What is an Estate Plan?

Simply put, it's a map of how you want your personal and financial affairs as well as your Fortune 500 benefits to be handled in case of incapacity or death and the subsequent implementation of the strategies that will fulfill those objectives.

If you are unfamiliar with your Fortune 500 benefits you can reach out to your Fortune 500 HR Department for details.

Chances are, you do:

Not just for the wealthy

Without an estate plan, you can't control what happens to your property if you die or become incapacitated

An estate plan makes your wishes clear and helps avoid family disputes

Proper estate planning can preserve assets and provide for loved ones

Especially needed if:

Your spouse isn't comfortable with financial matters

You have minor children

Your net worth exceeds the federal transfer tax exclusion amount ($12,060,000 in 2022) or, if less, your state's exemption amount

You own property in more than one state

Financial privacy is a concern

You own a side business

As a Fortune 500 employee or retiree, you need an estate plan. If you are unfamiliar with your Fortune 500 benefits you can reach out to your Fortune 500 HR Department for details.

You may think that estate planning is just for the wealthy, but it's not. In fact, an estate plan may actually be more important if you have a smaller estate because your final expenses will have a much greater impact on your estate and there's a much greater possibility that your loved ones could suffer from a lack of financial resources.

The fact is, without an estate plan, you can't control what happens to your property if you die or become incapacitated. Generally, people create estate plans because they want that control. They also want to make sure that their wishes are clear in order to avoid family disputes. In addition, they care about preserving their property for their loved ones and want to make sure that their loved ones are properly provided for.

These are the estate planning concepts we'll be looking at today, and they are especially applicable to Fortune 500 employees. We'll talk about planning for incapacity first, briefly discussing both healthcare issues and property management issues. Then we're going to talk about planning for death, focusing on wills and probate, tax basics, lifetime gifting, trusts, and the role of life insurance in estate planning.

Incapacity describes a condition in which you are legally unable to make your own decisions. We're talking about planning for incapacity first because incapacity could happen to anyone at any time. Think for a moment what might happen if, for example, you were to become the victim of an accident that puts you in a coma for several months. How would your doctor know what medical treatments you would want or not want if you can't speak for yourself? How would your personal business be transacted if no one is authorized to sign documents for you?

What would happen is this: someone would have to go to court and get legal permission to do things for you. And that person, who's called a guardian and is usually a close family member such as a spouse or child, would have to go back to court every time permission is needed. As you can imagine, this might be quite burdensome to the guardian. Further, without any preparation instructions from you, your guardian might make decisions that would be different from what you would have decided.

We'd like to remind Fortune 500 employees and retirees that not all types of healthcare directives are effective in all states. It's important to be sure to execute the one(s) that will be effective for you. You can leave instructions about the medical care you would want if conditions were such that you couldn't express your own wishes. There are three different ways to do this: with a living will; a durable power of attorney for health care, which is referred to as a health-care proxy in some states; and a Do Not Resuscitate order, or DNR.

A living will is a document that lists the types of medical treatment you would want, or not want, under particular circumstances. For example, your living will might state that you would not want life support if you fell into a persistent vegetative state. With a living will, you'll have to think about all possible scenarios where you would want a specific action to be taken, and then put your wishes in writing so that the reader will clearly understand them.

A durable power of attorney for health care, or health-care proxy, lets one or more family members or other trusted individuals (who are called agents) make medical care decisions for you. Unlike a living will, with this type of healthcare directive you don't have to envision specific circumstances. You simply grant authority to your agent or agents to make decisions for you.

A Do Not Resuscitate order is used for a different purpose. Let's say that you're in the hospital, lingering and suffering from a terminal illness, and you don't want the hospital staff to take life-saving measures if you suddenly go into cardiac or respiratory arrest. To make sure your wishes are carried out, you may be able to get your doctor to issue a DNR. A DNR is a legal form, signed by both you and your doctor, that's posted by your bed to give staff members the permission they need to carry out your wishes.

