An Overview of Some Sophisticated Estate Planning Strategies

Who Needs Advanced Estate Planning?

The Federal Transfer Tax System

The Federal Transfer Tax System: Basic Exclusion Amounts

The Federal Transfer Tax System: Estate Tax Exclusion Portability

The Federal Transfer Tax System: GST Tax Exemption Amounts

The Federal Transfer Tax System: Exclusion

The Federal Transfer Tax System: Marital and Charitable Deductions

Minimizing Estate Taxes: Equalizing Each Spouse's Estate

Minimizing Estate Taxes: Bypass Trust

Minimizing Estate Taxes: QTIP Trust

Minimizing Estate Taxes: Dynasty Trust

Minimizing Estate Taxes: Grantor Retained Annuity Trust (GRAT)

Estate Freeze: Family Limited Partnership (FLP)

Estate Freeze: Private Annuity

Charitable Giving: Charitable Remainder Trust (CRT)

Charitable Giving: Charitable Lead Trust (CLT)

Charitable Giving: Donor-Advised Fund (DAF)

What Strategies are Available?

Asset Protection: Business Entity

Asset Protection: Self-Settled Domestic Trust

Asset Protection: Offshore or Foreign Trust

As Fortune 500 employees or retirees, you likely need some kind of estate plan. A basic estate plan typically includes one or more healthcare directives (e.g., a healthcare proxy), a durable power of attorney, a will, and in some cases a living trust. Many people, however, need to go beyond the basics.

This e-book will illustrate some estate planning strategies for Fortune 500 employees and retirees, who are concerned about minimizing gift and estate taxes, and individuals who have specific goals such as transferring a business interest, providing for a favorite charity, or protecting assets from future creditors.

Please keep in mind that this presentation is intended to give Fortune 500 employees an overview of some sophisticated planning strategies and that these strategies are subject to various technical considerations. Some of them may or may not be appropriate in your particular situation, so you’ll need to consult your estate planning advisor to determine whether they are right for you.

From working with many Fortune 500 employees and retirees, we have listed below some qualities that may indicate that you might benefit from advanced estate planning:

If your estate exceeds the federal gift and estate tax basic exclusion amount, which is $12,060,000 in 2022, a number of the strategies we discuss here may help you minimize estate taxes so that more of your money will go to your loved ones instead of the federal government.[6] Let's stop here for just a moment to note that this presentation discusses estate tax at the federal level only. The fact is, though, that the individual states impose estate taxes as well, and these state taxes could impact estates of lesser value than the federal basic exclusion amount. Keep this fact in mind as we proceed through our slides.

If you want to leave a legacy to grandchildren or later generations, there are specific legal and tax issues that you'll need to consider (for example, the generation-skipping transfer tax). Similarly, if you own a family business or farm, you probably have unique planning concerns that may include transferring your business to your heirs in a way that doesn't disrupt operations, while taking advantage of special tax breaks. Some of the strategies we'll discuss may help you with these objectives. And if you're charitably inclined, some of the strategies we'll discuss will help you arrange charitable gifts in a manner that best suits your financial situation.

Finally, you may be interested in some strategies that can help you protect your assets from future creditors, an ex-spouse, or your heirs' future creditors and ex-spouses.

Let's briefly mention some of the general tradeoffs that come with using them before we begin:

First of all, implementing any estate planning strategy usually comes with a cost. For instance, you may need to hire an attorney to draw up legal documents, or you may need to hire an appraiser to determine the current fair market value of the property.

Second, most estate tax planning strategies require you to give up some or all of the financial benefits from your property. For example, putting life insurance in an irrevocable trust to avoid estate taxes on the proceeds also precludes you from drawing on the policy's cash value.

And finally, most of the strategies we'll look at require you to give up some degree of control over your property. For example, deeding your home to your children today will avoid estate taxes on the home's future appreciation, but, as the new owners, your children would have the legal right to evict you.

The bottom line is that you must balance your objectives against the cost, making sure that the potential benefits of a strategy outweigh the costs.

