficiaries and Ensuring Compliance: The plan stipulates clear processes for designating beneficiaries for pension benefits, ensuring that employees' wishes are respected and legally documented. This is crucial for planning and securing financial provisions for survivors, reflecting the plan's comprehensive approach to retirement benefits.

How can Cummins employees contact the Cummins Retirement Benefits Service Center to obtain more information about the Cummins Pension Plan and related retirement processes? This question emphasizes the various channels through which employees can reach out to the service center, the types of queries they can address regarding the Cummins Pension Plan, and the resources available online to assist with pension-related inquiries. Employees are encouraged to take advantage of these resources to make informed decisions regarding their retirement planning.

Accessing Information and Assistance: Cummins provides multiple channels for employees to access information and assistance regarding their pension plan, including online resources and a dedicated service center. This accessibility ensures that employees can obtain detailed information and personalized support, enabling them to navigate their pension benefits effectively.

/General/General%205.png?width=1280&height=853&name=General%205.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)