Be careful if you're using a DNR. Some states require their own DNR form, and some states require one DNR form if you're in the hospital, and a different DNR form if you're in a nursing home. Be aware also that some states don't recognize some of these healthcare directives. So, depending on your state, you might need one, two, or all three of them.

There are three ways you can plan to have your financial affairs taken care of for you in the event you become incapacitated. You can arrange to own property jointly, appoint an agent using a durable power of attorney, or create and put the property in a living trust and name someone to take over the management of the trust if something happens to you.

Granting joint ownership of your property to another person allows that person to have the same access to the property as you do. If you become incapacitated, your joint owner simply acts instead. For example, if you and your spouse have a joint checking account, each of you can make deposits and write checks. So, if you were to go into a coma, your spouse would still be able to make the mortgage payments on time.

A durable power of attorney lets you name family members or other trusted individuals to make financial decisions or transact business on your behalf (just like with the durable power of attorney for health care). In addition to joint ownership and a durable power of attorney, using a living trust is another common strategy. We'll talk in more detail about trusts later, but for now, we want Fortune 500 employees and retirees to know that a living trust can be used in planning for incapacity because someone (called a successor trustee) can step into your shoes to manage the property in the trust if something should happen to you.

Some property passes automatically to a joint owner or to a designated beneficiary (e.g., IRAs, retirement plans, life insurance, trusts)

All other property generally passes according to state intestacy laws

All of us make plans that are based on the possibility that a specific event may occur. Many of us carry more than the minimum required amount of auto insurance because we recognize the possibility that financial loss could result from an accident. Since it is 100 percent certain that each of us is going to die at some point, you might think that everyone would have an estate plan. The fact is, though, that's just not the case.

So, what happens if you die with no estate plan? If you own property jointly, that property may pass automatically to your joint owner upon your death. If you have an IRA or retirement plan, or you own life insurance, funds may pass automatically to your designated beneficiaries when you die. Similarly, property held in a trust may pass automatically to a designated beneficiary. In general, however, the property will pass according to state intestacy laws. These laws govern the disposition of property when someone dies without a will, or with a will that doesn't account for a portion of his or her estate.

Intestacy laws vary from state to state

Typical pattern of distribution divides property between surviving spouse and children

Your actual wishes are irrelevant

Many potential problems

Let's say you die leaving $5,000 in a savings account. Who does the money go to? Without instructions from you, the money would go to the person or people that your state's intestacy laws say it should go to. Intestacy laws vary from state to state, but here you see a typical pattern of distribution: 50 percent of the property goes to the spouse and 50 percent to the children. Remember, it may be different in your particular state.

The biggest issue with intestacy is the fact that your actual wishes are irrelevant. Let's assume that you live in a state that has intestacy laws patterned as shown on this page. Without an estate plan, regardless of your actual wishes (for example, let's say that you want all of your property to go to your spouse and none to your children) your estate would be divided between your spouse and your children.

There are many potential problems with allowing your property to pass by intestacy. For example, the distribution pattern imposed by your state's intestacy laws could result in disputes among your heirs, and higher overall taxes due. Intestacy can be particularly problematic for unmarried couples, since intestacy laws generally will not include an unmarried partner in the distribution of property. There's a very simple way to avoid intestacy, though. You can create a will.

A will is the cornerstone of an estate plan

Directs how your property will be distributed

Names executor and guardian for minor children

Can accomplish other estate planning goals (e.g., minimizing taxes)

Written, signed by you, and witnessed

How many people here have a will? A will is probably the most vital piece of anyone's estate plan. A will is a legal document in which you direct how your property will be dispersed when you die. It also allows you to name an executor who'll carry out your wishes, which are stated in your will. In addition, your will lets you name a guardian for your minor children. You can also create a trust in your will. You can use your will to accomplish other estate planning goals as well, such as tax planning.