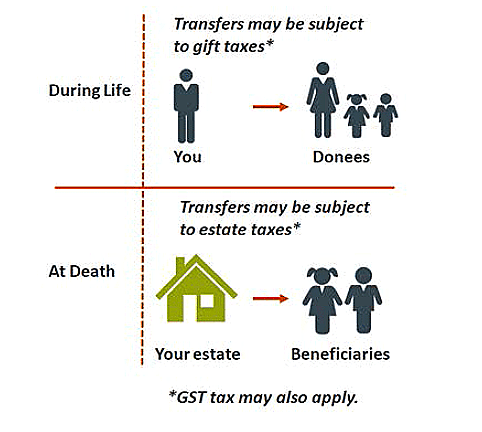

We receive many questions from Fortune 500 employees and retirees about how the federal transfer tax system works. Here is how how the federal transfer tax system works:

-1.png)

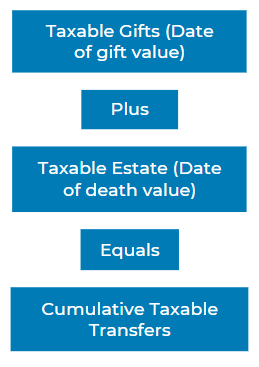

Now let's look at how these three transfer taxes work together. Under the current federal transfer tax system, gift and estate taxes are unified, meaning all transfers - those made during life and those made at death - are combined and taxed on your estate tax return.

Generally, gifts are valued as of the date the gifts were made, while transfers at death are valued as of the date of death. Then, the total is taxed at the appropriate rate.

Any gift tax that has already been paid is subtracted from any estate tax that is owed. Only gift and estate taxes are unified - the generation-skipping transfer tax is a separate tax imposed on both gifts and estate transfers.

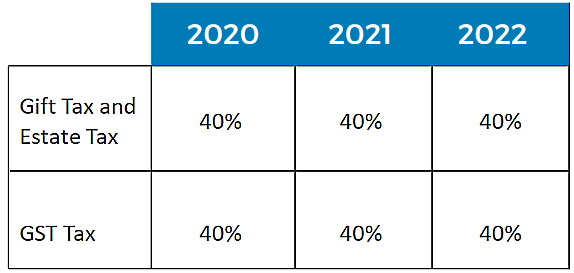

Let's talk now about the federal transfer tax top rates. This is important because your transfers could be subject to these tax rates.

Here, you can see how the gift tax, estate tax, and GST tax rates have stayed steady during recent years.

Legislation set the top tax rate at 40% for 2013 and later years.

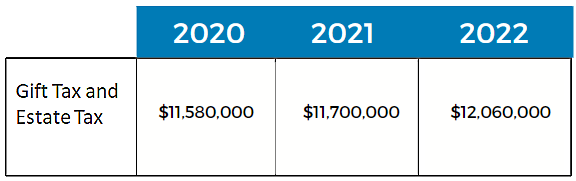

We also receive many questions from fortune 500 employees and retirees about the gift and estate tax basic exclusion amount. Now, let's understand the gift and estate tax basic exclusion amount. These amounts are now adjusted annually for inflation.

In 2017, Congress doubled the exemption starting in 2018, and the amount will continue to rise with inflation through 2025. For 2022, the exemption has been lifted to $12.06 million per individual and $24.12 million per couple. The increase in the exemption is set to lapse after 2025.[6]

Using your exclusion for gift tax purposes reduces your available estate tax exclusion.

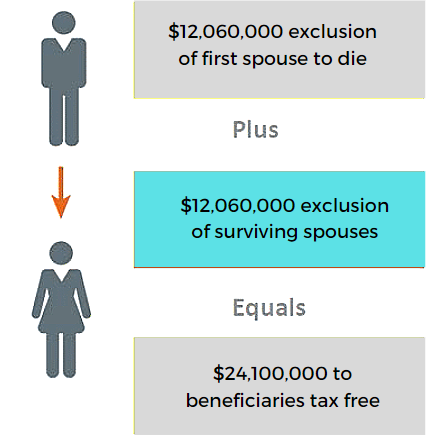

Prior to 2011, if a decedent's estate did not use all of the exclusion it was entitled to, the remaining balance was lost forever. The American Taxpayer Relief Act of 2010 changed that and made portability provisions permanent.

