With Holidays Ahead, Can Consumers Keep Carrying the Economy?

Consumer spending accounts for about two-thirds of U.S. gross domestic product (GDP), so it plays an outsized role in driving economic growth or...

In March 2022, the most common measure of inflation, the Consumer Price Index for All Urban Consumers (CPI-U), increased at an annual rate of 8.5%, the greatest level since December 1981.1 It is not surprising that, according to a Gallup poll conducted at the end of March, one in six Americans consider inflation to be the most pressing issue confronting the United States.2

According to a recent study by the National Institute on Retirement Security, the average retirement savings for Americans aged 55 to 64 is only $107,000, which is unlikely to last throughout retirement. With that taken into account, Fortune 500 employees and retirees may want to review their retirement plans and consider alternative income sources to supplement their retirement income as inflation continues to rise.

When inflation began to rise in the spring of 2021, many economists, including Federal Reserve policymakers, predicted that the increase would be temporary and subside within a few months. A year later, inflation has been more persistent than anticipated. Fortune 500 employees and retirees may find it useful to examine some of the forces behind rising prices, the Fed's plan to combat them, and early indications that inflation may be abating.

Hot Economy Meets Russia and China

The fundamental cause of rising inflation remains the growing pains of a swiftly expanding economy, a combination of pent-up consumer demand, supply-chain bottlenecks, and a shortage of workers to fill available positions. The Federal Reserve's loose monetary policies and billions of dollars in government stimulus helped prevent a deeper recession, but when the economy reopened, they added fuel to the fire.

Recent Russian invasion of Ukraine has added upward pressure to already elevated global fuel and food prices. (3) At the same time, the resurgence of COVID in China resulted in the closure of factories and the tightening of already struggling supply chains for Chinese products. Early in April, the volume of cargo handled by the port of Shanghai, the busiest port in the world, decreased by an estimated 40 percent. (4)

Behind the Headlines

Although the headline inflation rate of 8.5% year-over-year in March is intimidating for our Fortune 500 clients, monthly figures provide a clearer picture of the current trend. The month-to-month increase of 1.2% was exceptionally high, but more than half of it was attributable to the 18.3% increase in petroleum prices in March alone. (5) In spite of the Russia-Ukraine conflict and increased seasonal demand, U.S. gas prices fell in April, but by the end of the month, the trend had shifted upward. (6) The decision by the federal government to release one million barrels of oil per day from the Strategic Petroleum Reserve for the next six months and to enable the sale of gasoline with a higher ethanol content during the summer may help moderate prices. (7)

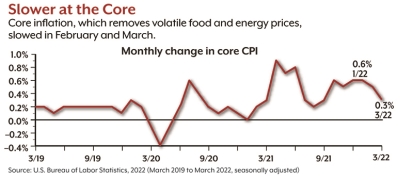

In March, core inflation, which excludes volatile food and energy prices, rose 6.5% annually, the highest rate since 1982. However, Fortune 500 clients should be aware that the month-over-month increase from February to March was only 0.3%, the weakest pace in the past six months. The price of used automobiles and trucks, which increased by more than 35% over the past year (a major contributor to general inflation) but declined by 3.8% in March, was another positive indicator. (8)

Wages and Consumer Demand

In March, the average hourly wage increased by 5.6%, but not enough to keep up with inflation and mitigate the effects felt by a variety of businesses and a large number of Fortune 500 employees and retirees. The wages of non-management employees in the leisure and hospitality industry increased by nearly 15%, while those of lower-paid service workers increased by more. Over the two-year duration of the pandemic, wages have increased roughly at the same rate as inflation, despite the fact that inflation has significantly eroded wage gains over the past year. (9)

One of the most important concerns for the foreseeable future is whether rising wages will allow consumers to continue paying higher prices, which can lead to an inflationary spiral of ever-rising wages and prices. Recent signals are ambiguous. In March, the official measure of consumer expenditure increased by 1.1%, but a poll conducted in early April found that two-thirds of Americans had reduced their spending due to inflation. (10-11)

Soft or Hard Landing?

The current inflationary circumstance has prompted numerous inquiries from Fortune 500 clients regarding the solution. The Federal Open Market Committee (FOMC) of the Federal Reserve has outlined a strategy to combat inflation by increasing interest rates and contracting the money supply. After lowering the benchmark federal funds rate to near zero to stimulate the economy at the onset of the pandemic, the FOMC raised the rate by 0.25 percentage points at its March 2022 meeting and projected six more quarter-point increases by the end of the year and three or four more in 2024.12 This would bring the rate to approximately 2.75 percent, just above what the Federal Open Market Committee considers a "neutral rate" that neither stimulates nor restrains the economy. (13)

The Fed's preferred measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, was projected to decline to 4.3% by the end of 2022, 2.7% by the end of 2023, and 2.2% by the end of 2024 as a result of these actions.14 PCE inflation, which was 6.6% in March, tends to run below CPI; therefore, even if the Fed accomplishes these objectives, CPI inflation will likely remain somewhat elevated. (15)