To be valid, your will must be in writing and signed by you. Your signature must also be witnessed, although the number of witnesses required varies from state to state. These requirements are important because if you aren't careful, your will may be invalid. So, see an estate planning attorney to take care of this for you, and avoid any "do-it-yourself" solutions. Now, there is one big consideration to having a will for some people, and that's the fact that wills generally have to go through a process known as probate. We'll take a look at the probate process next.

Most wills must be probated

Will is filed with probate court

Executor collects assets, pays debts, files tax returns, and distributes property to heirs

Typically. the process lasts several months to a year

Most wills have to be probated, The rules vary from state to state, but in some states, smaller estates are exempt from probate, or qualify for an expedited process. So, what does probate entail? Probate starts with someone filing the will with the probate court, which will then oversee the estate settlement process, Usually, the person named as the executor in the will does this. Once the will is filed with the court and validated, the executor can go about the business of settling the estate.

This means collecting money owed to the person who died (such as wages), paying any outstanding bills, filing final income tax and estate tax returns, if necessary, and then distributing the remaining property to the rightful heirs. Usually, everything goes smoothly during the probate process - which typically lasts anywhere from a few months to a year, depending on the size of the estate -as long as the executor does what needs to be done in a timely fashion, and there are no family squabbles. Nevertheless, some people may want to avoid this process, Let's take a look at why this is so,

PROS

Time and costs are typically modest

Court supervision

Protection against creditors

CONS

Can be time consuming for complex estates

Title transfer delays

Fees

Ancillary probate

Public record

Before we look at the reasons why you might want to avoid probate, let's review the positive aspects of probate, for most estates, there's usually little reason to avoid probate, The actual time and costs involved are modest, and it just doesn't make sense to plan around it. And there are actually a couple of benefits from probate. Because the court supervises the process, you have some assurance that your wishes will be abided by, and, if a family squabble should arise, the court can help settle the matter, Further, probate offers some protection against creditors. As part of the probate process, creditors are notified to make their claims against the estate in a timely manner. If they do not, it becomes much more difficult for them to make their claims later.

But for some complex estates, probate can be more burdensome. taking up to two or more years to complete, this could tie up property that your family may need immediately, and also increase the costs that can arise, such as executor fees, attorney fees, and insurance costs. And, if you have real estate in more than one state, for example if you own a summer home in Maine and a winter home in Florida, your executor will have to file in each state where the property is located, this is referred to as ancillary probate. Additionally, wills and any other documents submitted for probate become part of the public record, which may be undesirable if you or your family members have privacy concerns.

Can You Avoid Probate?

Yes, an estate plan can be designed to control which assets pass through probate, or to avoid probate.

Own property jointly with rights of survivorship

Complete beneficiary designation forms for property such as IRAS, retirement plans, and life insurance

Use trusts

Make lifetime gifts

If any of these issues are a concern to you, an estate plan can be designed to limit the assets that pass-through probate, or to avoid probate altogether. The major ways property is passed outside of probate are by owning property jointly with rights of survivorship; by ensuring that beneficiary designation forms are completed for those types of assets that allow them, such as IRAs, retirement plans, and life insurance; by putting property in a trust; and by making lifetime gifts. Now, let's switch gears a little and talk about estate taxes.

Transfer Taxes Include:

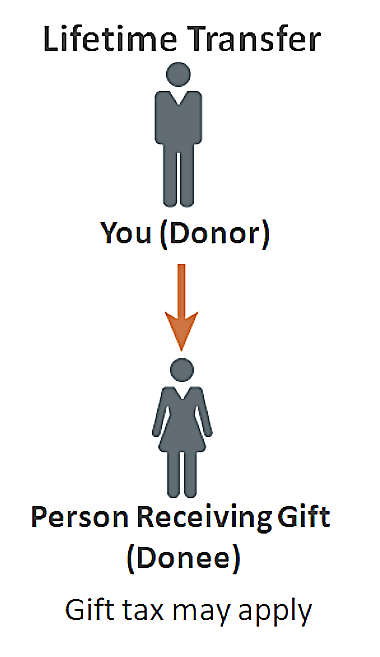

Federal gift tax - imposed on transfers you make during your life.

