Healthcare Provider Update: Healthcare Provider for ExxonMobil For the upcoming year, ExxonMobil's primary healthcare provider is Blue Cross and Blue Shield of Texas (BCBSTX). Effective from January 1, 2025, employees and their families will access healthcare through BCBSTX, ensuring improved network access and support for managing healthcare costs. Prescription drug services will continue to be provided by Express Scripts. Potential Healthcare Cost Increases in 2026 In 2026, ExxonMobil may experience significant healthcare cost increases, paralleling broader trends in the Affordable Care Act (ACA) marketplace. With some states projecting premium hikes of over 60% and the potential loss of enhanced federal premium subsidies, many employees could see their out-of-pocket costs escalate dramatically. The Kaiser Family Foundation has highlighted that without congressional action, most marketplace enrollees might face increases exceeding 75%. These combined pressures will necessitate careful planning and strategic healthcare decisions from ExxonMobil employees going into 2026. Click here to learn more

In our thorough retirement guide for ExxonMobil employees, we discuss several things to consider when determining whether to retire from ExxonMobil. Some of these issues are healthcare and benefit changes, interest rates, the new 2024 tax rates, inflation, and many others. Keep in mind that we are not linked with ExxonMobil. We recommend contacting your ExxonMobil benefits department for more information.

3. Health Benefits

-

Medical Plans: ExxonMobil's medical plan provides extensive coverage for medical, prescription drug, and mental health services. Employees can select from two Point of Service (POS) II alternatives and network-only options. Preventive care is completely covered, with minimal or no deductibles.

-

Dental and Vision Plans: The dental plan covers all preventative services and a percentage of other dental operations, such as orthodontics. The vision plan includes annual eye tests and allowances for lenses, frames, and contact lenses, as well as discounts on laser eye surgery.

-

Flexible Spending Accounts (FSAs): FSAs enable employees to save pre-tax cash for qualified healthcare and dependent care expenses, lowering taxable income and giving financial relief for out-of-pocket expenses.

-

Employee Assistance Program (EAP): The EAP offers confidential professional counseling for personal and family difficulties, including mental health support, at no extra charge.

4. Security Benefits

-

Life Insurance: Basic life insurance and accidental death and dismemberment (AD&D) coverage are included at no additional cost. Employees can get additional coverage through Group Universal Life (GUL) and optional AD&D insurance.

-

Disability Insurance: Short-term and long-term disability insurance provide income protection in the event of illness or injury. Short-term disability provides up to six weeks of full pay, whereas long-term disability provides half of pay, supplemented by other available replacement income.

5. Financial Benefits

-

Savings Plan: Employees can contribute 6% to 20% of their salaries, with ExxonMobil matching 7% if they contribute at least 6%. The plan provides a variety of investing possibilities, encouraging financial growth and stability.

-

Pension Plan: Enrollment in the pension plan is automatic, and it provides a monthly annuity upon retirement. Vesting takes place after five years of service, with early retirement options available.

-

Financial Fitness Program: The Financial Fitness Program provides tools and resources for financial planning, assisting employees in properly managing their money and preparing for a secure financial future.

6. Support Benefits

-

Work-Life Balance: ExxonMobil promotes work-life balance through a variety of initiatives, including vacation days from the start of employment, personal time for emergencies, and parental paid time off.

-

Adoption Assistance and Back-Up Care: Financial aid for adoption and back-up care programs for family members ensure that employees have the support they require during major life events.

7. Financial Performance and Strategic Updates

-

First Quarter 2024 Financial Results: ExxonMobil reported $8.22 billion in net income for the first quarter of 2024, a 28% decline from the same period in 2023, owing to higher expenses decreased industry refining margins. Total revenue decreased by 1.3% to $83.1 billion, with a profit margin of 9.9%.

-

Operational Achievements: Since 2016, the company has achieved quarterly gross production of more than 600,000 oil-equivalent barrels per day in Guyana and reduced the intensity of operating methane emissions by over 60%.

-

Shareholder Returns: ExxonMobil reported free cash flow of $10.1 billion and shareholder distributions of $6.8 billion in the first quarter of 2024, including $3.8 billion in dividends and $3.0 billion in share repurchases. The yearly share repurchase rate will rise to $20 billion per year.

8. Next Steps for Employees and Retirees

-

Register on the Your Total Rewards site: To fully manage their benefits, employees must first register on the new site. Instructions and temporary passwords will be provided to help with this procedure.

-

Update Payment Methods: Employees who pay health plan premiums by check or automated payment must alter their payment methods to maintain continued coverage.

-

Check Beneficiary Designations: Employees should check and amend beneficiary designations on the new portal to speed up the payment procedure in the event of unforeseen circumstances.

-

Monitor Pension Payments: The interface will provide pension payment statements, allowing retirees to evaluate and control their payments and withholdings.

Conclusion

ExxonMobil's dedication to its employees and retirees is demonstrated by the comprehensive benefits package and the meticulous planning of the transition to Alight Solutions. ExxonMobil protects and supports its staff throughout their careers and into retirement by providing a wide range of health, security, financial, and support benefits, as well as improved management tools. The switch to Alight Solutions is a key step toward better benefits administration, giving employees and retirees better access, security, and management of their benefits.

2024 Tax Changes & Inflation

Individuals must be aware of any new changes implemented by the IRS. The primary factors that will most likely influence corporate personnel are:

- The standard deduction for 2024 will rise to $14,600 for single filers and married couples filing separately, $29,200 for joint filers, and $21,900 for heads of household.

- Taxpayers over the age of 65 or blind can increase their standard deduction by $1,550. If you are not married or have no surviving spouse, the payment increases to $1,950.

