This article offers general information for Fortune 500 employees and retirees and should not be acted upon without obtaining specific advice from a qualified professional. The information is not intended as benefit, investment, tax, or legal advice, nor the solicitation for the purchase or sale of any security.

Making Judgments

Upon years of working with Fortune 500 employees and retirees, we have identified several topics that may prove beneficial for you to understand.

Behavioral retirement advice and what it is.

Three highly uncertain historical timeframes.

The brain's decision-making process.

The role of emotional intelligence in better financial decision-making.

Behavioral finance and the role of heuristics.

How to modify behavior – the 4 Rs.

Extreme Turmoil

We will be evaluating financial and retirement decision-making for Fortune 500 employees during periods of extreme turmoil.

Addressed historical time frames are comprised of events occurring in the past two decades:

2000-2002 –The Tech/Telcom Bubble and 9/11

2008-2009 –The Financial Crisis and the housing bubble

2020-Ongoing–COVID-19 pandemic and downturn

Decision-Based Finance

Integrates retirement planning and modern portfolio theory with recent findings in the fields of neuro economics and behavioral finance to achieve an emotional state for making better financial decisions.

Behavioral Finance Theory

An emerging field confronting us with our deeply irrational selves

The influence of psychology on the behavior of investors and it's subsequent effect on the markets

Help to explain how we make choices and decisions

Conventional Financial Theory

Conventional finance is predicated on the belief that

Both the market and investors are rational and unemotional

Investors make decisions without being biased by emotions

Investors have self-control and are not confused by cognitive errors and information processing errors

Behavioral Finance Theory

Traits of behavioral finance:

Investors are treated as “normal” not “rational”

Investors have limits to their self-control

Investors are influenced by their own biases

Investors make cognitive errors that can lead to wrong decisions

Three Uncertain Periods:

S&P 500 Index

U.S. Initial Jobless Claims, Per Week

Total U.S. Nonfarm Payrolls

GDP Annualized Growth Rate

During the last 75.75 years (since 1945) there have been 190 declines of 5% or greater.

Sources: Standard & Poor’s Corporation; Copyright 2020 Crandall, Pierce & Company

The Market's Reaction to a Financial Crisis

Cumulative total return of a balanced strategy: 60% stocks, 40% bonds

In US dollars. Represents cumulative total returns of a balanced strategy invested on the first day of the following calendar month of the event noted. Balanced Strategy: 12% S&P 500 Index, 12% Dimensional US Large Cap Value Index, 6% Dow Jones US Select REIT Index, 6% Dimensional International Value Index, 6% Dimensional US Small Cap Index, 6% Dimensional US Small Cap Value Index, 3% Dimensional International Small Cap Index, 3% Dimensional International Small Cap Value Index, 2.4% Dimensional Emerging Markets Small Index, 1.8% Dimensional Emerging Markets Value Index, 1.8% Dimensional Emerging Markets Index, 10% Bloomberg Barclays Treasury Bond Index 1-5 Years, 10% FTSE World Government Bond Index 1-5 Years (hedged), 10% FTSE World Government Bond Index 1-3 Years (hedged), 10% ICE BofAML1-Year US Treasury Note Index. Assumes monthly rebalancing. For illustrative purposes only. S&P and Dow Jones data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. ICE BofAMLindex data © 2019 ICE Data Indices, LLC. FTSE fixed income indices © 2019 FTSE Fixed Income LLC. All rights reserved. Bloomberg Barclays data provided by Bloomberg. Dimensional indices use CRSP and Compustat data.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Not to be construed as investment advice. Returns of model portfolios are based on back-tested model allocation mixes designed with the benefit of hindsight and do not represent actual investment performance. See the “Balanced Strategy Disclosure and Index Descriptions” pages in the Appendix for additional information.

“When dealing with people, remember you are not dealing with creatures of logic, but creatures of emotion.”

