Healthcare Provider Update: Healthcare Provider for ConocoPhillips ConocoPhillips provides its employees with access to various healthcare plans through third-party providers, primarily offering services via large insurers such as Blue Cross Blue Shield and UnitedHealthcare. These plans typically include comprehensive medical, vision, and dental coverage tailored to meet the diverse needs of its workforce. Potential Healthcare Cost Increases in 2026 As the healthcare landscape evolves, ConocoPhillips employees can expect significant premium hikes in 2026, driven by a perfect storm of factors impacting the Affordable Care Act (ACA) marketplace. With anticipated increases exceeding 60% in some states and the potential expiration of federal premium subsidies, many employees could face out-of-pocket costs soaring by up to 75%, compounding the financial pressure. The ongoing upward trend in medical costs, coupled with employers' shifts in cost-sharing strategies, may further challenge employees as they navigate rising healthcare expenses. Planning ahead and understanding these dynamics is crucial for effective budgeting and healthcare management in the coming years. Click here to learn more

In March 2022, the Consumer Price Index for All Urban Consumers (CPI-U), the most common measure of inflation, rose at an annual rate of 8.5%, the highest level since December 1981.

1

It's not surprising that a Gallup poll at the end of March found that one out of six Americans considers inflation to be the most important problem facing the United States.

2

When inflation began rising in the spring of 2021, many economists, including policymakers at the Federal Reserve, believed the increase would be transitory and subside over a period of months. One year later, inflation has proven to be more stubborn than expected. It may be helpful for ConocoPhillips employees and retirees to look at some of the forces behind rising prices, the Fed's plan to combat them, and early signs that inflation may be easing.

Hot Economy Meets Russia and China

The fundamental cause of rising inflation continues to be the growing pains of a rapidly opening economy — a combination of pent-up consumer demand, supply-chain slowdowns, and not enough workers to fill open jobs. Loose Federal Reserve monetary policies and billions of dollars in government stimulus helped prevent a deeper recession but added fuel to the fire when the economy reopened.

More recently, the Russian invasion of Ukraine has placed upward pressure on already high global fuel and food prices.

3

At the same time, a COVID resurgence in China led to strict lockdowns that have closed factories and tightened already struggling supply chains for Chinese goods. The volume of cargo handled by the port of Shanghai, the world's busiest port, dropped by an estimated 40% in early April.

4

Behind the Headlines

Although the 8.5% year-over-year 'headline' inflation in March is a daunting number for our ConocoPhillips clients to consider, monthly numbers provide a clearer picture of the current trend. The month-over-month increase of 1.2% was extremely high, but more than half of it was due to gasoline prices, which rose 18.3% in March alone.

5

Despite the Russia-Ukraine conflict and increased seasonal demand, U.S. gas prices dropped in April, but the trend was moving upward by the end of the month.

6

The federal government's decision to release one million barrels of oil per day from the Strategic Petroleum Reserve for the next six months and allow summer sales of higher-ethanol gasoline may help moderate prices.

7

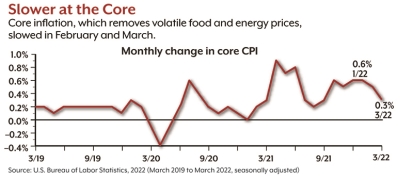

Core inflation, which strips out volatile food and energy prices, rose 6.5% year-over-year in March, the highest rate since 1982. However, it's important that our ConocoPhillips clients consider that the month-over-month increase from February to March was just 0.3%, the slowest pace in six months. Another positive sign was the price of used cars and trucks, which rose more than 35% over the last 12 months (a prime driver of general inflation) but dropped 3.8% in March.

8

Featured Video

Articles you may find interesting:

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

- Corporate Employees: 8 Factors When Choosing a Mutual Fund

- Use of Escrow Accounts: Divorce

- Medicare Open Enrollment for Corporate Employees: Cost Changes in 2024!

- Stages of Retirement for Corporate Employees

- 7 Things to Consider Before Leaving Your Company

- How Are Workers Impacted by Inflation & Rising Interest Rates?

- Lump-Sum vs Annuity and Rising Interest Rates

- Internal Revenue Code Section 409A (Governing Nonqualified Deferred Compensation Plans)

- Corporate Employees: Do NOT Believe These 6 Retirement Myths!