The personal exemption for tax year 2024 remains zero, same as it was in 2023. The abolition of the personal exemption was included in the Tax Cuts and Jobs Act.

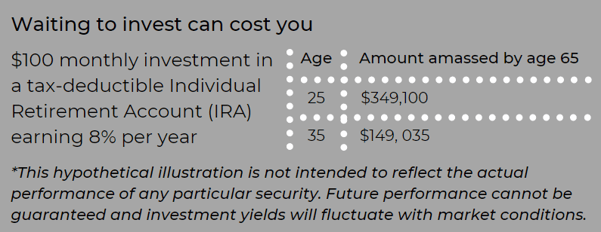

Remote workers hired by a business entity may incur double taxation on state taxes. Because of the epidemic, many employees returned to their homes, which may have been outside of the state where they worked. Some states had temporary relief procedures in place last year to prevent double income taxation, but many of those laws have since expired. Only six states now have a'special convenience of employer' rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for a corporate company and do not now reside in those areas, speak with your tax expert about various strategies to avoid double taxation.Retirement account contributions: Contributing to your employer's 401k plan can dramatically reduce your tax burden, and the amount you can save has increased for 2024. Individuals' 401(k) contributions in 2024 will climb to $23,000, up from $22,500 in 2023. The income levels for determining eligibility to make deductible contributions to traditional IRAs, Roth IRAs, and claim the Saver's Credit will all rise in 2024. The catch-up contribution ceiling for employees 50 and older will rise to $7,500.

As a taxpayer employed by a corporation, you should be aware of the following key changes to the Earned Income Tax Credit (EITC):

- For tax year 2024, the maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers with three or more qualifying children, up from $7,430 in 2023.

- Married taxpayers filing separately may qualify: If you meet the other requirements, you can claim the EITC as a married couple filing separately. This was unavailable in earlier years.

Deduction for cash charitable contributions: The special deduction, which enabled single non-itemizers to deduct up to $300 and married filing jointly couples to deduct $600 in cash donations to qualifying charities, has expired.

Child Tax Credit Changes:

- The highest tax credit per qualified child is $2,000 for children under five and $3,000 for children aged six to seventeen. Furthermore, you cannot obtain a portion of the credit in advance, as was the case in 2023.

- As a parent or guardian, you are eligible for the Child Tax Credit if your adjusted gross income is less than $200,000 when filing alone or less than $400,000 when filing jointly with a spouse.

- Individuals with a tax bill that is less than the credit amount are eligible for a 70% partial refund.

2024 Tax Brackets

Inflation diminishes purchasing power over time because the same basket of products becomes more expensive as prices rise. To maintain your current quality of life after leaving your business, you must account for rising expenditures in your retirement plan. While the Federal Reserve aims for a 2% inflation rate each year, that rate is expected to rise to 4.9% by 2023. A significant increase above 2020's 1.4%. While overall expenses have risen considerably, there are several key areas to consider if you are nearing or in retirement from your job, such as healthcare. Many corporate retirees rely on Medicare as their primary health care provider, and in 2023, their out-of-pocket healthcare costs are expected to rise by 5-14%. In addition to Medicare increases, the cost of over-the-counter drugs is expected to rise by at least 7%. According to the Employee Benefit Research Institute (ERBI)'s 2022 estimate, couples with typical prescription expenses would require $296,000 in retirement savings to cover such expenses. It is critical to consider all of these aspects when developing your overall plan for retirement from your company.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Retirement planning is a verb. Consistent activity is required, whether you are 20 or 60.

The truth is that most Americans have no idea how much to save or how much income they will require.

No matter where you are in the planning process or your present age, we hope this guide provides you with a good overview of the steps to follow and resources to help you streamline your transition from your workplace to retirement and make the most of your benefits.

You understand the importance of saving and investing, especially since time is on your side the sooner you start, but you lack the time and experience to determine whether you are creating retirement funds that will persist when you leave your employer.

'A separate study by Russell Investments, a large money management firm, came to a similar conclusion . Russell estimates a good financial advisor can increase investor returns by 3.75 percent.'

Source: Is it Worth the Money to Hire a Financial Advisor?, the balance, 2021

When you invest in your company's retirement plan, you can potentially increase your wealth by 79% at age 65 over the course of 20 years.

*Source: Bridging the Gap Between 401(k) Sponsors and Participants, T.Rowe Price, 2020

One of the most common planning dilemmas is deciding whether to save for retirement or college. Most financial advisors will advise you that retirement from your employer should be your main priority because your child can usually receive financial assistance, however you will be on your own to fund your retirement.

We always base our retirement investment recommendations on your specific financial circumstances and aspirations. Consider investing at least 10% of your earnings for retirement in your 30s and 40s. Maximizing your company's contribution match should be a goal as long as your specific circumstances allow.

As you enter your 50s and 60s, you should be in your peak earning years, with some large expenses, such as a mortgage or child-rearing, behind you or soon to be in the rearview mirror. This is an excellent moment to think about whether you can increase your retirement savings goal to 20% or more of your income. For many people, this could be their only chance to save money.

Workers aged 50 and over can put up to $23,000 in their retirement plan/401(k) in 2024, with an additional $7,500 in catch-up contributions available once this amount is reached. Annually, these restrictions are increased to reflect inflation.

If you’re a ExxonMobil employee over 50, you may be eligible to use a catch-up contribution within your IRA.

Why are 401(k)s and matching contributions so popular?

These retirement savings vehicles allow you to take advantage of three major benefits:

-

Compound growth prospects (as described above)

-

Tax-saving opportunities

-

Matching contributions

Unfortunately, many consumers may not be taking full benefit of your company's match since they aren't contributing enough themselves.

