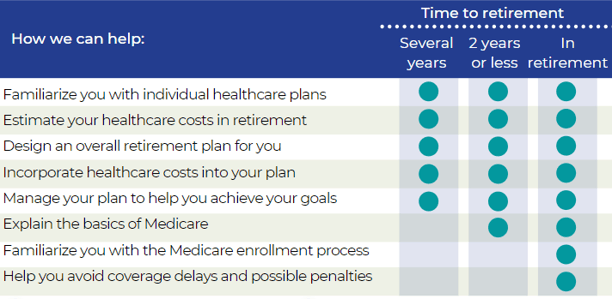

Healthcare Provider Update: Healthcare Provider for L3Harris L3Harris Technologies typically provides its employees with healthcare benefits through employer-sponsored insurance plans. The exact healthcare provider may vary based on location and specific employee circumstances, but major insurers commonly used include UnitedHealthcare, Anthem, and Cigna. Potential Healthcare Cost Increases in 2026 In 2026, L3Harris and similar employers are facing significant healthcare cost increases. Reports indicate a projected rise of approximately 8.5% in employer-sponsored insurance costs due to multiple inflationary pressures, including rising medical expenses and increased claims. Additionally, if the federal premium subsidies under the Affordable Care Act expire without renewal, employees may see a drastic rise in their out-of-pocket expenses, compounding the financial impact on both the company and its workforce. Employers are likely to respond by shifting more healthcare costs to employees, necessitating a proactive approach to managing these anticipated changes. Click here to learn more

With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect L3Harris employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from L3Harris, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by L3Harris might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for L3Harris, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

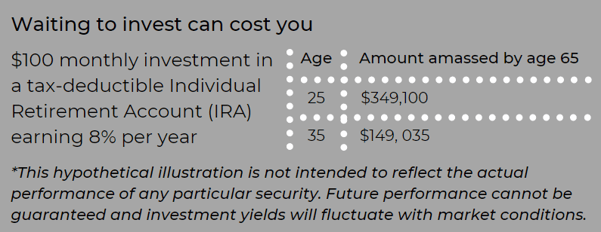

Retirement account contributions: Contributing to your L3Harris 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, L3Harris workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by L3Harris, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

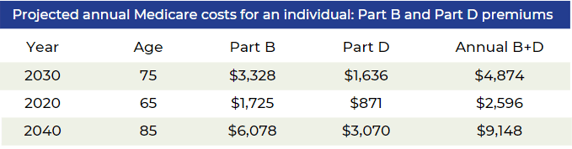

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving L3Harris, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from L3Harris, like healthcare. Many L3Harris corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from L3Harris.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

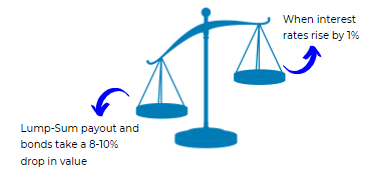

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

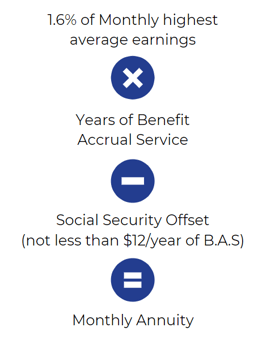

Highest Average Earnings is the monthly average of your regular earnings for the 36 consecutive months in which they’re the highest.

In most cases, this will be the sum of your last 36 months divided by 36.

The applicable interest rate is a separate average of each of the three segment rates for the fifth, fourth and third months preceding your annuity start date. The three segment rates are calculated by the IRS according to regulations that are also part of the Pension Protection Act of 2006 and reflect the yields of short-, mid-, and long-term corporate bonds. (Note: Chevron also has Legacy Unocal and Legacy Texaco Retirement Plans)

Different Plans

Similar to Chevron, AT&T has many different plans available. With AT&T, they have different pension plan formulas for management & non-management. Lets look at a sample non-management plan.

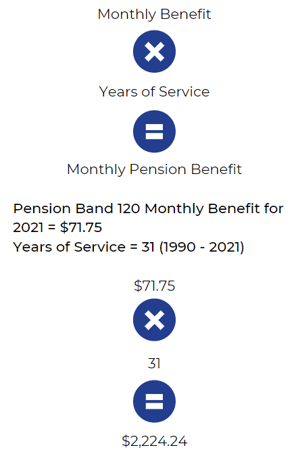

AT&T non-management employees have their own Craft/non-management pension plan. Let's take a look at a pension example for a gentleman by the name of Joe Smith who is hourly and using the Craft/non-management pension plan.