-Dale Carnegie

Physiology of the Brain

The human brain has not changed much in terms of size and weight

More of history finds humans as hunter-gatherers and farmers

Scanning the horizon for what might eat us was more important than evolving towards making complex financial decisions

Our brains are designed better for these primitive tasks

The Three Sections of the Brain

Outer layer – rational center

It handles complicated, cognitive processes like objective rational decision-making; the cerebral cortex

Middle layer –the emotional center

The limbic system & the amygdala translates outside stimulus into emotions

Inner layer –habit center

Not thinking; we just do it automatically In addition to breathing & body functions, we form habits

Brain Anatomy

Layers of the brain communicate via neural pathways and chemicals

Emotions like fear and anxiety can be so powerful that they have the effect of disabling the rational center of the brain

With stimulus, the brain processes emotions faster than a rational thought

The quality of decisions is impaired when our brains act reflexively

Brain Tendencies

Brains are better wired for survival than to deal with complex financial decisions

The brain has evolved slowly and is better suited to life 10,000 years ago and is not suited to keep up with the changes of the last 100 years

Technology makes it very easy to impulsively spend and invest. Two potentially dangerous things to do impulsively.

Brain Systems

Reward System

Produces Dopamine

Chemical plays a role in motivational component of behavior, we sense pleasure

Danger System

Adrenal gland produces cortisol (stress) & adrenaline

Emotional Brain

Stock market volatility

While emotionally painful, is not life-threatening

Our nature is to sacrifice the accuracy of our rational brain for the speed of the emotional brain

This is how we can get a closet full of shoes

Adapting Your Brain

The Brain Can Be Changed

We can change how we respond to financial situations

Neuroscientists refer to the brain as “plastic”

Neuroplasticity means we can create new habits so that when faced with challenging financial situations we can respond in ways that are in our best long-term interests

Financial Choices

Most people do not like thinking about finances

Retirement decisions are analytical, cold, and oftentimes abstract

Linking financial decisions to a financial life plan helps people make decisions in the pursuit of a satisfying happy life after Fortune 500.

“Life is 10% what happens to you and 90% how you react to it.”

-Charles R. Swindoll

Emotional Intelligence

The ability to perceive and control one’s emotions and use those emotions to guide thought and behavior

Many experts suggest emotional intelligence correlates better to happiness and success than traditional IQ

IQ vs EI

IQ = Brain Processing Power

EI = Relating & Communicating with Others

Book Smarts vs. Street Smarts

Braininess vs. Savvy

Ei 4 Unique Skill Sets

Self-Awareness

Self-Management

Social Awareness

Relationship Management

Self-awareness is the First Skill Set Required for Achieving Ei

Noticing our emotions and giving ourselves an accurate assessment

Pivotal to understanding ourselves

What is Mindfullness?

Is a tool to help cultivate self-awareness

Emotional self-assessment is easiest when we are alone, quiet, relaxed and inward

Meditation can help cultivate this state

Being mindful benefits

Shown to reduce stress and anxiety

Helps us to accept our experiences

Improves sleep quality

Helps with better concentration

Improves memory

Cultivates greater internal optimism

Engenders self-confidence and self-worth

Engaging in Mindfullness

Focus on breathing, listening (scanning) to your body

Notice thoughts without judgements

Examine underlying assumptions and beliefs

Connect feelings and thoughts for better decision making

Self-Management is the second skill set needed to achieve EI

Use emotions to assist thinking, including changes to our environment

Recognizing the role emotions play in decision making

Investors with good self-management skills have an increased ability to monitor their emotions

They can then be flexible and adaptable when responding to changing situations

Social Awareness is the third skill set in achieving EI

The ability to identify and understand another’s emotions

The nuts and bolts of financial planning and investment management are improved by effective and open dialogue

Better communication improves outcomes

Social Awareness

Having empathy and listening intently fosters self-reflection and openness in the listener

Helps to be able to see others’ contributions and how to effectively build relationships

Fosters better communication between partners/spouses

Relationship Management is the fourth skill set in achieving EI

Inspirational leadership

Strategic decision making

Cultivating a team environment

Consensus building

Community connections and strong relationships

Conflict management skills

Financial Self-Control & Self-Management

Financial self-control recognizes that “things” do not equal happiness

Wealth is income not spent, it is deferred consumption

Material consumption can distract us from activities that do improve happiness and quality of life

A simple lifestyle is much easier and less stressful to maintain

Heuristics

Emotional and impulsive decision making relies on certain mental short-cuts to make quick decisions

They rely upon people’s biases developed from:

