It Takes Forethought, Dedication, and, yes, Money.

Facts to be Considered by Fortune 500 Employees

Only 40 percent of Americans have calculated how much they need to save for retirement.

In 2021, almost 32 percent of private industry workers with access to a defined contribution plan (such as a 401(k) plan) did not participate.

The average American spends roughly 20 years in retirement.

Only 40 percent of Americans have calculated how much they need to save for retirement.

In 2021, almost 32 percent of private industry workers with access to a defined contribution plan (such as a 401(k) plan) did not participate.

The average American spends roughly 20 years in retirement.

Putting money away for retirement is a habit we can all live with.

1. Begin saving, continue saving, and stay focused on your objectives

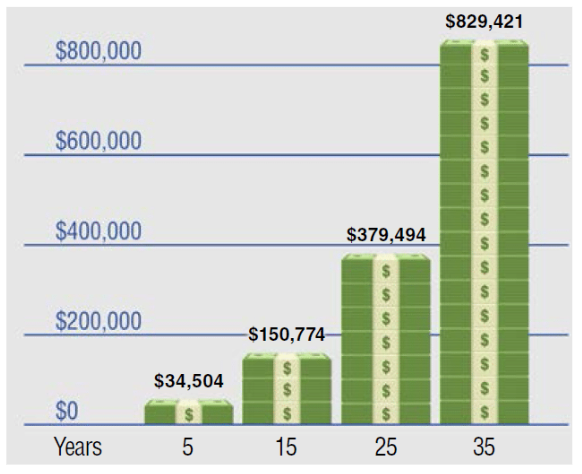

If you are already saving, whether for retirement after leaving Fortune 500 or another goal, keep going! You know that saving is a rewarding habit. If you’re not saving, it’s time to get started. Start small if you have to and try to increase the amount you save each month. The sooner you start saving, the more time your money has to grow (see the chart below). To be financially stable after leaving Fortune 500, make saving for retirement a priority. Devise a plan, stick to it, and set goals. Remember, it’s never too early or too late to start saving.

2. Recognize your retirement requirements

For those in Fortune 500, retirement can be expensive. Experts estimate that you will need 70 to 90 percent of your preretirement income to maintain your standard of living when you stop working. Take charge of your financial future. The key to a secure retirement from Fortune 500 is to plan ahead. Start by requesting Savings Fitness: A Guide to Your Money and Your Financial Future and, for those near retirement, Taking the Mystery Out of Retirement Planning.

3. Make a contribution to your retirement plan from Fortune 500

Utilize your Fortune 500 retirement savings plan, such as a 401(k) plan, and contribute all you can. Your taxes will be lower, your company may kick in more, and automatic deductions make it easy. Over time, compound interest and tax deferrals make a big difference in the amount you will accumulate. Find out about your plan from Fortune 500. For example, how much you would need to contribute to get the full employer contribution from and how long you would need to stay in the plan to get that money.

Start now! This chart shows what you would accumulate at 5, 15, 25, and 35 years if you saved $6,000 each year and your money earned 7% annually.

4. Find out about Fortune 500's pension plan

Determine if you qualify for a Fortune 500 traditional pension plan or cash balance. Then understand how it works. Ask for an individual benefit statement to see what your benefit is worth. Before you change jobs, find out what will happen to your pension benefit. Learn what benefits you may have from a previous employer. Find out if you will be entitled to benefits from your spouse’s plan. For more information, request What You Should Know about your Fortune 500 Retirement Plan. (See back panel for more information.)

5. Think about the fundamentals of investing

How you invest can be just as important as how much you save. Inflation and the type of investments you make play important roles in how much you’ll have saved at retirement. Know how your savings or Fortune 500-sponsored pension plan is invested. Learn about your plan’s investment options and ask questions. Put your savings in different types of investments. By diversifying this way, you are more likely to reduce risk and improve return. Your investment mix may change over time depending on a number of factors such as your age, goals, and financial circumstances. Financial security and knowledge go hand in hand.

6. Don't touch your 401(k) or IRA

If you withdraw your retirement savings now, you’ll lose principal and interest and you may lose tax benefits or have to pay withdrawal penalties. If you change jobs, leave your savings invested in your current Fortune 500 retirement plan, or roll them over to an IRA or your new employer’s plan.

7. Request that Fortune 500 create a retirement plan for you

There are a number of retirement options available from Fortune 500. For more information, request a copy of Choosing a Retirement Solution. (See back panel for more information.)

8. Contribute to an Individual Retirement Account (IRA)

You can put funds into an Individual Retirement Account (IRA). You can contribute even more if you are 50 or older. You can also start with much less. IRAs also provide tax advantages. When you open an IRA, you have two options – a traditional IRA or a Roth IRA. The tax treatment of your contributions and withdrawals will depend on which option you select. Also, the after-tax value of your withdrawal will depend on inflation and the type of IRA you choose. IRAs can provide an easy way to save. You can set it up so that an amount is automatically deducted from your checking or savings account and deposited in the IRA.

9. Find out if you are eligible for Social Security payments.

Social Security retirement benefits replace about 40 percent of a median wage earner’s income after retiring from Fortune 500. You may be able to estimate your benefit by using the retirement estimator on the Social Security Administration’s Website. For more information, visit their Website or call 1-800-772-1213.

10. Ask Questions

While these tips are meant to point you in the right direction, you’ll need more information. Read our publications listed on the back panel. Talk to your employer, your bank, your union, or a financial adviser. Ask questions and make sure you understand the answers. Get practical advice and act now.

The Retirement Group is a nation-wide group of financial advisors who work together as a team.

We focus entirely on retirement planning and the design of retirement portfolios for transitioning corporate employees from Fortune 500. Each representative of the group has been hand selected by The Retirement Group in select cities of the United States. Each advisor was selected based on their pension expertise, experience in financial planning, and portfolio construction knowledge.

TRG takes a teamwork approach in providing the best possible solutions for our clients’ concerns. The Team has a conservative investment philosophy and diversifies client portfolios with laddered bonds, CDs, mutual funds, ETFs, Annuities, Stocks and other investments to help achieve their goals. The team addresses Retirement, Pension, Tax, Asset Allocation, Estate, and Elder Care issues. This document utilizes various research tools and techniques. A variety of assumptions and judgmental elements are inevitably inherent in any attempt to estimate future results and, consequently, such results should be viewed as tentative estimations. Changes in the law, investment climate, interest rates, and personal circumstances will have profound effects on both the accuracy of our estimations and the suitability of our recommendations. The need for ongoing sensitivity to change and for constant re-examination and alteration of the plan is thus apparent.

Therefore, we encourage you to have your plan updated a few months before your potential retirement date as well as an annual review. It should be emphasized that neither The Retirement Group, LLC nor any of its employees can engage in the practice of law or accounting and that nothing in this document should be taken as an effort to do so. We look forward to working with tax and/or legal professionals you may select to discuss the relevant ramifications of our recommendations.

Throughout your retirement years after leaving Fortune 500, we will continue to update you on issues affecting your retirement through our complimentary and proprietary newsletters, workshops and regular updates. You may always reach us at (800) 900-5867.

|

© 2024 The Retirement Group, LLC |