These retirement savings vehicles allow you to take advantage of three major benefits:

-

Compound growth prospects (as described above)

-

Tax-saving opportunities

-

Matching contributions

Unfortunately, many consumers may not be taking full benefit of your company's match since they aren't contributing enough themselves.

According to Principal Financial Group research published in 2022, 62% of employees believe that business 401(k) matching are critical to meeting retirement goals.

Despite 58% of eligible employees investing in a 401(k) plan last year, 61% contributed less than $5,000, according to Bank of America's "2022 Financial Life Benefit Impact Report".

The study also discovered that fewer than one in every ten members' contributions exceeded the IRS Section 402(g) optional deferral limit, which is $23,000 in 2024.

According to a 2020 Financial Engines report titled "Missing Out: How Much Employer 401(k) Matching Contributions Do Employees Leave on the Table?", employees who do not maximize the employer match typically leave $1,336 of potential additional retirement money on the table each year.

- If your business matches up to 3% of your plan contributions and you only contribute 2% of your salary, you will not receive the entire company match. By boosting your contribution by just 1%, your firm will now match the full 3% (the maximum) of your contributions, for a total combined contribution of 6% of your pay. This ensures that you do not leave money on the table.

Whether you're changing jobs or retiring, deciding what to do with your hard-earned retirement funds can be challenging. A company-sponsored plan, such as a pension or 401(k), may account for the majority of your retirement assets, but how much do you actually understand about it and how it works?

There appear to be an infinite number of restrictions that differ from one retirement plan to the next, including early withdrawal offers, interest rate affects, age penalties, and intricate tax implications.

Increasing your investment balance and lowering taxes are the keys to a successful retirement plan spending strategy. At The Retirement Group, we can explain how your company's 401(k) fits into your entire financial picture and how to make it work for you.

Workers are much more likely to rely on defined contribution (DC) retirement plans for income.

'Getting help and leveraging the financial planning tools and resources your company

makes available can help you understand whether you are on track, or need to

make adjustments to meet your long-term retirement goals...'

Source: Schwab 401(k) Survey Finds Savings Goals and Stress Levels on the Rise

Lately, ExxonMobil has started releasing "Performance Improvement Plans," or PIPs.

When an employee earns a PIP, it indicates that they fell into ExxonMobil's "Needs Significant Improvement" (NSI) performance appraisal category, which represents 8-10% of employees. The PIP is effectively a severance package with the option to participate in an improvement program and perhaps keep your job. ExxonMobil increased the number of employees classified as NSI in April from 3% to 10% of paid US personnel.PIP. When an employee earns a PIP, it indicates that they fell into ExxonMobil's "Needs Significant Improvement" (NSI) performance appraisal category, which represents 8-10% of employees. The PIP is effectively a severance package with the option to participate in an improvement program and perhaps keep your job. ExxonMobil increased the number of employees classified as NSI in April from 3% to 10% of paid US personnel.

Information for XTO employees.

The XTO and ExxonMobil benefits programs were combined after the 2010 merger, however there are a few exceptions that XTO employees should be aware of. Your prior employment as an XTO employee is used to determine your eligibility for various benefits, such as retiree status, vesting, and the lump sum pension option. Years of service previous to ExxonMobil will not be included in your pension formula for computing your pension payout. This is vital to know when deciding when to quit the company in order to optimize your benefits and when to begin receiving your pension benefit.

Furthermore, the interest rates utilized to calculate your lump sum pension payout are based on corporate bond rates, rather than the lower, more favorable Treasury bond rates available to grandfathered ExxonMobil employees. This frequently results in a lesser lump sum payment, therefore it is even more important that you pay attention to the rates and timing of your elections to avoid leaving any money on the table (see the section on pension interest rates for "Non-Grandfathered Employees"). The Retirement Group XTO-focused advisers can guide you through the retirement decision-making process and assist you with your retirement paperwork in order to optimize your retirement benefits while minimizing the chance of making mistakes.

Will ExxonMobil freeze its pension?

ExxonMobil has previously suspended benefits, raising the question of whether they will freeze the pension program. How would it look if they did? A pension freeze would prevent employees from accruing additional future benefits. They would, however, be able to get the benefits that they have already earned. Over the last few decades, many organizations have shifted from defined benefit (DB) plans to defined contribution (DC) plans. Companies freeze or offload DB pension plans in order to reduce their current pension liabilities. By transitioning from a DB plan to a DC plan, firms can also shift risk from the company to the employees. The trend benefits investors because companies that eliminate pension debt become less risky assets. However, this trend may have a severe influence on employees who rely heavily on DB plans for retirement.

Pension Formula

The ExxonMobil Pension Plan is a Defined Benefit Pension, based on years of service, final average pay, and a social security offset, with potential age penalties.

DB Pension (formula based)

-

5 year vest or age 65

-

1.6% * YOS *FAP - SS offset

-

FAP (highest 36 consecutive months in last 10 years

-

Normal Retirement Age

-

Age 60 no AP reduction as a retiree

-

Age 65 no AP reduction as a terminee

-

55 + 15 = Retiree* = -5% per year under 60

-

*Earliest you can take pension is 50 if on disability

Age Penalty Reduction:

-

If you are a pre-65 terminee, you will face harsh age penalties for each year before 65.

-

Pension Distribution Options:

Lump Sum

Annuity (SLA + J&S + Period Certain 10/15/20)

Partial Lump Sum w/Partial Annuity (75%/50%/25%)

*Terminee only has Annuity Options

PPA rate is being transitioned in. High-quality corporate bond rates, and updated mortality assumptions, prescribed by the IRS, are being used.

Pension Death Benefit—Active Employees

Less than 15 years of service - Surviving Spouse Annuity

The Pension Plan gives surviving spouse annuity equivalent to half of your basic pension benefit earned up to the date of your death (50% J&S Annuity).