Federal estate tax - imposed on transfers made upon your death

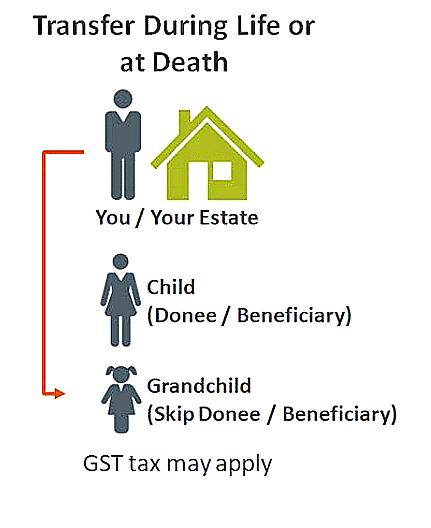

Federal generation-skipping transfer (GST) tax- imposed on transfers to individuals who are more than one generation below you (e.g., grandchildren) both during your life and upon your death

There are three types of federal taxes that may be imposed when property is transferred from one person to another either during life or at death, referred to collectively as "transfer taxes," these taxes are the gift tax, the estate tax, and the generation-skipping transfer tax. We're going to discuss transfer taxes on the federal level only but be aware that the individual states may also impose their own transfer taxes, and they generally affect smaller estates, it's important for you to get more information on the transfer taxes imposed by your particular state "Transfer taxes imposed on the state level tend to affect smaller estates.

Gift tax applies to transfers made during your life

Certain gifts are excluded (e.g., $16,000 annual gift tax exclusion)

$12,060,000 excluded from all transfers (gifts and estates) combined in 2022

The $12,060,000 exclusion is the largest in the history of the federal gift and estate tax

The gift tax doesn't apply to every lifetime gift, though. For example, in 2022, you can give up to $16,000 to as many individuals as you want gift tax free under the annual gift tax exclusion. By the way, that $16,000 figure is for 2022, but the annual gift tax exclusion is indexed for inflation, so it may change in future years. In addition, each individual has a lifetime exclusion from all transfers (that's gifts and your estate) combined, that amount is $12,060,000 in 2022. That's the largest exclusion that has ever been allowed in the history of the federal gift and estate tax.

Estate tax applies to transfers made at death

Generally, does not apply to transfers made to spouse or charity

$12,060,000 excluded from all transfers (gifts and estates) combined in 2022

Any portion of exclusion used for gifts will be unavailable to the estate

When property is transferred at death, it is generally subject to estate tax, this is true whether or not the property goes through probate. For example, even though funds in an IRA pass by virtue of a beneficiary designation, the funds are still potentially subject to estate tax. As with the gift tax, there are exceptions to the estate tax. For example, property that you leave to your spouse will generally not be subject to estate tax because there's a full deduction allowed for marital transfers. A similar deduction is available for property left to a charity. In addition, as discussed on the previous slide, each individual has a lifetime exclusion from gifts and estate tax combined. That amount is $12,060,000 in 2022. To be clear, there is one $12,060,000 exclusion that covers both gifts and estates. So, any portion of the exclusion you use for gifts will not be available for your estate.

There's a new feature of the lifetime exclusion that is potentially very important to married couples. The exclusion is portable. That means that any portion of the exclusion that is not used by a deceased spouse can be transferred to the surviving spouse. In prior years, that was not the case, so married couples with larger estates had to do what is referred to as bypass planning, typically using a trust. But for 2011 and later years, such planning will not be necessary for transfer tax purposes, although there are other good reasons to use a bypass trust, but that is more than we want to discuss today. Suffice it to say that together, a married couple can pass along $24,120,000 tax free as long as the estate of the deceased spouse makes the proper election on the estate tax return.