The statute allows the decreased spouse's unused exclusion (DSUE) amount to be made available to the surviving spouse only if the predeceased spouse's executor elects portability on "timely filed" and "complete and properly prepared" estate tax return. Portability may effectively double the exclusion of the surviving spouse.[8]

Portability may make minimizing gift and estate taxes easier for spouses (but, as we will see next, portability is not available for the GST exemption).

The exemption for the GST tax has also changed during recent years.

These exemptions mirror the estate tax basic exclusion amounts. The current GST tax exemption is $12,060,000 in 2022. The exemption will grow each year, based on inflation, through 2025. Unless Congress intervenes, the exemption amount is scheduled to revert to its $5 million baseline, indexed for inflation, in 2026.[9]

One important thing to know about the GST tax exemption is that unlike the gift and estate tax exclusion, it is not portable. Now, let's consider how to transfer an estate while minimizing transfer taxes.

Certain gifts and transfers are excluded from transfer taxes. The annual gift tax exclusion lets you give $16,000 to as many individuals as you want each year with no transfer tax consequences. If you and your spouse make the gift together, you can double the amount and give $32,000 per person per year. If you're giving to a Section 529 plan, a type of tax-deferred college savings plan, you can give $80,000 in a single year, if you treat the contribution as if it were spread over a 5-year period. Spouses can double that amount and give $160,000 to a 529 plan. You should be aware, however, that if you should die during the five-year period, a pro-rata portion of your gift will be brought back into your estate.[10]

The amount of the annual gift tax exclusion is indexed for inflation, so these amounts may rise or fall in future years. And even though it is called a gift tax exclusion, a similar annual exclusion also applies to the generation-skipping transfer tax. Payments that you make directly to an educational institution for someone else's tuition is also exempt from transfer taxes, as are payments made directly to a medical care provider for someone's medical care. You can't give the money to the person benefitting from the gift and then have that person make the payments. The payment must go directly from you to the payee. This can be a great way to transfer money tax-free because there's no limit to the number of funds you can transfer in this manner.

Now, let's look at some transfer tax deductions.

Generally, transfers you make to your spouse, either during your lifetime or at your death, are fully deductible for transfer tax purposes. To qualify for the gift tax marital deduction, your spouse must be a U.S. citizen. If your spouse is not a U.S. citizen, you may qualify for a special annual gift tax exclusion instead of the marital deduction. In 2022, this annual exclusion is $160,000. [11]

Transfers made to a charity are also generally fully deductible for purposes of determining transfer taxes. To be eligible, the charity must be a qualified charity. That means it must be on the IRS's list of qualified charities, which is published each year in Publication 78, also known as the Blue Book.

Another benefit of giving to charity is that your transfers may also be deductible for income tax purposes. Now, let's look at some strategies that make the best use of the transfer tax exemptions, exclusions, and deductions that we've discussed.

All of the strategies we're going to discuss over the next few minutes help to minimize transfer taxes while achieving one or more specific objectives. Whether any of these strategies are appropriate for you depends upon your particular circumstances.

Specifically, we're going to talk about equalizing each spouse's estate, optimizing the marital deduction, the qualified terminable interest property trust (QTIP), the bypass (credit shelter) trust, the dynasty trust, the grantor retained annuity trust (GRAT), and the qualified personal residence trust (QPRT).

Let's look at a situation where two spouses own property with unequal values. As noted earlier, with portability, the first spouse to die could leave everything to the other spouse, and the estate of the first spouse to die could transfer the decedent's $12,060,000 exclusion to the surviving spouse. If the surviving spouse, then has an estate that is no more than $24,120,000, there is no estate tax since the surviving spouse would then have an exclusion of $24,120,000. But portability isn't the only possible strategy.

For example, John and Mary own property with unequal values. John owns $10 million in his own name and Mary owns nothing in her own name. Let's assume that the basic exclusion amount is a nice, even $5 million. We're using the round number here for convenience, but remember, the exemption in 2022 is $12,060,000. In a situation such as this, the spouse with the greater taxable estate might consider transferring assets to the spouse with the smaller taxable estate, at least to the extent that estate tax basic exclusion amounts would be fully utilized. Because transfers to spouses are fully deductible for transfer tax purposes, no gift tax results from such transfers.