Spouse may begin benefit at any time between the ages of 50 and 65 (your age), subject to early commencement penalties for terminations.

15 years of service or more - Death Benefit Pension

Calculated as if you retired on the date of death and chose the lump sum option (subject to early commencement penalties based on age at death).

Payable to the beneficiary selected on the "Special Beneficiary Designation Form" (available on the HR intranet). Spousal permission is necessary for non-spouse beneficiaries, which must be revised at age 35.

Can be paid as a lump payment or basic life annuity based on the beneficiary's life expectancy.

Lump sum rollover is subject to inherited IRA restrictions (PPA 2006).

Lump sum vs. annuity

Retirees who are eligible for a pension are frequently given the option of taking the pension payments for life or receiving a lump-sum dollar amount for the "equivalent" value of the pension - with the expectation that you will then take the money (rolling it over to an IRA), invest it, and generate your own cash flows by taking systematic withdrawals from your company throughout retirement.

The benefit of preserving the pension is that the payments are guaranteed to continue indefinitely (as long as the pension plan is in effect, viable, and does not default). Thus, whether you survive 10, 20, or 30 (or more!) years after leaving your company, you will not be concerned about outliving your money.

In contrast, choosing the lump-sum option allows you to invest, earn higher growth, and perhaps produce even more retirement income flow. Furthermore, if something happens to you, any unused account balance will be available to your surviving spouse or heirs. However, if you fail to invest the funds for sufficient development, the money may run out entirely, and you may regret not taking advantage of the pension's "income for life" guarantee.

Finally, the "risk" assessment that should be performed to determine whether you should choose the lump amount or the guaranteed lifetime payments that your business pension provides is determined by the type of return that must be created on that lump sum in order to match the annuity payments. After all, if it only takes a 1% to 2% return on the lump-sum to generate the same pension cash flows for a lifetime, there is little chance that you will outlive the lump-sum after leaving your firm, even if you withdraw it for life(10). However, if the pension payments can only be replaced with a higher and more risky rate of return, there is a bigger danger that those gains will not materialize and you would run out of funds.

Interest Rates and Life Expectancy

Current interest rates and your life expectancy at retirement have a significant impact on lump sum payouts from defined benefit pension plans. The Blended Interest Rates increased for retirees starting their ExxonMobil Pension in Q1 2023 through Q2 2024, before leveling out in the last two months. As interest rates rise, the value of your lump amount falls. The reverse is also true. Lowering or decreasing interest rates will increase lump sum values.

Interest rates are significant in calculating your lump payment option under the pension plan. However, they have no bearing on the annuity options. Before making pension decisions, the Retirement Group thinks that all ExxonMobil workers should conduct a full RetireKit Cash Flow Analysis that compares their lump sum value to the monthly annuity payout alternatives. As appealing as a large lump payment is, an annuity for all or part of the pension may still be the better option, particularly in a higher interest rate environment. Everyone's situation is unique, and a Cash Flow Analysis will show you how your pension options may evolve over the next 30 years or more.

For grandfathered employees, the Q2 and Q3 2024 pension rates are 4.25% and 4.00%, respectively, up 0.50% from the same period last year. For non-grandfathered employees, the second and third quarter blended segments have similarly shrunk. If interest rates continue to fall, lump sum payments may increase in value; however, there is no certainty that interest rates will fall further in this current environment.

As we continue to follow the interest rate environment through the early summer months and beyond, we will acquire a better understanding of how the year is progressing. If rates continue to fall, lump sum values will rise. However, if rates rise, lump sums will fall. If you need assistance assessing whether or not you are grandfathered, please let us know. Feel free to contact The Retirement Group for assistance in calculating and reviewing your pension options, whether annuity or lump sum. We offer a complimentary retirement cash flow study or an update to an existing one.

Knowing where you stand allows you to make a more informed decision about whether Q2 or Q3 2024 is the best time to retire, or if you should work longer or delay the start of your pension benefit. As interest rates fluctuate, so do lump sums. How much money are you willing to lose in one big sum? Working more hours will result in greater earned income, but this may be offset by a reduction in a future lump sum benefit, which could mean working for free or for less pay.

ExxonMobil 401k Savings Plan

Employees are encouraged to sign up for a 401(k) savings plan immediately away. You can invest before or after tax (regular or Roth) and select from seven investment options with varied levels of risk. You can also transfer pre-tax and Roth funds from other qualifying plans. Your contribution is 6% to 20% of your wage, plus the company contribution (if you contribute at least 6%). 7% of your wage equals total savings of 13% to 27% of your earnings.

Vesting

As a participant, you will receive the employer match after three years of vesting service, at the age of 65, or upon death. If you leave with fewer than three years of service, you lose the corporate match but keep the rest.

Furthermore, if you have an account in an eligible plan from a previous employer, you may be able to roll over a payout from that account to the Savings Plan.

Note: If you contribute at least 6% of your pay, you will receive a 7% corporate match.

If you have 401(k) plan balances at the time of retirement, you will receive a Participant Distribution Notice in the mail. This message will display the current value that you are eligible to receive from each plan and explain your distribution options. It will also explain what you must do to obtain your final allocation. Please call The Retirement Group at (800)-900-5867 for additional information, and we will connect you with an ExxonMobil-focused advisor.

Next step:

-

Look for your Participant Distribution Notice and Special Tax Notice Regarding Plan Payments. These mailings will assist you understand your options and the potential federal tax implications for your vested account balance.

-

"What has Worked in Investing" & "8 Tenets when picking a Mutual Fund" .

-

To learn more about your distribution alternatives, call The Retirement Group at (800)-900-5867. More information on "Rollover Strategies for 401(k)s" is available in our e-book. If you need to amend your beneficiary designations, use the Online Beneficiary Designation tool.