Life experiences

Preferences

Perspectives

Heuristics Very Commonly Biased

They could lead to incorrect estimates and sometimes serious errors

Used to simplify complex problems that might otherwise require more time and consideration

Recognize your Biases

We all have mental biases; they are short cuts for the many thousands of daily decisions we make

Some mental biases cause us to ignore key information

Or attach too much importance to one piece of information

Or encourage decisions that are misguided by biases

These are entirely natural and unavoidable but the more skilled we are at recognizing these biases, the better our financial decision making

Four Kinds of Bias

Self-Deception– Tricking ourselves into thinking we know more than we do

We are closed off to information that we need to make an informed decision

Simplification– We make shortcuts and oversimplify.

Emotion– Decisions made when we are angry, sad, happy, etc.

Affects the types of decisions we make

Social influence – How we are influenced by others

Myopic Loss Aversion

Most investors suffer from myopic loss aversion

The tendency to compare the performance of their portfolio from the perspective of avoiding a possible loss rather than potential gain

They have a greater sensitivity to losses than gains and a tendency to evaluate outcomes frequently

Don't Overthink

Weighting past experiences too much in decision making

Similarity of objects is confused with the probability of an outcome

Using stereotypes that color decision making

In US dollars. Performance data is historical and does not predict future returns. Indices not available for direct investment. See index descriptions in the appendix.

Don't be Overconfident

Putting too much emphasis on one’s predictive abilities and knowing what the future holds

Illusion of control –people think they have control over a situation when in fact they don’t

Over-Confidence

Timing optimism –where people overestimate how quickly they can accumulate wealth over time, overestimate security selection and market timing

Desirability effect –when people overestimate the odds of something happening because the outcome is preferable to the alternatives “wishful thinking”

Nasdaq Composite: 2010-2021

Anchoring

Failing to adjust to changing or new information

Heuristic revealed by behavioral finance

Rely too much on pre-existing information and first data points

Confirmation Bias

Look for confirming rather than disconfirming evidence

Looking for information that agrees with us (“echo chamber”)

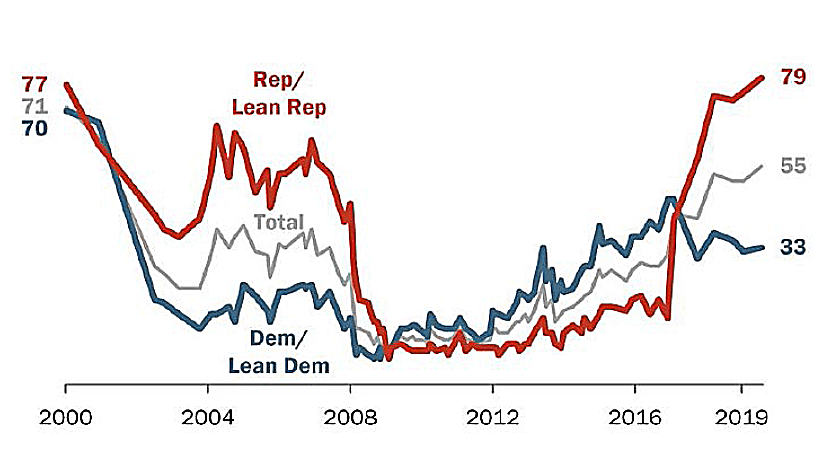

Political Affiliation Influences Economic Perception

Percentage of U.S. adults who rate national economic conditions as excellent or good

Pew Research Center, July 2019, “Public’s Views of Nation’s Economy Remain Positive and Deeply Partisan.”

Heuristics Availability

Describes the way in which people assess the probability of an event by the ease with which they can remember a similar event

The more easily we recall something from memory the more likely it is to be true

The common effect leads us to believe other people think like we do because our opinion dominates our considerations

Illusion of Money

Investors think in nominal results without figuring in inflation

They are making investment decisions while not looking at real returns

Bias Toward the Status Quo

When forced to make a complex decision with uncertainty, people tend to procrastinate and delay their decision

Often happens when it comes to saving for retirement

Doing nothing is easier

The Narrative Fallacy

Make a decision based on the way information is presented as opposed to facts themselves

We love stories and we let our reference for a good story cloud the facts and our ability to make rational decisions