If you have any questions/concerns about your estate planning, reach out to one of our Financial Advisors! Let's see how this might work in our example. If John makes a tax-free gift of $5 million to Mary, each spouse will have a $5 million estate. If John and Mary both died this year, both John's estate and Mary's estate would be able to take a full $5 million estate tax exclusion, and no estate tax is due. Each estate could be passed on to their children tax-free. This strategy can work only if each individual has a will that leaves property to someone other than their spouse. That means both spouses need to be able to accommodate the situation financially. Implementing this strategy is simply a matter of retitling assets in the recipient spouse's name.

Now, let's look at another strategy that can be used instead of retitling assets.

When Mary dies, her own estate passes to their children. Any portion of Mary's estate that is in excess of her estate tax exclusion amount will be subject to estate taxes. Upon Mary's death, the bypass trust funds are distributed to the children according to the terms of the trust. If John and Mary's children are adults, but John doesn't want them to have access to the property outright, a spendthrift provision should be included in the trust agreement.

Now, let's say that John doesn't want the property to go outright to his children and also doesn't want property to go outright to Mary. In this case, John might leave the remainder estate to a QTIP trust as we discuss next, rather than directly to his spouse. When a bypass trust is used in conjunction with a QTIP trust, the arrangement is usually called an A/B trust arrangement.

What if John wants to take the marital deduction and provide for Mary, but is concerned that Mary will remarry and his property will ultimately go to Mary's new spouse instead of his children? Can John's estate plan preserve his property for his children?

Yes, with a qualified terminable interest property (QTIP) trust. Under a QTIP, income is paid to a surviving spouse, while the balance of funds is held in trust until that spouse's death, at which point it is then paid out the beneficiaries specified by the grantor.

How It Works:

In his will, John leaves the maximum amount that can pass free from estate taxes under his exclusion to his children and the remainder of the estate to a QTIP trust. The assets left to the QTIP trust will pass tax-free under the marital deduction as long as the following conditions are met.

Mary receives all the income from the trust at least annually for life, and any remaining trust assets will be included in Mary's taxable estate when she dies. John's executor must make a QTIP election on John's estate tax return (that means attaching schedule M to the return). John may also give Mary unlimited access to the principal if he wants, but he does not need to.

Now, when Mary dies, the amount remaining in the QTIP trust is included in Mary's taxable estate but can be offset by her estate tax exclusion. The trust assets will then be distributed to the children who John has named as beneficiaries in the trust agreement (which Mary can't change). This can be a very effective strategy for individuals who want to provide for the children of a previous marriage.

Often, Fortune 500 employees who want to leave a legacy for multiple generations may be worried about how their estates could be eaten away by estate taxes and the generation-skipping transfer tax. A dynasty trust might be the solution.

A dynasty trust is a long-term irrevocable trust to pass wealth from generation to generation without incurring transfer taxes- it can last for 21 years after the death of the last beneficiary alive when the trust was created. For example, say you create a trust today and name your 1-year-old grandchild as a beneficiary. The trust won't end until 21 years after that grandchild dies. If the grandchild lives a long life, the trust could last for over 100 years. Once assets are in the trust, they remain shielded from transfer taxes. Let's look at this example to see how estate tax savings work, you might find you'll enjoy a dynasty trust instead of passing an estate to your child outright.

If you were to pass $10 million (down through your child) to your great-grandchild today, assuming the money grew at a rate of 7%, and that there are 26 years between generational transfers, your great-grandchild would end up with approximately $142 million after taxes. But if the same amount was put into a dynasty trust, about $337 million would go to your great-grandchild. That's because estate taxes aren't shrinking the principal each time the property is passed from generation to generation.

Because income earned by trust assets would be subject to income taxes, and at very high trust rates, consideration should be given to funding a dynasty trust with investments that generate tax-free income, such as municipal bonds, or property that offers tax deferral or tax-advantaged growth such as growth stock or cash value life insurance.

Earlier we explained that to minimize transfer taxes, generally, you have to give up some control or financial benefit from the property. Let's say that you have an asset that you expect to increase in value. You want to remove the asset from your estate so that you won't have to pay transfer taxes on future increases in value, but you also need the income that is generated by that asset. How can assets be removed from an estate while continuing to provide benefits to the owner? By using a grantor-retained annuity trust, or GRAT.

