Healthcare Provider Update: The Southern Company's healthcare provider is generally managed through an employer-sponsored health plan, which typically relies on insurers such as Aetna or Cigna, although specific arrangements can vary. As we approach 2026, significant healthcare cost increases are anticipated due to a multitude of factors affecting the Affordable Care Act (ACA) marketplace. With some states projecting premium hikes of over 60%, the expiration of enhanced federal subsidies is expected to push monthly costs for many enrollees up by more than 75%. This unprecedented rise in premiums combined with ongoing inflation in medical costs, driven by higher hospital and drug prices, creates a complex financial landscape for consumers navigating their health insurance options in the coming year. Employers like The Southern Company may need to strategize effectively to mitigate the impact of these escalating costs on their employees' healthcare coverage and overall well-being. Click here to learn more

With 2021 wrapped up and going into the new year, the IRS just released Revenue Procedure 2021-45 and Notice 2021-61 which detail the tax changes and cost of living adjustments for 2022. The main points of this new release that will most likely affect The Southern Company employees would be:

- This year, the tax filing deadline is on April 18, instead of the typical April 15.

- The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.

- For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

Also, the personal exemption for tax year 2022 remains at 0, as it was for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

If you experienced a job change, retirement or lapse in employment from The Southern Company, the “lookback” rule may be an important option to consider when filing taxes this year. You’ll also have the option to use your 2019 earned income for your 2021 return thanks to changes from the American Rescue Plan Act. This rule is mainly used for calculation of the Earned Income Tax Credit and the Child Tax Credit.

Remote workers employed by The Southern Company might face double taxation on state taxes. Due to the pandemic, many employees moved back home which could have been outside of the state where they were employed. Last year, some states had temporary relief provisions to avoid double taxation of income, but many of those provisions have expired. There are only six states that currently have a ‘special convenience of employer’ rule: Connecticut, Delaware, Nebraska, New Jersey, New York, and Pennsylvania. If you work remotely for The Southern Company, and if you don't currently reside in those states, consult with your tax advisor if there are other ways to mitigate the double taxation.

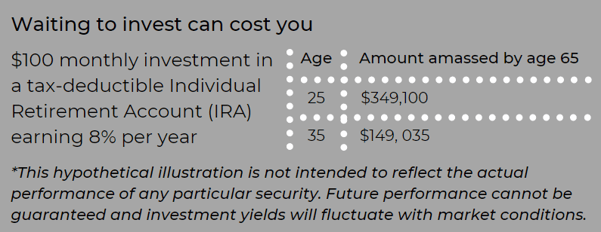

Retirement account contributions: Contributing to your The Southern Company 401k plan can cut your tax bill significantly, and the amount you can save has increased for 2022. In 2022, the IRS has raised the contribution limit for a 401k to $20,500 - up by $1,000. Meanwhile, The Southern Company workers who are older than 50 years old are eligible for an extra catch-up contribution of $6,500.

There are important changes for the Earned Income Tax Credit (EITC) that you, as a taxpayer employed by The Southern Company, should know:

- The income threshold has been increased for single filers with no children; the American Rescue Plan Act temporarily boosted it from $543 to $1,502 in 2021; this expansion has not been carried over to the 2022 tax year.

- Married taxpayers filing separately can qualify: You can claim the EITC as a married filing separately if you meet other qualifications. This wasn't available in previous years.

Increased deduction for cash charitable contributions: In years past, the threshold was $300 for both single and joint filers, but in 2022 that changed to $300 for single filers and up to $600 for joint filers.

Child Tax Credit changes:

- A $2,000 credit per dependent under age seventeen..

- Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and heads of households).

- A 70 percent, partial refundability affecting individuals whose tax bill falls below the credit amount.

2022 Tax Brackets

-png.png?width=575&name=image%20(18)-png.png)

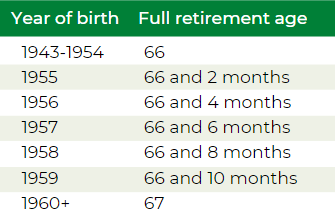

Inflation reduces purchasing power over time as the same basket of goods will cost more as prices rise. In order to maintain the same standard of living throughout your retirement after leaving The Southern Company, you will have to factor rising costs into your plan. While the Federal reserve strives to achieve 2% inflation rate each year, in 2021 that rate shot up to 7% a drastic increase from 2020’s 1.4%. While prices as a whole have risen dramatically, there are specific areas to pay attention to if you are nearing or in retirement from The Southern Company, like healthcare. Many The Southern Company corporate retirees depend on Medicare as their main health care provider and in 2022 that healthcare out-of-pocket premium is set to increase by 14.5%. In addition to Medicare increases, the cost of over-the-counter medications is also projected to increase by at least 10%. The Employee Benefit Research Institute (ERBI) found in their 2022 report that couples with average drug expenses would need $296,000 in savings just to cover those expenses in retirement. It is crucial to take all of these factors into consideration when constructing your holistic plan for retirement from The Southern Company.

