Fortune 500 employees may be asking themselves, when can I afford to retire from Fortune 500? How long will your nest egg last? If something happens to you, what can you do to ensure your family is taken care of? How can you protect your nest egg from major financial market declines? Depending on who you ask, the answers to these questions may vary. The goal of this guidebook is to provide valuable information that will help you organize a financial plan and place you on the right path to a secure retirement from Fortune 500.

Do you know how much you can spend and retire in comfort after working for Fortune 500? A simple way to figure this out is to use a Safe Withdrawal Rate (SWR). What exactly is a safe withdrawal rate? It is the amount you can withdraw from your savings while maintaining a low risk of running out of money once you've retired from Fortune 500. All things being equal, the lower your withdrawal rate, the longer your hard-earned money will last. So, what is a conservative target for an SWR?

Financial studies show a retirement portfolio with an investment mix of 50% in stocks and 50% in bonds, and a withdrawal rate of 4%, had a 100% success rate lasting at least 30 years. In the 63 hypothetical 30-year retirement scenarios that occurred between 1926 and 2017 (1926-1955, 1927-1956, and so on) the retiree’s nest egg would not have run out of money in each scenario. These retirement forecasts included periods of inflation, deflation, world wars, recessions, the dot-com crash, real estate bubbles, and the global banking crisis.

Retirement Portfolio Invested in 50% Stocks & 50% Bonds

Inflation Adjusted Withdrawal Rate

The lower your withdrawal rate, the longer your money will last.

How can you use the 4% safe withdrawal rate to come up with a nest egg target? Use the rule to work backward. For example, if you need $40,000 from your savings every year to live on (after taking into consideration other forms of retirement income ie: social security, part-time work, etc.…), simply divide your annual spending need ($40,000) by 4% (or multiply your spending by 25). In this example, a reasonable target for $40,000 in withdrawals equates to a $1,000,000 retirement nest egg.

Bottom Line:

While there is no “correct” answer to how much you need to retire, using a 4% withdrawal rate has historically been a conservative benchmark for a secure retirement. While following a conservative safe withdrawal rate is a good start, contact The Retirement Group to schedule a retirement assessment and receive your own personalized retirement plan recommendation at 800-900-5867.

If you have any questions, you can reach out to your Fortune 500 HR Department.

Losses in investing are inevitable, but it is absolutely critical that Fortune 500 employees and retirees avoid big losses. The diagram below demonstrates the importance of not losing big. For instance, if your portfolio loses -20%, you need to gain +25% to make back the loss. A larger decline of -50% requires a much more difficult 100% advance. The deeper the declines, the greater the gain required to get back even.

The amount of gain needed to recoup from a significant loss is exponential

Limiting losses is even more crucial after retiring from Fortune 500 because you depend on withdrawing portions of capital from your investment portfolio. Withdrawals impair gains while intensifying losses, making it even more important to generate consistent portfolio returns with minimal losses. A secure retirement from Fortune 500 will be hugely dependent on playing a great game of investment defense.

Bottom Line:

Occasional losses are inevitable. This is why it is absolutely critical to protect yourself against large losses by incorporating many layers of risk protection into your Fortune 500 retirement portfolio.

If you have any questions, you can reach out to your Fortune 500 HR Department.

Like the seasons of the year, the economy also goes through its own series of seasons called the business cycle. A bell-shaped curve provides the best illustration of the business cycle and the repeated ups and downs of the economy. You can use the business cycle to make investment adjustments to better prepare for the road ahead.

Typically, the stock market suffers declines, often substantial losses, associated with recessions. Over the last century, three out of every four bear markets for stocks (-20% or greater declines) have occurred during recessions.

The real value of understanding the business cycle is that it helps you look ahead and anticipate economic turning points without extrapolating current financial market conditions indefinitely. In simple terms, it will help you identify whether it is an appropriate time to emphasize offense (grow wealth) or defense (protect wealth) in your Fortune 500 retirement portfolio.