Fed policymakers have signaled a propensity to be more aggressive if necessary, and at its May meeting, the FOMC raised the fund's rate by 0.5%, as opposed to the more typical 0.25 percentage point increase. This was the first half-percent increase since May 2000, and additional increases are possible. In addition to reducing the Fed's bond holdings, the FOMC began reducing the money supply. The Fed's intentions regarding the federal funds rate will be updated with the publication of new projections in June. (16)

The Federal Open Market Committee (FOMC) faces the question of how quickly it can raise interest rates and restrict the money supply while maintaining optimal employment and economic growth. The optimal scenario is a "soft landing," similar to what occurred in the 1990s when inflation was brought under control without harming the economy. At the opposite end of the spectrum is the "hard landing" of the early 1980s, when the Fed raised the federal funds rate to nearly 20% in order to control double-digit inflation, thereby causing a recession. (18)

Fed Chair Jerome Powell acknowledges that a gentle landing will be challenging to achieve, but he believes that the robust labor market may help the economy withstand aggressive monetary policies. Over time, supply chains are anticipated to strengthen, and workers who have not yet returned to the workforce may fill open positions without increasing wage or price pressures. (19)

Fortune 500 employees and retirees are advised to keep this topic in mind over the next few months, which will be crucial for determining the future course of inflation and monetary policy. The expectation is that March marked the inflation's apex and that it will now begin to decline. Even if this turns out to be true, the descent could be excruciatingly gradual.

Fortune 500 clients are reminded that projections are based on current conditions, are subject to change, and may not materialize.

Conclusion

Inflation can be likened to a speeding train that's hard to slow down once it picks up momentum. As the economy picks up pace, the train accelerates, and various factors such as supply chain bottlenecks, worker shortages, and geopolitical events add fuel to the fire. The Federal Reserve has been working to apply the brakes by raising interest rates and reducing the money supply, but finding the sweet spot between controlling inflation without derailing the economy is like trying to slow down a speeding train without causing it to crash. Fortune 500 employees and retirees should stay informed and vigilant as the train continues its bumpy ride, hoping for a safe and smooth landing.

Added Fact:

According to a recent report by Bloomberg published on June 10, 2023, economists are projecting that high inflation is expected to persist for Fortune 500 employees and retirees. While the rate of inflation may gradually decrease over time, it is anticipated to remain elevated for the next several years. Factors such as supply chain disruptions, rising commodity prices, and increased consumer demand are contributing to the prolonged inflationary pressures. It is crucial for Fortune 500 individuals to stay informed and consider strategies to mitigate the impact of high inflation on their retirement plans and income.

Added Analogy:

High inflation can be likened to a turbulent river with a strong current that Fortune 500 employees and retirees find themselves navigating. Just as a river can surge and become unpredictable, inflation has surged to unprecedented levels, challenging the stability of the economy. Like skilled navigators, individuals must adapt their strategies to effectively traverse the rapid currents of inflation. While the current may gradually subside, it is anticipated that the river of inflation will continue to flow with strength for the foreseeable future. Fortune 500 employees and retirees must remain vigilant, equipped with the knowledge and tools to steer their financial ships through these challenging waters. By staying informed, adjusting their financial plans, and seeking expert guidance, individuals can successfully navigate the twists and turns of high inflation, ultimately reaching their desired financial destinations.

1, 5, 8-9) U.S. Bureau of Labor Statistics, 2022

2) Gallup, March 29, 2022

3, 7) The New York Times, April 12, 2022

4) CNBC, April 7, 2022

6) AAA, April 25 & 29, 2022

10, 15) U.S. Bureau of Economic Analysis, 2022

11) CBS News, April 11, 2022

12, 14, 16) Federal Reserve, 2022

13, 17) The Wall Street Journal, April 18, 2022

18) The New York Times, March 21, 2022

This material was prepared by Broadridge Investor Communication Solutions, Inc., and does not necessarily represent the views of The Retirement Group or FSC Financial Corp. This information should not be construed as investment advice. Neither the named Representatives nor Broker/Dealer gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The publisher is not engaged in rendering legal, accounting or other professional services. If other expert assistance is needed, the reader is advised to engage the services of a competent professional. Please consult your Financial Advisor for further information or call 800-900-5867.

The Retirement Group is not affiliated with nor endorsed by your company. We are an independent financial advisory group that focuses on transition planning and lump sum distribution. Neither The Retirement Group or FSC Securities provide tax or legal advice. Please call our office at 800-900-5867 if you have additional questions or need help in the retirement planning process.

The Retirement Group is a Registered Investment Advisor not affiliated with FSC Securities and may be reached at www.theretirementgroup.com.

Consumer spending accounts for about two-thirds of U.S. gross domestic product (GDP), so it plays an outsized role in driving economic growth or...

Discover the definition of a recession, how it's officially determined, and current economic indicators. Learn why it's essential for Fortune 500...

The use of mobile payment apps and person-to-person (P2P) payments are more popular than ever, giving businesses and consumers the ability to send...