With a GRAT, you can transfer property to the trust and receive annuity payments from the trust for a specified term of years. Gift tax is calculated on the value of the property less the value of the annuity stream you will receive. The value of the annuity stream will depend on the applicable federal rate in effect when the trust is created and the length of the trust term. The longer the term, the bigger the discount.

If you outlive the term of years specified in the trust, the property passes to the trust beneficiaries' estate tax-free. This can be especially beneficial if the property is rapidly appreciating property. However, when the property goes to the beneficiaries, the annuity payments to you also stop. There's also one drawback for the beneficiaries - they will not receive a step-up in basis to the fair market value of the trust assets they might have enjoyed had they inherited these assets at your death. Instead, they carry over your basis in the trust assets.

What happens if you die before the term specified in the trust expires? The value of trust assets will be included in your taxable estate, just as if you had died without the GRAT. You will have gained nothing, but you don't lose anything either. The key to this strategy is to choose a term that is long enough to provide a substantial discount, but that is also achievable. The younger you are, the better this will work for you. This strategy works best when interest rates are low. Now, let's look at how this arrangement works when the property that is transferred to the trust is the family home. A trust that holds a home is called a qualified personal residence trust, or QPRT ("Q-Pert").

With a QPRT, the interest that is retained is not the right to receive annuity payments, but the right to continue living in the home. Just as with a GRAT, if you outlive the term of years, no additional tax will be imposed. But, with a QPRT, if you outlive the specified number of years and continue living in the home, you will have to start paying fair market rent to the trust beneficiaries or the IRS might look at the transaction as a sham. And just as with a GRAT, if you die before the term of years expires, the value of the home is included in your taxable estate. Now, let's switch gears, and talk about a group of strategies commonly characterized as estate freeze techniques.

An estate freeze is an asset management strategy whereby an estate owner seeks to transfer assets to his or her beneficiaries, without tax consequences. The objective is to fix, or freeze, the value of property for the person who is transferring the property out of an estate and transfer any future growth to the person who is receiving the property. This makes it an effective strategy when you have property that is expected to appreciate significantly, such as real estate or investments.

What you're really doing with an estate freeze is deferring taxes. That's because when you transfer property during your lifetime, the recipient gets your basis in the property and not a step-up in basis to current fair market value. So, any capital gains are transferred to the recipient along with the property. If you think about it, many of the strategies we have already looked at, like the GRAT and QPRT, are, in essence, estate freezes. But, when we say estate freeze, we're really talking about some specific strategies. These strategies also allow you to retain some degree of control over the property you're transferring.

The most common estate freeze strategies include family-limited partnerships and private annuities.

A family limited partnership, or FLP, can be a powerful estate planning strategy for Fortune 500 employees, family business owners, or even farmers who are ready to hand over the business to the next generation because it can minimize estate taxes and protect the business from creditors of the younger generation. Here's how it typically works:

Fortune 500 employees whose spouse is a business owner, can create an FLP according to the laws of their state and transfer the business assets to the FLP. The parents are named as the general partners and the children are named as the limited partners. If you're a business owner, you as a parent, remain personally liable to future creditors of the business, while the children are liable only to the extent of any contributions, they have made to the FLP (in this example, nothing). It also means that the general partners manage the day-to-day affairs of the business, while the limited partners have no say. Also, the limited partners can't compel distributions from the FLP.

The FLP then begins to gift ownership interests, called units, to the children. The gifts are valued at a discount for gift tax purposes because the limited partners can't sell their units to a buyer unless the buyer is a family member. This discount s called a lack of marketability discount. Other discounts may apply depending on the restrictions the FLP puts on the limited partners. These discounts range from 15% to 60%. In some cases, these discounts can mean significant estate tax savings for the parents. Moreover, the future appreciation of the business assets has been removed from the parents' estates.