- 401K, Social Security, Pension – How to Maximize Your Options

- Have You Looked at Your 401(k) Plan Recently?

- 11 Questions You Should Ask Yourself When Planning for Retirement

- Worst Month of Layoffs In Over a Year!

Wages and Consumer Demand

In March, average hourly earnings increased by 5.6% — but not enough to keep up with inflation and blunt the effects that impacted a variety of businesses, as well as many ConocoPhillips employees and retirees around the country. Lower-paid service workers received higher increases, with wages jumping by almost 15% for non-management employees in the leisure and hospitality industry. Although inflation has cut deeply into wage gains over the last year, wages have increased at about the same rate as inflation over the two-year period of the pandemic.

9

One of the big questions going forward is whether rising wages will enable consumers to continue to pay higher prices, which can lead to an inflationary spiral of ever-increasing wages and prices. Recent signals are mixed. The official measure of consumer spending increased 1.1% in March, but an early April poll found that two out of three Americans had cut back on spending due to inflation.

10-11

Soft or Hard Landing?

The current inflationary situation has raised many questions among our ConocoPhillips clients in regard to what the solution is. The Federal Open Market Committee (FOMC) of the Federal Reserve has laid out a plan to fight inflation by raising interest rates and tightening the money supply. After dropping the benchmark federal funds rate to near zero in order to stimulate the economy at the onset of the pandemic, the FOMC raised the rate by 0.25% at its March 2022 meeting and projected the equivalent of six more quarter-percent increases by the end of the year and three or four more in 2024.

12

This would bring the rate to around 2.75%, just above what the FOMC considers a 'neutral rate' that will neither stimulate nor restrain the economy.

13

These moves were projected to bring the Fed's preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, down to 4.3% by the end of 2022, 2.7% by the end of 2023, and 2.3% by the end of 2024.

14

PCE inflation — which was 6.6% in March — tends to run below CPI, so even if the Fed achieves these goals, CPI inflation will likely remain somewhat higher.

15

Fed policymakers have signaled a willingness to be more aggressive, if necessary, and the FOMC raised the fund's rate by 0.5% at its May meeting, as opposed to the more common 0.25% increase. This was the first half-percent increase since May 2000, and there may be more to come. The FOMC also began reducing the Fed's bond holdings to tighten the money supply. New projections to be released in June will provide an updated picture of the Fed's intentions for the federal funds rate.

16

The question facing the FOMC is how fast it can raise interest rates and tighten the money supply while maintaining optimal employment and economic growth. The ideal is a 'soft landing,' similar to what occurred in the 1990s, when inflation was tamed without damaging the economy. At the other extreme is the 'hard landing' of the early 1980s, when the Fed raised the fund's rate to almost 20% in order to control runaway double-digit inflation, throwing the economy into a recession. 18

Fed Chair Jerome Powell acknowledges that a soft landing will be difficult to achieve, but he believes the strong job market may help the economy withstand aggressive monetary policies. Supply chains are expected to improve over time, and workers who have not yet returned to the labor force might fill open jobs without increasing wage and price pressures. 19

The next few months will be a key period to reveal the future direction of inflation and monetary policy, and we recommend that ConocoPhillips employees and retirees keep this topic in mind. The hope is that March represented the peak and inflation will begin to trend downward. But even if that proves to be true, it could be a painfully slow descent.

We'd like to remind our clients from ConocoPhillips that projections are based on current conditions, are subject to change, and may not come to pass.

1, 5, 8-9) U.S. Bureau of Labor Statistics, 2022

2) Gallup, March 29, 2022

3, 7) The New York Times, April 12, 2022

4) CNBC, April 7, 2022

6) AAA, April 25 & 29, 2022

10, 15) U.S. Bureau of Economic Analysis, 2022

11) CBS News, April 11, 2022

12, 14, 16) Federal Reserve, 2022

13, 17) The Wall Street Journal, April 18, 2022

18) The New York Times, March 21, 2022

How does the retirement process at ConocoPhillips provide guidance to employees in selecting the most beneficial form of payment? In what ways can employees utilize available resources to maximize their understanding of the pension options offered by ConocoPhillips?

