Healthcare Provider Update: Healthcare Provider for Southern California Edison: Southern California Edison (SCE) primarily utilizes Blue Shield of California as its healthcare provider for employees. This partnership enables the company to offer a variety of health insurance options to its workforce, including comprehensive coverage options tailored to meet the diverse needs of its employees. Potential Healthcare Cost Increases in 2026: As the healthcare landscape shifts, Southern California Edison employees may see a significant impact on healthcare costs in 2026. With projected record increases in insurance premiums-some states reporting hikes exceeding 60%-combined with the potential expiration of enhanced federal subsidies, many employees could face out-of-pocket premium spikes exceeding 75%. Factors contributing to this trend include rising medical costs and aggressive rate hikes from major insurers, which underline the importance of strategic planning for healthcare expenses as retirement approaches. Adapting to these changes is essential for maintaining financial stability and ensuring access to necessary healthcare services. Click here to learn more

With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect Southern California Edison employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from Southern California Edison, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by Southern California Edison might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for Southern California Edison, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

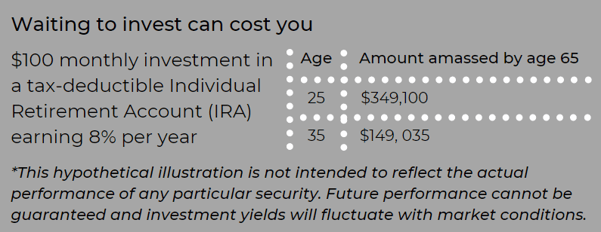

Retirement account contributions: Contributing to your Southern California Edison 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, Southern California Edison workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by Southern California Edison, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving Southern California Edison, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from Southern California Edison, like healthcare. Many Southern California Edison corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from Southern California Edison.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

How does SoCalGas determine its pension contribution levels for 2024, and what factors influence the funding strategies to maintain financial stability? In preparing for the Test Year (TY) 2024, SoCalGas employs a detailed actuarial process to ascertain the necessary pension contributions. The actuarial valuation includes an assessment of the company's Projected Benefit Obligation (PBO) under Generally Accepted Accounting Principles (GAAP). These calculations incorporate variables such as current employee demographics, expected retirement ages, and market conditions. Additionally, SoCalGas must navigate external economic factors, including interest rates and economic forecasts, which can impact the funded status of its pension plans and the associated financial obligations.

SoCalGas determines its pension contribution levels using a detailed actuarial process that evaluates the Projected Benefit Obligation (PBO) under Generally Accepted Accounting Principles (GAAP). The contribution is influenced by variables such as employee demographics, retirement age expectations, market conditions, and external economic factors like interest rates and economic forecasts. SoCalGas maintains financial stability by adjusting funding strategies based on market returns and required amortization periods(Southern_California_Gas…).

What specific changes to SoCalGas's pension plan are being proposed for the upcoming fiscal year, and how will these changes impact existing employees and retirees? The proposals for the TY 2024 incorporate adjustments to the existing pension funding mechanisms, including the continuation of the two-way balancing account to account for fluctuations in pension costs. This measure is designed to stabilize funding while meeting both the service cost and the annual minimum contributions required under regulatory standards. Existing employees and retirees may see changes in their benefits as adjustments are made to align with these funding strategies, which may include modifications to expected payouts or contributions required from retirees depending on their service years and retirement age.

For the 2024 Test Year, SoCalGas is proposing to adjust its pension funding policy by shortening the amortization period for the PBO shortfall from fourteen to seven years. This change aims to fully fund the pension plan more quickly, improving long-term financial health while reducing intergenerational ratepayer burden. Existing employees and retirees may experience greater financial stability in the pension plan due to these proactive funding strategies(Southern_California_Gas…).

In what ways does SoCalGas's health care cost escalation projections for postretirement benefits compare with national trends, and what strategies are in place to manage these costs? The health care cost escalations required for the Postretirement Health and Welfare Benefits Other than Pension (PBOP) at SoCalGas have been developed in alignment with industry trends, which show consistent increases in health care expenses across the nation. Strategies implemented by SoCalGas involve negotiation with health care providers for favorable rates, introduction of health reimbursement accounts (HRAs), and ongoing assessments of utilization rates among retirees to identify potential savings. These measures aim to contain costs while ensuring that retirees maintain access to necessary healthcare services without a significant financial burden.

SoCalGas's healthcare cost projections for its Postretirement Benefits Other than Pensions (PBOP) align with national trends of increasing healthcare expenses. To manage these costs, SoCalGas employs strategies like negotiating favorable rates with providers, utilizing health reimbursement accounts (HRAs), and regularly assessing healthcare utilization. These efforts aim to control healthcare costs while ensuring that retirees receive necessary care(Southern_California_Gas…).

What resources are available to SoCalGas employees to help them understand their benefits and the changes that may occur in 2024? SoCalGas provides various resources to employees to clarify their benefits and upcoming changes, including dedicated HR representatives, comprehensive guides on benefits options, web-based portals, and informational seminars. Employees can access personalized accounts to view their specific benefits, contributions, and projections. Additionally, the company offers regular training sessions covering changes in benefits and how to navigate the retirement process effectively, empowering employees to make informed decisions regarding their retirement planning.

SoCalGas provides employees with various resources, including HR representatives, benefit guides, and web-based portals to help them understand their benefits. Employees also have access to personalized retirement accounts and training sessions that cover benefit changes and retirement planning, helping them make informed decisions regarding their future(Southern_California_Gas…).