An FLP is typically established by married couples who place assets in the FLP and serve as their general partners. You may then grant limited-partnership interests to your children, of up to 99% of the value of the FLP's assets.[11] Warning: FLPs are costly to implement. FLP often costs $15,000 or more to create, and annual expenses are required to maintain the FLP. However, they can be a great strategy for Fortune 500 employees whose spouse is a business owner, in the right circumstances. [12] State filing fees can be high, and an independent appraiser must be hired to value the business assets, otherwise, the discounts probably won't be allowed. Also, the FLP entity must be created and maintained very carefully because the IRS won't hesitate to challenge your FLP, and you may lose all those estate tax benefits we just discussed. Now, let's look at private annuities.

A private annuity is essentially a sales contract. You sell an asset to a buyer for the asset's current fair market value, and the buyer pays you a specified income for life (or pays you and your spouse income for both of your lives). Private annuities are commonly used by parents and their children, and they work well when the children don't have enough money to pay for an asset all at once. Because this transaction is technically a sale, there's no gift to report and no gift tax to pay. Because it's a sale, though, capital gains may need to be reported and taxes paid. And, with a private annuity, the asset is removed from your estate completely, not just any future appreciation.

There are many options for planned to give. They include leaving a bequest in your will, lifetime gifting, charitable remainder trusts, charitable lead trusts, charitable annuities, community and private foundations, and donor-advised funds, to name a few. Each option has advantages and disadvantages, so you should review them carefully with the help of an experienced advisor. We'll take a look at three of these options: charitable remainder trusts, charitable lead trusts, and donor-devised funds.

A charitable remainder trust, or CRT, is a gift of cash or other property to an irrevocable trust that designates a charitable beneficiary and a noncharitable beneficiary. You, or you and your spouse, are designated as the noncharitable beneficiary - meaning you'll receive payments generated by the trust assets for your life, or for your life and your spouse's life. One or more charities are designated as a charitable beneficiary, which will receive the trust assets after you die.

While you can't change or amend most of the trust provisions, you can change the charitable beneficiary anytime you want. And, in certain cases, you may even be able to serve as trustee, which allows you to retain control over how the trust assets are invested.

A CRT can be a great way to satisfy your philanthropic desires and supplement your retirement income at the same time. Now, let's look at a reverse CRT, or charitable lead trust.

A charitable lead trust, or CLT, is a charitable remainder trust in reverse. With a charitable lead trust, the charity is entitled to payments during the trust term. At the end of the specified trust the term, which can be for a term of years, for your lifetime, or for the lifetimes of both you and your spouse, the assets either revert back to you or to your beneficiaries, Gift or estate tax may be due on the value of any interest that passes to your beneficiaries, but not on any increase in value that the assets may enjoy during the time the trust is making payments to the charity.

Donors are entitled to an unlimited charitable gift tax deduction based on the value of the lead interest. This arrangement may be especially appropriate for taxpayers who want to take an immediate income tax deduction. Now, let's look at donor-advised funds.

A donor-advised fund, or DAF, offers an easy way for Fortune 500 employees to make significant charitable gifts over a long period of time. A donor-advised fund is similar to a private foundation but requires less money, time, legal assistance, and administration to establish and maintain. Because donor-advised funds are public charities, they also enjoy greater tax advantages than private foundations. Here's how they work:

Fortune 500 employees can open an account with an organization that offers a donor-advised fund, such as a financial services company. You then donate your property to the fund. The fund invests in your donation and makes grants to charities. You can offer advice to the fund about how to invest the property and how to make the grants, but the fund has no legal obligation to follow your advice (although it is likely to do so for practical reasons). Grants can be made in your name or anonymously. You get an immediate income tax deduction, and, unlike private foundations, no excise tax is imposed.

So far, we have talked about strategies that are designed around tax consequences. We're going to spend the last few minutes, however, talking about strategies that are designed to protect your assets from potential creditors. If you haven't done any asset protection planning, your wealth is potentially vulnerable.

Lawsuits, tax debts, accidents, divorce, and other potential financial risks are acts of everyday life. The average person is involved in approximately 4 accidents throughout the course of his or her life. And though you'd like to hope that you're safe, misfortune can befall even the most careful person. What can you do? First, identify your potential loss exposure, then implement strategies that are designed to help reduce that exposure without compromising your other estate and financial planning objectives.