Note: If you voluntarily leave your firm, you may be ineligible for the annual contribution.

More than half of plan participants say they lack the time, desire, or understanding to manage their 401(k) portfolio. However, the advantages of seeking aid extend beyond convenience. According to Charles Schwab studies, plan participants who receive investment advice tend to have portfolios that perform better: The annual performance disparity between those who receive assistance and those who do not is 3.32%, net of expenses. This indicates that a 45-year-old participant may enjoy a 79% increase in wealth by age 65 merely by contacting an advisor. That's a huge difference.

Getting assistance can be the key to improved results across the 401(k) board.

A Charles Schwab study discovered various good effects for those who seek independent professional guidance. They include the following:

-

Improved savings rates - 70% of participants who received 401(k) guidance raised their contributions.

-

Increased diversity - Participants who managed their own portfolios invested in an average of just under four asset types, whereas those in advice-based portfolios invested in at least eight.

-

Increased likelihood of staying the course- Getting assistance enhanced participants' odds of sticking to their financial goals, making them less reactive during unpredictable market conditions and more likely to stick with their original 401(k) investments during a downturn. accomplish not attempt to accomplish it alone. Get assistance with your company's 401(k) plan investments. Your nest egg will appreciate you.

In-Service Withdrawals

In general, you can withdraw funds from your account while still employed with your firm, subject to the conditions indicated below.

Certain withdrawals are subject to standard federal income tax, and if you're under age 59½, you may be subject to an additional 10% penalty tax. You can check your eligibility and request a withdrawal online or by phoning your company's Benefits Center.

Rolling over your 401(k)

An in-service dividend can be rolled over to an IRA if the plan participant is under the age of 72. Direct rollovers eliminate both the 10% early withdrawal penalty and the necessary 20% tax withholding. More information, as well as potential rollover and withdrawal limits, can be found in your company's plan summary.

Because a withdrawal permanently decreases your retirement savings and is taxed, you should always consider borrowing from the plan to fulfill your financial needs. Loans, unlike withdrawals, must be repaid and are not taxable (unless they are not paid back). In other circumstances, such as hardship withdrawals, you cannot make a withdrawal unless you have also taken out the maximum loan allowable under the employer plan.

You should also be aware that your company's plan administrator reserves the right to change the regulations governing withdrawals at any moment, and may further restrict or limit the availability of withdrawals for administrative or other reasons. All plan participants will be notified of any such limits, which apply equally to all corporate workers.

Borrowing From Your 401(k)

Should you do it? Perhaps you lose your job with your firm, have a significant health issue, or have another cause why you require a large sum of money. Banks require excessive paperwork for personal loans, credit cards have high interest rates, and you may consider deferring retirement from your firm to compensate for taking money out.

We understand how you feel: this is your money, and you need it right now. However, consider how this may effect your retirement plans once you leave your employer.

Consider these facts while deciding whether you should borrow from your 401(k). You could do:

-

You will lose the development potential of the money you borrowed.

-

If you leave your company, you will be responsible for repayment and tax concerns.

-

Repayment and tax complications may arise if you leave your organization.

Net unrealized appreciation (NUA)

When you qualify for a distribution, you have three choices:

-

Roll over your eligible plan to an IRA and continue to defer taxes.

-

Take a distribution and pay regular income taxes on the entire amount.

-

Take advantage of NUA and profit from a more favorable tax structure for gains

IRA Withdrawal

When you qualify for a distribution, you will have three options:

Your retirement assets could include IRAs, 401(k)s, taxable accounts, and others.

So, what is the best approach to withdraw your retirement income after leaving your company?Consider fulfilling your retirement income demands by withdrawing from taxable assets rather than tax-deferred investments.

This may help your company's retirement assets last longer by allowing them to grow tax-deferred.

You should also prepare to take the required minimum distributions (RMDs) from any company-sponsored retirement plans, as well as traditional or rollover IRA accounts.

This is due to IRS guidelines for 2024, which state that you must begin taking distributions from these types of accounts when you reach age 73. Beginning in 2023, the excise tax on each dollar of under-distributed RMD will be decreased by 50% to 25%.

There is new legislation that allows account owners to postpone their first RMD until April 1 of the calendar year in which they reach age 73 or, in a company retirement plan, retire.

Two flexible distribution alternatives for your IRA

When it comes to drawing on your IRA for income or taking RMDs, you have a few options. IRA distributions are taxed and may have penalties for those under 59½.

Partial withdrawals: You may remove any amount from your IRA at any time. If you're 73 or older, you must withdraw money from one or more IRAs to pay your annual RMD.

Systematic withdrawal plans: Set up regular, automatic withdrawals from your IRA based on your income needs once you retire from your company. If you are under 59½, you may face a 10% early withdrawal penalty (unless your withdrawal plan meets Code Section 72(t) criteria).

Your tax advisor can assist you in understanding distribution alternatives, determining RMD obligations, calculating RMDs, and establishing a systematic withdrawal strategy.

HSA's

Health Savings Accounts (HSAs) are frequently praised for their effectiveness in managing healthcare costs, particularly for people with high-deductible health plans. However, their advantages go beyond medical cost management, establishing HSAs as a potentially superior retirement savings vehicle compared to typical retirement plans such as 401(k)s, particularly after employer matching contributions are exhausted.

Understanding HSAs

HSAs are tax-advantaged accounts intended for people who have high-deductible health insurance policies. For 2024, the IRS classifies high-deductible plans as having a minimum deductible of $1,600 for individuals and $3,200 for families. HSAs provide pre-tax contributions, tax-free investment growth, and tax-free withdrawals for qualified medical costs, making them a triple-tax-advantaged account.