*Source: IRS.gov, Yahoo, Bankrate

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

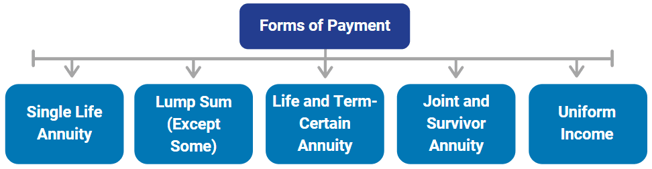

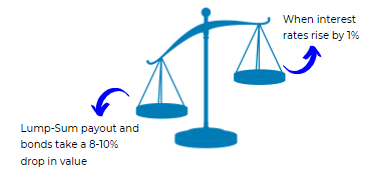

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

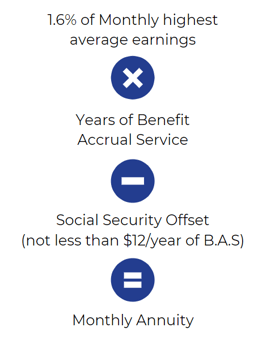

Highest Average Earnings is the monthly average of your regular earnings for the 36 consecutive months in which they’re the highest.

In most cases, this will be the sum of your last 36 months divided by 36.

The applicable interest rate is a separate average of each of the three segment rates for the fifth, fourth and third months preceding your annuity start date. The three segment rates are calculated by the IRS according to regulations that are also part of the Pension Protection Act of 2006 and reflect the yields of short-, mid-, and long-term corporate bonds. (Note: Chevron also has Legacy Unocal and Legacy Texaco Retirement Plans)

Different Plans

Similar to Chevron, AT&T has many different plans available. With AT&T, they have different pension plan formulas for management & non-management. Lets look at a sample non-management plan.

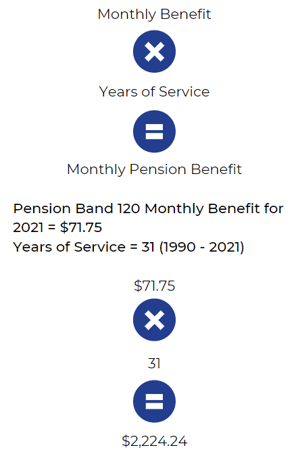

AT&T non-management employees have their own Craft/non-management pension plan. Let's take a look at a pension example for a gentleman by the name of Joe Smith who is hourly and using the Craft/non-management pension plan.

In 1990, Joe is hired by AT&T and participates in the Craft Pension Plan:

Craft Pension Plan

-

Craft has a defined benefit plan that uses pension bands.

-

A pension band determines your benefits based on your job title/grade level/occupation.

- Joe will receive a monthly dollar amount into his account for each year of service.

-

Joe's benefit (pension band may change yearly).

-

A pension band determines your benefits based on your job title/grade level/occupation.

Rising Interest Rates e-book

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2022

https://news.yahoo.com/taxes-2022-important-changes-to-know-164333287.html

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

https://www.the-sun.com/money/4490094/key-tax-changes-for-2022/

https://www.bankrate.com/taxes/child-tax-credit-2022-what-to-know/

What is the 401(k) plan offered by The Southern Company?

The Southern Company offers a 401(k) plan that allows employees to save for retirement through pre-tax contributions, which can grow tax-deferred until withdrawal.

How can I enroll in The Southern Company's 401(k) plan?

Employees can enroll in The Southern Company's 401(k) plan through the online benefits portal or by contacting the HR department for assistance.

Does The Southern Company match employee contributions to the 401(k) plan?

Yes, The Southern Company provides a matching contribution to employee 401(k) accounts, which helps enhance retirement savings.

What is the maximum contribution limit for The Southern Company's 401(k) plan?

The maximum contribution limit for The Southern Company's 401(k) plan is subject to IRS limits, which are updated annually. Employees should refer to the latest IRS guidelines for specific amounts.

Can I change my contribution percentage to The Southern Company's 401(k) plan?

Yes, employees can change their contribution percentage to The Southern Company's 401(k) plan at any time through the online benefits portal.

What investment options are available in The Southern Company's 401(k) plan?

The Southern Company's 401(k) plan offers a variety of investment options, including mutual funds, target-date funds, and other investment vehicles tailored to different risk tolerances.

When can I access my funds from The Southern Company's 401(k) plan?

Employees can access their funds from The Southern Company's 401(k) plan upon reaching retirement age, or under certain circumstances such as financial hardship or termination of employment.

Does The Southern Company offer financial education regarding the 401(k) plan?

Yes, The Southern Company provides financial education resources and workshops to help employees understand their 401(k) options and make informed investment decisions.

What happens to my 401(k) plan if I leave The Southern Company?

If you leave The Southern Company, you have several options for your 401(k) plan, including rolling it over to another retirement account, leaving it with The Southern Company, or cashing it out (subject to taxes and penalties).

Are there any fees associated with The Southern Company's 401(k) plan?

Yes, The Southern Company’s 401(k) plan may have administrative fees and investment-related expenses, which are disclosed in the plan documents.

/General/General%203.png?width=1280&height=853&name=General%203.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)