The generation-skipping transfer (GST) tax may apply to transfers made to someone more than one generation below you

$12,060,000 GST tax exemption in 2022

Unlike the gift and estate tax exclusion, the GST tax exemption is NOT portable

The third piece of the transfer tax system that we need to mention is the generation-skipping transfer (GST) tax. In the world of estate planning, someone who is more than one generation below you, for example a grandchild or great grandchild, is referred to as a "skip" person. If property is transferred, either during life or at death, to a skip person, then the transfer is subject to generation-skipping transfer tax, which is imposed in addition to gift tax or estate tax. The reason there's a generation skipping transfer tax is to prevent individuals from avoiding estate tax on the intermediate (the skipped) generation.

Because the generation-skipping transfer tax is a separate tax, you get a separate exemption. The exemption for generation-skipping transfer tax purposes is $12,060.000 in 2022, Unlike the gift and estate tax exclusion, the GST tax exemption is not portable,

Some key tax figures are adjusted each year for inflation. You can see here how the exclusion and exemption amounts have changed. The Tax Cuts and Jobs Act, signed into law in December 2017, doubled the gift and estate tax exclusion amount and the GST tax exemption to about $11,200,000 in 2018. After 2025, they are scheduled to revert to pre-2018 levels and cut by about one-half. If your estate is larger than the exclusion or exemption, you may want to do some estate planning to minimize the potential impact of transfer taxes.

Lets you see the recipient enjoying your gift

Lets you minimize transfer taxes by taking advantage of the $16,000 annual gift tax exclusion and other tax deductions

Removes future appreciation property from your taxable estate

No "step-up" in basis - your basis in the property carries over instead

Making gifts during one's life is a common estate planning strategy that can also serve to minimize transfer taxes. In fact, transferring property to your heirs during your lifetime has certain advantages over waiting until you die. For one thing, when you make lifetime gifts, you have the satisfaction of seeing the recipients enjoy your gifts. For many people, though, gifting is used to minimize transfer taxes. As I mentioned earlier, one way to do this is to take advantage of the annual gift tax exclusion, which lets you give up to $16,000 to as many individuals as you want gift tax free in 2022. And there are several other gift tax exclusions and deductions that you can take advantage of. In addition, when you gift property that is expected to appreciate in value, you remove the future appreciation from your taxable estate.

There is one tradeoff to lifetime gifting, though. Generally, if you give property during your life, your basis in the property for federal income tax purposes is carried over to the person who receives the gift. So, if you give your $1 million home that you purchased for $50,000 to your brother, your $50,000 basis carries over to your brother - if he sells the house immediately, income tax will be due on the resulting gain In contrast, if you leave property to your heirs at death, they get a 'stepped-up" (or "stepped-down") basis in the property equal to the property's fair market value at the time of your death. So, if the home that you purchased for $50,000 is worth $1 million when you die, your heirs get the property with a basis of $1 million. If they then sell the home for $1 million. they pay no federal income tax.

You can give $16,000 to as many individuals as you want federal gift tax free ($32,000 if you and your spouse make the gift together)

If you're contributing to a Section 529 plan, you can give $80,000 ($160,000 with spouse) gift tax-free.

No gift tax on amounts paid directly to a school for an individual's tuition

No gift tax on amounts paid directly to a medical care provider for an individual's medical care

Remember that the annual gift tax exclusion lets you give $65,000 to as many individuals as you want gift tax free in 2022. If you and your spouse make gifts together, you can double that amount and give $32,000 to as many individuals as you want. If you're contributing to a child or grandchild's Section 529 plan, a type of tax-deferred college savings plan, you can give $80,000 in 2022 gift tax-free, though you will have to report the gift over a period of five years. If you and your spouse contribute together, this amount is $160,000.