HSAs' annual contribution limits in 2024 are $4,150 for individuals and $8,300 for families, with an additional $1,000 allowed for those 55 and older. Unlike Flexible Spending Accounts (FSAs), HSA funds do not expire at the end of the year; they grow and can be carried forward indefinitely.

Comparing HSAs versus 401(k)s after Matching

Once an employer's maximum 401(k) match is reached, additional contributions result in less immediate financial rewards. This is where HSAs can serve as a strategic complement. 401(k)s provide tax-deferred growth and tax-deductible contributions, but withdrawals are taxed. In contrast, HSAs allow for tax-free withdrawals for medical expenses, which account for a major amount of retirement costs.

HSA as a Retirement Tool.

After age 65, the HSA stretches its muscles as a powerful retirement tool. Funds can be withdrawn for any reason, subject only to standard income tax if spent for non-medical expenses. This flexibility is similar to that of regular retirement plans, but it also includes tax-free withdrawals for medical bills, which is a substantial benefit given escalating healthcare costs in retirement.

Furthermore, unlike 401(k)s and Traditional IRAs, HSAs have no Required Minimum Distributions (RMDs), giving you more flexibility over your tax planning in retirement. This makes HSAs especially appealing to those who may not need to access their funds immediately after retirement or who want to reduce their taxable income.

Investment Strategy for HSAs.

Initially, it is prudent to invest conservatively in an HSA, with an emphasis on ensuring that there are enough liquid assets to cover the near-term deductible and other out-of-pocket medical expenses. However, if a financial cushion has been formed, using the HSA as a retirement account and investing in a diverse mix of equities and bonds can considerably improve the account's long-term growth potential.

Utilizing HSAs in retirement

In retirement, HSAs can cover a variety of expenses:

- Healthcare Costs-Pre-Medicare: HSAs can cover healthcare costs to bridge you to Medicare.

- Healthcare Costs After Medicare: HSAs can be used to pay for Medicare premiums as well as out-of-pocket medical expenses such as dental and eye treatment, which are frequently not covered by Medicare.

- Long-term Care: Funds may be used for approved long-term care services and insurance payments.

- Non-medical Expenses: After age 65, HSA funds can be used for non-medical expenses without penalty, but withdrawals are subject to income tax.

In conclusion, HSAs have distinct advantages that can make them a better alternative for retirement savings, especially once the benefits of 401(k) matching are fully realized. HSAs are an important component of a comprehensive retirement strategy because of their fund flexibility and tax advantages. Individuals can improve their financial health in retirement by strategically managing contributions and withdrawals, ensuring both medical and financial security.

Life Insurance Plan

If you have 10 years of service at ExxonMobil and are at least 50 years old, you may be eligible to continue receiving employee-paid coverage. You are not obliged to take any action to continue your coverage; however, you should verify with ExxonMobil. However, the cost of your coverage may rise. In general, retiree contributions are higher than employee contributions. After retirement, you can reduce your additional coverage at any time. The adjustment will be effective on the first of the next month. If your retiree basic life insurance is less than one times your active income, you may be allowed to obtain one-time extra coverage (within 31 days of retirement). Note: If you stop making extra contributions, your coverage will expire. You will be unable to reinstate it. For further information, please refer to ExxonMobil's SPD.

Short-Term and Long-Term Disability

Short-Term: Depending on your plan, you may be eligible for short-term disability (STD) benefits via your workplace.

Long-Term Disability: Your plan's long-term disability (LTD) benefits are intended to provide you with income if you are absent from work for six months or more due to an eligible sickness or injury.

Your life insurance coverage, as well as any optional coverage you acquire for your spouse/domestic partner and/or children, terminates on the day your employment with your firm ends, unless your employment stops due to incapacity. If you die within 31 days of your company's termination date, your beneficiary will receive benefits for both your basic life insurance and any additional life insurance policy you chose.

Note:

- You may be able to transfer your life insurance to an individual policy or select portability for any optional coverage.

- If you cease making supplemental contributions, your coverage will terminate.

- If you are at least 65 years old and pay for additional life insurance, the insurance company should provide you information outlining your alternatives.

- Update your beneficiaries. For more information, please refer to your company's SPD.

ExxonMobil Beneficiary Designation

As part of your retirement and estate planning, you should designate someone to receive the proceeds of your benefit programs in the case of your death. That is how your employer will choose who should receive your final wages and perks. This may include life insurance benefits, as well as any pension or savings balances.

Next Steps:

- When you retire, make sure to notify your beneficiaries. ExxonMobil offers an online beneficiary designation form for life events like as death, marriage, divorce, childbirth, and adoption.

Knowing the fundamentals of Social Security and using them to your advantage will help you collect the most benefit.

It is your duty to enroll in Medicare Parts A and B when you first become eligible, and you must remain enrolled in order to receive coverage for Medicare-eligible expenses. This also applies to your dependents who are qualified for Medicare.

They can assist you with determining your eligibility, enrolling you and/or your eligible dependents in Medicare, and providing you with information about other government programs. Please call us for further information on Social Security.

Before you resign from your employer, check on the status of your Social Security payments. Contact the US Social Security Administration, your local Social Security office, or go to ssa.gov.

Are you already or will you soon be eligible for Medicare?

If you or your dependents become eligible for Medicare after leaving your telecom industry business, Medicare will normally become your primary coverage as soon as they do. This will have an impact on the medical benefits offered by the employer.

When you become eligible for Medicare, you and your dependents must enroll in Parts A and B. Medical and MH/SA benefits due under the company-sponsored plan will be lowered by the amounts that Medicare Parts A and B would have paid regardless of whether you enrolled in them.

Your company's summary plan description will provide more information on benefit coordination.