Doesn’t it make sense to have an active plan for investment management? By that, we mean a plan to reduce your exposure to stocks in anticipation of a recession and boost your stock exposure when the economy is expected to grow. For instance, during a recession, your asset allocation could include a significantly lower exposure to stocks, a healthy mix of high-quality bonds, and extra cash to stabilize your retirement nest egg. The opposite is true when the economy is accelerating into growth mode, as it makes sense to have higher exposure to stocks during favorable market conditions.

Bottom Line:

Over the last century, three out of every four major stock market declines (-20% or more) have occurred during economic recessions. You can better prepare for the road ahead and protect your valuable retirement nest egg by using the business cycle as a roadmap. Learn more about the Business Cycle Roadmap.

If you have any questions, you can reach out to your Fortune 500 HR Department.

How can Fortune 500 employees earn better investment returns with less risk? Invest in quality! Yes, it’s that simple. You can earn better returns with less risk by focusing your investments in high-quality businesses. What is a high-quality business? High-quality companies consistently grow their earnings regardless of the underlying business atmosphere. These financially strong companies tend to be the cream of the crop in their industry, with key competitive advantages that allow them to continually prosper over the long run.

The financial ratings firm Standard and Poor’s (S&P) has published quality rankings for stocks over many decades. This service provides an easy method to track quality. Its rankings range from A+ (highest) through D (Lowest); the better the growth, and stability of earnings, and dividends, the higher the ranking.

High Quality = Better Returns

High-quality stocks generate better returns over the long run. In an S&P study, over the 30-year time span between 1981-2011, High-Quality Stocks (S&P Ranks B+ or Better) earned average annual returns of 14.9% significantly outperforming their Low-Quality counterparts (B or lower) at 8.7%.

Why Do High-Quality Stocks Perform Better Over Time?

It’s easy to forget that buying stocks is actually becoming an owner of a company (you get much more than just a volatile ticker symbol). Just as the financial success of your local coffee shop owner depends on how profitable their business is, your financial success will ultimately be determined by the business results of your investments. Since high-quality businesses are those with steady and superior earnings growth, their stocks generate higher returns than their low-quality counterparts in the long run.

To put the High Quality vs. Low-Quality results from S&P’s study in dollar terms, if you retired in 1981 and invested $100,000 in low-quality stocks and left it alone it would have grown to just over $1.2 million by 2011. Not too shabby! However, by comparison, a $100,000 investment in high-quality stocks would have grown to $6.4 million – over 5 times the low-quality amount! That is a remarkable $5.2 million dollar difference over 30 years.

Given the superior performance of high-quality investments, you might find it fascinating that they actually are less risky. Who said you can’t have your investment cake and eat it too? That’s right, better returns with less risk, the ultimate investment combination.

Stocks of higher quality are less risky

ValueLine is an independent research firm that ranks companies by “Safety” ratings. Their rating system compares and combines a company’s balance sheet, financial strength, and price stability to arrive at a safety rating (similar to the S&P Quality Rankings). We compiled the ValueLine safety rank data during some of the last 16 major market drawdowns from 1972 – 2016 to calculate and compare high-quality vs. low-quality performance.

As shown in the table below, high-quality stocks go down much less (-14.6% on average vs. low-quality stocks -31.0%) during significant stock market declines. By focusing on high-quality investments, you not only can increase your returns but also lower your risk. As discussed in the Avoiding Large Loss section, going down less in a bear market makes it much easier to recover from the decline and ultimately allows you to reach new recovery highs much faster.

Bottom Line:

By focusing your investments on high-quality stocks, you not only can increase your returns and lower your risk, but you may also sleep better at night.

If you have any questions, you can reach out to your Fortune 500 HR Department.