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

-

Craft has a defined benefit plan that uses pension bands.

-

A pension band determines your benefits based on your job title/grade level/occupation.

- Joe will receive a monthly dollar amount into his account for each year of service.

-

Joe's benefit (pension band may change yearly).

-

A pension band determines your benefits based on your job title/grade level/occupation.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

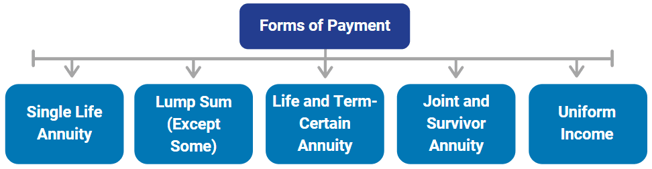

What specific factors should L3Harris Technologies employees consider when determining the most suitable form of pension benefit at retirement? Employees of L3Harris Technologies may have various options, such as life annuities, contingent annuities, and lump-sum payouts. Understanding the implications of each option, including tax treatments and benefit guarantees, can be crucial in making a decision that aligns with long-term financial goals. It is also important to consider how the selected form may affect survivor benefits and overall retirement income planning.

Pension Options at Retirement: L3Harris Technologies employees have various pension benefit options to consider at retirement, such as life annuities, contingent annuities, and lump-sum payouts(L3Harris Technologies I…). Each option has different tax treatments, survivor benefits, and guarantees. For example, selecting a life annuity ensures a fixed monthly payment for life, while a lump-sum payout might offer more flexibility but comes with immediate tax implications. Employees should evaluate how each option aligns with their long-term financial goals and whether it provides adequate survivor protection for dependents(L3Harris Technologies I…).

How does L3Harris Technologies determine eligibility for early retirement, and what implications does this have for pension benefits? Employees should familiarize themselves with the criteria for qualifying for early retirement, including age and service requirements. Additionally, understanding the benefits that are available should retirement occur before the standard retirement age can affect financial planning, as these benefits can differ significantly from those available at normal retirement age due to reduction factors or penalties.

Early Retirement Eligibility: L3Harris Technologies determines eligibility for early retirement based on age and years of service. Employees may qualify for early retirement if they are at least 55 years old and have completed 10 years of service(L3Harris Technologies I…). Opting for early retirement can result in a reduced pension benefit due to the longer payment period. These reductions, known as early retirement penalties, affect financial planning since the payout is lower compared to waiting until the normal retirement age(L3Harris Technologies I…).

In what ways do the pension formulas at L3Harris Technologies differ, and how can employees assess which plan is most advantageous for their retirement? Employees participating in the L3Harris pension plan can choose between different formulas, such as the Traditional Pension Plan and the Pension Equity Plan. Assessing which formula may yield higher benefits involves understanding the benefits calculation processes, including how each formula accounts for years of service, salary history, and participation criteria, which can significantly impact total retirement income.

Pension Formulas: L3Harris employees can choose between different pension formulas, such as the Traditional Pension Plan and Pension Equity Plan(L3Harris Technologies I…). The Traditional Plan is based on years of service and final average pay, while the Pension Equity Plan uses a lump-sum formula that accrues value over time. Understanding how each formula calculates benefits is essential for employees to determine which plan will provide higher retirement income, depending on their service years and salary history(L3Harris Technologies I…).

How should L3Harris Technologies employees prepare for the selection of a beneficiary, and what are the potential impacts on their pension benefits? Selecting a beneficiary is an important component of retirement planning. Employees at L3Harris Technologies must understand the implications that come with adding a spouse or other individuals as beneficiaries, including the effect on benefit amounts and how beneficiary selection can influence survivor payouts. Moreover, they should familiarize themselves with the requirements for updating beneficiary information and the legal implications of such designations.

Beneficiary Selection: Choosing a beneficiary is a crucial step for L3Harris employees. Adding a spouse or another individual as a beneficiary may reduce the employee's pension benefit but ensures that a portion of the pension continues after the employee's death(L3Harris Technologies I…). Employees should be aware of the survivor benefit provisions, spousal consent requirements, and the need to regularly update their beneficiary information(L3Harris Technologies I…).