First, federal and state laws give you some general protection. For example, filing under your state's homestead statute should provide some protection for your home. Each state is different, though, so you'll need to look at your own state's laws. Also, in some states, owning property jointly can provide some protection. And, state and federal laws generally protect certain types of assets, such as 401(k) plans, IRAs, cash value life insurance, and annuities, As a last resort, bankruptcy law offers protection for at least a small portion of your property.

If you're substantially more at risk than your spouse, simply shifting property to your spouse may afford some protection, but this may not be the best option for many people. Adequate insurance, including life, health, disability, long-term care, property, liability, and business insurance, provides enough protection for most people, but others require more elaborate strategies, such strategies can include creating a business entity to own business assets, and putting personal assets into a protective trust. Let's look first at how creating a business entity to own business assets works.

C corporations, limited liability companies and limited liability partnerships are separate legal entities in the eyes of the law. If one of these types of business entities owns your business assets, the entity will be responsible for all business debts, Your personal assets will generally not be at risk for the acts of the business.

Keep in mind, though, that a number of issues should be considered when selecting a form of business entity, including tax considerations, so be sure to consult an attorney or tax professional with the appropriate experience before implementing this strategy. Now, let's look at a couple of protective trusts - first, the self-settled domestic trust.

The laws in a number of states enable you to set up a self-settled trust, Alaska was the first state to allow self-settled trusts, and Delaware quickly followed, and that's why this type of trust is often called an Alaska/Delaware trust. There are currently only 15 states that allow some form of self-settled asset protection trusts. A self-settled trust is a trust in which the person who creates the trust (the grantor) to convey his or her own assets into a trust where he or she is also the sole beneficiary.

These trusts give the trustee wide latitude to pay as much or as little of the trust assets to any or all of the eligible beneficiaries as the trustee deems appropriate. The key to this type of protective trust is that the trustee has the discretion to distribute or not distribute trust property. Creditors can only reach property that you have the legal right to receive. Therefore, the trust property will not be considered your property, and your creditors will be unable to reach it, though they will be able to reach any property that is distributed to you, Now, let's look at offshore or foreign trusts.

Finally, let's see how an offshore or foreign trust works. In order for a creditor to be able to reach assets held in a trust, a court must have jurisdiction over the trustee or the trust assets. Where the trust is properly established in a foreign country, obtaining jurisdiction over the trustee in a U.S, court action will not be possible. Thus, a U.S. court will be unable to exert any of its powers over the offshore trustee.

So, the creditor must commence the suit in the offshore jurisdiction. The creditor can't use its U.S. attorney; it must use a local attorney. Typically, a local attorney will not take the case on a contingency fee basis. Therefore, if a creditor wants to pursue litigation in the offshore jurisdiction, it must be prepared to pay the foreign attorney up front. To make matters even less convenient, many jurisdictions require the creditor to post a bond or other surety to guarantee the payment of any costs that the court may impose against the creditor if it is unsuccessful. Taken as a whole, these obstacles have the general effect of deterring creditors from pursuing action.

Take a moment and ask yourself the following questions:

Do you need to plan for estate taxes?

Do you need to plan for property transfers to grandchildren or to charity?

Do you have special concerns, such as transferring a business interest or protecting your assets from future creditors or an ex-spouse?

If the answer to any of these questions is yes, some of the strategies we've discussed may be appropriate for you.

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

.png)

Saunders, Laura. "Estate and Gift Taxes 2020-2021: Here’s What You Need to Know". WSJ, April 8, 2021

Uradu, Lea. "Transfer Tax". Investopedia, March 31, 2021

Deceased Spousal unused Exclusion (DSUE) Portability". ThisMatter, January 7, 2021

"What is the Generation-Skipping Tax". Turbotax, May 3, 2021

Flynn, Kathryn. "How much can you contribute to a 529 plan in 2021?". Savingforcollege, February 25, 2021

"Family Limited Partnerships". McLlawfirm, 2021

Carlson, Rob. "Survival Guide for Family Limited Partnerships". RetirementWatch, August 10, 2020

Mattar, William. "How many car accidents does the average person have?". WilliamMatter, November 20, 2020.

|

© 2024 The Retirement Group, LLC |