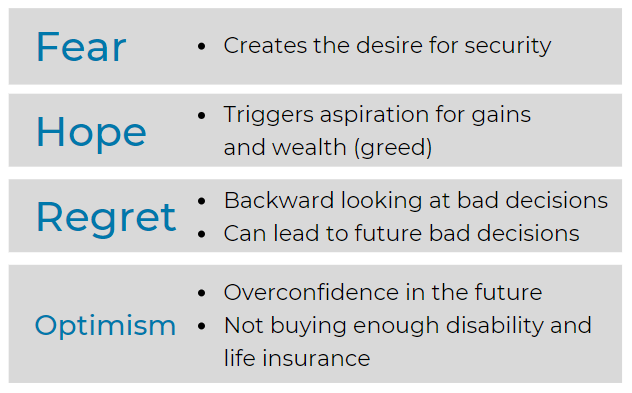

Emotions and Bias: A Dangerous Mix

How is Your Investor Psyche

Risk Tolerance

People who are less worried when taking greater levels of risk are considered to have a high-risk tolerance

People who are less willing to take risk are risk averse

Risk Capacity

A person’s ability to take financial risk based on their financial resources

Financial Capability

Defined as an individual's capacity based on financial knowledge, skills and access to manage resources effectively

Reducing Bias

Decision readiness is impacted by fatigue, distractions, visceral influences and individual differences

To reduce biases, we must modify the decision maker

Spend time educating yourself, take an alternative view and use proven checklists

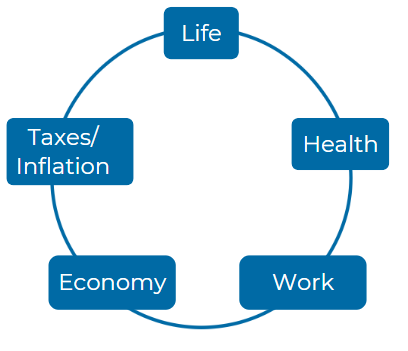

Life is Full of Unknown Variables

There are many things we do not control and admitting this is a necessary first step in being able to plan for it

We cannot know when our life or that of a family member will be significantly changed

We cannot know when our employment will be disrupted

We cannot know what is going to happen with the overall economy, stock/bond market, real estate

Planning for Uncertainty

Most Fortune 500 employees desire to make sense out of our lives, so we set goals

Being deliberate about aligning values to goals helps keep us on task toward building a meaningful life

Writing down goals enhances our commitment and makes us responsible for the choices we make

Researchers Say You’re

42% more likely to act on your goals if you write them down.

Certainty in the Face of Uncertainty

There is no shortage of opinions and prognostications, and it is natural to want to know the future, but it is important to know that there is a certainty of uncertainty

Manage resources in an “all weather” way and build in a “margin of error”

Account for the certainty of uncertainty and reduce the temptation of trying to know the future will help to better manage the potential outcomes

How To Protect yourself

Being extremely well-diversified across a variety of financial instruments

Using debt only very prudently

Use insurance to transfer some of the risks of uncertainty to an insurance company

Have a financial plan but know that things will not go exactly according to plan. You’ll change.

Consider these five Elements:

Why the 4rs are Important.

We can better balance between the emotional and the rational sections of the brain:

Emotions sacrifice accuracy for spee

Rational thinking is more accurate but not quite as fast

We are hard wired this way, but we can gradually change so we can make better decisions

Be Aware and Recognize

Stop whatever you are doing to take notice of everything you are thinking, feeling and doing

Pay attention to the objective facts surrounding the potential decision

Check Your Awareness

When managing emotions, you begin with recognizing the role they play

As we have learned, they are involuntary and come with physical sensations like heart rate, tension, sweat, etc.

Recognizing this is the key

The act of recognizing gives your rational logic side time to work

Looking back

What values are important and how should they influence the choice?

What biases might be influencing the situation?