Finding the price of a stock is easy. Determining the "value” is a more complicated task. Value can be characterized in many ways. For example, the price-to-earnings or P/E ratio is calculated by dividing the price of the company (P) by the earnings per share (E). Essentially, the P/E ratio represents how much an investor is willing to pay for one dollar’s worth of today's earnings. As stock prices decline, P/E ratios fall and indicate better value for investors (assuming earnings don’t fall more than price - underscoring the importance of investing in high-quality companies that consistently grow their earnings).

Value is not only a fundamental measure but also a sentiment indicator. The sentiment is continually moving from a position of excessive optimism to one of pessimism, and vice versa. Why, at one time, are fearful investors willing to pay only a low price for $1 of earnings, while at another time they are eager to pay a high price for that same $1 of earnings? The answer lies in the extremes of confidence or lack thereof. We believe that a value-focused investment philosophy is best for Fortune 500 employees and retirees.

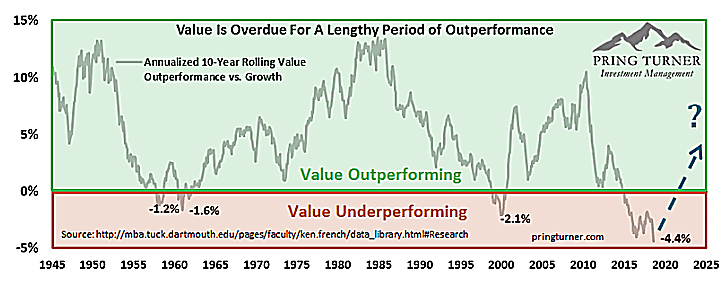

Investors can be extremely confident (or even greedy) when they are willing to pay a high price for earnings. Similarly, investors can be overly pessimistic (or fearful) when stocks are trading at extremely low valuations. Purchasing stocks of high-quality companies at attractive valuation levels will add another important layer of protection to your Fortune 500 retirement portfolio. While growth investing gets the glamorous headlines, value quietly gets the better results over the long run. Of course, every few years we expect value investing to encounter some rough patches. Such has been the case in recent years as value investing has experienced its longest dry spell in over 70 years. So, what can value investors expect looking forward?

This chart compares investment styles and illustrates that every period of under-performance for value vs. growth investing in the past has experienced a return to value’s pre-eminence with strong relative performance. We believe that today's environment is quite similar to the early 2000s following the dot.com bust when leadership changed and value stocks outperformed for a number of years.

Bottom Line:

We believe that in the long run, value investing outperforms growth investing for Fortune 500 employees and retirees. By incorporating valuation yardsticks into your investment decision-making process you will add another layer of protection in your retirement from Fortune 500.

If you have any questions you can reach out to your Fortune 500 HR Department.

Income from dividends is a significant contributor to positive long-term stock performance, especially during retirement from Fortune 500. While income may lack the appeal and excitement of growth-oriented investing, it can be a very effective strategy for a secure Fortune 500 retirement.

Many people associate the term compounding with capital gains.

Compounding can also be accomplished with stock dividends. An advantage of dividends vs income from bond investments is that, in many instances, payments are periodically increased (this is especially true for high-quality companies). Given today’s low-interest rate environment, a gradually rising dividend stream from high-quality companies can produce dependable income that helps offset inflation in your retirement years. Consistent income serves as a stabilizing cushion for Fortune 500 employees and retirees' retirement portfolios and can act as a shock absorber when markets drop. Share prices will always move up and down, but dependable income helps provide consistent performance with less volatility.

Bottom Line:

Make dividends an important component of your investment strategy in your retirement from Fortune 500. Markets will always move up and down but consistent dividend income serves as a protective shock absorber. Are your investments providing dividend growth? Email The Retirement Group for a cash flow analysis and to learn how you can improve the income of your Fortune 500 retirement portfolio.

If you have any questions you can reach out to your Fortune 500 HR Department.

It’s no coincidence that investment advisors are one of the fastest-growing areas within the financial service industry. Clearly many are recognizing the benefits of working with an advisor. One major benefit of working with a financial advisor is that they can help protect you from your yourself.