Certain conditions apply in each case. Be aware that, if you should die during the five-year period, a pro-rata share of the gift will be included in your estate for estate tax purposes. Also be aware that the $16,000 figure is indexed for inflation, so this amount may rise or fall in future years. in addition, there's no gift tax imposed on any amounts paid directly to an educational institution for an individual's tuition. There's also no gift tax imposed on any amounts paid directly to a medical care provider for an individual's medical care, including payments for health insurance premiums.

Versatile estate planning tool

Can protect against incapacity avoid probate, minimize taxes

Allow professional management of assets

Provide safeguards for minor children, elderly parents, other beneficiaries

Can protect assets from future creditors

Control over property

If you aren't inclined to make outright gifts, you might consider using a trust. A trust is a common and versatile estate planning tool. We've already seen that a trust can play a role in planning for incapacity, and in avoiding probate. In addition, you may want to use a trust as part of an overall strategy to minimize transfer taxes, to have certain property managed by a professional, and to provide for minor children, elderly parents, and other beneficiaries. Certain trusts can be established to protect your assets from future creditors, Most importantly, though, trusts can provide a means to administer property on an ongoing basis according to your wishes, allowing you to maintain a degree of control after a property is placed in the trust, even after your death.

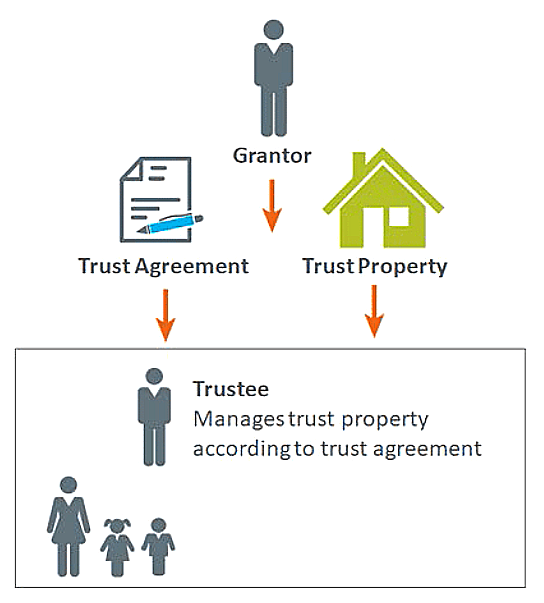

Legal entity that holds property

Parties to a trust: grantor, trustee, beneficiary

Living trusts vs. testamentary trusts

Revocable trusts vs. irrevocable trusts

A trust is a legal entity where someone, who's called the grantor, arranges with another person, who's called the trustee, to hold property for the benefit of a third party, who's called the beneficiary. The grantor names the beneficiary and trustee and establishes the rules the trustee must follow in a document known as a trust agreement.

When you create a trust, you split the ownership of the trust property - legal ownership goes to the trustee and beneficial ownership goes to the beneficiary. That means that the trustee is legally responsible for managing the property according to the trust rules, and that the beneficiary receives the financial benefits, such as income, principal, and use of and enjoyment from the trust property.

A trust that you create while you're alive is referred to as a living (or "inter vivos") trust. A trust that is created upon your death (for example, under the terms of your will) is referred to as a testamentary trust. If you have the right to change or end the trust anytime you want to, the trust is described as a revocable trust. If the trust cannot be changed or revoked, the trust is described as an irrevocable trust. A revocable trust generally becomes irrevocable when you die, since you're no longer around to change or revoke it.

While we won't go into great detail, revocable trusts are commonly used to plan for incapacity and avoid probate. A trust avoids probate because the trust agreement itself determines what happens to the trust property upon your death. Irrevocable trusts, on the other hand, are commonly used for transfer tax planning and creditor protection.