Be Aware and Reflect

By increasing awareness of what we are experiencing and how we react to inbound stimulus it helps us perform better

Changing the source of stimulation to something internal that is based on values helps logic take control from emotion

Practicing being reflective is a good part of self-care and going about it intentionally works

Reflection Techniques

Deep breathing is at the heart of most relaxation techniques

Diffusing emotions happens only with several deep and slow breaths

Reflect on the big picture of life, your values and economic reality

Emotions make exciting opportunities and scary news developments fertile ground for bad decision making

Know your big picture: Finances, Family, Goals, Health

This helps make sure your decisions are not impulsive

Be Real

Your ideas about the situation by stating the most positive, realistic outcome for the decision you are about to make.

Stay True to Yourself

To create positive change, we must change our attitude rather than our circumstances

Learning to look at things in different ways

Admit, using our reflection about our habit patterns to see the big picture helps us to re-interpret whatever financial situation we are in

Stay Present

Emotionally stimulating events tend to tilt ourselves positively or negatively and away from our usual rational mind

Acknowledging that you do not need to predict the future to succeed financially is a valuable first step

Trust Yourself

Most everyone has a baseline:

Positive or negative

Sense of well-being –thriving or struggling

Our own view of our intelligence –high or low

Optimists need to be careful because they get overconfident

Pessimists tend to be overconfident that they know things will not work out well

Both types trust their instincts

The 4 R's Responsivity, Recognize, Reflect and Reframe

Make a decision that is consistent with your values and goals that are properly aligned.

Responsible decisions aligned with our values

The quality of our response is dependent on the quality of the first 3R’s

Recognizing –What am I thinking and feeling?

Reflecting –What biases do I have? What have I not considered? Who is affected and what are the consequences?

Reframing –How realistic is this, and am I too positive or negative?

Financial Security and Sound Decision-Making

Good financial decisions promote happiness

When decisions are in alignment with values it can increase the chance of having a meaningful life

Growing inner life capacities like love, generosity and empathy is better than acquiring more “things” in the external life

Be satisfied with what you have, stop moving the goal post.

Values and Goals Alignment

Aligning values to goals then to behaviors helps you create the best backdrop for finding financial meaning

When we are in alignment, we are at our best

It is an intentional process of doing things on purpose, with purpose

Values are different for everyone

They are an expression of what’s most important

They are an attitude about your life

Behavioral & Goals

Behavior puts the living into our values and goals

Behavior is what we do including our thoughts, emotions and actions

As we already know, emotions sacrifice accuracy for speed

Thus, we must take time to reflect on our values

Write down goals and behaviors that seek alignment between them

Financial Satisfaction

Having the correct amount in cash

Having the correct asset allocation

Feeling free from being debt-free

Monitoring spending and establishing control

Having clear communication with spouse or partner

Investing in an active social life and hobbies

Engaging in social spending versus consumer/materialistic spending

Financial Displeasure

Sustained fear, stress and loneliness will alter biological systems and is bad wear and tear on the mind and body

Sustained happiness is more important than how happy a person is on a single occasion

Emotional vitality is having a sense of enthusiasm, hopefulness and engagement

Negative emotions can harm the body

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees from Fortune 500. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our Fortune 500 clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

Psychology Today –Duke Medical School, published Aged and Aging, between 2009-2015, 4,478 participants

University College, London; English Longitudinal Study of Aging, 2014

Academy of National Sciences

The International Journal of Coaching in Organizations; The Emotional Intelligence of Money.Brenda Smith 2009

Financial Intelligence; How to make smart, values-based decisions with your Money and Life. Doug Lennick 2010

Emotional Intelligence 2.0 by Travis Bradberry and Jean Greaves

Behavioral Finance, Individual Investors and Institutional Investors, CFA program curriculum; 2011

Behavioral Financial Advisor curriculum; Kaplan Learning and think2perform

Emotional Intelligence: The Overlooked Ability Required for Successful Financial Planning,” Brunner, Jason Brunner, Ph.Dand Pasztor, Jim MSF, MPASW, CFP; 2013.White Paper 1304

Primal Leadership: Unleashing the Power of Emotional Intelligence; by Daniel Goleman and Richard Boyatzis.Harvard Business School Publishing, 2013

Modern Portfolio Theory & Behavioral Finance, Module 3: College of Financial Planning, Behavioral Finance Module, 2015

Client Psychology, Certified Financial Planner Board of Standards, Inc. Center for Financial Planning Series, Book 2, 2018

|

© 2024 The Retirement Group, LLC |