The retirement process at ConocoPhillips provides employees with various resources to guide them in selecting the most beneficial form of pension payment. Employees can access the "How to Choose the Best Form of Payment" link on Your Benefits Resources™ (YBR) to learn more about their options and determine what works best for their financial situation(ConocoPhillips_Your_Ret…).

What steps must be completed by employees at ConocoPhillips to ensure they initiate their retirement process accurately and avoid any delays? How crucial is the timing of these steps in determining the Benefit Commencement Date (BCD)?

Employees at ConocoPhillips must initiate the retirement process by requesting their pension paperwork 60-90 days before their Benefit Commencement Date (BCD). Timing is crucial, as missing deadlines may delay the BCD and associated payments. Completing all steps on time ensures that the retirement process flows smoothly(ConocoPhillips_Your_Ret…).

Given the complexities associated with the lump-sum pension payment option at ConocoPhillips, what considerations should employees take into account before electing this choice? How does the current interest rate at the Benefit Commencement Date impact the lump-sum amount?

Before electing a lump-sum pension payment, ConocoPhillips employees should consider the current interest rate at their BCD, as it directly affects the lump-sum amount. A higher interest rate typically reduces the lump-sum payment, making timing and rate awareness critical(ConocoPhillips_Your_Ret…).

In what ways can ConocoPhillips employees ensure their Pension Election Authorization form is completed correctly to facilitate timely pension payments? What are the implications of not adhering to the required notarized consent for married participants?

Ensuring the correct completion of the Pension Election Authorization form is vital for timely pension payments. For married participants, notarized spousal consent is required, and failure to provide this could result in delays or issues with payment processing(ConocoPhillips_Your_Ret…).

How does choosing direct deposit for pension payments at ConocoPhillips streamline the retirement process for employees? What should employees know about setup and changes regarding direct deposit after initiating their pension benefits?

Choosing direct deposit for pension payments simplifies the process for employees at ConocoPhillips, as it enables automatic payments to their bank account. Employees can set up direct deposit during their retirement process or update it at a later time(ConocoPhillips_Your_Ret…).

For employees considering rolling over their lump-sum pension payment from ConocoPhillips, what procedures should they follow to ensure compliance with IRS regulations and to avoid tax penalties? How can effective planning influence the success of this rollover?

Employees electing to roll over their lump-sum pension payment must follow specific IRS regulations to avoid tax penalties. Effective planning, such as obtaining rollover paperwork and adhering to IRS rules, ensures compliance and smooth fund transfer(ConocoPhillips_Your_Ret…).

What resources does ConocoPhillips provide for employees to calculate and project their retirement income? How can these tools empower employees to make informed decisions regarding their future financial security?

ConocoPhillips provides employees with tools such as the "Project Retirement Income" feature on YBR, empowering them to calculate and project their retirement income. These resources help employees make informed decisions about their financial future(ConocoPhillips_Your_Ret…).

How do deadlines play a pivotal role in the benefits process for retiring employees at ConocoPhillips, and what specific dates must be adhered to in order to avoid payment delays? Can you provide examples of consequences resulting from missed deadlines?

Deadlines are critical in ConocoPhillips' retirement process, as missing them can delay pension payments. For example, requesting pension paperwork after the 15th of the month can delay the BCD by a month, affecting the pension payout date(ConocoPhillips_Your_Ret…).

What are the added advantages for employees at ConocoPhillips who actively seek assistance or information from the Benefits Center during their retirement planning? How can this proactive approach enhance their overall retirement experience?

Employees who seek assistance from the Benefits Center during their retirement planning benefit from personalized guidance. This proactive approach ensures that they fully understand their options and deadlines, enhancing their overall retirement experience(ConocoPhillips_Your_Ret…).

How can employees at ConocoPhillips contact the Benefits Center to receive personalized assistance in navigating their retirement options? What specific resources and support can they expect when reaching out for help?

ConocoPhillips employees can contact the Benefits Center by calling 800-622-5501 or accessing YBR online. The Benefits Center provides personalized assistance and guidance, helping employees navigate their pension options effectively(ConocoPhillips_Your_Ret…).

/General/General%209.png?width=1280&height=853&name=General%209.png)

-2.png?width=300&height=200&name=office-builing-main-lobby%20(52)-2.png)

.webp?width=300&height=200&name=office-builing-main-lobby%20(27).webp)

-2.png)

.webp)