Can provide instant estate

Can provide needed estate liquidity

Life insurance proceeds are included in your estate for federal estate tax purposes unless your estate plan addresses this issue

Key issue is ownership of policy

Life insurance plays a part in almost everyone's estate plan in one way or another. For example, if you otherwise have a small or modest estate, life insurance can be used to actually create an estate. In other words, the life insurance proceeds will be the primary financial resource for your surviving family members, at least until they are able to access other financial resources. Life insurance can also be used to provide liquidity for your estate. That is, the life insurance proceeds will provide the cash your survivors need to pay final expenses, outstanding debts, and taxes. For example, you may have physical assets, such as a home, retirement plan, and some investments, that you do not want to be liquidated, but rather left intact for your surviving spouse. And life insurance can play many other roles as well, such as creating a bequest to a charity, or providing funds for your child's college education.

You need to be aware, however, that the general rule is that life insurance proceeds will be included in your estate for estate tax purposes. Now, recall that in the beginning of this presentation, I made clear that we're only talking about taxes on the federal level here, and the situation may be different on the state level. Recall, also, that I said that $12,060,000 is effectively excluded from estate tax in 2022. So, if your total estate, including the proceeds from your life insurance, is equal to or less than $12,060,000, you have no worries. But, if your total estate is more than $12,060,000, then some of those life insurance proceeds may have to go to pay estate tax. Although the general rule is that life insurance proceeds are included in your estate for estate tax purposes, an estate plan can be structured to exclude life insurance proceeds from your taxable estate. The key issue is the ownership of the life insurance policy.

A common strategy to avoid estate tax on life insurance uses a trust to own and hold the life insurance policy. Such a trust is commonly referred to as an irrevocable life insurance trust, or "ILIT." If the ILIT owns the life insurance policy. the proceeds of the policy will not be included in your estate for estate tax purposes. However, this is only true if the strategy is correctly implemented. Ultimately, you'll need to work with an experienced estate planning attorney if this strategy is of interest to you.

But let me give you a basic idea of how an ILIT can work. You create an irrevocable trust, name someone as trustee, and name beneficiaries. The trustee buys a new life insurance policy on your life. The ILIT owns the policy. You make cash gifts to the ILIT. The trustee notifies the beneficiaries as you make the cash gifts. The beneficiaries have a limited window of time during which they have a technical right to withdraw your cash gift, but they don't, since withdrawing the gifts would defeat the purpose of the trust. As the withdrawal periods elapse, the trustee uses the cash gifts to pay the premiums on the policy to the insurance company.

1. ILIT receives proceeds of life insurance policy

2. Proceeds not subject to estate tax

3. Proceeds distributed according to terms of trust

4. Beneficiaries receive full proceeds, free from estate tax

At your death, the ILIT receives the proceeds of the life insurance policy. If properly implemented, no estate tax is due on the life insurance proceeds, and the funds are distributed according to the terms of the trust. The beneficiaries of the ILIT receive funds free from estate tax. Like most trusts, irrevocable life insurance trusts are a more advanced estate planning strategy, and I've just attempted to give you a very basic understanding of how they might apply to your situation. If you are interested in learning more, I'd be happy to provide you with additional information.

Have you implemented a plan for incapacity (health and property)?

Do you have a valid will?

Are transfer taxes a planning concern for you?

Does your overall estate plan reflect your current wishes and circumstances?

As we wrap up, take a moment and ask yourself these questions

Do you have a plan in place for incapacity?

Do you have a will?

If the answer to either question is no, there's really no time to waste - you need to address these issues as soon as possible. Ask yourself as well if transfer taxes are an issue for you. If you died today, would your total estate, including your home and life insurance, exceed the federal exclusion of $12,060,000 or your state's exemption limit, which may be less?

Finally, even if you have an estate plan, does it reflect your current wishes and circumstances? Small steps can enhance your financial life one day at a time. Questions are always welcome.

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

|

© 2024 The Retirement Group, LLC |