Healthcare Provider Update: Healthcare Provider for Sysco Sysco partners with Aetna to provide its healthcare benefits to employees. Those enrolled in Sysco's national medical plan have access to various services through Aetna, including options for MinuteClinic appointments. Potential Healthcare Cost Increases in 2026 As we look ahead to 2026, Sysco employees can expect substantial increases in healthcare costs, reflecting broader trends in the industry. Nationwide, health insurance premiums for Affordable Care Act (ACA) plans are set to rise significantly, with some states forecasting hikes of over 60%. This surge is driven by a combination of expiring federal premium subsidies and ongoing medical cost inflation, leaving many enrollees at risk of facing out-of-pocket premium increases exceeding 75%. Consequently, it's imperative for individuals to prepare strategically to mitigate financial impact as these shifts unfold. Click here to learn more

With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect Sysco employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from Sysco, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by Sysco might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for Sysco, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

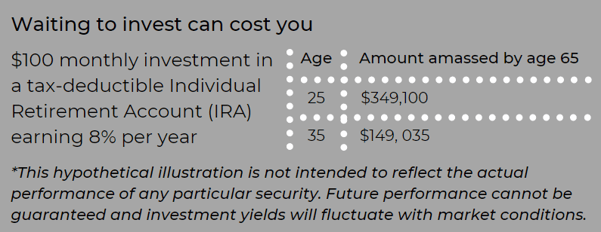

Retirement account contributions: Contributing to your Sysco 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, Sysco workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by Sysco, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

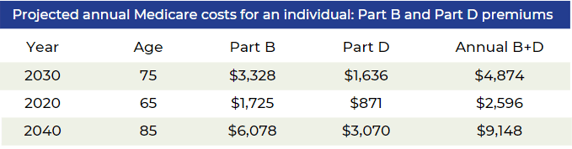

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving Sysco, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from Sysco, like healthcare. Many Sysco corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from Sysco.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

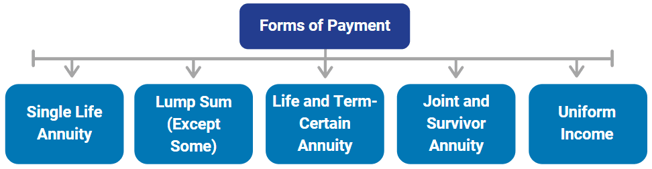

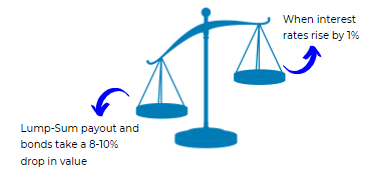

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

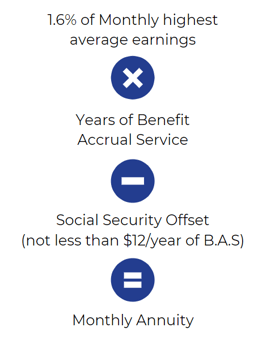

Highest Average Earnings is the monthly average of your regular earnings for the 36 consecutive months in which they’re the highest.

In most cases, this will be the sum of your last 36 months divided by 36.

The applicable interest rate is a separate average of each of the three segment rates for the fifth, fourth and third months preceding your annuity start date. The three segment rates are calculated by the IRS according to regulations that are also part of the Pension Protection Act of 2006 and reflect the yields of short-, mid-, and long-term corporate bonds. (Note: Chevron also has Legacy Unocal and Legacy Texaco Retirement Plans)

Different Plans

Similar to Chevron, AT&T has many different plans available. With AT&T, they have different pension plan formulas for management & non-management. Lets look at a sample non-management plan.

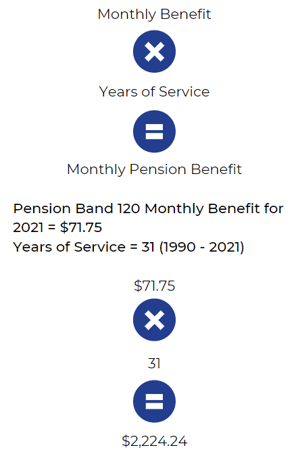

AT&T non-management employees have their own Craft/non-management pension plan. Let's take a look at a pension example for a gentleman by the name of Joe Smith who is hourly and using the Craft/non-management pension plan.

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

-

Craft has a defined benefit plan that uses pension bands.

-

A pension band determines your benefits based on your job title/grade level/occupation.

- Joe will receive a monthly dollar amount into his account for each year of service.

-

Joe's benefit (pension band may change yearly).

-

A pension band determines your benefits based on your job title/grade level/occupation.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

What type of retirement plan does Sysco offer to its employees?

Sysco offers a 401(k) Savings Plan to help employees save for retirement.

Does Sysco provide a matching contribution for its 401(k) plan?

Yes, Sysco provides a matching contribution to the 401(k) plan, which helps employees increase their retirement savings.

At what age can Sysco employees start participating in the 401(k) Savings Plan?

Sysco employees can typically start participating in the 401(k) Savings Plan as soon as they meet the eligibility requirements, usually at age 21.

How can Sysco employees enroll in the 401(k) Savings Plan?

Sysco employees can enroll in the 401(k) Savings Plan through the company’s benefits portal or by contacting the HR department for assistance.

What investment options are available in Sysco's 401(k) Savings Plan?

Sysco's 401(k) Savings Plan offers a variety of investment options, including mutual funds, target-date funds, and company stock.

How much can Sysco employees contribute to their 401(k) plan each year?

Sysco employees can contribute up to the IRS limit for 401(k) contributions, which is adjusted annually.

Does Sysco allow employees to take loans from their 401(k) Savings Plan?

Yes, Sysco allows employees to take loans from their 401(k) Savings Plan under certain conditions.

What happens to a Sysco employee's 401(k) account if they leave the company?

If a Sysco employee leaves the company, they can choose to roll over their 401(k) account to another retirement plan, cash out, or leave it with Sysco.

Can Sysco employees change their contribution percentage to the 401(k) plan?

Yes, Sysco employees can change their contribution percentage to the 401(k) plan at any time, subject to certain guidelines.

Is there a vesting schedule for Sysco's matching contributions to the 401(k) plan?

Yes, Sysco has a vesting schedule for its matching contributions, meaning employees must work for a certain period before they fully own those contributions.

/General/General%206.png?width=1280&height=853&name=General%206.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)