If you or an eligible dependant do not enroll in Medicare Parts A and B, your provider may bill you for any expenses not covered by Medicare or your company-specific medical plan. increasing your out-of-pocket payments dramatically.

According to the Employee Benefit Research Institute (EBRI), Medicare only covers roughly 60% of an individual's medical expenses. This indicates that a 65-year-old couple with typical prescription-drug expenses for their age will require $259,000 in savings to cover 90% of their healthcare costs. A single man will need $124,000, whereas a single woman will need $140,000 because to her longer life expectancy.

Check ExxonMobil's plan summary to see if you’re eligible to enroll in Medicare Parts A and B.

If you become Medicare-eligible for reasons other than age, you must notify ExxonMobil's benefit center of your eligibility.

For 28% of couples over the age of 53, happily ever after and until death do us part will not come true. Most couples have saved for decades, expecting they will retire together. Following a divorce, they must face the expenses of a pre- or post-retirement existence while having just half of their savings.

If you're divorced or in the process of divorcing, your ex-spouse(s) may be interested in a share of your corporate retirement benefits. Before you may begin your pension — and for each former spouse who may be interested — you must submit your firm with the following documents:

- A copy of the court-filed Judgment of Dissolution or Judgment of Divorce and any Marital Settlement Agreement (MSA)

- A copy of the court-filed Qualified Domestic Relations Order (QDRO).

You must submit this proof to your company's online pension center, regardless of how old or brief the marriage was. *Sources: The Retirement Group, "Retirement Plans - Benefits and Savings," US Department of Labor, 2019; "Generating Income That Will Last Throughout Retirement," Fidelity: 2019

Social Security and Divorce

You can apply for a divorced spouse's benefit if you meet the following criteria:

You must be 62 years old or older.

You were married for at least ten years before your divorce.

You are not presently married.

Your ex-spouse is qualified for Social Security benefits.

Your individual Social Security benefit amount is lower than your spousal benefit amount, which is equivalent to one-half of your ex's entire benefit amount if claimed at entire Retirement Age.

Unlike a married pair, your ex-spouse does not have to file for Social Security before you may apply for your divorced spouse's benefit; however, this only applies if you've been divorced for at least two years and your ex is at least 62 years old. If your divorce was less than two years ago, your ex must be receiving benefits before you can file as a divorced spouse.

Unlike a married couple, you do not have to wait for your ex-spouse to file for Social Security before applying for your divorced spouse's benefit.

Divorce does not disqualify you for survivor benefits. You can claim a divorced spouse's survivor benefit if the following apply:

-

Your ex-spouse has died.

-

You are at least sixty years old.

-

You were married for at least ten years before the divorce.

-

You are single (or remarried after turning 60).

Are you going through a divorce?

If your divorce is not finalized by the time you retire from your company, you are still considered married. You have two choices:

Retire from your company before your divorce is finalized and opt for a combined pension of at least 50% with your spouse — or obtain your spouse's signed, notarized approval to a different election or lump amount.

Defer your retirement from your company until your divorce is finalized and you can supply the necessary divorce documentation*.

Sources: The Retirement Group, "Retirement Plans - Benefits and Savings," United States Department of Labor, 2019; "Generating Income That Will Last Throughout Retirement," Fidelity, 2019.

In the event that you are unable to collect your benefits from your employer, your survivor will be responsible for taking action.

Things that your survivor must do:

-

File a report of your passing. As soon as practical, your spouse, a family member, or a friend should contact your company's benefits service center to report your death.

-

Collect the benefits of life insurance. Life insurance benefits must be collected by your spouse or other designated beneficiary by contacting your company's benefits service center.

-

Commence the combined pension payments. The combined pension is not automatic. In order to commence receiving joint pension payments, your joint pensioner must complete and return the documentation from your company's pension center.

-

Make sure you have the necessary financial resources to support your living expenses. Your spouse must have sufficient savings to cover the gap of at least one month between the termination of your pension payments from your employer and the commencement of their own pension payments.

-

Determine whether or not to maintain medical coverage.

-

If your survivor is enrolled as a dependent in your company-sponsored retiree medical coverage at the time of your death, they must determine whether to maintain it. The complete monthly premium must be paid by survivors.

While you may be ready for some leisure and relaxation away from the stress and schedule of your full-time job with your firm, it may make financial and emotional sense for you to continue working.

Financial advantages of working

Make up for the reduced value of savings or assets. Low interest rates are ideal for lump sums but make it difficult to generate portfolio income. Some people continue to work to compensate for poor returns on their savings and investments.

Perhaps you accepted a job offer and left your firm earlier than you desired, with less retirement savings than you required. Instead of depleting your money, you may decide to work a bit longer to afford items you've previously denied yourself.

Meet the financial needs of daily living. Expenses can rise after your retirement from your employer, and working can be a practical and successful option. You may choose to continue working in order to maintain your insurance or other benefits; many firms provide free or low-cost health insurance to part-time employees.

Emotional benefits of working

You may discover highly appealing career opportunities just as you were about to leave the workforce.

Remaining active and involved. Retaining employment after leaving your prior job, even if it's only part-time, can be a terrific opportunity to put your abilities to use while also keeping in touch with friends and coworkers.

Enjoying yourself at work. Just because the government has established a retirement age through its Social Security program does not obligate you to organize your personal life accordingly. Many people really appreciate their professions and continue to work because it enriches their lives.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

How does the ExxonMobil Savings Plan compare against typical retirement savings plans, and what unique features does it offer that can benefit employees approaching retirement? Additionally, can you elaborate on the necessary steps ExxonMobil employees should take within the savings plan to ensure maximum contributions and employer match during their service years?