How does the PBOP plan impact SoCalGas’s overall compensation strategy for attracting talent? The PBOP plan is a critical component of SoCalGas’s total compensation strategy, designed to attract and retain high-caliber talent in an increasingly competitive market. SoCalGas recognizes that comprehensive postretirement benefits enhance their appeal as an employer. The direct correlation between competitive benefits packages, including the PBOP plan's provisions for health care coverage and financial support during retirement, plays a significant role in talent acquisition and retention by providing peace of mind for employees about their long-term financial security.

SoCalGas's PBOP plan plays a crucial role in its overall compensation strategy by offering competitive postretirement health benefits that enhance the attractiveness of the company's total compensation package. This helps SoCalGas attract and retain a high-performing workforce, as comprehensive retirement and healthcare benefits are important factors for employees when choosing an employer(Southern_California_Gas…).

What are the anticipated trends in the pension and postretirement cost estimates for SoCalGas from 2024 through 2031, and what implications do these trends hold for financial planning? Anticipated trends in pension and postretirement cost estimates are projected to indicate gradual increases in these costs due to changing demographics, increasing life expectancies, and inflation impacting healthcare costs. Financial planning at SoCalGas thus necessitates a proactive approach to ensure adequate funding mechanisms are in place. This involves forecasting contributions that will remain in line with the projected obligations while also navigating regulatory requirements to avoid potential funding shortfalls or impacts on corporate finances.

SoCalGas anticipates gradual increases in pension and postretirement costs from 2024 to 2031 due to changing demographics, increased life expectancies, and rising healthcare costs. This trend implies that SoCalGas will need to implement robust financial planning strategies, including forecasting contributions and aligning funding mechanisms with regulatory requirements to avoid potential shortfalls(Southern_California_Gas…).

How do SoCalGas's pension plans compare with those offered by other utility companies in California in terms of competitiveness and sustainability? When evaluating SoCalGas's pension plans compared to other California utility companies, it becomes evident that SoCalGas's offerings emphasize not only competitive benefits but also a sustainable framework for its pension obligations. This comparative analysis includes studying funding ratios, benefit structures, and employee satisfaction levels. SoCalGas aims to maintain a robust pension plan that not only meets current employee needs but is also sustainable in the long term, adapting to changing economic conditions and workforce requirements while remaining compliant with state regulations.

SoCalGas's pension plans are competitive with those of other utility companies in California, with a focus on both benefit structure and long-term sustainability. SoCalGas emphasizes maintaining a robust pension plan that is adaptable to changing market conditions, regulatory requirements, and workforce needs. This allows the company to remain an attractive employer while ensuring the sustainability of its pension commitments(Southern_California_Gas…).

How can SoCalGas employees reach out for support regarding their pension and retirement benefits, and what types of inquiries can they make? Employees can contact SoCalGas’s Human Resources Benefits Department through dedicated communication channels such as the company’s HR support line, email, or scheduled one-on-one consultations. The HR team is trained to address a variety of inquiries related to pension benefits, eligibility requirements, plan options, and retirement planning strategies. Moreover, employees can request personalized benefits statements and assistance with understanding their entitlements and the implications of any regulatory changes affecting their plans.

SoCalGas employees can reach out to the company's HR Benefits Department through a dedicated support line, email, or consultations. They can inquire about pension benefits, eligibility, plan options, and retirement strategies. Employees may also request personalized benefits statements and clarification on regulatory changes that may affect their plans(Southern_California_Gas…).

What role does market volatility and economic conditions play in shaping the funding strategy of SoCalGas's pension plans? Market volatility and economic conditions play a significant role in shaping SoCalGas's pension funding strategy, influencing both asset returns and liabilities. Fluctuations in interest rates, market performance of invested pension assets, and changes in demographic factors directly affect the PBO calculation, requiring SoCalGas to adjust its funding strategy responsively. This involved the use of sophisticated financial modeling and scenario analysis to ensure that the pension plans remain adequately funded and financially viable despite adverse economic conditions, thereby protecting the interests of current and future beneficiaries.

Market volatility and economic conditions significantly impact SoCalGas's pension funding strategy, affecting both asset returns and liabilities. Factors like interest rates, market performance of pension assets, and demographic shifts influence the PBO calculation, prompting SoCalGas to adjust its funding strategy to ensure adequate pension funding and long-term plan viability(Southern_California_Gas…).

What steps have SoCalGas and SDG&E proposed to recover costs related to pension and PBOP to alleviate financial pressure on ratepayers? SoCalGas and SDG&E proposed implementing a two-way balancing account mechanism designed to smoothly recover the costs associated with their pension and PBOP plans. This initiative aims to ensure that any variances between projected and actual contributions are adjusted in a timely manner, thereby reducing the financial burden on ratepayers. By utilizing this approach, the Companies seek to maintain stable rates while ensuring that all pension obligations can be met without compromising operational integrity or service delivery to their customers. These questions reflect complex issues relevant to SoCalGas employees preparing for retirement and navigating the nuances of their benefits.

SoCalGas and SDG&E have proposed utilizing a two-way balancing account mechanism to recover pension and PBOP-related costs. This mechanism helps adjust for variances between projected and actual contributions, ensuring that costs are managed effectively and do not overly burden ratepayers. This approach aims to maintain stable rates while fulfilling pension obligations(Southern_California_Gas…).

/General/General%202.png?width=1280&height=853&name=General%202.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)