“The investors chief problem - and even his worst enemy - is likely to be himself.” -Benjamin Graham

Investment Advisors Keep You From Buying High and Selling Low

Financial studies over the years have demonstrated that the average investor earns less - in many cases, much less - than mutual fund performance would suggest. According to data from a J.P. Morgan Asset Management study, “In 2015, the 20-year annualized return for a typical retirement portfolio (50% stocks/ 50% bonds) was 7% while the 20-year annualized return for the average investor was only 2.1%, a gap of 4.9%.” Why is this?

A major reason is that there is a tendency for investors, from companies such as Fortune 500, to let emotions drive their financial decision-making. As the study results clearly demonstrate, investors left to their own tend to buy high and sell low. Many chase past-performance results and consequently invest after an investment has demonstrated success; often that is late in the game.

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. - Warren Buffett

Investment Advisors Can Help Keep Your Emotions in Check

An investment advisor can help you keep your emotions in check and steer you clear of making self-forced mistakes. They can help you contrast the comfortable feeling in buying a recent strong-performing investment to another one that has perhaps been an underperformer, and offers good value, but is not highly touted. It takes a lot of courage to go against the crowd and purchase a new potential emerging winner when the markets are in turmoil.

Bottom Line:

There is no sugar-coating it: investing is not easy. Ultimately, you have to consider whether you have the time, knowledge, experience, and, most importantly, emotional fortitude to successfully invest on your own. If you would like an experienced and knowledgeable investment advisor on your side to guide you through your Fortune 500 retirement, you are welcome to call The Retirement Group at 800-900-5867

If you have any questions you can reach out to your Fortune 500 HR Department.

You may be an avid investor and planner, but who will be the steward of your valuable retirement nest egg in the event of age and/or health-related issues? Will your spouse or loved ones be up to the task of managing your personal affairs, while also making day-to-day investment decisions? You may find it comforting to have an experienced and knowledgeable financial team that you can trust on your side. Working closely with a CPA, Estate Attorney, and Financial Advisor will create a strong support team and provide financial continuity for your spouse and loved ones, ensuring steadfast support for years to come.

Bottom Line:

Make sure you have a well-thought-out financial continuity plan, in case something unexpected happens to you or a loved one.

Our team of experienced retirement professionals can help you organize, design and execute an effective financial plan for your years of retirement from Fortune 500.

1. Answers to Your Retirement Questions

Receive a thorough retirement forecasting analysis and plan that answers your important questions. In addition, through our ongoing communication and educational services, we can become your go-to Fortune 500 retirement resource.

2. Added Protection During Market Downturns

Protecting your valuable retirement assets is the top priority. This safety-first approach is focused on protecting your money during market downturns. The goal is to generate returns that meet your Fortune 500 retirement goals, without subjecting your wealth to significant losses.

3. Financial Continuity

You may find it comforting to have an experienced and knowledgeable financial team on your side. We provide financial continuity for your spouse and loved ones, ensuring steadfast support for years to come.

4. Coordinated Planning with Your Trusted Professionals

Your path to a secure retirement from Fortune 500 includes a well-organized plan of action. We work closely with your other professional advisors (i.e. CPA and Estate Attorney) and can recommend professional specialists where needed. This way, your entire financial support team can coordinate efforts so you can focus your precious time and energy on what is most important to you.

5. Straightforward Pricing – No Fine Print, No Surprises

We do not receive compensation from commissions and strive to keep your transaction costs low. Your interests are 100% aligned with ours, which means we look out for your financial best interests, at all times, and strive to assist you in a smooth retirement from Fortune 500.

If you have any questions you can reach out to your Fortune 500 HR Department.

Still have questions regarding your Fortune 500 retirement? Not exactly sure what to do? Want help getting started? Our knowledgeable team of investment professionals can help you organize, design, and execute an effective financial plan for your Fortune 500 retirement years.

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

|

© 2024 The Retirement Group, LLC |