ExxonMobil Savings Plan: ExxonMobil's Savings Plan offers flexibility with pre-tax, after-tax, and Roth contributions, and features a 7% company match for the first 6% of employee contributions, a unique benefit compared to typical plans. Employees should contribute the maximum percentage to receive the full match and regularly review their investment allocations through the Voya platform(ExxonMobil_2024_ExxonMo…).

What are the eligibility criteria for employees to participate in the ExxonMobil Pension Plan, and how is the retirement benefit calculated? As employees consider their long-term savings strategy, how does the option of a lump-sum distribution versus an annuity influence their financial planning at ExxonMobil?

ExxonMobil Pension Plan: Employees are automatically enrolled and eligible for benefits after five years of service, with full retirement benefits offered at 55 with 15 years of service. The pension is calculated based on 1.6% of final average pay multiplied by years of service, minus a social security offset. Lump-sum and annuity options affect long-term financial planning, with lump sums offering immediate flexibility while annuities provide a steady income(ExxonMobil_2024_ExxonMo…).

In what ways does the ExxonMobil Employee Assistance Program (EAP) support employees during personal or family crises, and what confidentiality measures are in place to protect their privacy? Additionally, how can ExxonMobil employees access these services, and what are the key resources available through this program?

Employee Assistance Program (EAP): ExxonMobil's EAP provides confidential counseling services for personal and family issues like anxiety, addiction, and family conflict. Services are accessible by phone, video chat, or text, with privacy strictly protected. Employees can contact ComPsych for guidance and support through the GuidanceNow app or website(ExxonMobil_2024_ExxonMo…).

With the introduction of Flexible Spending Accounts (FSAs) at ExxonMobil, how do these accounts help employees manage their health care and dependent care expenses more effectively? What guidelines should employees follow to ensure they maximize their tax advantages while complying with IRS regulations during the enrollment process?

Flexible Spending Accounts (FSAs): FSAs at ExxonMobil allow employees to reduce taxable income by contributing pre-tax dollars to healthcare or dependent care expenses. Employees should estimate their expenses carefully during the enrollment period and comply with IRS rules, ensuring they submit claims by April 15th of the following year(ExxonMobil_2024_ExxonMo…).

How does ExxonMobil define "work-life balance," and what specific benefits and programs are in place to support this philosophy for employees? Can you discuss how employees can utilize these options, such as flexible schedules and leave of absence policies, without negatively impacting their career progression within the company?

Work-Life Balance: ExxonMobil promotes work-life balance with programs like “Flex Your Day,” allowing flexibility in work hours, and up to 20 days of back-up dependent care. Employees are encouraged to use these options strategically to maintain career progression while balancing personal obligations(ExxonMobil_2024_ExxonMo…).

In light of the various medical plan options offered at ExxonMobil, how should employees approach selecting the right plan to best meet their healthcare needs? What factors should they consider, including family health history and financial implications, when making their decisions?

Medical Plan Selection: ExxonMobil offers Aetna POS II and network-only options, allowing employees to choose between plans based on cost, coverage, and provider access. Employees should assess their family's healthcare needs, financial situation, and preferred providers when selecting the most appropriate plan(ExxonMobil_2024_ExxonMo…).

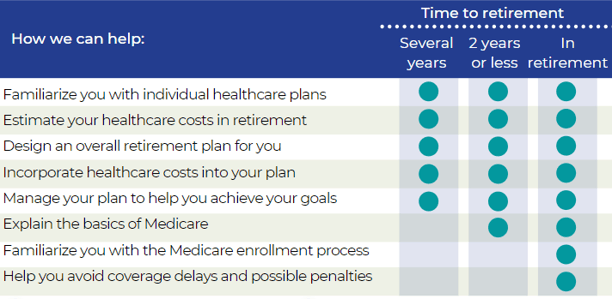

For ExxonMobil employees nearing retirement, what resources are available to help them understand the nuances of health benefits coordination through Medicare and their ExxonMobil coverage? How can they best navigate this transition, and what checkpoints should they be aware of to ensure they remain compliant with company policies during retirement?

Retirement Health Benefits and Medicare: ExxonMobil offers resources to help employees coordinate health benefits with Medicare upon retirement. Employees nearing retirement should explore their options through the Your Total Rewards portal and ensure compliance with company policies during the transition(ExxonMobil_2024_ExxonMo…).

What financial education resources does ExxonMobil provide to employees to promote informed decision-making about their retirement savings and benefits? Can you detail how programs like the Financial Fitness Program enable employees to strategically manage their finances and plan for retirement?

Financial Education Resources: ExxonMobil's Financial Fitness Program, provided in collaboration with Ernst & Young, helps employees manage their finances with resources such as EY Navigate and personalized financial planning. This program supports informed decision-making about retirement and savings strategies(ExxonMobil_2024_ExxonMo…).

As part of the benefits provided by ExxonMobil, how does the company facilitate employee participation in volunteer programs and charitable activities through the ExxonMobil Foundation? How can employees engage with these initiatives while also balancing their work commitments?

Volunteer Programs: Through the ExxonMobil Foundation, employees can engage in charitable activities via the Volunteer Involvement Program (VIP), which offers grants to nonprofits based on time spent volunteering. Participation in these programs is flexible, enabling employees to balance work commitments with volunteer efforts(ExxonMobil_2024_ExxonMo…).

How can ExxonMobil employees get in touch with benefits representatives to address specific questions about their retirement and savings plans? What are the recommended channels and best times to reach out for assistance to ensure they receive timely and relevant information about their options?

Contacting Benefits Representatives: Employees can reach out to the ExxonMobil Benefits Service Center at 833-776-9966 during business hours (8 a.m. to 4 p.m. CST) for assistance with retirement and savings plan questions. The Your Total Rewards portal also offers 24/7 access for reviewing and managing benefits(ExxonMobil_2024_ExxonMo…).

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)