What procedures must L3Harris Technologies employees follow to appeal a denied pension benefit claim, and what timelines should they be aware of? Employees should be well-informed about the steps involved in the appeals process for denied claims, including how and when to file an appeal and the importance of providing adequate documentation. Understanding the statutes of limitations related to claims and appeals can significantly influence the outcomes for employees seeking to reinstate or secure their benefits.

Appealing Denied Claims: L3Harris Technologies employees must follow a formal process to appeal denied pension benefit claims(L3Harris Technologies I…). The process includes submitting an appeal within a specific timeframe and providing supporting documentation. It is important to be familiar with the statute of limitations and administrative remedies to ensure the best chance of success when appealing a decision(L3Harris Technologies I…).

How does L3Harris Technologies handle survivor benefits, and what actions should employees take to ensure that their surviving spouses or partners have access to these benefits? Understanding the components of survivor benefits at L3Harris Technologies is crucial. Employees should learn about the eligibility of their spouses or partners following their death, the type of benefits due, and any actions required to secure these benefits. Familiarity with the plan’s rules surrounding survivor benefits and timelines for elections can also affect the financial security of beneficiaries.

Survivor Benefits: L3Harris offers survivor benefits to spouses or designated beneficiaries(L3Harris Technologies I…). Employees must ensure that their spouse or partner is properly designated to receive these benefits, which may involve selecting an annuity option that provides continued payments to the survivor. Understanding the timelines for making these elections and the rules governing survivor benefits is crucial for securing financial support for loved ones(L3Harris Technologies I…).

What resources are available for L3Harris Technologies employees for receiving personalized retirement counseling, and how can these resources aid in making informed financial decisions? Employees may benefit from accessing professional counseling services or informational resources provided by L3Harris Technologies. These resources can include individual retirement planning sessions that help employees align their pension benefits with their overall retirement strategy, ensuring that they utilize their benefits effectively and are informed about their options.

Retirement Counseling Resources: L3Harris provides personalized retirement counseling services to assist employees with their pension and retirement planning(L3Harris Technologies I…). These resources include individual sessions to discuss how pension benefits fit into overall retirement strategies. By leveraging these services, employees can make well-informed decisions about their financial future(L3Harris Technologies I…).

How can employees of L3Harris Technologies find out more about their eligibility for the Cash Balance Plan and the advantages of this plan over traditional pension formulas? Employees should research what defines an "active Cash Balance Plan Participant" as well as the benefit calculations associated with it. Investigating the elements that set this type of plan apart—specifically regarding lump-sum distributions and the ability to track benefits—can better inform employees about the potential advantages for their future retirement income.

Cash Balance Plan: Employees interested in the Cash Balance Plan can research its advantages over traditional pension formulas. The Cash Balance Plan allows for lump-sum distributions and provides clear benefit tracking, which can be more appealing to employees looking for flexibility and control over their retirement funds(L3Harris Technologies I…).

What impact do potential changes to the L3Harris Technologies pension plan have on current employees, and what steps should they take to stay informed about such changes? Employees should remain vigilant regarding any amendments to the pension plan that could influence their retirement benefits. This includes understanding their rights under ERISA and staying engaged with communication from L3Harris regarding plan updates, ensuring that they are equipped to make timely decisions based on the latest information.

Plan Changes: L3Harris employees should stay updated on any changes to the pension plan, which could impact their benefits(L3Harris Technologies I…). Monitoring communications from the company and understanding their rights under ERISA is essential to making timely decisions based on new plan terms or amendments(L3Harris Technologies I…).

How can employees of L3Harris Technologies contact the Benefits Service Center to address specific questions regarding their pension plan or retirement strategy? It is essential for employees seeking clarity on their pension benefits or retirement planning to know how to reach out to the L3Harris Benefits Service Center. This center acts as a vital resource, and understanding its operations—including contact times, methods of contact, and the types of inquiries that can be addressed—will enable employees to receive the guidance they need regarding their benefits.

Benefits Service Center: L3Harris employees can contact the Benefits Service Center for any questions regarding their pension or retirement strategy. The center provides assistance with understanding pension benefits, resolving issues, and addressing specific inquiries related to retirement planning(L3Harris Technologies I…)(L3Harris Technologies I…).

/General/General%203.png?width=1280&height=853&name=General%203.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)